Written by: Glendon, Techub News

After a gap of 3 years and 8 months, Ethereum has finally risen above $4,400 again, which is truly inspiring.

Compared to its lackluster performance in the previous cycle, Ethereum has recently shown a resilience that rivals Bitcoin. Therefore, whether Ethereum can maintain its current momentum and break through its previous highs has inevitably become the focus of investors. This article will discuss the driving forces behind Ethereum's recent rise and its ecological status, as well as explore whether it can set a new historical high.

"The Era of Institutions" Arrives, Public Companies Ignite the "Ethereum Reserve War"

The recent continuous rise of Ethereum is attributed to institutions initiating the "Ethereum Reserve War," the inflow of ETF funds, and the compounded effects of favorable policies. Undoubtedly, the "Ethereum Reserve War" has played a major driving role. Just as the surge in Bitcoin prices was backed by public companies buying in large quantities, Ethereum has similarly benefited.

On May 31, the U.S. publicly listed company SharpLink Gaming announced the completion of a $425 million private placement to initiate an Ethereum asset reserve strategy, and on June 13, it purchased approximately $463 million worth of Ethereum at an average price of $2,626, becoming the largest publicly traded holder of Ethereum, officially firing the first shot in the "Ethereum Reserve War"!

Prior to this, although many public companies had bought Ethereum, no company had publicly announced an increase in its Ethereum holdings with over $400 million in large funds. At that time, Bitcoin was in the spotlight, attracting nearly all institutional attention, while Ethereum's price performance was mediocre, and there were still many doubts surrounding its trading volume, scalability, and other aspects.

Digital asset derivatives company Two Prime publicly criticized in early May that Ethereum's statistical trading behavior, value proposition, and community culture had failed to the point of being unworthy of participation, emphasizing that Ethereum had undergone fundamental changes, its correlation with Bitcoin had decreased, and tail risks had significantly increased, with a future focus on Bitcoin.

Glassnode also tweeted on May 20 that the Ethereum Pectra upgrade had not yet driven an increase in network participation. Since the upgrade, the average number of new and recovered addresses has decreased by 1.8% and 8.4%, respectively, compared to the beginning of the year.

It is worth noting that the Ethereum Pectra upgrade was completed on the mainnet on May 7. Prior to this, Galaxy researcher Zack Pokorny had monitored that in the five full trading days following the Pectra launch, the number of Blobs purchased daily by Rollup increased from about 21,200 to 25,600, leading to a sharp drop in L2 costs on Ethereum, but an increase in node pressure.

The Pectra upgrade undoubtedly improved the scalability, efficiency, and flexible staking of the Ethereum network, but at that time, the ecological status of Ethereum did not see substantial improvement.

However, during this period, institutional interest in Ethereum was already evident.

As early as May 15, Nasdaq-listed blockchain company BTCS announced it had raised $57.8 million through convertible notes for strategic increases in Ethereum holdings, stating it would emulate MicroStrategy's strategy to obtain continuous income through staking and block building. However, compared to SharpLink Gaming, which is an internet technology public company, BTCS, as an industry-native company focused on blockchain infrastructure services, could not match the scale and effect of Ethereum acquisition.

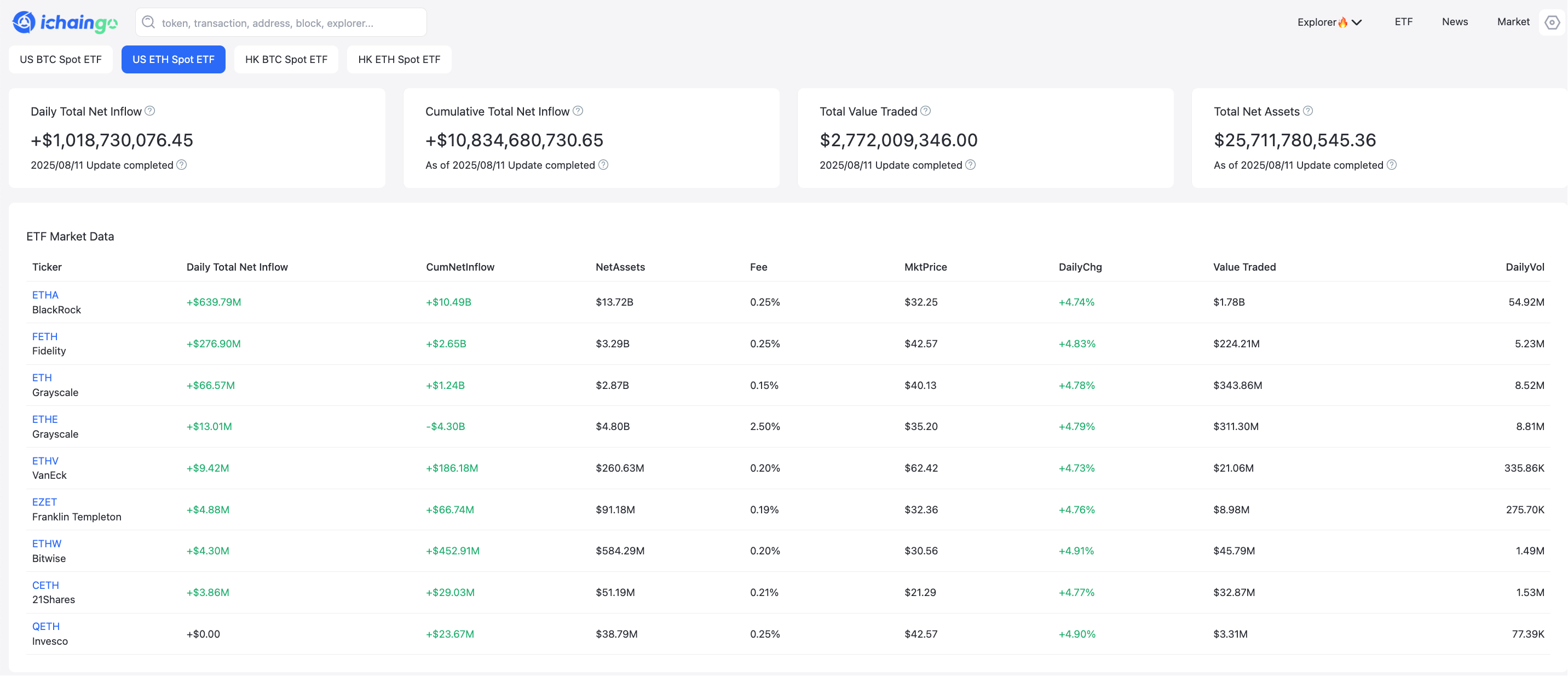

At the same time, significant turning points also appeared in the data for U.S. Ethereum spot ETFs. According to ichaingo data, starting from May 12, U.S. Ethereum spot ETFs officially ended nearly nine consecutive weeks of net outflows and achieved 13 consecutive weeks of net inflows.

As June approached, with more public companies entering the fray, the Ethereum reserve war finally began to unfold.

During this period, on June 26, the listed mining company Bit Digital announced it would shut down its Bitcoin mining business and transition to a pure Ethereum staking company, adopting an Ethereum reserve strategy. Subsequently, the company raised $150 million to purchase Ethereum and planned to "gradually" convert its Bitcoin holdings into Ethereum.

Coincidentally, BitMine, which had previously focused on a Bitcoin reserve strategy, also announced on June 30 that it would shift to Ethereum, completing a $250 million private placement to implement an Ethereum financial strategy.

Thus, Ethereum welcomed its early three giants in the reserve strategy: BitMine, SharpLink Gaming, and Bit Digital. It was also from this time that Ethereum gradually surpassed its competitor Solana in the cryptocurrency reserve war, despite the latter having earlier public companies that regarded it as a core reserve asset: DeFi Development Corp., Upexi, and SOL Strategies.

So, why was Ethereum able to surpass Solana, which has slower transaction processing speeds, higher transaction costs, and even faces ecological development bottlenecks?

In response, Ethereum co-founder Vitalik Buterin provided an answer in an interview with CNBC. He stated that people think institutional investors only care about scale and speed, but in practice, the opposite is true; many institutions express that they value Ethereum because it is stable, reliable, and does not crash.

Tomasz Stańczak, the newly appointed co-executive director of the Ethereum Foundation, also added that the core reason institutions choose Ethereum is the same; Ethereum has not stopped for a moment in the past decade. When institutions send orders to the market, they want to ensure that their orders are treated fairly, with no preferences, and that trades are executed at the time of delivery. As stablecoins and tokenized assets become mainstream, these guarantees become increasingly valuable.

In July, under the influence of the three giants continuously increasing their Ethereum holdings, more and more public companies like GameSquare and BTC Digital joined this reserve war, leading Ethereum to experience what can be described as its strongest "institutional era" ever. So much so that Wintermute founder and CEO Evgeny Gaevoy tweeted on July 17 that "there is almost no Ethereum available for sale on Wintermute's OTC trading platform." During this period, Ethereum's price also broke through $3,500, reaching its highest level since January 2025.

Throughout this process, it is important to clarify that Ethereum's continuous rise has largely benefited from favorable policies.

On July 19, U.S. President Trump officially signed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (the "GENIUS Act") at the White House, marking the implementation phase of U.S. stablecoin regulatory legislation and significantly impacting the global cryptocurrency market landscape.

In addition to stablecoins, which are the core of the bill, many believe that Ethereum is the biggest beneficiary of this act, including Andrew Keys, co-founder and chairman of the Ethereum reserve company "The Ether Machine."

In an interview with CNBC, he pointed out, "Ethereum is the biggest beneficiary of the GENIUS Act because 90% of RWA and stablecoins are deployed on Ethereum, just as 90% of searches in the market happen on Google, while Yahoo and Bing account for only a small share. Ethereum is a productive asset, unlike Bitcoin, as it can generate intrinsic returns through staking."

According to Cointelegraph, since the passage of the GENIUS Act in July, the supply of yield-bearing stablecoins has surged, with on-chain data showing that the biggest beneficiaries are Ethena USDe (USDe) and Sky's USDS. Additionally, according to DefiLlama data, the circulating supply of USDe has increased by over 97% in the past month, reaching 10.431 billion, ranking third among all stablecoins by market capitalization. Interestingly, as Andrew Keys mentioned, the circulating supply of USDe on Ethereum has also increased by more than 97%.

When he and several early Ethereum builders and financial veterans publicly launched their new company, The Ether Machine, they immediately proclaimed that the company plans to hold over 400,000 Ethereum at the time of its listing, with a total value exceeding $1.5 billion.

On July 31, The Ether Machine increased its holdings by approximately 15,000 Ethereum, raising its total holdings to 334,757 Ethereum, quickly surpassing Big Digital and BTCS in reserve amounts.

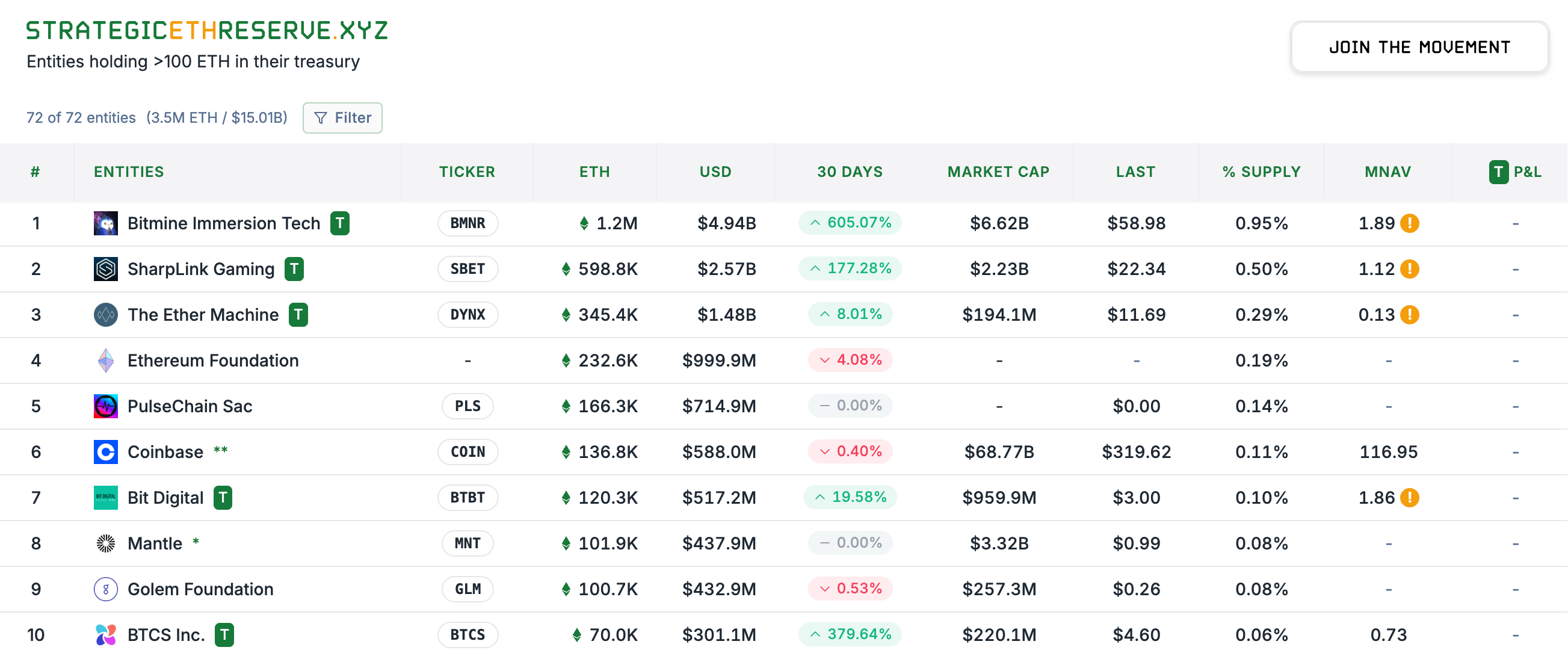

Data from the Strategic ETH Reserve website shows that as of the time of writing, The Ether Machine holds approximately 345,400 Ethereum, currently valued at about $1.48 billion, ranking third among Ethereum reserve companies, only behind BitMine's approximately 1.2 million (valued at about $4.94 billion) and SharpLink Gaming's approximately 598,800 (valued at about $2.57 billion).

Thus, the Ethereum reserve war has intensified. This situation, apart from Bitcoin, is no longer comparable to competitors like SOL and BNB. Even Vitalik has come out to support "Ethereum asset reserve companies," but he also pointed out that Ethereum's future cannot come at the cost of excessive leverage. He worries that a price drop could trigger a chain reaction of forced liquidations, leading to further declines in Ethereum's price and damaging its reputation. CryptoQuant analyst CryptoOnchain also noted that Ethereum's market leverage is nearing historical highs (ELR at 0.68), and high leverage and resistance testing factors may still trigger violent downward fluctuations in the short term.

Throughout this process, this situation is also fully reflected in the data for Ethereum spot ETFs. As of last week, U.S. Ethereum spot ETFs have achieved 13 consecutive weeks of net inflows, with a total inflow exceeding $7.3 billion. On August 11, Eastern Time, the net inflow of funds in this ETF sector reached approximately $1.019 billion, setting a historical high.

Looking back at Ethereum's development trends over the past three months, the institutional reserve war has undoubtedly been the main driving force behind Ethereum's continuous upward movement. So, as prices continue to rise, has the activity level of the Ethereum network and ecosystem kept pace?

A Stable and Slow Recovery Trend

Currently, Ethereum's price is approaching historical highs, and looking at the entire ecosystem, while Ethereum's various data may not be particularly eye-catching, they do exhibit a stable upward vitality.

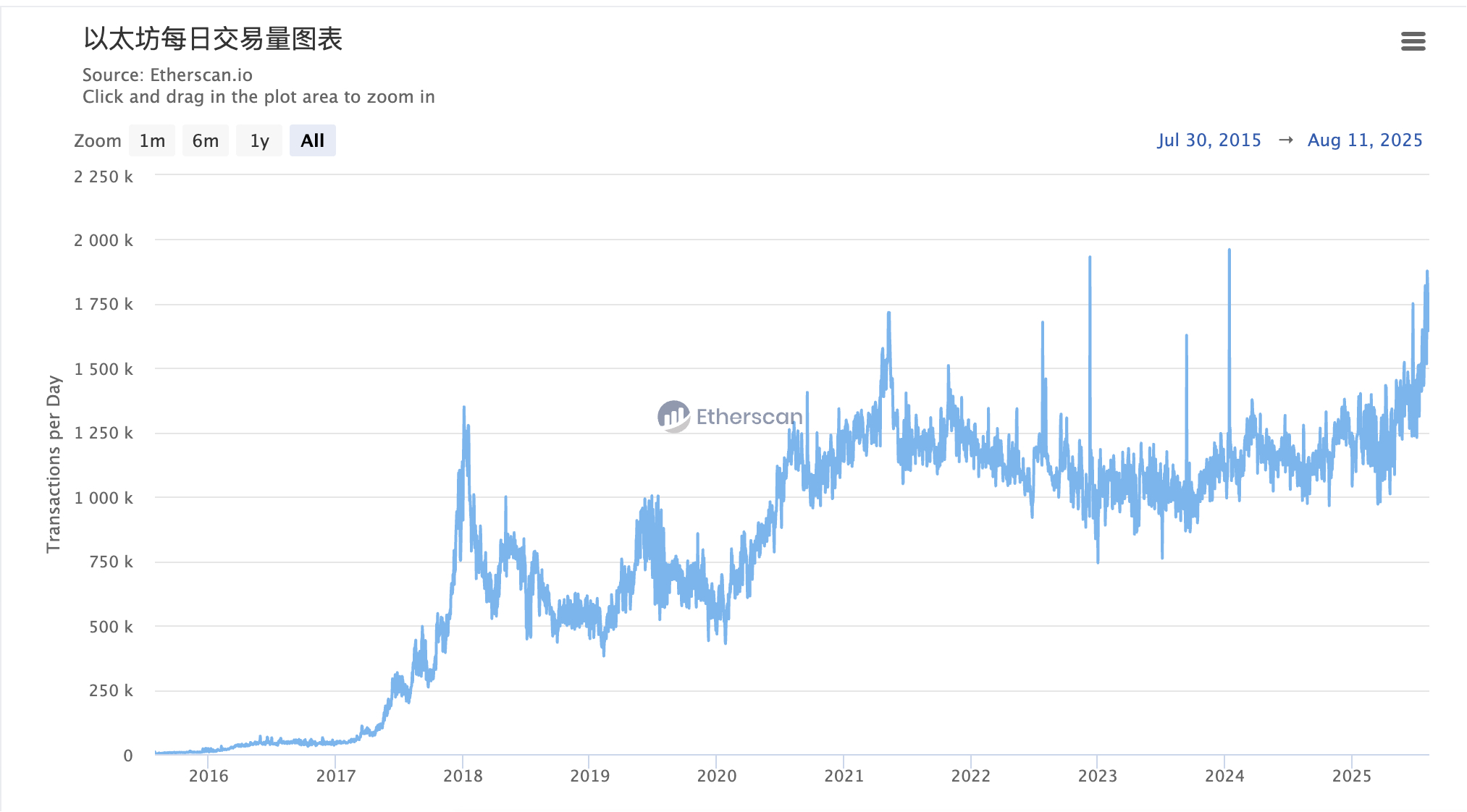

According to Etherscan data, on August 5, the daily number of Ethereum transactions rose to approximately 1.878 million, nearing the historical high of about 1.96 million set on January 14, 2024. In the past week, the daily transaction count for Ethereum reached a low of about 1.645 million.

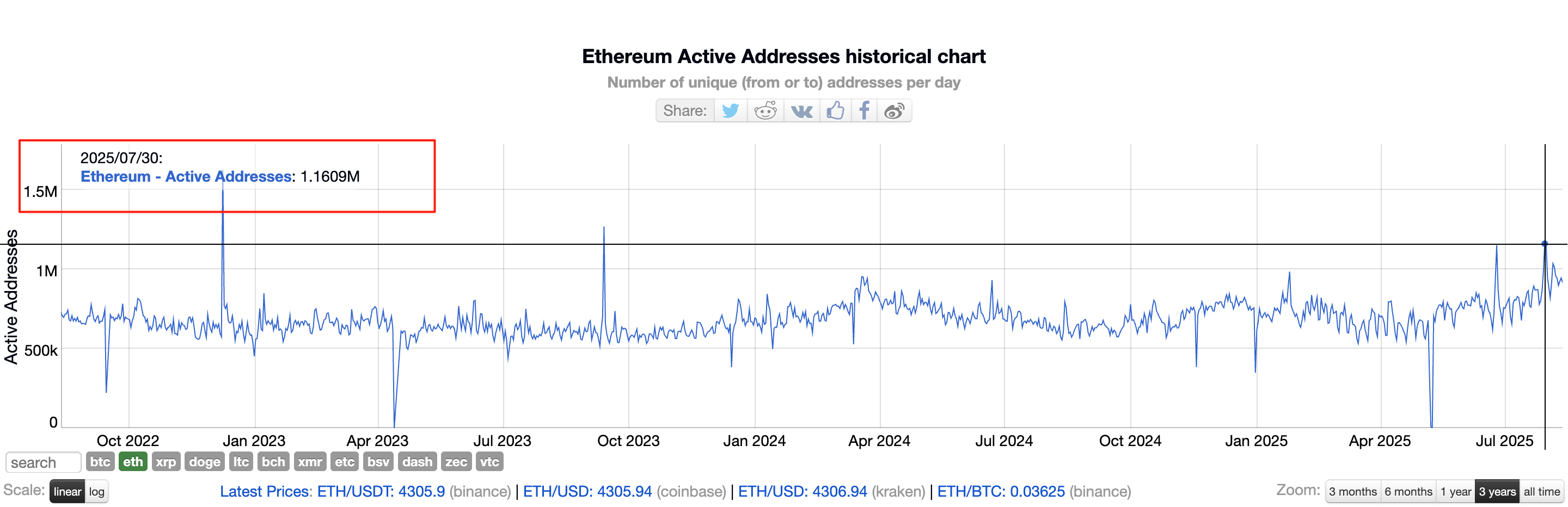

Additionally, Bitinfocharts data shows that on July 30, the number of active Ethereum addresses reached approximately 1.16 million, the highest level since September 13, 2023. We can observe that as the price rises, the recent activity on the Ethereum network has shown a noticeable upward trend.

Despite the increase in daily transaction counts and active addresses, as of the time of writing, Ethereum's gas fees remain low, around 0.32 Gwei. This indicates that a large number of transactions are "not urgent," not requiring users to artificially raise gas fees to ensure confirmation priority. Thus, these may include activities such as wallet consolidation, simple transfers, or participation in some DeFi protocols for long-term gains.

This is likely due to Ethereum raising the block gas limit to 45 million units on July 22, a 25% increase from the 36 million units set in February this year. In the short term, increasing the block gas limit will lead to a decrease in gas fees. However, as network activity continues to grow, especially if a DeFi or NFT boom occurs, new transactions could quickly fill the expanded block space, leading to a rise in gas fees.

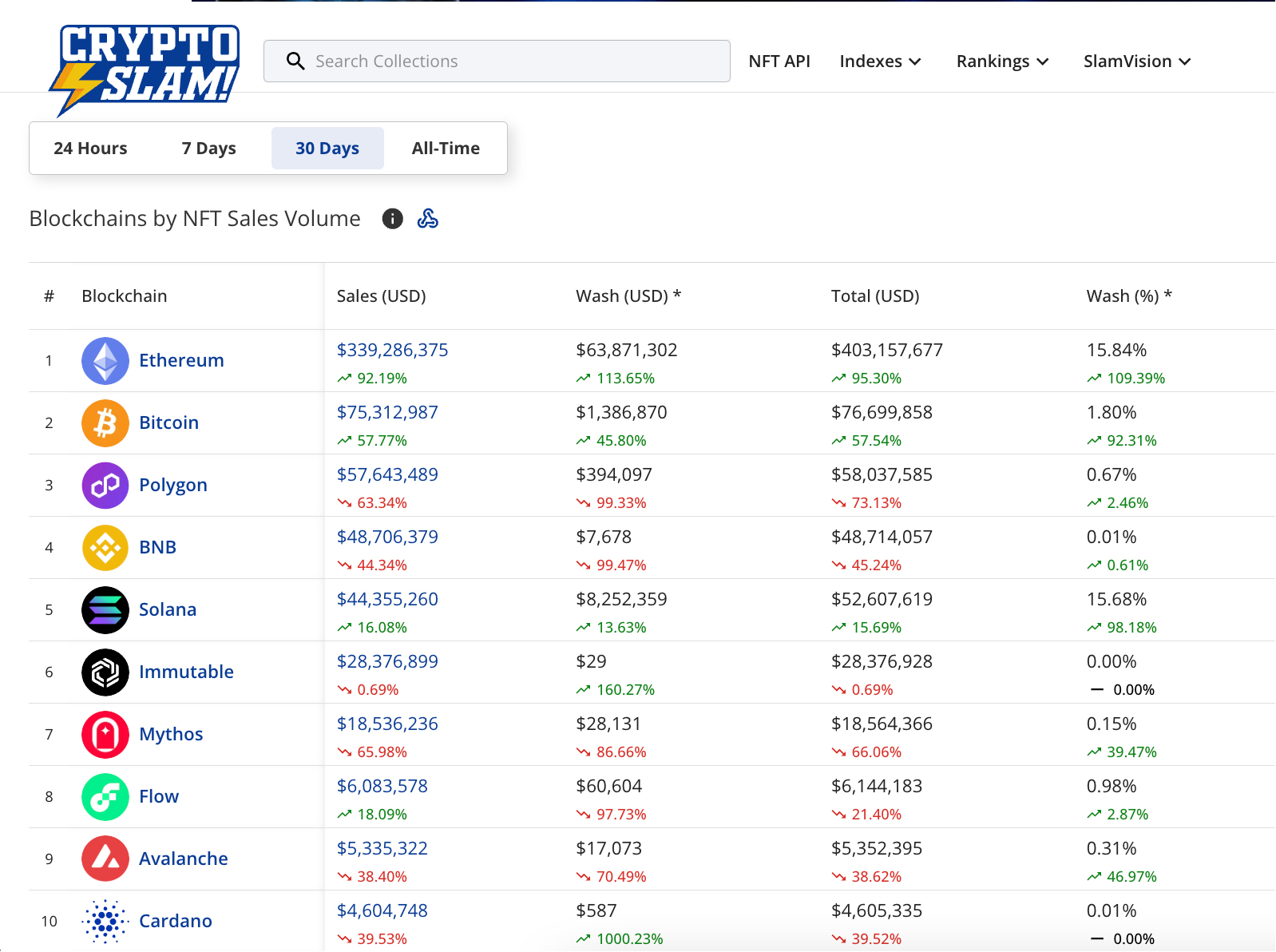

Speaking of DeFi/NFT, the NFT market experienced a revival a few weeks ago. In the week of July 14, the total NFT trading volume across all blockchains reached $143.5 million, a six-month high, with Ethereum's NFT weekly trading volume hitting $75 million, accounting for about 52% of the total trading volume across major blockchains. According to CryptoSlam data, Ethereum's NFT sales in June were only about $100 million.

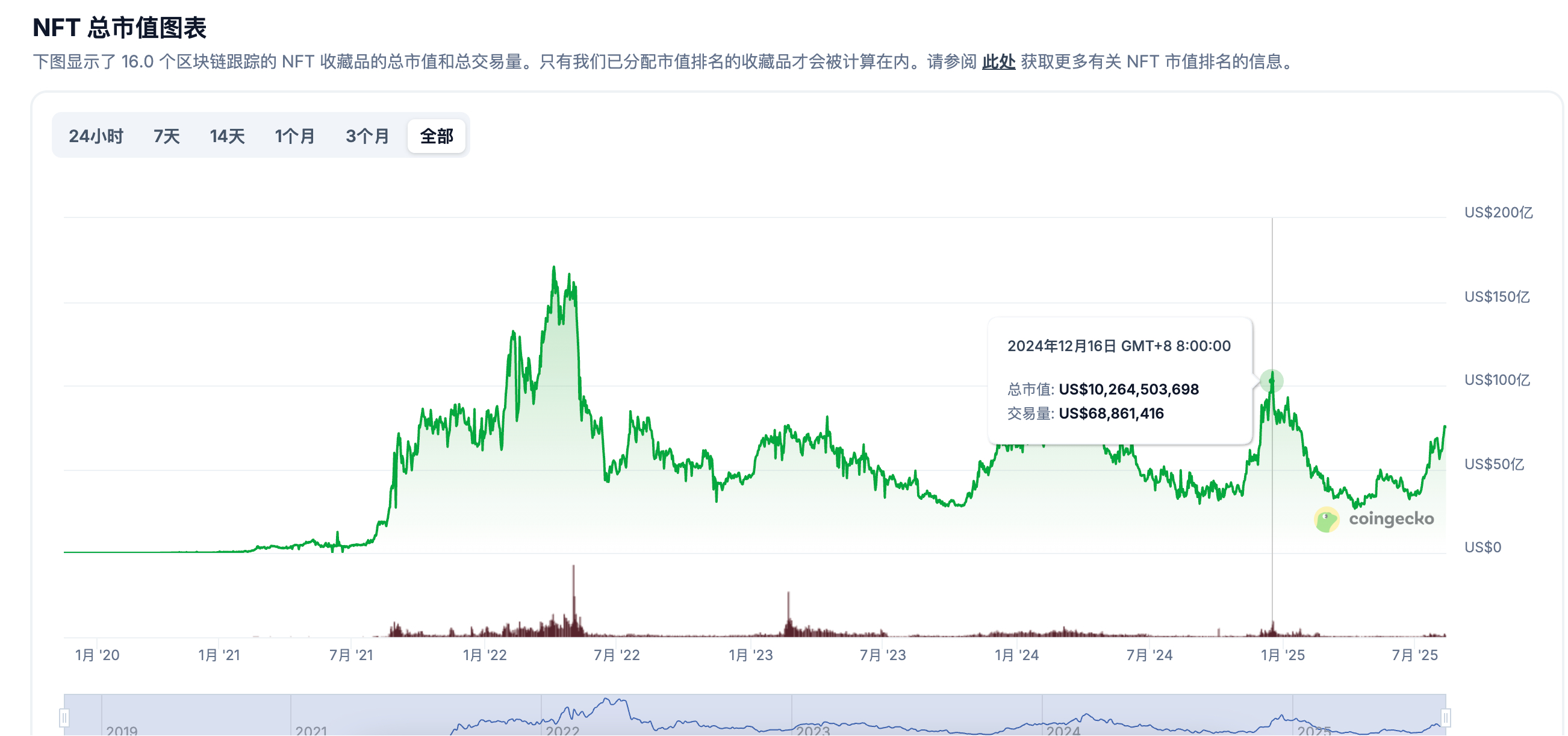

In the past month, Ethereum's NFT sales exceeded $339 million, an increase of over 92%. CoinGecko data shows that the current global NFT total market cap has risen to $7.513 billion. However, this figure is still significantly lower than the previous cycle's peak of $10.2 billion, perhaps indicating that there is still more room for growth in this round of the NFT market.

In terms of DeFi, various indicators suggest that DeFi is in a thriving phase. As of August 12, DefiLlama data shows that the total value locked (TVL) in DeFi has surpassed $150 billion. Although this is far from the peak of the DeFi boom in 2021 (approximately $178.7 billion), it has exceeded the TVL high of $128.4 billion on December 15, 2024. Among this, the DeFi TVL on Ethereum is approximately $91.75 billion, accounting for 61.16%, with a monthly increase of over 29%.

At the same time, the top ten DeFi projects on Ethereum have all seen increases over the past month, with Ethena's monthly increase exceeding 93%, and its TVL around $10.6 billion; the top three projects, Lido, Aave, and EigenLayer, also saw monthly increases of over 35%. Additionally, in the past seven days, the DEX trading volume on Ethereum was approximately $30.553 billion, an increase of 12.1%.

It is worth noting that compared to the previous bull market, this round has seen a plethora of liquid staking and re-staking protocols, with a large amount of Ethereum locked in these protocols. There may even be some overlapping calculations in the middle. In this context, the TVL data has not yet broken new highs, indicating that interest in DeFi has not significantly rebounded.

In summary, we have not seen the kind of congestion in Ethereum that was seen in the previous bull market, indicating a decline in ecological participation. To draw a comparison, it is like a shopping mall in the off-season and peak season; the daily foot traffic may be the same, but during peak season, consumer desire is strong, while in the off-season, it may just be a casual stroll after a meal. However, this also indicates that Ethereum is gradually maturing, with protocols that once led to reckless gambling gradually disappearing, leaving behind investors who calmly seek opportunities and players who participate in projects rationally.

Yet, this still falls short of our expectations. We do not wish for chaotic and frenzied stampedes, but rather for orderly queues in a bustling scene. Overall, Ethereum is still steadily developing in this round, though the intensity is not what it once was.

Can Ethereum Set a New Historical High?

Finally, returning to the initial question, can Ethereum's price in this cycle break through the high point of November 2021 ($4,868) and set a new historical high? With Ethereum just breaking through $4,400, I believe the possibility is very high.

First, the enthusiasm for institutional buying has not cooled, and the pace of accumulation has not slowed down. The buying wave has expanded from U.S. publicly listed companies to those listed in Hong Kong, such as Jinyong Investment and Huajian Medical.

As of the time of writing, several listed companies have announced plans to continue increasing their Ethereum holdings. U.S. publicly listed company Fundamental Global has submitted a $5 billion shelf registration application to the U.S. Securities and Exchange Commission (SEC) to support its Ethereum accumulation strategy and has completed the purchase of 47,331 Ethereum for about $200 million today.

In addition, BTCS plans to raise $2 billion to expand its Ethereum reserves; Nasdaq-listed company 180 Life Sciences intends to raise approximately $425 million through private equity financing to establish an Ethereum reserve strategy and will be renamed ETHZilla Corporation; U.S. publicly listed medical company Cosmos Health has reached a securities purchase agreement with a U.S. institutional investor to raise $300 million to initiate its Ethereum treasury strategy.

In summary, these institutional Ethereum reserve plans may indicate that this exciting Ethereum reserve war has not yet truly entered a heated phase.

Michael Nadeau, founder of The DeFi Report, also published an article today pointing out that the supply shock of Ethereum is unfolding in real-time. In the third quarter to date, Ethereum on CEX has decreased by 6.7%. It has now fallen to its lowest level since July 2016. As Ethereum treasury companies begin to implement on-chain strategies to enhance yields and per-share ETH holdings, this number is expected to continue to decline.

This means that more capital will flow on-chain, potentially triggering a stronger "reflexivity" effect, where market activity and fundamentals will further improve with price movements.

Secondly, on the policy front, the latest guidelines released by the U.S. SEC recently indicated that certain liquid staking activities do not involve securities, and individuals engaging in liquid staking activities do not need to register with the agency under securities laws. Liquid staking parties that may not be subject to securities laws include Lido, Marinade Finance, JitoSOL, and Stakewise. In simple terms, the U.S. SEC has ruled that liquid staking tokens do not fall under the category of securities, which brings significant regulatory benefits to the industry and enhances market confidence in Ethereum and staking platforms. Because of this, some listed companies have begun to accelerate the implementation of Ethereum reserve strategies.

Moreover, while the issue of Ethereum's scalability has not been perfectly resolved, its short-term goal is to raise the gas limit again to 60 million. Additionally, Ethereum core developers have preliminarily chosen to release the next major hard fork, Fusaka, in November, aimed at making the network more efficient and scalable, with a long-term goal of achieving a gas limit of 150 million per block through the Fusaka hard fork.

In conclusion, although there may be short-term risks of high leverage and price volatility, the strong institutional buying enthusiasm, spot ETF demand, and network upgrades remain important bullish factors for Ethereum in the medium term. With regulatory benefits and a continuous increase in staking participation, Ethereum's scalability and usability will further improve.

Therefore, I believe that Ethereum is very likely to experience growth similar to Bitcoin. Of course, each cycle and each cryptocurrency has different driving forces for their price increases, and it is difficult to truly predict Ethereum's subsequent development based on past experiences. However, for now, the prospects for Ethereum are worth looking forward to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。