Written by: Babywhale, Techub News

One major characteristic of a16z's investments in the Web3 space is that they do not blindly follow trends but often accurately identify key tracks before the general market consensus forms. For example, before the boom of DeFi, new public chains, and NFTs in 2021, they invested in projects or companies such as Compound, NEAR, OpenSea, and Yuga Labs. In the past two years, the tracks and projects that a16z has clearly favored are EigenLayer in the re-staking field and Story Protocol in the intellectual property domain.

When it comes to EigenLayer, our first reaction often remains focused on the term "re-staking." Everything indeed started with re-staking, but as it has developed, EigenLayer's goal is no longer limited to providing more returns for users participating in staking. Instead, it aims to build a Web3 version of a cloud platform based on re-staking. In a Web3 environment where "taxation" is the primary profit model, a16z has invested over a hundred million dollars in EigenLayer, creating something new.

The Rise of Web2 Cloud Services

Few people know that a16z's two founders, Marc Lowell Andreessen and Ben Horowitz, founded Loudcloud in 1999, which is recognized as one of the earliest cloud service companies in the industry, even predating the establishment of the current largest cloud service provider, Amazon Web Services, by three years. This may also be one of the important reasons for a16z's strong affinity for the cloud concept.

Ren Xianghui, founder of Meihua Wang, wrote in an article titled "A Brief History of Cloud Computing" published in 2020, "The economic and convenient cloud computing services we enjoy today mainly come from two major drivers: one is the virtualization technology of computing resources, and the other is the economies of scale. The former originated from the Hypervisor virtualization software launched by VMWare after 2000, which no longer relied on a parent operating system and allowed users to partition hardware and network resources into multiple units, thus achieving pooling, sharing, and on-demand scheduling of computing resources. In 2006, Amazon launched the S3 object storage service and SQS simple queue service, pioneering public cloud computing services."

The former laid the technical foundation, while the latter pioneered the business model. For developers needing relevant resources to develop online services, building servers themselves is time-consuming, labor-intensive, and costly, and they cannot flexibly respond to changes in resource demand. Scalable cloud services not only gain cost advantages and high-quality resources through economies of scale but also offer higher security, disaster recovery, and flexibility.

According to a research report published by Guosen Securities in 2018, AWS (Amazon Web Services) achieved a terrifying market share of 47.10% in the public cloud IaaS (Infrastructure as a Service) sector in 2017. Amazon successfully turned a profit in 2015 through its cloud services.

In China, the commercial giant Alibaba invested in the establishment of Alibaba Cloud in September 2009, becoming one of the first large internet companies to make cloud computing a strategic core. In 2011, Jack Ma stated in an internal speech, "Invest 1 billion every year in Alibaba Cloud for 10 years; if we can't make it work, then we'll talk." Before this, there was an interesting episode during the "IT Leaders Summit" held in China in 2010, where in discussions about cloud computing, Li Yanhong referred to it as "old wine in a new bottle," while Ma Huateng believed that cloud computing would take hundreds or even a thousand years to become as essential as "water, electricity, and coal." Only Jack Ma expressed that if Alibaba did not engage in cloud computing, it would die in the future.

This misjudgment of the importance of cloud computing by large internet companies in China is evident. To this day, according to a report released by Guosen Securities in February this year, the market share of the global public cloud market in 2024 is expected to reach 54% in the US and 21% in Western Europe, while China only accounts for 5%. However, within this 5%, Alibaba Cloud holds over (or at least close to) one-third of the shares in IaaS, PaaS, and SaaS.

This shows that a sufficiently large market, an early entry, and a significant scale allow cloud computing giants to reap long-term dividends and high market shares. But will the same thing happen in the Web3 space?

What Does EigenLayer Aim to Do?

For Web3 developers, creating a decentralized product that requires building its own consensus has always been a cumbersome issue regarding the true establishment, perfection, and security of that consensus, similar to how Web2 developers build a website or app. If there were a product that could establish a complete set of infrastructure for Web3 developers, allowing them to focus solely on the characteristics of the chain itself, including communication, verification, and consensus establishment, all of which could be solved in one stop, and unlike development tools, it only requires providing the logic for verifying transactions to directly launch the product, could this be considered a "cloud service" for Web3 products?

At least, EigenLayer thinks so. The aforementioned logic for verifying transactions refers to what we commonly call AVS, Active Verification Service. Literally understanding "active verification," EigenLayer can provide different verification functions executed according to customer requirements. For example, the verification logic for Layer 1 may be the most complex, while Layer 2 might assume the validity of transactions by default and later execute challenges to ultimately confirm transactions. Oracles may require mechanisms to ensure the authenticity of the data being fed, which all represent differences in the "verification" aspect. Even for L1, different consensus mechanisms will have different designs regarding verification, while other aspects may be relatively unified.

The above may be a relatively straightforward explanation of AVS; we will not delve into overly detailed technical aspects here. EigenLayer initially focused on "re-staking," allowing users to stake their Ethereum or Ethereum's LST tokens to EigenLayer, which can then be used as collateral to provide verification services for new products. From a security perspective, for instance, if EigenLayer provides a verification node with collateral worth 100 million dollars to a new product, then an attacker would need to exceed 100 million dollars in attack costs, assuming they cannot breach EigenLayer, similar to the so-called 51% attack in Bitcoin and Ethereum networks.

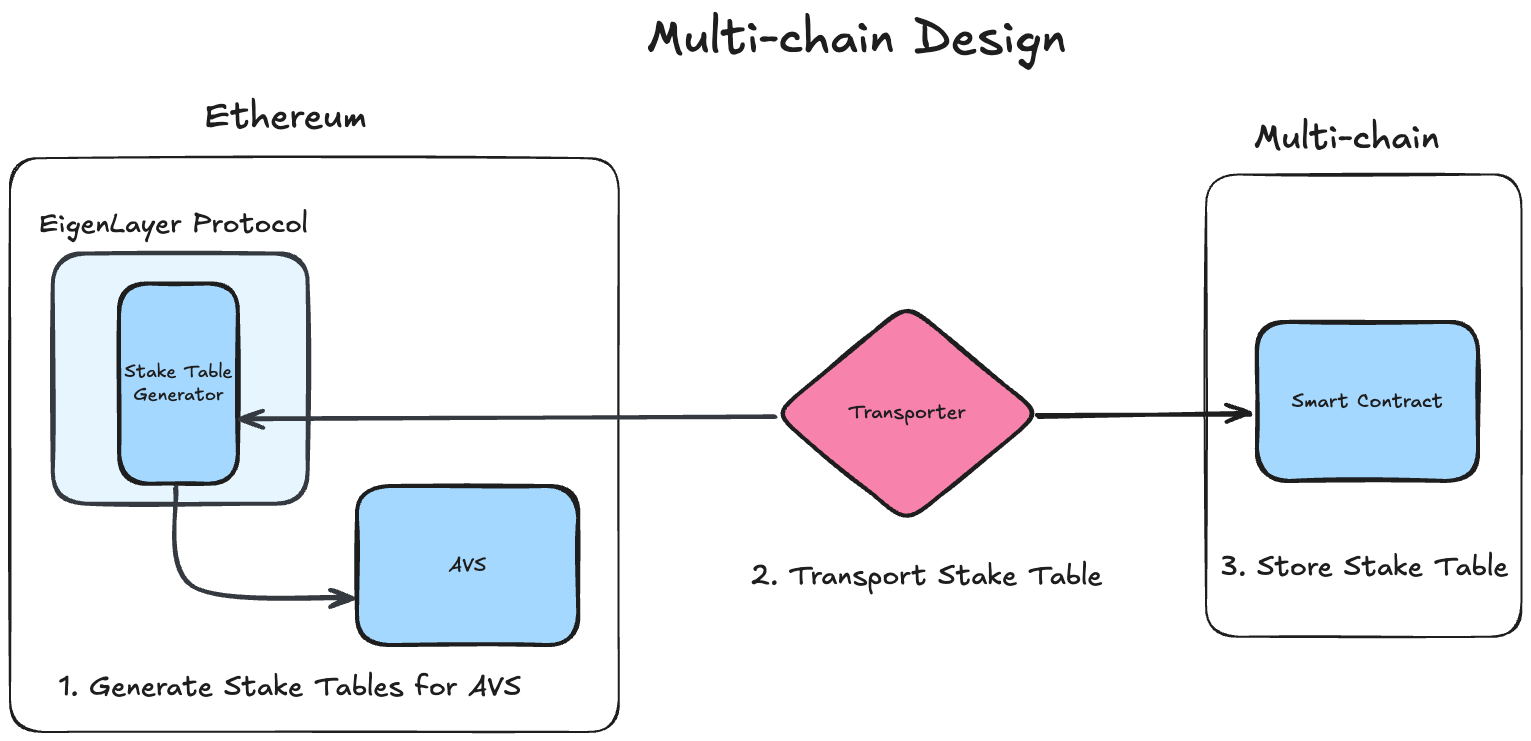

In a recent article, EigenLayer elaborated on the working principles of AVS: EigenLayer generates a state, transmits that state to the contract of the target product or chain in some way, and the off-chain computation contained in the state ultimately needs to be verified on Ethereum.

EigenLayer also stated that Eigen Labs is developing a multi-chain verification solution to utilize the EigenLayer state transmitted via RPC. The article analyzed the implementation of AVS in various environments, using shared sorters, SVM environments, and Cosmos application chains as examples. Additionally, EigenLayer plans to add more development components in the future to help developers more easily launch products or services.

Becoming the Amazon of the "Web3 Cloud" space may be EigenLayer's goal and a16z's expectation. From a feasibility standpoint, there is indeed significant room for development, but is that really the case?

Is There Enough Demand in the Web3 Market?

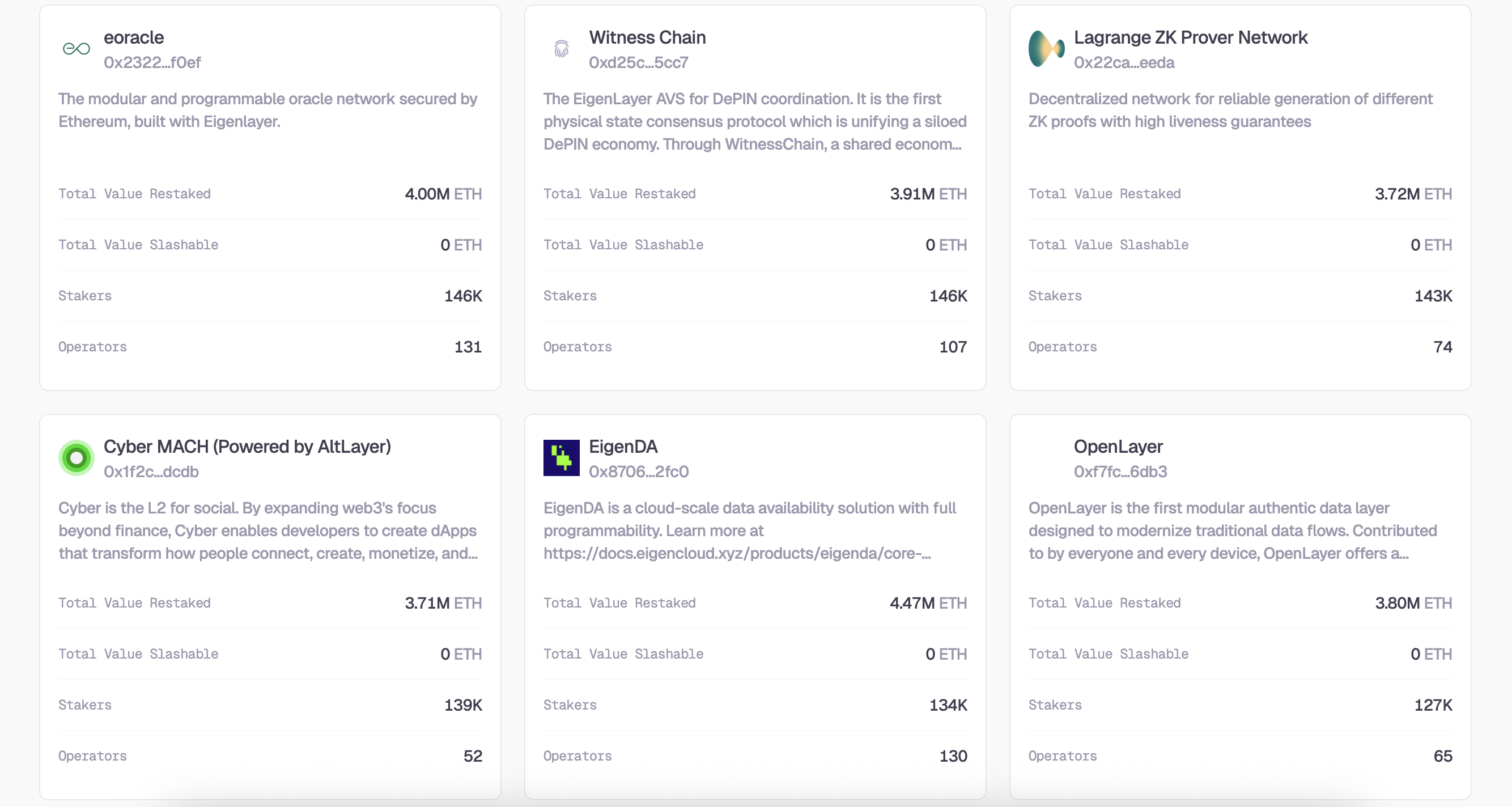

Whether EigenLayer's vision can be realized actually depends on whether there will be enough projects in the future Web3 space that can and are willing to use AVS. According to the current information on their official website, there are nearly 40 supported AVS, and around 30 have received collateral support worth over 100 million dollars, but the specific yield rates are currently unknown.

From my perspective, the future resurgence of projects is undoubtedly on the horizon; the key is when that day will come. Projects that comply with regulations, such as RWA and stablecoin projects, may not easily choose external validators and will rely more on the growth of the native ecosystem. However, the crux of Web3 right now seems to be that aside from finance, there are not many new scenarios; most users come to make money rather than spend it.

If Web3 is merely a game of transferring money from one hand to the other, then EigenCloud's ceiling will be very limited. The explosion of applications on the consumer side must continuously meet various demands, just as Web2 applications satisfy needs for shopping, entertainment, socializing, etc., giving rise to tens of thousands or even hundreds of thousands of applications. Web3 is not a revolutionary technological advancement like the internet; at best, it is a new module built on the internet. Aside from attempts to "redo everything in Web3" and so-called transformative collaboration methods, how many truly meaningful "products" that require significant security protection from the outset will determine the height of EigenCloud's development.

Non-Financial Applications Serving Consensus Security

The core of EigenCloud is to directly extend the security established by Ethereum over the years to any product based on its AVS, placing all off-chain computations ultimately verified on Ethereum, effectively making Ethereum the underlying guarantee for all products. This is actually similar to the operating system of cloud products in Web2.

EigenCloud's vision of the cloud cannot be called innovative, but the idea of utilizing Ethereum's security as the foundation, without designing for decentralization for the sake of decentralization, and not using its issued tokens as a means of payment, provides a new native product design approach while also offering a good model for non-financial projects.

Finance was the first to be introduced to Web3, primarily because blockchain is inherently a ledger, a "sanctuary" for asset issuance. Applications like stablecoins and RWA tokenization have already gained mainstream acceptance, but the ceiling for asset issuance and trading stories is already visible. If non-financial applications, such as the once-popular TON mini-games, could be accepted like stablecoins, then EigenCloud's ceiling could be exponentially raised. I believe EigenLayer is also motivated to promote the arrival of such an era and share the design experience of EigenCloud, which is inherently a non-financial native product.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。