Metaplanet Bitcoin Purchase of 518 BTC Strengthens Asia Strategy

Tokyo, Japan August 12, 2025 Japanese-listed Metaplanet took another significant step in its Bitcoin strategy, buying 518 BTC for reserves at a cost of approximately $61.4 million.

The purchase at an average price of $118,519 per BTC raised the total holdings of the company to 18,113 BTC valued at approximately $1.85 billion at an average cost per coin of $101,911.

This latest action signals that the Metaplanet Bitcoin strategy is not slowing down. Rather, it is solidifying the company as one of Asia's most aggressive corporate buyers of this digital asset.

A Rising Force in Global BTC Holdings

Metaplanet's continuous buying has drawn comparisons to MicroStrategy, the American business intelligence company that began popularizing the massive-scale BTC treasury strategy.

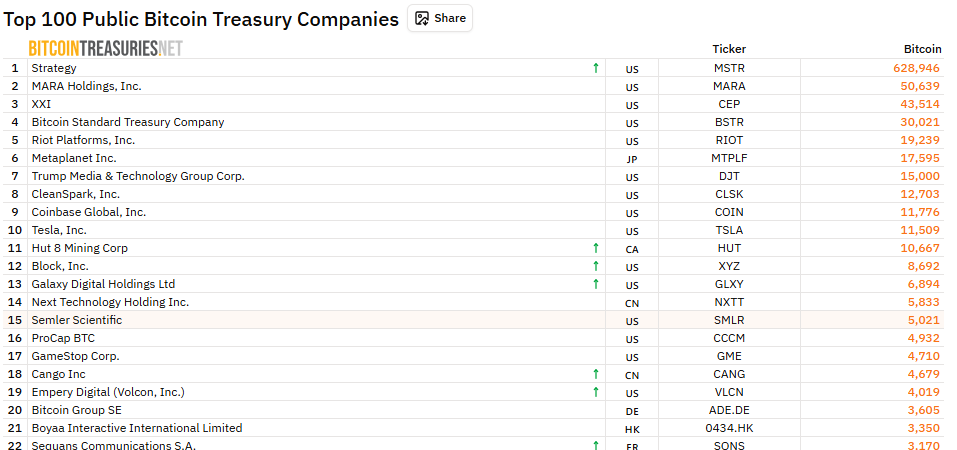

The Japanese firm now stands among the world's leading corporate holders, behind just industry giants such as MicroStrategy , Marathon Digital (MARA), and Riot Platforms. The company now stands at 6th largest holder globally.

Source: BitcoinTreasuries Net

Its path has been nothing short of meteoric. In the last purchase, Metaplanet Bitcoin Holdings hit the headlines for the purchase of 463 BTC at $115,895 per unit.

Today, not only has it increased its stack but also optimized the manner in which it finances these purchases.

Funding Strategy With Minimal Dilution

One aspect that stands out about the Metaplanet Bitcoin strategy is the way that it raises capital. Rather than using share dilution typical of traditional means, the company has relied on perpetual preferred shares.

This approach offers long-term capital without substantially affecting current shareholder value.

CEO Simon Gerovich has publicly espoused the strategy. In a recent blog post, he described how the objective is to increase BTC holdings per share on a continuous basis while maintaining shareholder equity.

"Selling perpetual preferreds is a very accretive instrument that is meant to return maximum long-term shareholder value," Gerovich said.

Market Impact and Sentiment

Metaplanet Bitcoin purchases have been sparking debate among trading and social communities.

Most consider its disciplined building as an indication of strong institutional belief in this digital asset's long-term worth.

Analysts think that the consistent flow of corporate capital from companies such as Metaplanet may stabilize the prices in market selloffs, serving as a "soft price floor."

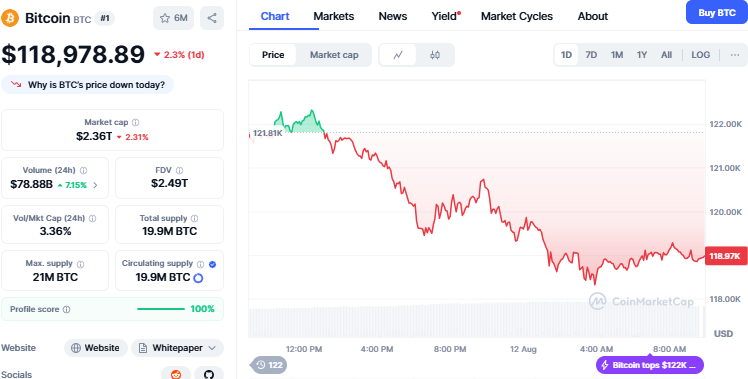

Source: CoinMarketCap

Currently the coin is trading at $118,978 with a decrease of 2.3% while the volume has increased by 7.33% within the last 24 hours.

A Blueprint for Asia to Follow

If the Metaplanet Bitcoin strategy keeps up this quality of execution and precision. It could become the default example for Asian companies looking to add this cryptocurrency to their reserves in the near future.

Such corporate treasury action is still relatively uncommon in Asia, so Metaplanet's move is even more impactful.

Market observers say it may make other Asian companies follow suit with a similar cryptocurrency standard for managing treasuries.

Its blend of intense buying, creative financing, and long-term perspective makes it a standout among other corporate participants.

Conclusion

For the time being through this Metaplanet Bitcoin purchase, the message is unmistakable: it is dedicated to accumulating digital currency, accumulating shareholder value, and redefining how Asian businesses view their balance sheets in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。