大多数人都知道,币圈最赚钱的生意是合约。

但你能想象,一家仅运营了一年的低调黑马 Perp DEX,在 24 小时收入上超过了 Ethereum、Base 等头部公链。把时间拉长到 7 天,它把 Uniswap、Jupiter、AAVE、Lido 一众 DeFi 老玩家全都踩在脚下。它不仅是日收入榜单 15 内少数几个没有发币的项目,也是 0.01% 的价差区间内买 BTC 和 ETH 流动性深度最好的 perp dex。

这个营收曲线新「怪兽」,叫做 edgeX。

营收曲线为何如此凶猛?

与我们熟知的 Hyperliquid 不同,edgeX 是一个 ZK 架构的 perp dex。团队背景上由 Amber 孵化,核心成员汇聚了一批来自高盛、Jump Trading 等在高频交易有深厚经验的团队。产品形态上,edgeX 更像是一个「链上金融全栈化基地」:除了 perp dex 之外,还有 eStrategy(金库)和 edgeX 链另外两个产品线。

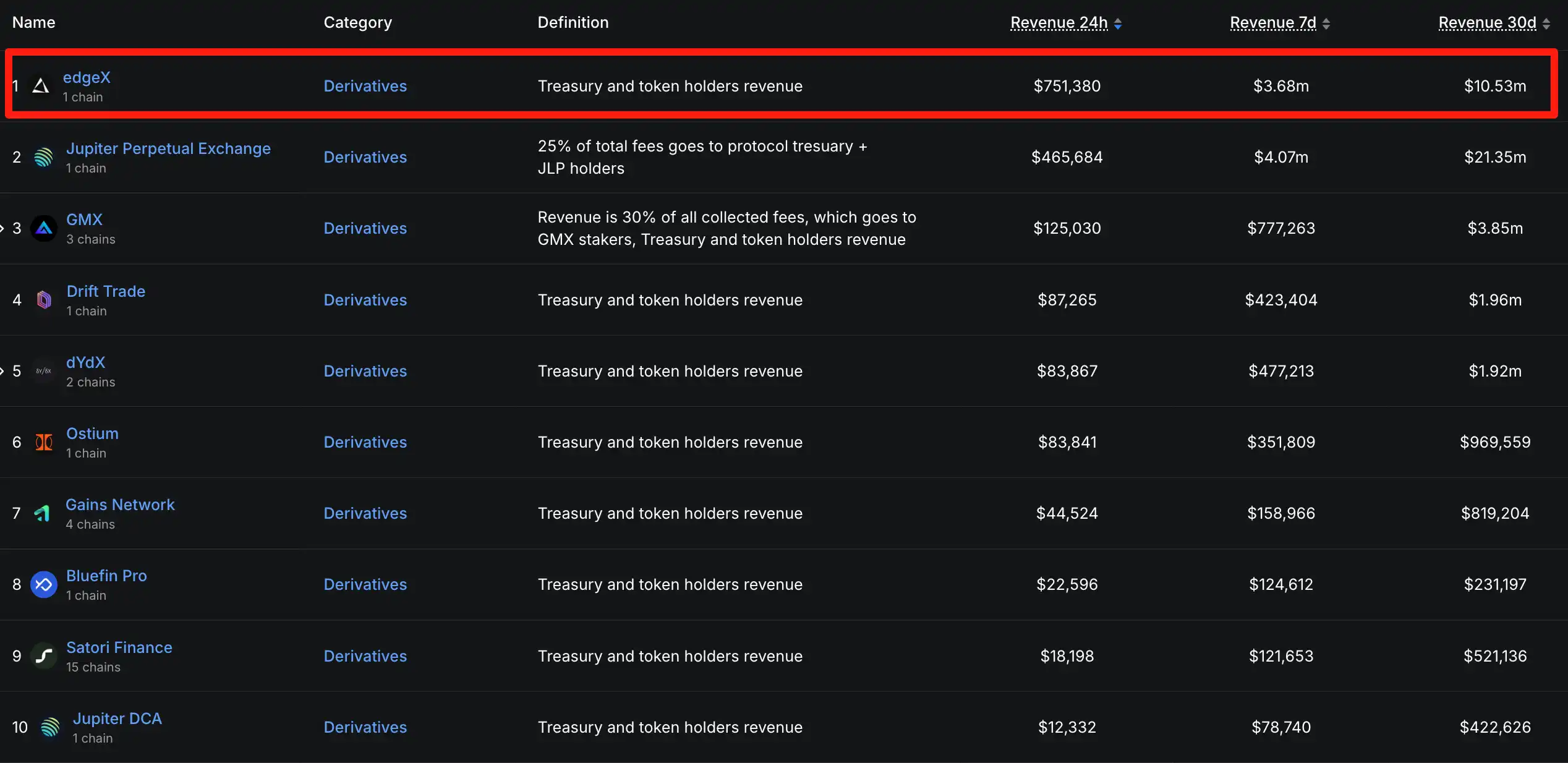

正如文章开头说的那样,产品的优质程度直接体现在收入上,所以对比 perp dex 赛道内部的收入对比,能更直接看出 edgeX 的凶猛。

作为一个仅运营了一年的 perp dex,在过去 30 天,edgeX 手续费收入是 $10.53M,远超赛道老将 GMX 的 $3.85M 和 dYdX 的 $1.92M。也就是说,edgeX 的收入几乎是 GMX 的两倍多、dYdX 的五倍多。

数据来源:DefiLlama

所以,edgeX 是怎样通过收入曲线闯进 perp dex 第一梯队的?答案或许是在交易深度和费率,这两个交易员们最在意和最直观的数据上。

在流动性深度方面,edgeX 目前在所有 Perp DEX 中位列第二。以最核心的 BTC/USDT 为例,在 0.01% 的价差区间内,edgeX 的订单簿可支持高达 $6M 的 BTC 下单量,超越 hyperliquid($5M),Aster($4M)和 Lighter($1M)。虽然整体深度仍略逊于 hyperliquid,但在绝大多数币种上,edgeX 都是除 hyperliquid 外深度最好的 Perp DEX。在这一点上的更多延伸内容可以看 edgeX 的研究负责人Dan的最新文章《Understanding DEX Liquidity: A Comparative Look at Trading Efficiency》,做出了更深入的讨论,这里就不赘述了。

另外,edgeX 对 Maker 和 Taker 也都给出业内极具竞争力的费率:Maker 仅 0.015%,Taker 0.038%,显著低于 Hyperliquid 的 0.045%。此外,用户通过大使推荐链接注册后可解锁 VIP1 等级,Taker 费率可再降至 0.036%,成为大使并享最高 35% 的手续费返佣——既能省下交易成本,又能持续积累空投积分。

在这样的交易深度和费率优势上,edgeX 的护城河就自然而然得形成了,也就推动了收入曲线的增长。即使目前还没发币,也证明了 edgeX 有持续「代币回购」以及为生态建设造血的能力。

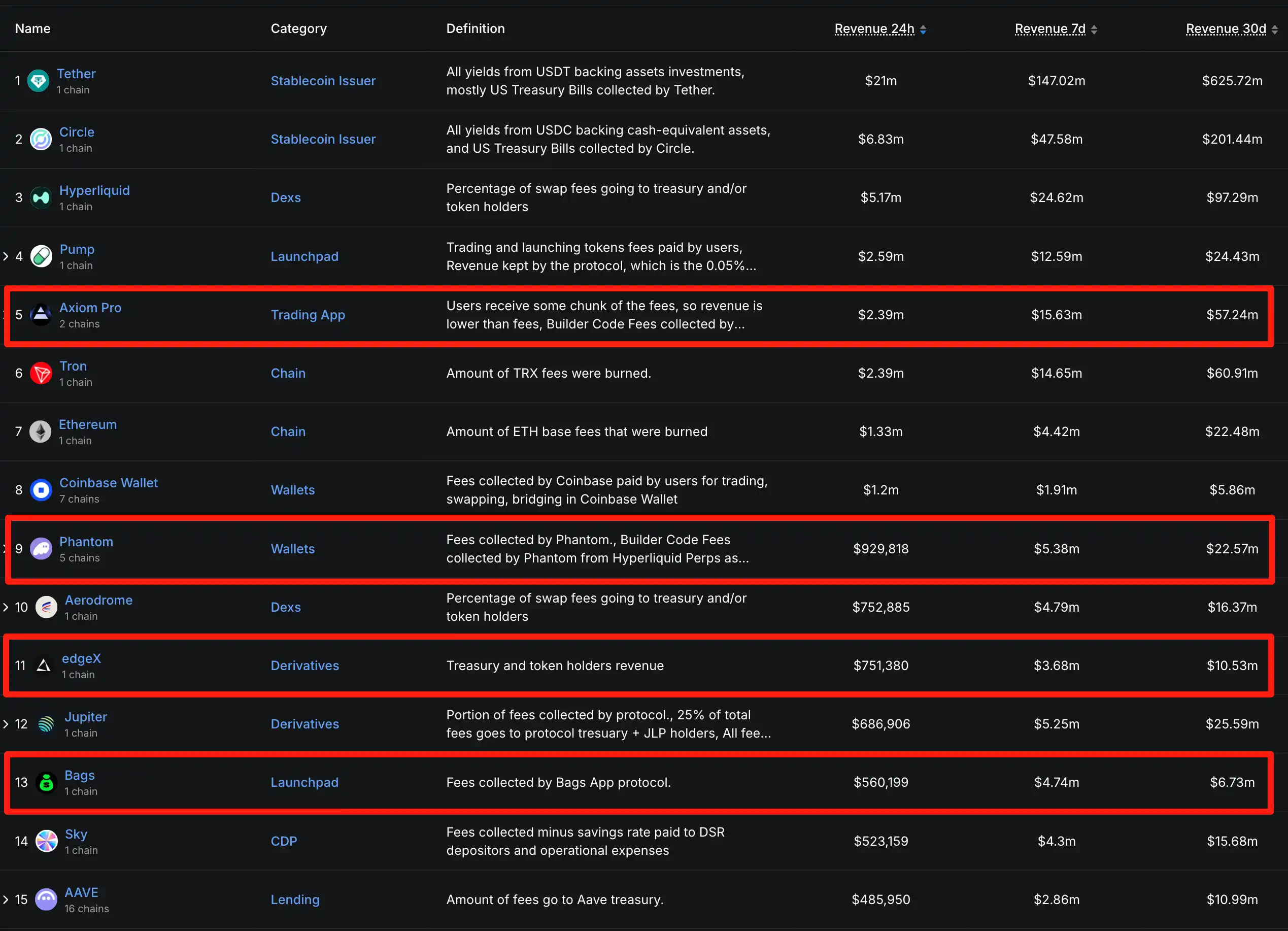

更加耐人寻味的是,把视角拉到全网收入排行榜:在 Top 15 的协议中(剔除 USDT、USDC 这两个稳定币发行方),能够跻身前列却尚未发币的,只剩四家,edgeX 就是其中之一。

数据来源:DefiLlama

而许多中文区的朋友可能没听过这个黑马的名字,因为这家 perp dex 很少做所谓叙事上的包装,社区受众更多在韩国和北美社区中。

换句话说,这是一个明显的高收入、低估值、且仍处代币空窗期的稀缺 Alpha。

目前,edgeX 采用 edgeX Points 作为贡献计量每周发放,目前已发放 2.4 M,获取方式包括交易量、持仓、金库参与和邀请等等,同时 edgeX 的 Messenger 大使计划 正在进行中。

交易量可以刷,但盈利收入很难说假话。不管是传统金融还是 web3 行业,只有真金白银意义上的「用户付费意愿」才是「产品可持续性」的最直接验证。

edgeX 用不到一年的时间,把现金流做到了行业前 15,这是一条确定性极高的增长曲,或许也是一个确定性极强的 alpha。下一阶段,它会以怎样的 FDV 上线、又会给早期参与者怎样的回报?我们也可以期待一下。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。