The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

In the past two days, the market has fluctuated significantly. Yesterday, Ethereum's daily range was from 4154 to 4370, reaching a 200-point swing. The short-term decline has left many friends very confused about the subsequent trends. Why is this happening? This is also related to today's data; perhaps the release of this month's CPI will be the last opportunity to enter before interest rate cuts. Therefore, tonight's speech is crucial, but the confrontation between the Federal Reserve and Trump has a long history. According to convention, today's data will likely favor interest rate cuts, but it may not necessarily be good for market trends. Many friends have this idea but do not fully understand it. Lao Cui would like to remind you that if the data favors interest rate cuts, it is highly likely that the current financial environment is not good, and market liquidity is insufficient. Therefore, interest rate cuts are needed to stimulate economic trends. So as long as the evening data is favorable for interest rate cuts, it is basically unfavorable for the current financial market. If the data has significant issues, it may even lead to a wave of panic selling. However, as long as the data mentions a rate cut in September, it is highly likely to increase. This is also a double-edged sword, depending on how the Federal Reserve wields it.

This point is very important; everyone needs some understanding of market control. The trends in the past two days will be extremely fierce, and the current layout must focus on safety. Yesterday, I mentioned contract issues, and some coin friends reflected to Lao Cui that it is difficult to grasp short-term trends. Although Lao Cui does not strongly advocate for contracts, there is one important idea: after identifying the trend, you must follow your own thoughts. For example, Lao Cui has always encouraged everyone to go long; the market is not static. You must be flexible and avoid entering at daily high points. Even taking the middle value to go long is not a big problem, as long as you are firm in your trend. Yesterday's article had Ethereum around 4250, and the current price is around 4310. If you are not greedy and only take a range of 30-50 points, it is not a big issue. Even if you hit yesterday's lowest point, you should still end up with a profit.

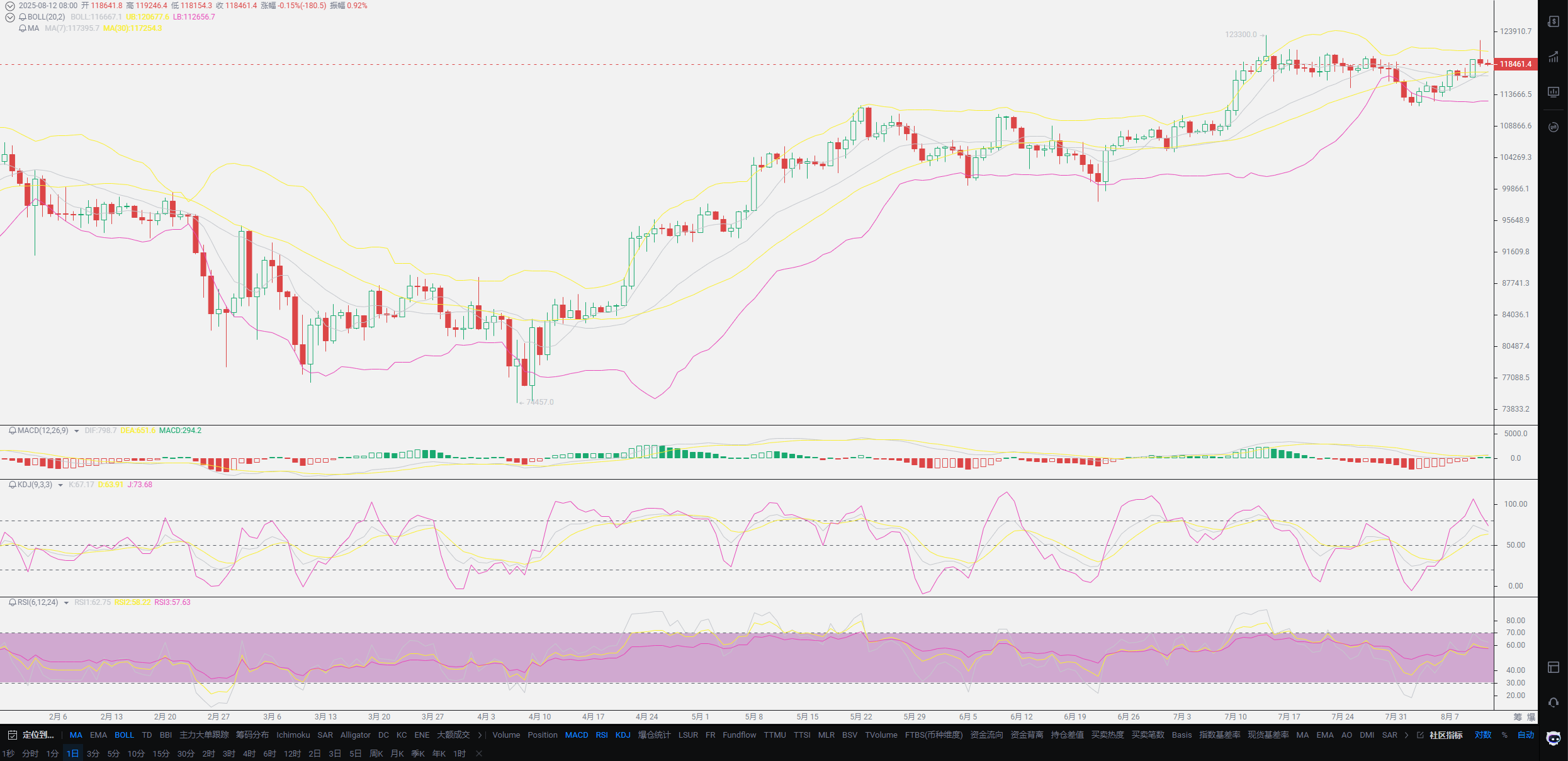

Surprisingly, many friends found Lao Cui today and are experiencing losses from going long. This is entirely a psychological issue and has little to do with technical analysis. Overcoming psychological issues requires increasing experience, and Lao Cui is powerless in this regard. Lao Cui can only make a high-probability prediction of the trend in the coin circle, and everyone can choose to reference it. Looking at today's market, the overall state is under pressure, which is also influenced by risk-averse sentiment. Some funds will choose to withdraw for risk aversion. Regarding your positions, it is best to choose to exit a portion of your positions and wait for the evening results before deciding whether to enter. From Lao Cui's perspective, even if there is a downward trend, it will not be too deep, so Lao Cui's approach will focus more on entering during this pullback. Regarding Bitcoin, it has been continuously repairing towards new highs, and it is very difficult for Bitcoin to break below the 110,000 mark at this stage, which can be considered a basic support level.

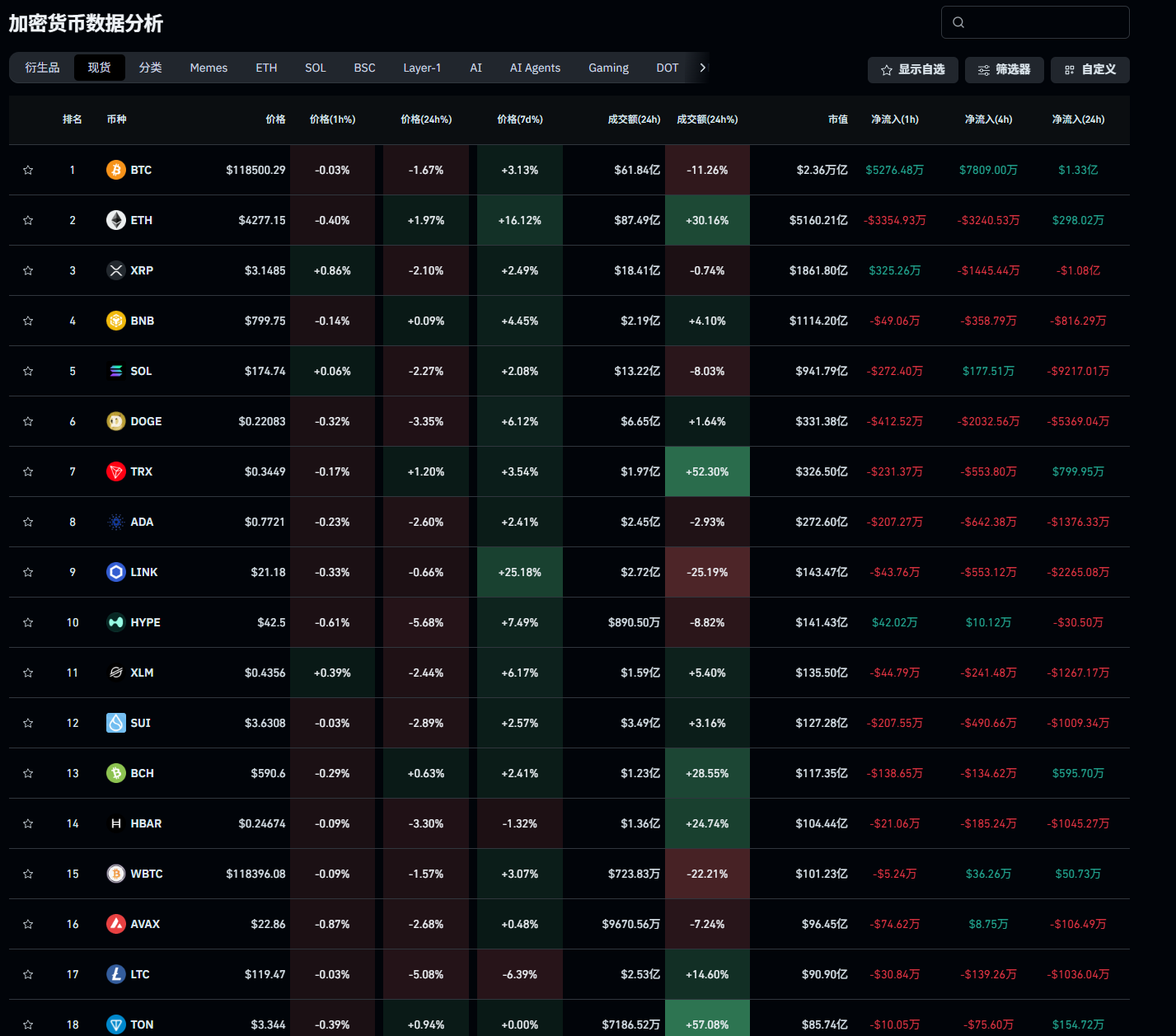

Moreover, the selling pressure on Bitcoin is stronger than that on Ethereum. For Ethereum, there is almost no resistance before breaking the previous high, as the inflow of funds is very rapid. The institutional holding has been steadily increasing, and the trend for Ethereum will be clearer. However, the SOL we are focusing on seems to be getting more and more confusing, as it has developed its own path. Fortunately, we have analyzed SOL's trend in detail before; an independent market before the rate cut is a good thing for SOL. Currently, during this capital accumulation period, you just need to follow the bull market mindset. From the funding perspective, in the last 12 hours, large transaction data for BTC shows a clear short-selling trend, with a net outflow of 6.81 million from the main force, and the buy-sell ratio reaching 1:1.15. Especially during the 16:00 period, the main force continuously sold over 7 million, directly suppressing the price below the EMA24 support. Combined with the latest K-line pattern, a bearish engulfing and KDJ death cross appeared during the 16:00 period, confirming the main force's intention to exit. Although the current price is above EMA52, the risk of EMA24 crossing below increases, and trading volume has decreased by 19.91% in the short term, further weakening the rebound momentum.

However, you can pay attention to the data from the past week; both Bitcoin and Ethereum are showing a net inflow state. The short-term buying phenomenon is also relatively stable, so the support below will be very stable. With the interest rate cuts in the second half of the year, we also have Europe and most Asian countries choosing to respond with interest rate cuts. The basic trend for the second half of the year can be simply assessed at this stage. The bull market will definitely be the main theme of the second half of the year. In the tariff negotiations, interest rate cuts are also a top priority, so you don't need to engage in internal strife over interest rate cuts; just assume they will happen. Today's market crash was clearly driven by a giant whale selling nearly 220,000 coins, and the market only declined by about ten points, so just hold strong. You need to understand that the contract and spot markets are completely opposed and can almost be viewed as two separate markets. The funds currently concentrated in the market will not target retail investors; they have basically formed an operational style similar to the stock market, with institutions more significantly hunting down whales.

In less than a month, the hunting methods around whales have been emerging one after another, with the liquidation amount of whales already exceeding one billion U. You can refer to the heat map and the contract holding ratio; during the bull market phase, the operators will not target spot users but will have different strategies for the principal of contracts. A little bit of compliance will lead the coin circle towards the path of securitization, and everyone should also try to accept this judgment. Due to the imminent data release, Lao Cui does not have time to explain too much, so I have already taught you how to respond at the beginning of the article; you can refer to it. Due to time constraints, Lao Cui will go to layout this year's entry positions. If you have questions, you can ask Lao Cui directly, and I will reply after seeing them. I hope everyone understands! The subsequent trend will form a pattern of falling first and then rising. The bull market has not ended, so there is no need to panic. Find low positions and quickly lay out long positions; after September, you will see certain profits!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one position, aiming for the final victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。