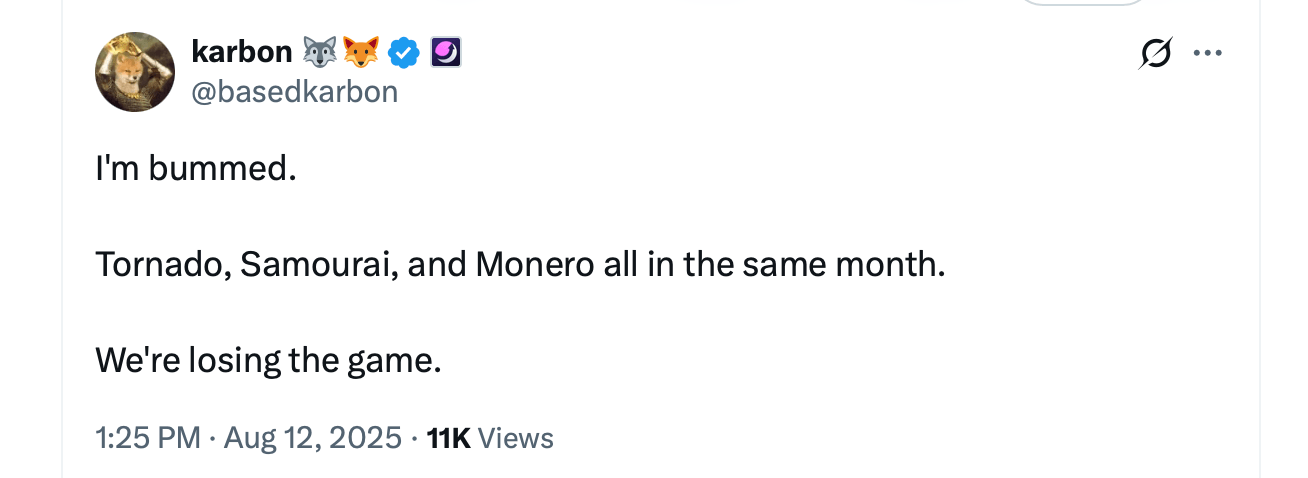

在社交媒体上,X用户Karbon告诉他们的86,900名关注者,最近对Monero和其他项目的打击已经严重削弱了加密隐私。“Tornado Cash - 消失了,Samourai - 消失了,Monero - 正在经历51%的攻击,”Karbon写道。“如果你想要隐私,已经没有什么可以使用的了。干得好,团队。耶,数字上涨。”

Karbon指的是最近一系列对加密隐私的打击:Tornado Cash被制裁并有效地列入黑名单,Samourai Wallet遭遇法律行动并失去了基础设施,而现在Monero正面临一个成功重组多个区块的矿池。隐私币经历了多年的交易所下架,而专注于隐私的加密项目现在似乎受到如此严重的压制,以至于使用它们变得越来越困难。

Karbon的X帖子吸引了近200,000次观看,并引发了大量反应。“每个人都更担心Fartcoin的价格波动,而不是Monero的51%攻击,这几乎概括了加密货币的现状,”Zack Voell写道。一位用户问Karbon,Monero的51%攻击是否仅仅与挖矿有关,指出实施攻击的人可能有利益关系,想要保持网络的正常运行。

“你现在使用它感到安全吗,知道他们刚刚经历了重组并且可以审查交易吗?”Karbon问那个人。“在这种情况下,你愿意冒多大的风险进行转移?”其他人也同意隐私的侵蚀随着每年的推移而加深。“区块链最终会超级充实监控国家,而现金将是唯一保留隐私的方式——这真是讽刺,”另一位网友在讨论中回复道。

这场讨论突显了关注资产价格和牛市的人与对加密隐私空间缩小感到警惕的人之间日益加大的分歧。当许多人庆祝今天的加密收益时,其他人警告说,如果没有可访问的、抗审查的工具,行业可能会危及其核心承诺之一:赋予个人在没有持续监督或控制的情况下进行交易的能力。

更广泛的担忧是,加密的未来是否会偏向便利和合规,而不是曾经定义它的原则。如果隐私成为事后考虑,这项技术的变革潜力可能会缩小到仅仅是一个投机资产类别,留下其原始愿景被搁置,取而代之的是一个与传统金融更为接近的系统,远远超出了其开创者的想象。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。