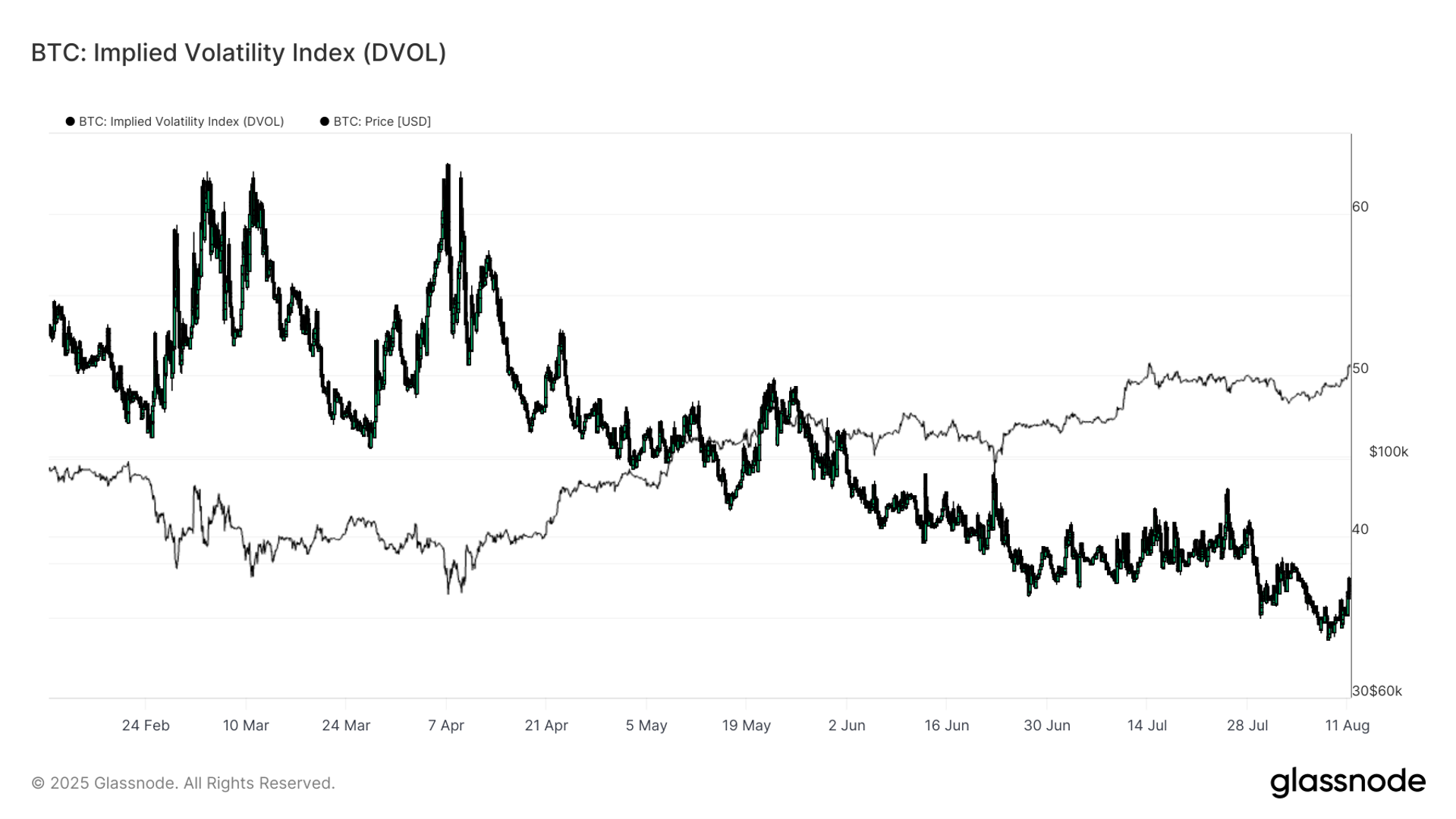

比特币(BTC)的隐含波动率(IV)在周一从33上升至37,这一显著的上升标志着多年来的低点,可能预示着市场的平静期即将结束。

Deribit波动率指数(DVOL)是基于传统市场的VIX模型,跟踪比特币期权的30天隐含波动率,目前处于数周以来的最高水平。

隐含波动率代表市场对价格波动的预测,计算基于期权价格。正式来说,IV衡量的是资产在一年内预期运动的一个标准差范围。跟踪平值(ATM)IV提供了情绪的标准化视图,通常与实现的波动率一起上升和下降。

上周,BTC的短期IV降至约26%,这是自期权数据开始记录以来的最低读数之一,随后迅速反弹。上一次波动率如此之低是在2023年8月,当时比特币在$30,000附近徘徊,随后出现了急剧上涨。

在周末,比特币从$116,000跃升至$122,000,暗示了当波动率开始扩张时可能发生的情况。8月通常是交易量低迷和市场活动平淡的时期,但上升的IV表明交易者可能正在为未来更大的波动做准备。

Checkonchain的数据表明,这一最新的反弹是由现货驱动的,这比单纯由杠杆推动的上涨更健康。开放兴趣在8月期间一直在下降,这意味着如果情绪发生变化,突然涌入的杠杆可能会放大价格波动。

阅读更多: 比特币多头在通胀数据临近之际再次挑战$122K以上的斐波那契黄金比例

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。