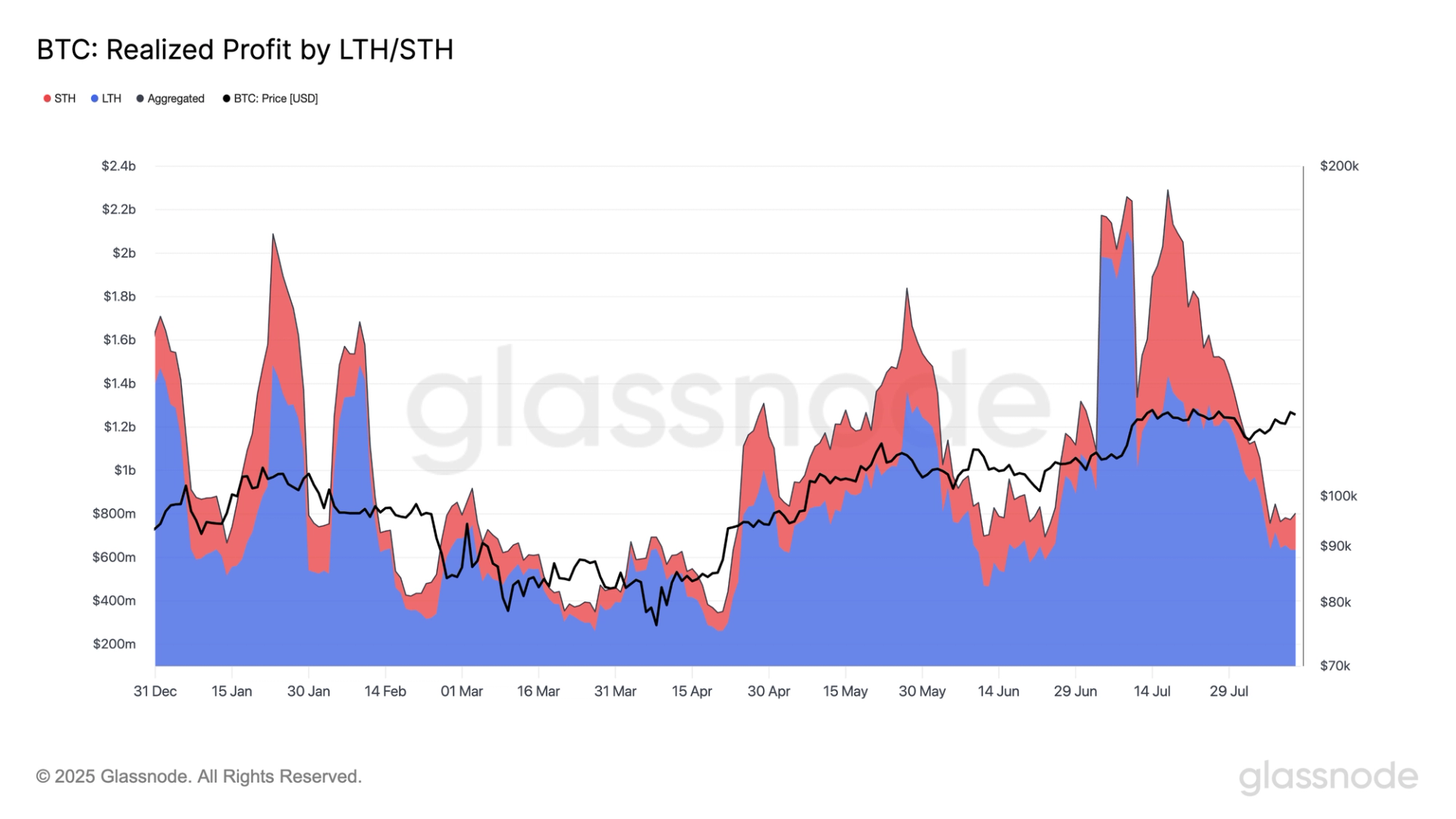

Over the past five days, bitcoin (BTC) has surged from $116,000 to just above $122,000 before retreating to the current $119,000. Despite this price movement, profit-taking has remained muted, averaging under $750 million per day on a year-to-date basis.

For perspective, Glassnode data shows that in January daily realized profits were around $2 billion, with similar spikes in July when bitcoin reached its all-time high of $123,000.

Glassnode’s Realized Profit metric measures the total profit from all spent coins where the sale price exceeded the acquisition price. When broken down by Long-Term Holders (LTH) and Short-Term Holders (STH), it offers a more granular view of market behavior. This classification is based on the weighted average acquisition date, with LTH supply defined as holdings aged more than roughly 155 days.

The data reveals that LTHs have consistently realized far more profit than STHs. An exception occurred in July, when STH realized profits spiked as bitcoin hit its all-time high. Many of these short-term gains likely came from investors who bought during the March “tariff tantrum” sell-off, when bitcoin fell to $76,000.

The current low level of realized profit-taking, particularly compared with prior market peaks, is encouraging for bitcoin’s bullish outlook. It suggests that holders, both long and short term, are largely refraining from locking in gains despite recent price increases. If this trend persists, it could provide the market with the stability and momentum needed to push toward new all-time highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。