The National Pension Service (NPS) of South Korea will significantly increase its investment exposure to Bitcoin in the first half of 2025, with a rise of up to 182%. This move not only highlights the growing recognition of digital assets by mainstream financial institutions but may also prompt more pension funds to follow suit, pushing cryptocurrencies further into the mainstream. According to the latest disclosed data, NPS has indirectly increased its Bitcoin exposure by investing in crypto-related stocks, with the total amount significantly expanding, further reinforcing its strategic foresight as the world's third-largest public pension fund.

NPS manages assets totaling $927 billion, making it the largest institutional investor in South Korea, and its investment decisions are often seen as a barometer of national financial strategy. In the first half of 2025, the fund's increase in Bitcoin exposure was not through direct purchases of Bitcoin but rather through holding equity in crypto-related companies. Market analysis indicates that this exposure primarily stems from investments in companies such as Coinbase, Block, and Robinhood, which are closely tied to the crypto ecosystem and provide indirect Bitcoin exposure. NPS's investment strategy aims to comply with regulatory frameworks while capturing the potential upside of digital assets. Data shows that this exposure grew by 182%, significantly rising from the benchmark at the end of the previous year, reflecting NPS's confidence in digital assets as a hedge against inflation and a diversification tool.

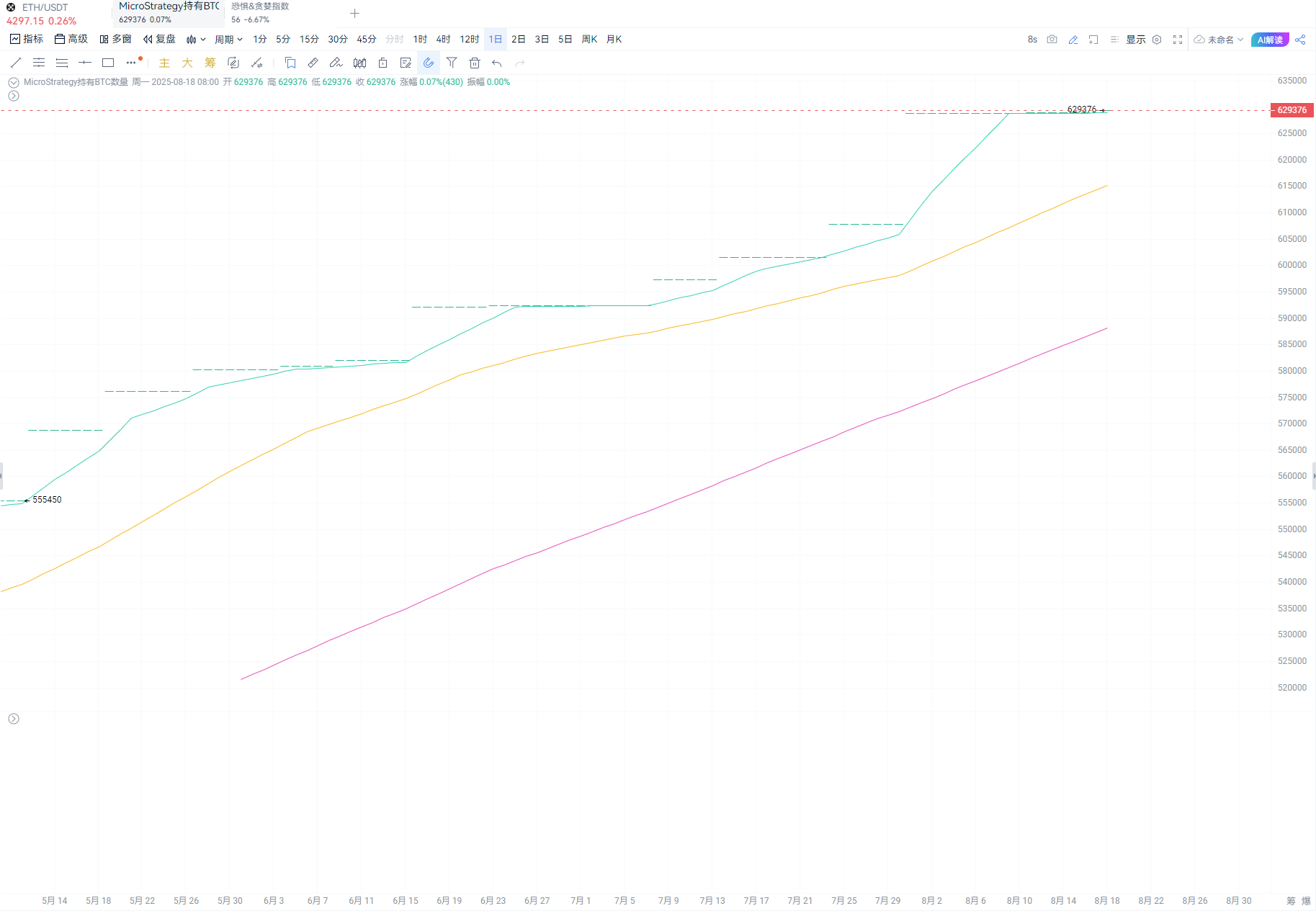

Strategy, as the world's largest corporate holder of Bitcoin, is known for its aggressive Bitcoin acquisition strategy. As of the time of writing, the company holds over 629,380 Bitcoins, with a total value based on the average purchase price exceeding the initial investment. NPS first purchased shares in Strategy in the second quarter of 2024, valued at approximately $34 million. Subsequently, in the first half of 2025, its holdings grew to $102 million, an increase of about 200%, approaching the market rumor level of 226%. This growth is partly attributed to the strong performance of Strategy's stock price and the company's ongoing strategy of acquiring Bitcoin through issuing stocks and bonds. Strategy's CEO, Michael Saylor, has consistently viewed Bitcoin as "a superior store of value compared to cash," especially in an environment of inflation and currency devaluation. This perspective aligns closely with NPS's long-term pension goals, which must address the funding pressures of South Korea's aging society.

NPS's overall crypto investment portfolio is also noteworthy. In addition to Strategy, the fund holds approximately 229,800 shares of Coinbase, valued at over $45 million; shares of Block valued at about $61.5 million; and shares of Roblox worth around $31.5 million. These investments collectively grew by 182% in the first half of 2025, bringing the total crypto-related exposure to about $770 million. This allocation represents 0.04% of NPS's U.S. equity investment portfolio, which, while not large, carries significant symbolic meaning. It indicates that pension funds are shifting from traditional assets (such as stocks and bonds) to emerging asset classes in pursuit of higher returns and risk hedging.

Deep Impacts:

Accelerated the legitimization process of cryptocurrencies. As a public fund, NPS's investments undergo strict scrutiny, and this move serves as an "invisible endorsement" of Bitcoin at the national level. Industry insiders point out that while the South Korean government maintains strict regulations on retail crypto trading, the easing of institutional investments is quietly driving market maturation. NPS is also exploring blockchain technology to enhance operational transparency, such as optimizing pension distribution and auditing processes through distributed ledgers. This can not only reduce costs but also enhance public trust.

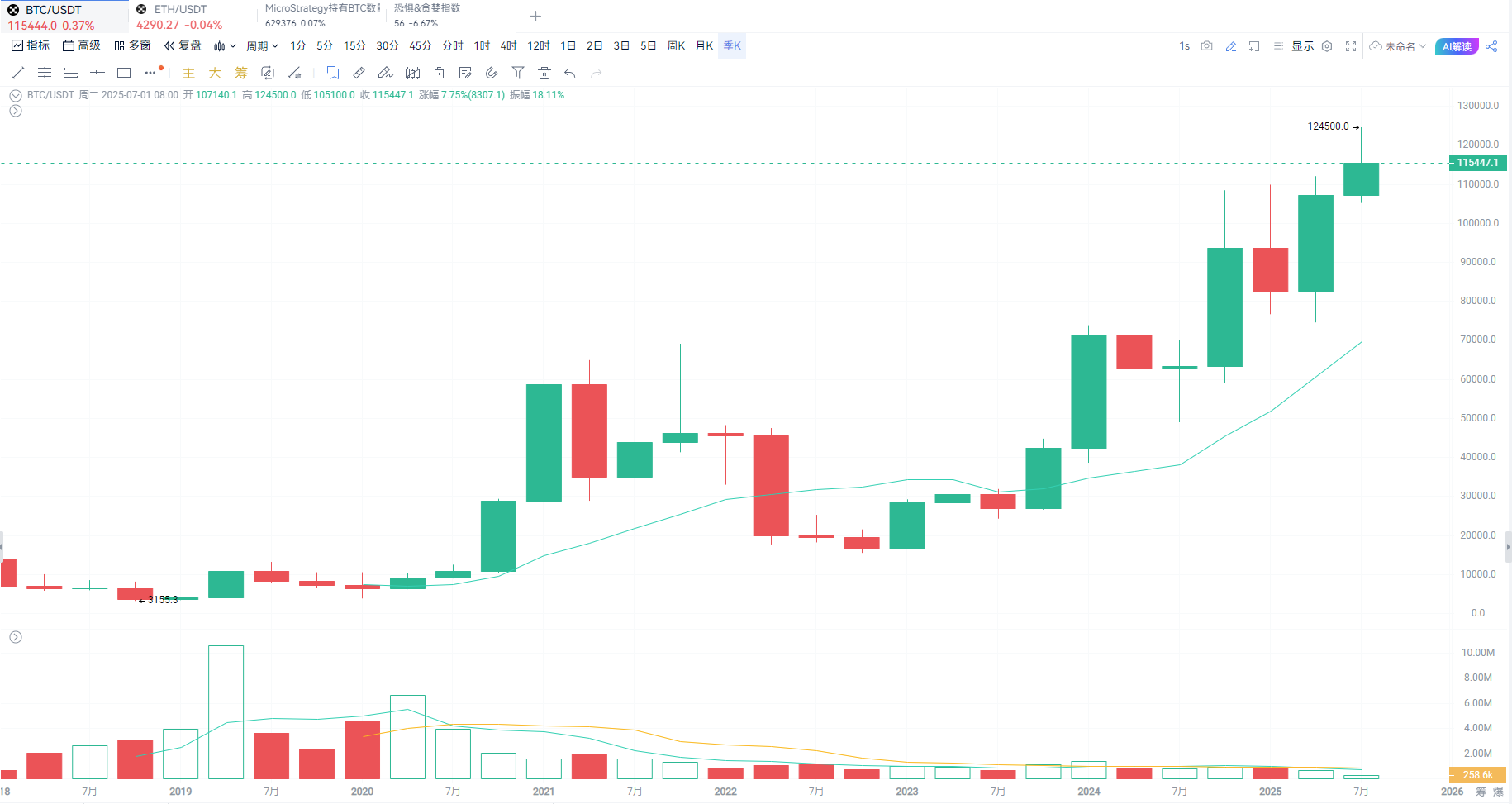

May lead global pension funds to follow suit. NPS is the third-largest public pension fund globally, following the Japan Government Pension Investment Fund ($1.5931 trillion) and the Norway Government Pension Fund ($1.5845 trillion). Its actions are often seen as a benchmark. Since 2025, institutional interest in Bitcoin has surged: inflows into Bitcoin spot ETFs have remained strong, and Strategy's stock price has risen over 92% this year. NPS's increased investment further strengthens this momentum. The market warns that Bitcoin's key support level is at $118,000, and a short-term drop below this level could pose risks, but in the long term, institutional inflows will support prices.

Reflects the strategic positioning of Asian countries towards crypto assets. As a technological powerhouse, South Korea's pension fund actions align with the overall trend in Asia, where institutions in China and Japan are also indirectly increasing crypto exposure. Although the crypto portion of NPS's $927 billion assets is small, its rapid growth demonstrates confidence in the digital economy. Experts believe this is not just a financial decision but also a strategy to cope with global economic uncertainties. Bitcoin, as "digital gold," offers a non-correlated asset allocation option in an environment of high inflation and geopolitical tensions.

However, this strategy is not without risks. Bitcoin prices are highly volatile, and historical data shows that its annualized volatility far exceeds that of traditional assets. NPS must balance returns with risks, especially as a public fund responsible for millions of retirees. On the regulatory front, the Financial Supervisory Service (FSS) of South Korea is closely monitoring institutional crypto investments to prevent systemic risks. Additionally, environmental factors cannot be overlooked: Bitcoin mining consumes significant energy, and NPS's investments indirectly support this ecosystem, potentially raising ESG (Environmental, Social, and Governance) controversies.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。