以太坊(ETH)在8月14日达到了4,743美元,这是自2021年11月以来的最高水平,距离之前的峰值4,865美元仅一步之遥,Cryptoquant研究人员指出。关键是,ETH/BTC价格比率突破了其365天移动平均线,历史上这通常预示着以太坊相对于比特币的牛市周期。

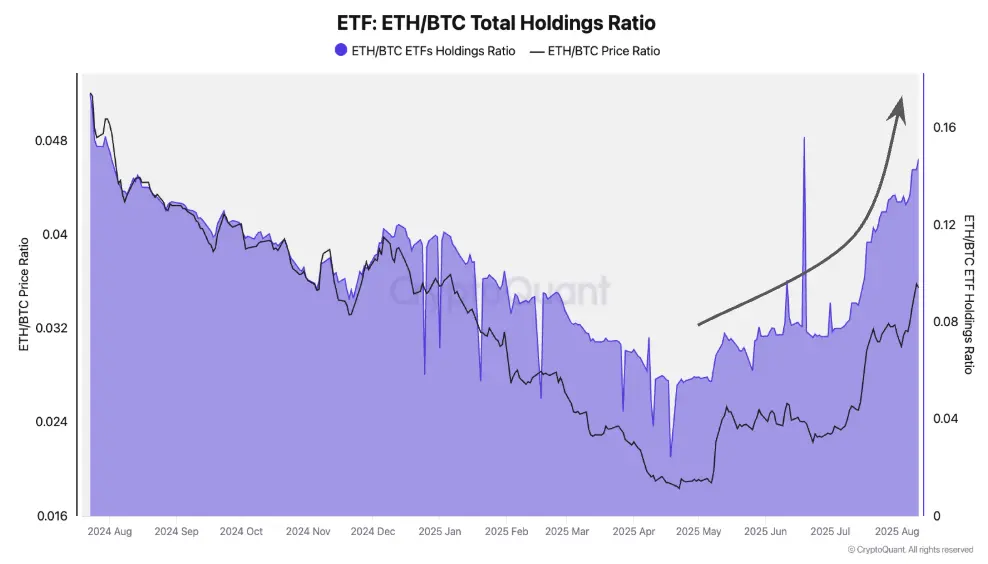

根据cryptoquant.com的数据,机构投资者通过现货交易所交易基金(ETFs)的兴趣激增。ETH/BTC ETF持有比例从三个月前的0.05上升至0.15,表明以太坊的ETF购买量显著高于比特币。同时,ETH在永续期货市场的未平仓合约增长速度超过比特币,相关比例从0.57跃升至0.76。

现货交易量展示了以太坊的动能。ETH的每周现货交易量连续四周超过比特币,最近的差额为100亿美元(240亿美元对140亿美元)。ETH/BTC交易量比率达到了1.66,为2017年6月以来的最高水平。

尽管表现强劲,Cryptoquant分析师识别出潜在的阻力。每日流入交易所的ETH数量现在超过比特币,表明持有者可能正在准备实现利润。ETH/BTC交易所流入比率在5月至8月之间从低位转向更高的卖压。

此外,ETH/BTC MVRV比率——衡量相对资产价值——自5月以来从0.4上升至0.8,接近0.9的阈值,在此历史上以太坊相对于比特币通常被视为高估。研究人员警告,如果市场情绪发生变化,这可能会限制短期内的收益。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。