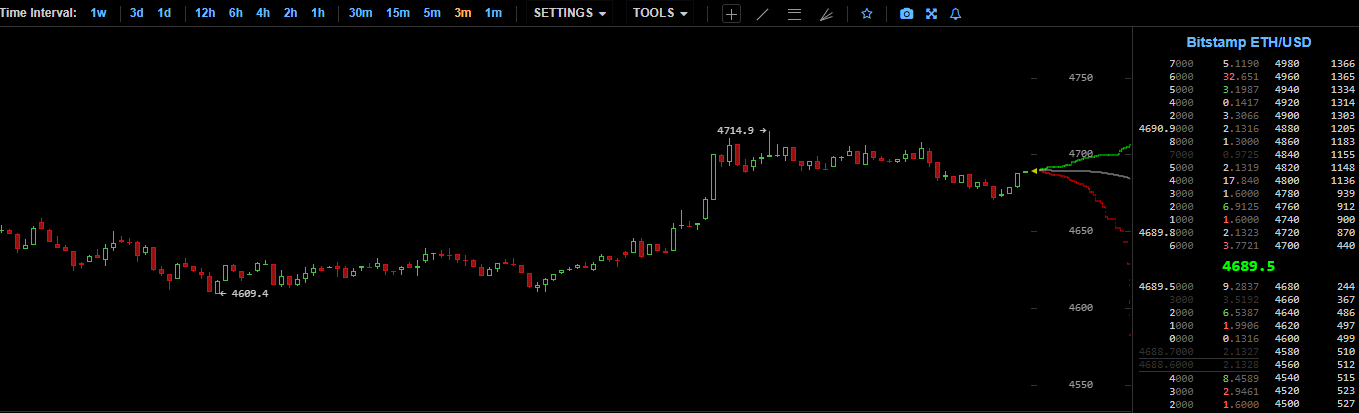

以太坊(ETH)在8月13日接近历史最高点,在24小时内上涨超过10%,首次达到4,700美元,这是自2021年11月以来的首次。自8月6日以来,当时ETH短暂交易低于3,600美元,ETH在不到七天的时间里上涨了近30%,成为山寨币中的佼佼者。

ETH的上涨至4,708美元(东部标准时间5:15)也帮助推动了加密货币生态系统的总市值重新回到4.1万亿美元以上。这一第二大数字资产的最新上涨在短短24小时内消灭了超过2.5亿美元的空头头寸,这一数字几乎是比特币(BTC)空头被清算的10倍。

这轮加密货币的上涨导致大多数ETH供应处于盈利状态。一位关键意见领袖(KOL)Ted Pillows表示,ETH供应中盈利的比例接近100%。

“KOL表示,ETH供应中的盈利比例现在为97.22%。这很快就会达到100%。”

该数字资产的激增与以太坊国库公司Bitmine Immersions希望筹集200亿美元的消息相吻合,这笔资金将用于将其ETH持有量提升至总流通供应的5%。这些报道是在Bitmine将其ETH持有量增加至1,150,263之后发布的,使其加密国库的价值超过50亿美元。

据Bitcoin.com News报道,以太坊国库公司的ETH储备使其成为全球第三大加密货币国库资产持有者。只有Michael Saylor的Strategy和Marathon Digital Holdings的持有量更大。

尽管Bitmine的计划被视为影响ETH供需结构,但Bitunix分析师警告称,这样的计划是中长期因素,不太可能“改变历史供应区的即时卖压”。此外,Bitunix还警告称,机构采用的增加往往会导致流动性集中上升,这反过来在牛市期间放大收益,但在回调期间加速下跌。

与此同时,Zero Complexity Trading的创始人Koroush AK表示,当ETH开始超越BTC时,这表明资金正在流入以太坊。

“这是你提前警告,下一波资金可能会涌入大盘山寨币。查看ETH/BTC图表可以清晰地描绘出ETH的强度,”AK在X上写道。

这位创始人补充道,一旦ETH开始显示出对BTC的“明显强度”,这意味着“像SOL、SUI、AVAX和XRP这样的市值较大的山寨币通常会是下一个。”然而,AK警告称,这种资金轮换“可能会迅速逆转。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。