Written by: Yangz, Techub News

As the DeFi market cools down and funds shift towards stablecoins and tokenized stock assets, Uniswap, as an industry leader, is planning a compliant "big move" to seek a way out. In simple terms, the protocol aims to establish a legal entity "DUNI" based on the DUNA (Decentralized Unincorporated Nonprofit Association) framework that took effect in Wyoming last year, thereby granting Uniswap governance real-world recognition, new capabilities, and greater autonomy. More importantly, this move may provide a legal basis for the "Fee Switch" proposal that has troubled its community for years.

After the announcement, UNI surged nearly 10%. Meanwhile, the community began to discuss whether this carefully designed legal "armor" could help Uniswap weather this long DeFi winter. Additionally, a deeper discussion revolves around whether DUNA can truly push DAO compliance into a new phase today, after the "DAO LLC" standard introduced by Wyoming in 2021 ultimately failed to become mainstream due to regulatory conflicts and operational complexities.

Uniswap: The First "Pioneer" of the DUNA Framework

Since Wyoming incorporated the DUNA framework into law in March last year and it officially took effect on July 1, there has not been much attention on this innovative legal structure throughout the year. A review of relevant records shows that only a few projects have expressed exploratory intentions, including the ai16z DAO discussing the launch of DUNA with a16z at the end of last year, and last week Axie Infinity announced plans to establish a foundation and explore the DUNA framework to create a legal entity in the U.S. In this atmosphere of observation, Uniswap has taken the lead in making substantial progress, becoming the first pioneer to put the DUNA framework into practice. According to the DUNA framework, the entity that Uniswap plans to establish will grant it three key capabilities: first, to obtain legal recognition for on-chain governance resolutions, enabling it to sign contracts, own assets, sue and be sued, and pay taxes like other legal entities; second, to protect UNI holders from personal liability due to collective decision-making through a clear liability isolation mechanism; and most importantly, this legal shell will not change the existing governance structure, and the UNI token economic model and voting mechanism will remain unchanged.

Specifically, the Uniswap Foundation's proposal includes three key protocol arrangements:

Association Agreement: Establishes the basic rules of DUNI, including defining participant qualifications, the rights and obligations of each member, and how to formulate and execute collective decisions.

Executive Agent Agreement: Authorizes the Uniswap Foundation to handle administrative affairs on behalf of DUNI without introducing centralized control or discretion. Specific examples include executing documents or submitting filings on behalf of DUNI according to governance instructions; appointing and coordinating third-party service providers (such as lawyers, auditors, tax administrators, banks, etc.) approved by governance; and transferring governance-approved funds, payments, or grants.

Administrator Agreement: Delegates professional agency Cowrie (founded by David Kerr, who helped draft Wyoming's DUNA regulations) to perform duties explicitly approved by Uniswap governance, such as handling tax filings and other compliance work.

In terms of funding arrangements, the proposal requests a disbursement of $16.7 million worth of UNI from the treasury as a legal defense fund, primarily to address potential regulatory challenges and historical tax issues, while also allocating $75,000 worth of UNI for compliance service fees. These funds will be managed through a trust structure to ensure they are used for their intended purpose.

It is noteworthy that this design deliberately maintains the decentralization of power. The Uniswap Foundation acts only as an "executive agent" handling procedural matters, while Cowrie focuses on compliance operations, with all major decisions still made through on-chain governance. This arrangement meets real-world compliance requirements while upholding the core principle of decentralization.

According to the established process, the proposal is expected to undergo a snapshot vote during the week of August 18 or 25 after community discussions this week.

Can DUNA Become Uniswap's "Winter Survival Tool"?

The introduction of the DUNA framework is seen as an important attempt for Uniswap to break through its current predicament. The core value of this proposal may be most directly reflected in the long-standing unresolved issue of the Fee Switch. According to The Block, Uniswap Foundation's General Counsel Brian Nistler stated in an interview that adopting DUNA would "pave the way" for activating the Fee Switch.

Currently, Uniswap Labs charges a fixed interface fee of 0.25% on certain token pairs to support ongoing operations. As for transaction fees, Uniswap defaults to allocating them to liquidity providers (LPs). If the Fee Switch is activated, the protocol could extract a portion of the fees to distribute to UNI holders or the protocol treasury.

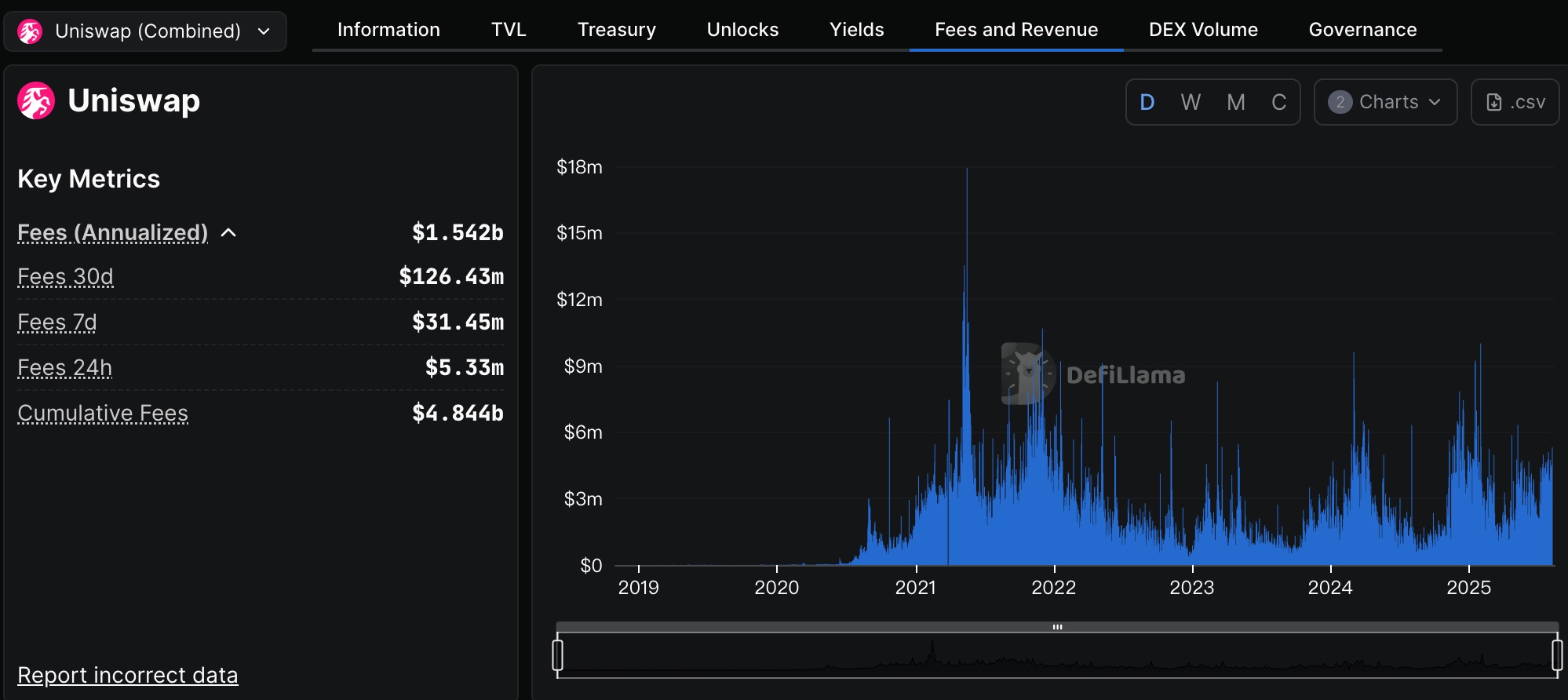

For example, based on data from the past 30 days (DefiLlama data shows protocol fees of approximately $126 million), even if a lower percentage of fees is extracted, the scale of this funding is not insignificant and could undoubtedly support protocol development, serve as compliance reserves, or incentivize the community, becoming a key resource for Uniswap to withstand the current DeFi winter. However, due to legal risks and other considerations, community proposals regarding the Fee Switch have been long shelved.

Last year, the foundation attempted to propose activating the Fee Switch again, but unexpectedly withdrew the proposal at the last moment, with the official explanation being that an anonymous stakeholder raised a "new issue." According to Paradigm partner Dan Robinson, this decision stemmed from pressure from an unnamed VC. Although Robinson did not explicitly name the VC, various clues point to a16z, with some jokingly suggesting that Uniswap should be renamed "a16z-Swap." This top venture capital firm praised DUNA as the "oasis for DAOs" when it launched the DUNA framework in Wyoming, stating in a post that "DAOs that fail to use legal entities as organizational structures will be deprived of legal existence, unable to pay taxes, and face potential liabilities."

Fortunately, after a year of dormancy and preparation, Uniswap DAO Accountability Committee member Abdullah Umar summarized the content of the first Foundation Feedback Group (FFG) meeting, stating that the foundation plans to advance the DUNA framework alongside the fee conversion proposal. This strategic arrangement also indicates that the previous decision to postpone voting may indeed have been unavoidable. Now, if the DUNI entity is ultimately established, the legal certainty it brings is expected to clear the main compliance obstacles for Uniswap's Fee Switch.

From DAO LLC to DUNA: The DAO Compliance Process Led by Wyoming

If the Uniswap Foundation's proposal to adopt the DUNA framework is an important practice in the DAO compliance process, then the key role of Wyoming in this historic transformation cannot be overlooked. From DAO LLC to DUNA, Wyoming has played an indispensable role in promoting the DAO compliance process, and this leading position is not coincidental but stems from its deep legal innovation gene. As early as 1977, the state was the first in the nation to pass the Limited Liability Company Act (LLC Act), providing a form of business entity for small and medium-sized enterprises that combines flexibility with liability limitation. Additionally, Wyoming was the first state to adopt the Unincorporated Nonprofit Association (UNA) system. These pioneering initiatives not only influenced legislation in other U.S. states but also laid the groundwork for the state's later explorations in the fields of digital assets and decentralized organizations.

In 2021, the year hailed as the "Year of the DAO," Wyoming demonstrated legislative foresight by officially passing the Wyoming DAO Supplement, becoming the first jurisdiction in the world to provide a clear legal framework for DAOs. This innovative legislation allows DAOs to register and operate as a special form of limited liability company (DAO LLC), with the core breakthrough being: on one hand, it provides liability protection for members, shielding personal assets from organizational debts; on the other hand, it recognizes the legal validity of smart contracts and token voting, preserving the decentralized governance characteristics of DAOs.

This innovative model quickly attracted practical implementations from projects like CityDAO. However, data indicates that DAO LLCs did not trigger a large-scale registration wave. Furthermore, according to the Wyoming Secretary of State's office report for the fourth quarter of 2023, among the 47 DAO LLC entities registered in the state, only 11 (23.4%) remain in good standing.

In the following years, as the market turned bearish and the DAO narrative weakened, the related compliance progress stagnated. It wasn't until March 7, 2024, when Wyoming Governor Mark Gordon signed the DUNA Act, that the story of DAO compliance was renewed.

Compared to the relatively simple DAO LLC, DUNA presents a more mature and complete legal framework design. It establishes DUNA as an independent legal entity, enabling it to participate in litigation, hold assets, and assume legal responsibilities in its own name, while achieving true decentralized governance through distributed ledger technology; similar to DAO LLC, the DUNA Act also constructs a liability isolation mechanism, but goes further by ensuring that members are not personally liable for organizational actions while allowing the organization to provide compensation to members for their duties; in terms of organizational operation, DUNA innovatively sets a standard of "default perpetual existence + a minimum of 100 members," ensuring organizational stability while maintaining decentralization. Notably, the act allows DUNA to engage in profit-making activities and use the proceeds for nonprofit purposes, while strictly limiting profit distribution, balancing the operational needs of DAOs with their nonprofit nature. Additionally, DUNA enjoys the right to change its organizational form, allowing it to transition to traditional forms such as corporations or partnerships as needed.

Now, with the Uniswap Foundation proposing to adopt the DUNA framework to establish a legal entity, this innovative DAO compliance framework has taken a key first step towards practical application. However, whether the DUNA framework can truly lead DAO compliance into a new phase remains uncertain.

Considering the favorable backdrop of the current improving cryptocurrency policy environment in the U.S., combined with Wyoming's consistent leading advantage in digital asset legislation, DUNA indeed has the potential to become an important milestone in the DAO compliance process. As emphasized by Wyoming Senator Cynthia Lummis, the state has shown "foresight" in building the decentralized nonprofit association system.

Summary

The Uniswap Foundation's attempt to adopt the DUNA framework marks a significant exploration phase in the DAO compliance process. This initiative not only concerns the future development of the Uniswap project but may also provide a model for balancing compliance and decentralization for the entire DAO sector and other DeFi protocols.

Of course, this compliance process still faces many challenges: first is the uncertainty of the regulatory environment; although there are signs of easing in current U.S. cryptocurrency regulatory policies, the attitudes of agencies like the SEC remain variable; second is the complexity at the practical level, including the implementation of the DUNA framework and cross-border compliance issues that require time to validate.

It is commendable that Wyoming's legislative innovation and Uniswap's practical courage demonstrate foresight. At this critical moment when the cryptocurrency industry is moving towards mainstream acceptance, this pioneering spirit is particularly valuable. Perhaps, just like the early development of the internet, the path to DAO compliance is destined to be bumpy, but in the future, with the addition of more projects and the accumulation of practical experience, we have reason to expect the emergence of an organizational form that is both compliant and truly decentralized.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。