The privacy-focused crypto network Monero has been rattled after the Qubic mining pool claimed it had seized more than 51% of the network’s hashrate. The move triggered a six-block chain reorganization, orphaned 60 blocks, and coincided with an 8-17% drop in XMR’s price, though some argue Qubic’s dominance is little more than smoke and mirrors.

There are many perspectives on the Monero/Qubic situation.

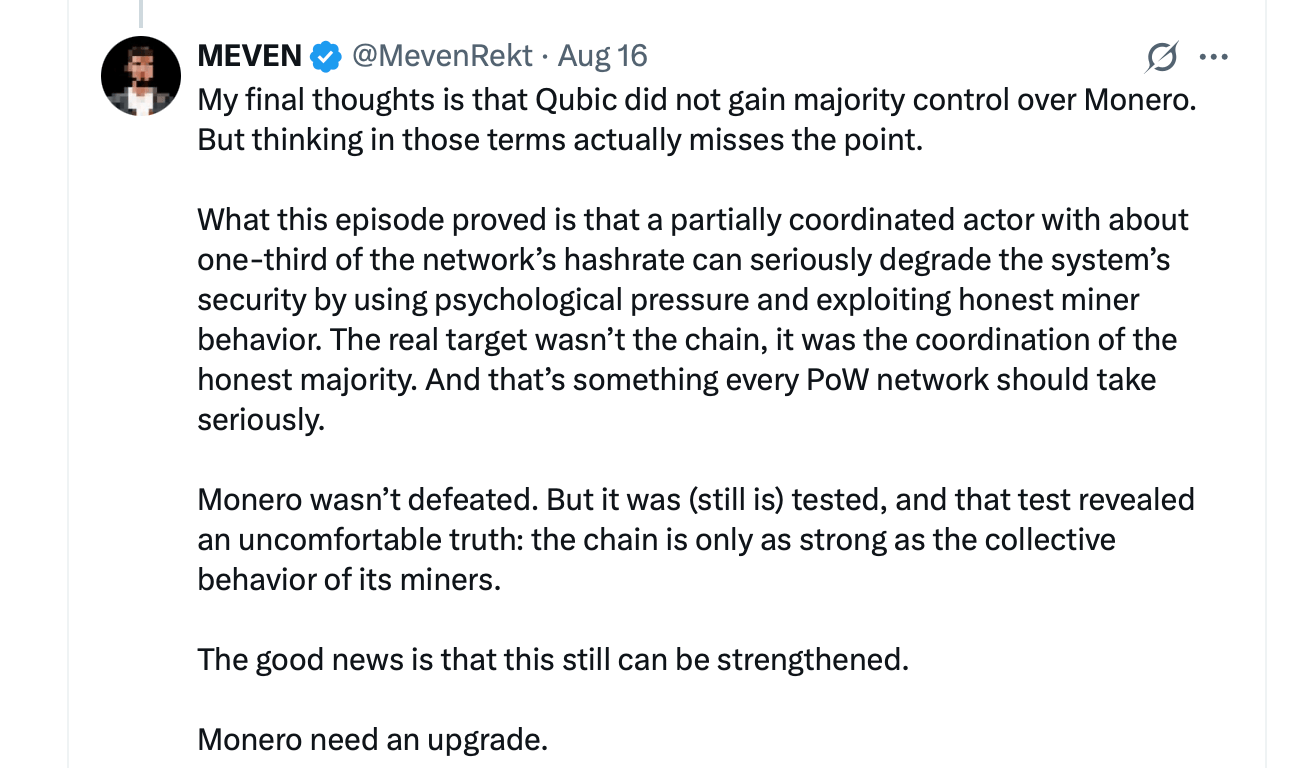

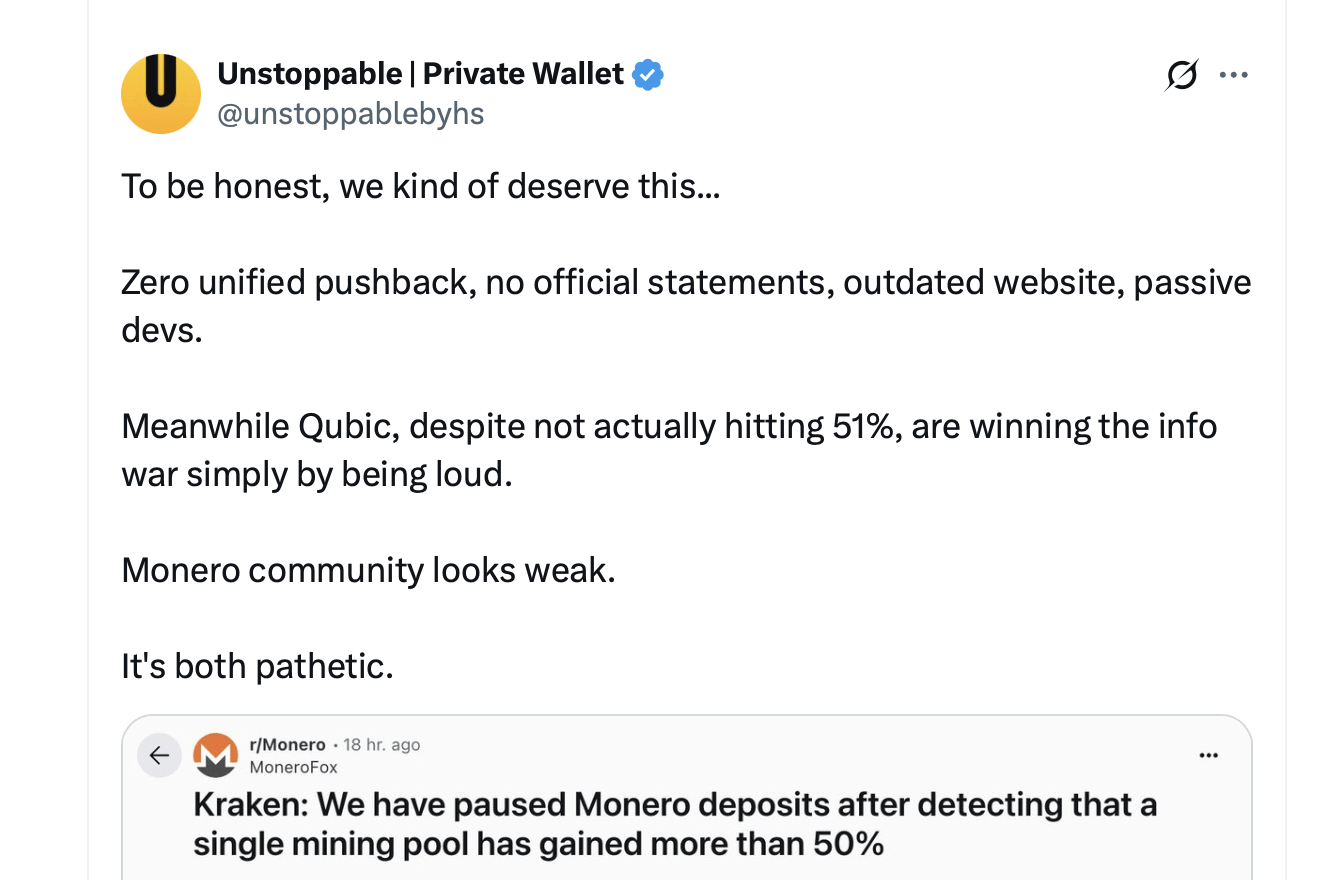

Supporters of XMR have pushed back, calling Qubic’s claim inflated or outright fabricated. They point to mismatches between the pool’s reported hashrate and its actual block production, the absence of any confirmed double-spend, and frame the episode as a marketing ploy rather than a lasting threat. Even so, reports of blockchain reorganizations continue. Moreover, Kraken has judged the situation serious enough to suspend XMR deposits.

Kraken stated this week:

As a security precaution, we have paused Monero ( XMR) deposits after detecting that a single mining pool has gained more than 50% of the network’s total hashing power. This concentration of mining power poses a potential risk to network integrity.

The exchange said it is closely tracking developments and will reopen deposits once its team decides conditions are secure. Kraken also noted that XMR trading and withdrawals continue to operate without interruption.

The Monero episode spotlights how fragile trust can be in this industry, where storylines can sway markets as quickly as technical changes, reminding participants that confidence often rests as much on perception as it does on cryptographic certainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。