Stripe’s Tempo, revealed earlier this week, is described as a high-performance, payments-focused L1 blockchain compatible with Ethereum. The company partnered with crypto investment firm Paradigm, with co-founder Matt Huang reportedly leading the initiative. Tempo aims to facilitate faster and cheaper cross-border payments, building on Stripe’s acquisitions of stablecoin startup Bridge and identity firm Privy.

The announcements from Stripe and Circle have caused a great deal of people to share their opinions on the subject.

Circle followed suit with the introduction of Arc, an open L1 blockchain designed for stablecoin payments, foreign exchange, and capital markets applications. Arc is EVM-compatible and uses USDC as its native gas token, with a public testnet planned for later in 2025. The announcement coincided with Circle reporting its second-quarter earnings, pointing to its push into blockchain infrastructure.

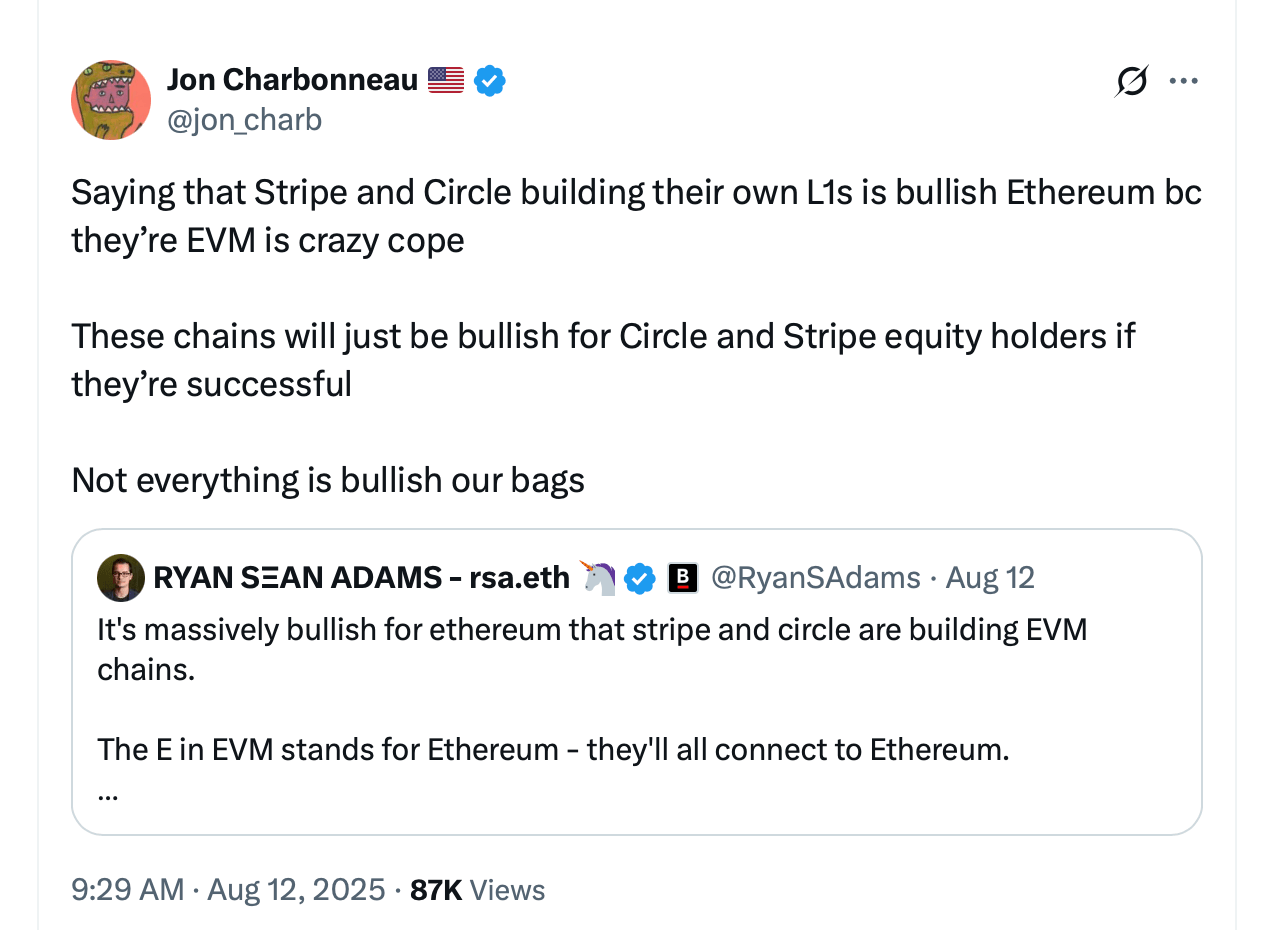

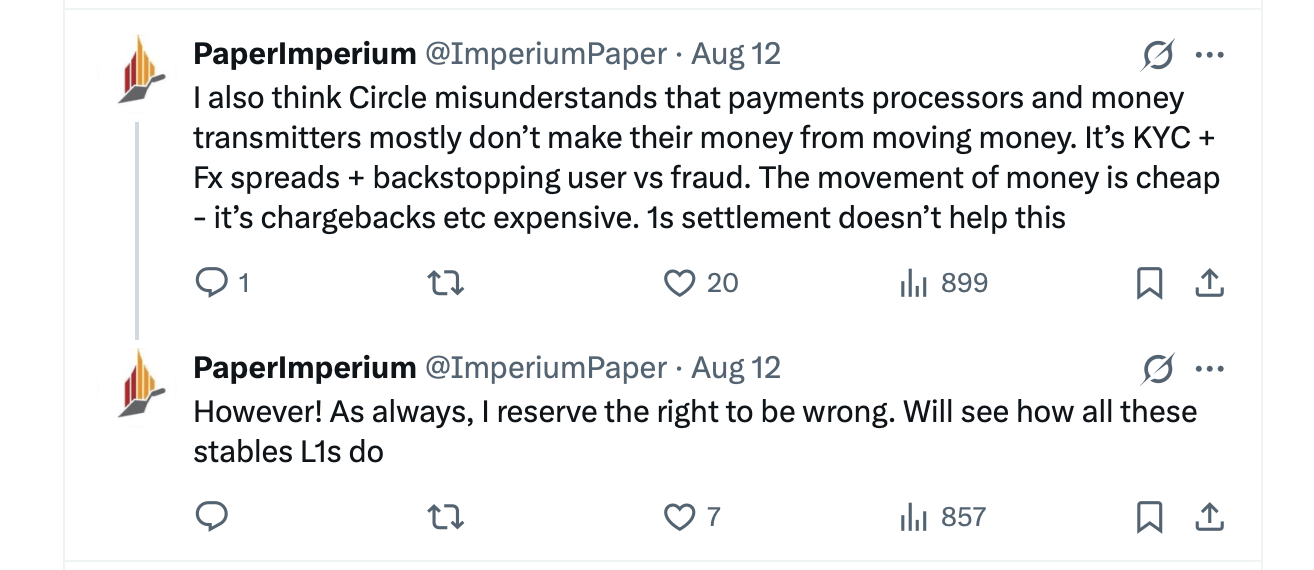

The moves have triggered intense discussion on X, where users question whether these new L1 chains offer genuine innovation or merely exacerbate liquidity fragmentation in an already crowded ecosystem. Some critics argue that Stripe and Circle should have built on existing L2 solutions or created an L2, that scales atop blockchains like Ethereum to reduce costs and improve efficiency without creating separate networks.

One X user, expressed skepticism, posting: “Okay let me give u a controversial perspective about Stripe and Circle L1: What does Circle and Stripe have except for distribution… this is actually not a bullish case for crypto.” This view highlights concerns that the chains prioritize corporate control over decentralized advancement.

Supporters, however, see the launches as validation for specialized blockchains. One individual wrote: “Stripe and Circle launching their own L1 is massive validation for the don’t abstract my chain thesis… If your chain isn’t thinking about how to uniquely own distribution it’s probably ngmi.” Such opinions emphasize the firms’ vast merchant networks as a competitive edge.

Debate also centers on L2 competition, with users noting that platforms like Optimism and Arbitrum already address scaling issues. Another person argued: “The reason that Stripe doing an L1 instead of an L2 is a bad idea… Stripe is *not* well positioned for this.” This reflects fears that new L1s could dilute user bases and liquidity across chains.

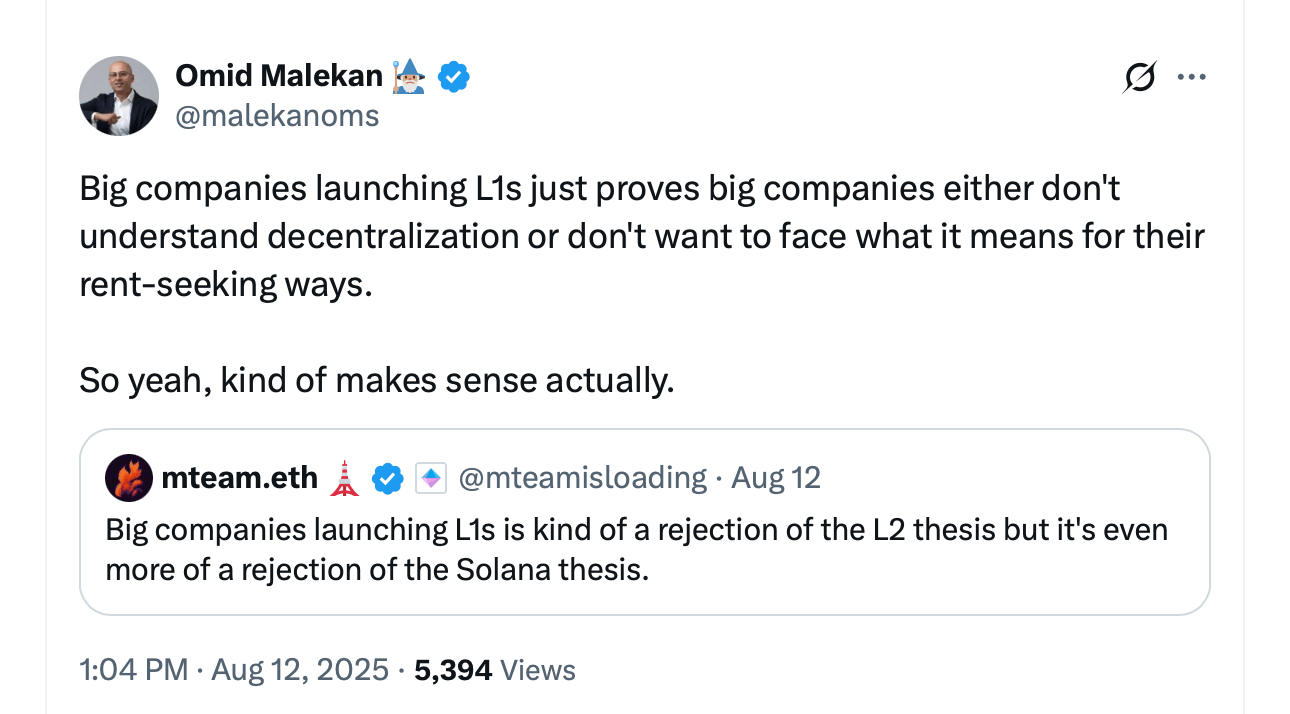

Omid Malekan stated:

For the love of god and Satoshi, we don’t need any more L1s! And we really don’t need L1s for stablecoins. They won’t have other desirable assets, so no DeFi. They’ll be single stablecoin (from the creator) so no interop. They’ll only utility for their native coin will be to pay fees, so low value and little economic security.

Others view the announcements as part of a broader trend toward vertical integration in crypto. The X user dubbed ‘qw’ posted: “saw a lot of cope on the tl about stripe/circle launching their own l1… chains have little moat relative to the distribution layer.” Proponents suggest this could enhance interoperability, though skeptics warn of regulatory hurdles.

The controversy highlights a divide: While some hail the entries as bullish for adoption, others see them as redundant amid L2 dominance. As of Aug. 13, X discussions continue, with mixed sentiments on whether Tempo and Arc will thrive or falter in a fragmented market.

Industry watchers note that both chains aim for compliance and speed, potentially appealing to institutional users. However, success may hinge on developer adoption and bridging with existing ecosystems.

The launches come as ethereum exchange-traded funds (ETFs) see record inflows, signaling growing mainstream interest in ETH-based infrastructure alongside L2s. Yet, the backlash on X highlights ongoing tensions between innovation and consolidation in blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。