Author: Lesley

On June 30, 2025, BitMine Immersion Technologies (NYSE: BMNR) announced the launch of a $250 million private placement, officially shifting to an Ethereum ($ETH) treasury strategy. At the same time, Thomas Lee, founder and Chief Investment Officer of the well-known investment firm Fundstrat, was appointed as the chairman of the company's board and personally participated in the investment. Soon after, heavyweight figures from Wall Street, including former PayPal CEO Peter Thiel and ARK Investment Management CEO Cathie Wood, followed suit, providing strong capital endorsement for this strategic transformation.

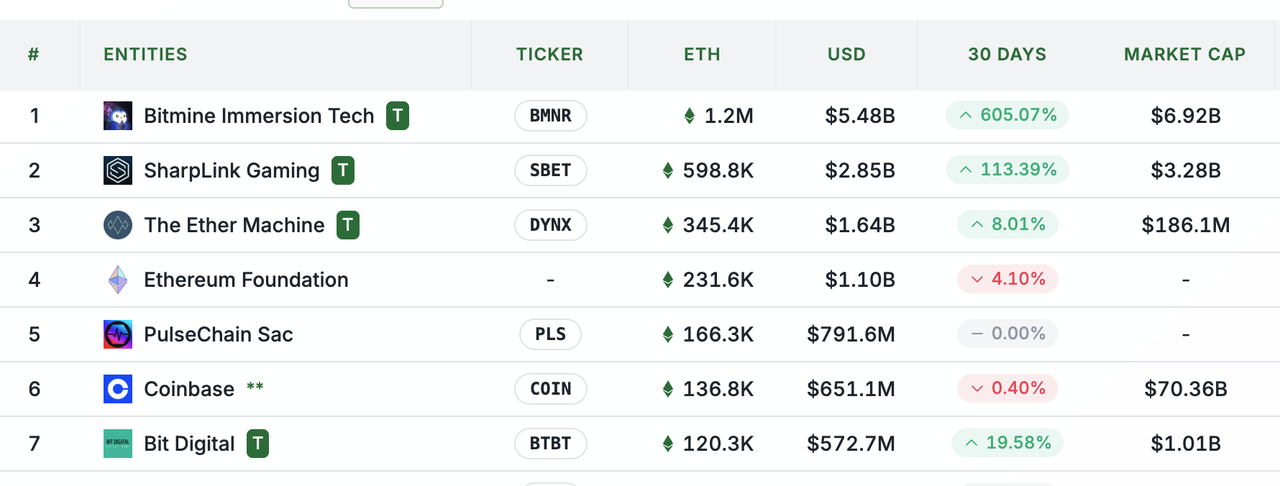

ETH Strategic Reserve Ranking (Source: strategicethreserve.xyz)

More than forty days later, the market responded clearly. This Bitcoin mining company has become the focus of the capital market. As of August 14, BitMine, with a cumulative holding of approximately 1.2 million ETH, valued at about $5.48 billion, has become the largest corporate holder of Ethereum in the world.

The stock price trend more intuitively reflects market sentiment: it rose by 605.07% in 30 days, and the three-month increase reached 1214.38%. From any perspective, this is a textbook-level operation in the capital market.

Behind the numbers is a reallocation of capital. BitMine's shift from the traditional "Bitcoin mining monetization" model to a "long-term holding of Ethereum" treasury strategy essentially represents a transition from industrial capital to financial capital. The success of this model not only proves the feasibility of digital assets as corporate reserve assets but, more importantly, it may be opening up a new path for traditional financial institutions to participate in the crypto economy.

How did BitMine, this Bitcoin mining company, rise to become the world's largest ETH corporate holder in just two months? This article will provide an in-depth analysis.

BitMine Treasury Strategy Execution and In-Depth Analysis

From the launch of the $250 million private placement on June 30 to becoming the world's largest ETH corporate holder, BitMine demonstrated the power of the Digital Asset Treasury (DAT) model through a textbook-level capital operation.

Timeline of BitMine's Ethereum Treasury Strategy

BitMine's ETH accumulation trajectory exhibits a textbook-level rhythm of capital allocation, with each step meticulously designed:

June 30, 2025: BitMine announced the launch of a $250 million private placement plan to implement its Ethereum treasury strategy. Thomas Lee officially became the chairman of the company's board and led the company in advancing this new strategy.

July 9, 2025: BitMine announced the completion of its $250 million private placement plan, further promoting the implementation of its asset-light treasury strategy.

July 14, 2025: The company announced it held over $500 million worth of ETH.

July 17, 2025: The company announced it held over $1 billion worth of ETH.

July 24, 2025: Holding over $2 billion worth of ETH, it established its leadership position in the Ethereum treasury space.

August 4, 2025: Holding over 833,000 ETH tokens, valued at over $2.9 billion, it became the world's largest ETH treasury.

August 11, 2025: Holding over 1.15 million ETH tokens, valued at over $4.96 billion, it increased by another $2 billion within a week.

August 12, 2025: Bitmine Immersion submitted documents to U.S. federal regulators, increasing its fundraising target for purchasing ETH by an additional $20 billion, raising it to $24.5 billion, to solidify its position as the world's largest ETH treasury.

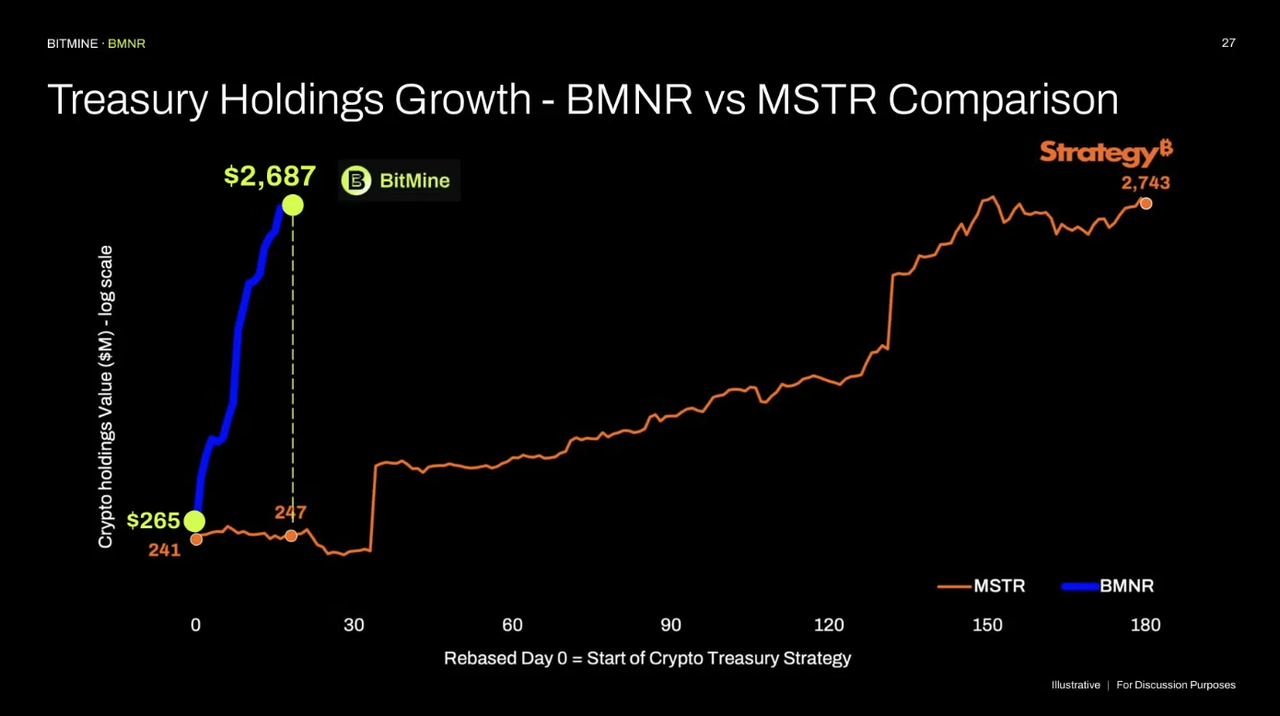

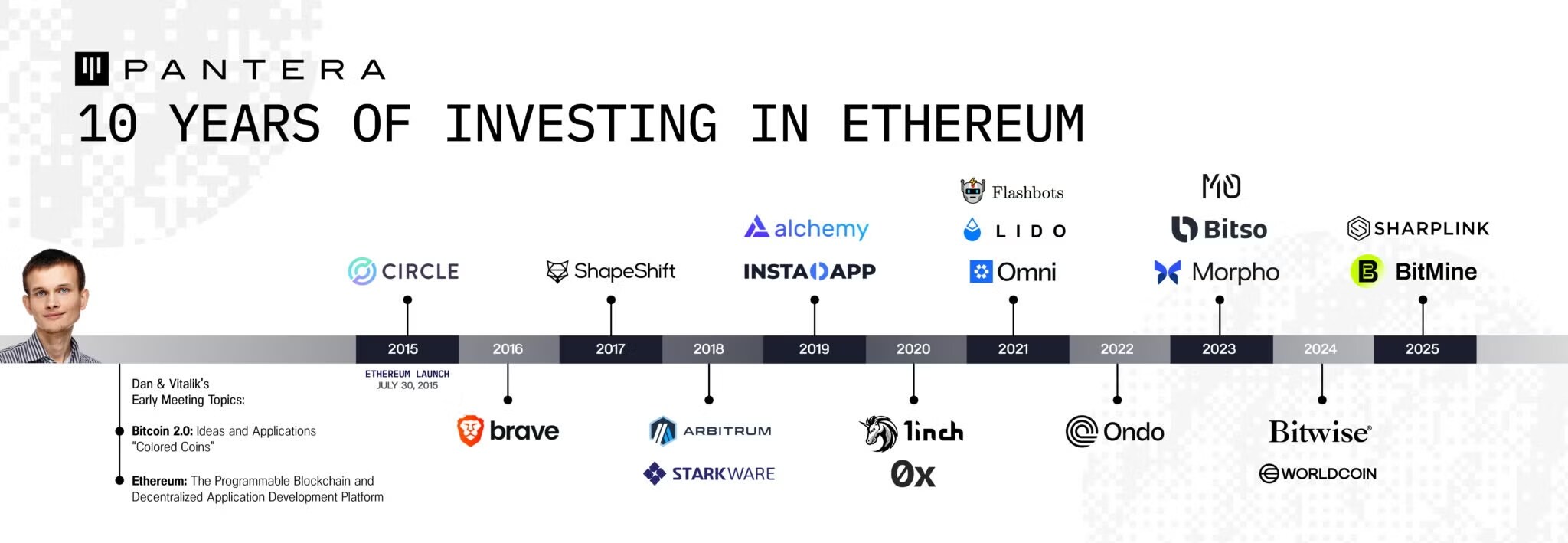

Source: Pantera Official Website

This accumulation speed is rare in the capital market—BitMine's monthly per-share ETH growth rate in the first month of launching its Ethereum treasury strategy has surpassed the cumulative growth of Strategy (formerly MicroStrategy) in the first six months.

In-Depth Analysis of BitMine's Ethereum Treasury Strategy

Why choose a digital asset treasury strategy?

DAT (Digital Asset Treasury) refers to the emerging model where companies incorporate cryptocurrencies like Bitcoin and Ethereum as strategic reserve assets into their balance sheets. For a long time, Bitcoin treasury strategies represented by Strategy have become a mature path for companies to participate in the crypto economy, while in June 2025, Bitmine launched its Ethereum digital treasury strategy, igniting the current ETH market.

The core of the DAT model lies in redefining the way companies create value. According to analysis by Pantera Capital, the most important factor for the success of DAT is the long-term investment value of its underlying tokens. Traditional companies create value based on cash flow generated from operations, while DAT companies rely on the appreciation of digital assets for value creation. The advantages of this model include:

• Capital Allocation Efficiency: Compared to traditional heavy asset operations, the DAT model can allocate capital more efficiently. BitMine's shift from Bitcoin mining to an Ethereum treasury essentially transitions from a heavy asset model reliant on electricity, hardware, and operations to a flexible capital allocation model.

• Valuation Reconstruction and Asset Management: The valuation of DAT companies no longer depends on traditional price-to-earnings (P/E) ratios but is more based on their net asset value (NAV). When investors buy shares of DAT companies, they are essentially purchasing a professionally managed digital asset investment portfolio.

• Utilization of Stock Price Premiums: The stock price of DAT can be decomposed into the product of three elements: (1) the number of tokens per share; (2) the price of the underlying tokens; (3) the NAV premium multiple (mNAV). When the stock trades at a premium to NAV (i.e., mNAV > 1x), the company can raise funds exceeding its net asset value by issuing shares, which can be used to increase the number of tokens held per share, thereby enhancing value. The core of this strategy lies in leveraging the valuation premium granted by the market to increase the number of tokens held per share, thus amplifying shareholder returns when the price of the underlying tokens rises.

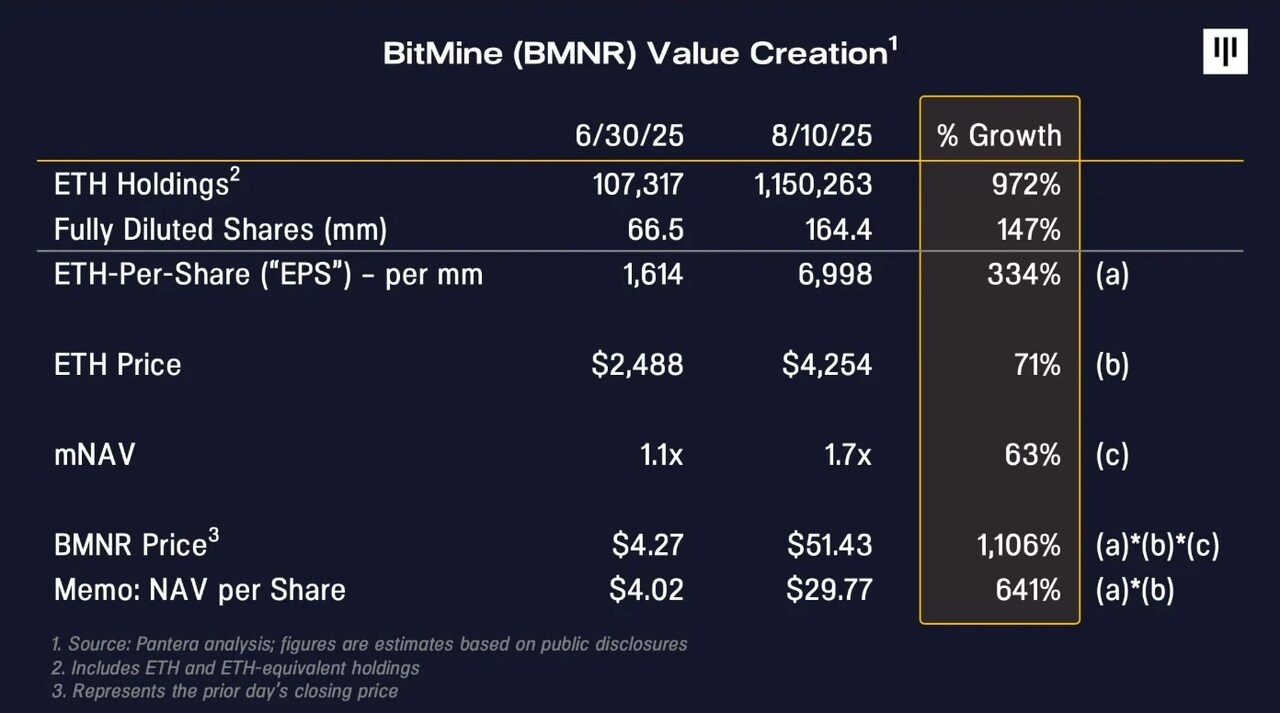

Source: Pantera Official Website

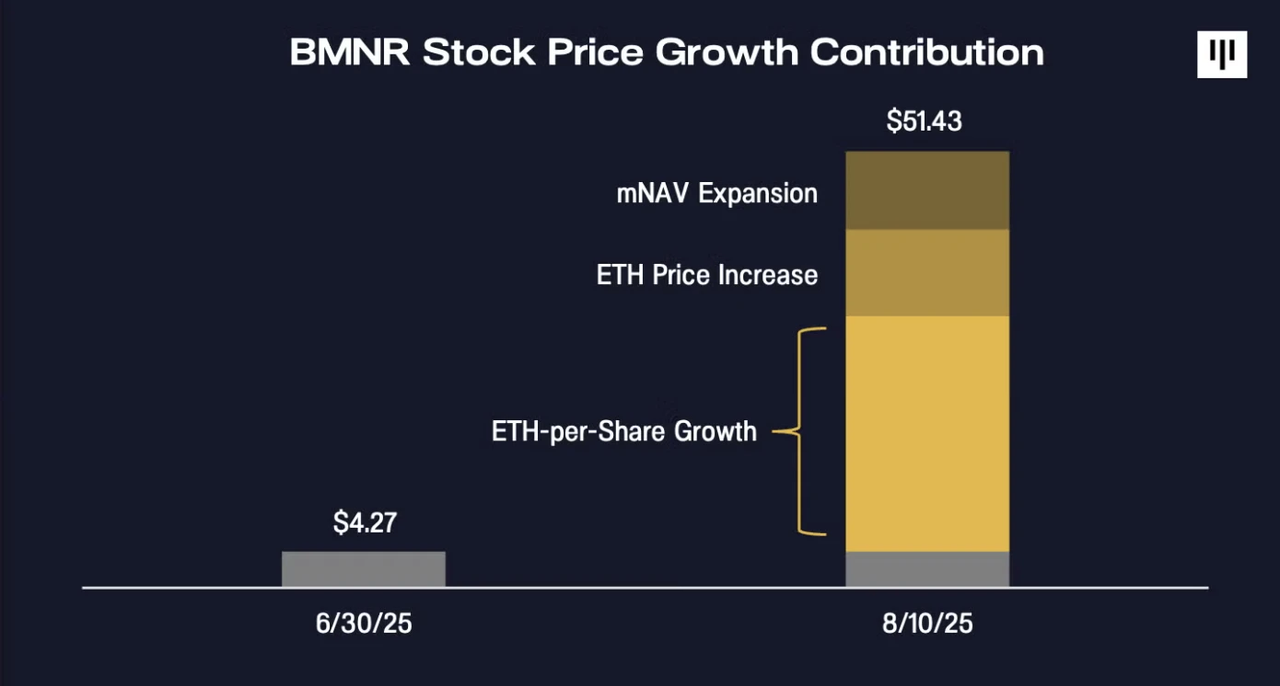

According to Pantera's analysis, using BMNR as an example, the astonishing rise in its stock price is backed by a clear value-driven logic. Within a month of launching the treasury strategy at the end of June, BMNR's per-share ETH holding surged by 334%, contributing about 60% of the stock price increase; the ETH price rose from $2,500 to $4,300, contributing about 20%; and mNAV expanded from 1.1 times to 1.7 times, also contributing about 20%.

This breakdown of returns highlights the core competitive advantage of the DAT model: the primary driver of stock price growth is not passive fluctuations in digital asset prices but rather the appreciation of tokens per share achieved through proactive capital allocation by management. In other words, investors gain not only from the market returns associated with the rise in ETH prices (i.e., returns generated by market fluctuations) but, more importantly, from the proactive returns created by management (i.e., returns that do not fluctuate with the market). This "management-controlled value creation mechanism" is the core differentiated value proposition of DAT companies compared to direct holdings of spot assets, explaining why institutional investors are willing to pay a premium for DAT stocks.

Why choose Ethereum?

Source: Pantera Official Website

BitMine's firm choice of Ethereum reflects a deep judgment on the future development direction of blockchain infrastructure. Tom Lee stated on the Bankless podcast that Ethereum will become the infrastructure for the financialization and AI era, and that the current market price is far below its true potential. As Wall Street accelerates its on-chain activities, Ethereum is set to become one of the most important macro trends in the next decade.

• Network Effect Advantage: Ethereum has become the core infrastructure of digital finance. It hosts the vast majority of DeFi applications, NFT transactions, and enterprise-level blockchain applications. As traditional financial institutions accelerate their "on-chain" activities, the network value of Ethereum will continue to grow.

• Diversified Revenue: Compared to Bitcoin, Ethereum offers a more diverse range of revenue sources. Companies can earn stable returns through staking via Ethereum's Proof of Stake (PoS) mechanism. As Tom Lee stated, "This essentially allows these companies to operate like infrastructure operators, with stable income sources." Additionally, staking derivatives and on-chain yield strategies within the DeFi ecosystem provide more financial innovation tools and revenue opportunities than Bitcoin.

• Institutional Adoption Trend: Tom Lee mentioned on the podcast, "For many U.S. institutions, ETH ETFs may not fit the fund investment parameters, while digital asset treasury companies provide a compliant and efficient alternative." This indicates that as institutional investors show increased interest in Ethereum, digital asset treasury companies offer them more investment options.

BitMine's Core Business Model: Maximizing Per-Share ETH Holdings

BitMine's core business model is to maximize the ETH per share (EPS, ETH Per Share) — because in a digital asset bull market, the density of holdings determines the amplification factor of shareholder returns, this metric has replaced traditional earnings per share as a key performance indicator. BitMine has taken this logic to the extreme by continuously enhancing the per-share ETH content through diversified capital allocation strategies, thereby achieving super-linear growth in stock prices when ETH prices rise.

The main methods for increasing the per-share token holdings are as follows:

• Premium Issuance Strategy: Based on the theoretical framework of the aforementioned DAT model, BitMine has transformed the strategy of "utilizing stock price premiums" into specific operational techniques. New shares are issued when the stock price trades at a premium relative to the NAV of ETH. The logic behind BitMine's latest plan to raise $20 billion to purchase ETH lies here — assuming each share's NAV is $100 but the stock price is $120, the company can issue shares to obtain $120 in cash to purchase an equivalent amount of ETH, thereby increasing the per-share ETH value from $100 to approximately $110, achieving value enhancement.

• Derivative Tool Innovation: Issuing convertible bonds and other equity-linked securities to gain additional capital through the monetization of the dual volatility of stocks and ETH. Pantera predicts that BitMine will soon expand into this area, raising funds to purchase more ETH through bond financing and other means without diluting existing shareholder equity.

• Staking Yield Reinvestment: The Ethereum PoS mechanism provides BitMine with an additional source of income that Bitcoin DAT companies do not possess. The annualized returns obtained from staking ETH can be automatically reinvested to purchase more ETH, creating a compound growth effect. This is a unique advantage of DATs like ETH and other smart contract tokens compared to Bitcoin DATs.

• Mergers and Acquisitions: As more companies shift to Ethereum treasury strategies, BitMine can achieve scale expansion by acquiring other DAT companies whose transaction prices are close to or below NAV.

The synergistic effect of these four growth mechanisms allows BitMine to amplify returns when ETH prices rise and maintain a competitive advantage through proactive capital allocation strategies when ETH prices fall.

Essentially, BitMine's treasury strategy is a meticulously designed financial engineering project, whose success depends on the management's precise grasp of market timing, skilled use of capital market tools, and accurate judgment of the long-term value of the Ethereum ecosystem. The sustainability and replicability of this model will largely determine the future development trajectory of DAT as an emerging asset class.

Summary: Future Outlook

With clear strategic planning and strong execution capabilities, BitMine is driving profound changes in the field of crypto asset management. As BitMine's board chairman Tom Lee has proposed the company's long-term goal — to acquire 5% of the total supply of Ethereum, this goal is referred to as "Alchemy of 5%".

Ethereum treasury strategy companies are replicating the successful experiences of firms like Strategy in the Bitcoin space, attracting follow-ups from several companies, including Bit Digital and SharpLink Gaming. Meanwhile, Pantera Capital's investment of $300 million in the DAT field demonstrates the positioning of institutional capital in this emerging area.

Pioneers like BitMine are successfully transforming theoretical concepts into replicable business realities through their Ethereum treasury reserves. As more publicly listed companies recognize the unique value of digital assets, the strategic layouts and execution experiences of these pioneers will become important catalysts for driving corporate digital transformation, accelerating the deep integration of traditional finance and the blockchain economy.

Reference Information:

Bitmine Immersion Technologies, Inc. official disclosure (PR Newswire release): https://www.prnewswire.com/news/bitmine-immersion-technologies%2C-inc/

Pantera's research on digital asset treasury investment strategies: https://panteracapital.com/blockchain-letter/dat-value-creation/

LongHash VC's analysis of the new asset class of DAT: https://www.longhash.vc/post/digital-asset-treasury-companies-passing-fad-or-a-new-asset-class

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。