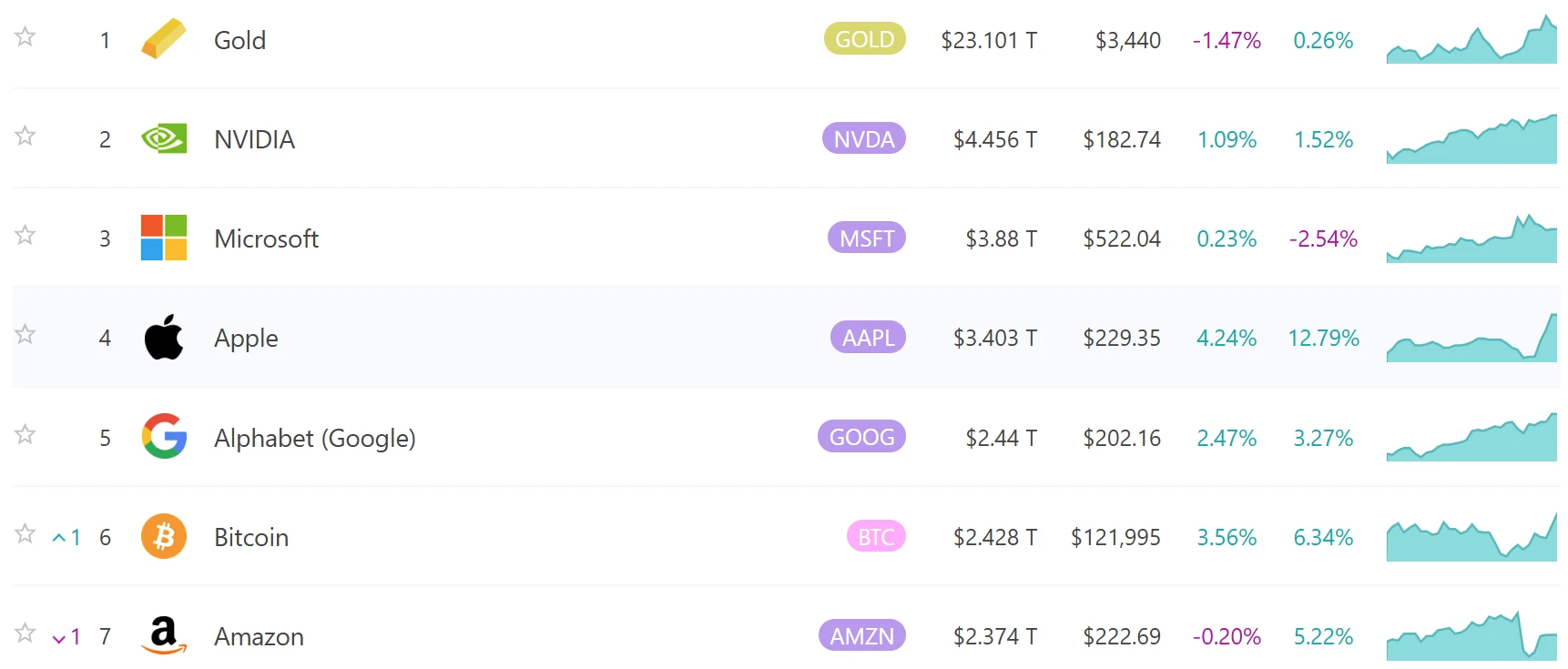

On August 11, 2025, Bitcoin's market capitalization had climbed to $2.428 trillion, surpassing Amazon's $2.374 trillion, ranking sixth in the global asset leaderboard, only behind gold, Nvidia, Microsoft, Apple, and Google's parent company Alphabet. This highlights Bitcoin's strong rise in global asset allocation.

Crypto-Friendly Signals in the Trump Era

The latest surge in Bitcoin is closely related to the shift in the U.S. political environment. Last week, U.S. President Trump signed an executive order allowing cryptocurrencies to be included in 401(k) retirement accounts, which is seen as a significant boon for the crypto industry. This move could unleash up to $9 trillion in potential funds into the digital asset market, nearly four times the current market cap of Bitcoin. Market analysts point out that this policy directly stimulated institutional investor enthusiasm, pushing Bitcoin's price from $117,478 on August 7 to over $120,000.

More broadly, the Republican-led "Crypto Week" earlier this month passed several bills, including the GENIUS Act, which provides a federal regulatory framework for stablecoins. These initiatives ended a long period of regulatory uncertainty, allowing Bitcoin to transition from a fringe asset to a mainstream allocation. Trump himself has dubbed himself the "crypto president," and his team has even pushed for the establishment of a U.S. strategic Bitcoin reserve, further bolstering market confidence. In contrast, the regulatory pressure of the past few years had led to significant volatility in Bitcoin's price; the current policy shift acts as a shot in the arm, allowing Bitcoin to steadily rise in the global asset rankings.

However, this policy dependence also brings concerns. If the Democrats regain control of Congress in the future, or if international coordination strengthens anti-money laundering regulations, Bitcoin's gains may face a correction. Investors should be cautious; while the policy dividends are strong, they are not guaranteed.

ETF as the Engine of Growth

The core driving force behind Bitcoin's rise is the massive influx of institutional funds. Since 2025, spot Bitcoin ETFs have become a powerful fundraising tool, with BlackRock's iShares Bitcoin ETF (IBIT) surpassing $86 billion in assets under management, far exceeding Grayscale Trust. Last week, Bitcoin ETFs saw a net inflow of $252.6 million, with a cumulative net inflow of $54.4 billion. This is not just retail FOMO; Wall Street giants are taking action: Bernstein analysts predict that by the end of 2025, assets in spot Bitcoin ETFs will reach $190 billion.

Data shows that institutions now hold over 30% of Bitcoin's circulating supply, including exchanges, ETFs, publicly listed companies, and sovereign entities. Japanese company Metaplanet added 463 Bitcoins to its reserves this month, bringing its total to over 17,500; companies like MicroStrategy continue to incorporate Bitcoin into their balance sheets. This "corporate Bitcoin reserve strategy" is spreading from Silicon Valley to the globe, with only 900 new Bitcoins added to the supply daily, while institutional demand has reached over five times that, leading to liquidity tightening and pushing prices upward. The institutionalization process is accelerating Bitcoin's transition from a speculative asset to a store of value. However, it should be noted that concentrated ETF liquidity also amplifies volatility.

Safe-Haven Demand and Federal Reserve Expectations

Global macro uncertainty is another driver of Bitcoin's rise. In 2025, escalating geopolitical conflicts and persistently high inflation have led gold prices to reach historic highs, benefiting Bitcoin as "digital gold." Year-to-date, Bitcoin has risen by 25.2%, second only to gold's 29%. Investors view it as a hedging tool, especially when the dollar is weak: this month, the dollar index declined, pushing Bitcoin to new highs in euros, while it has already broken records in dollar terms.

Expectations regarding Federal Reserve policy further amplify this effect. The market is betting on a 92.7% probability of a rate cut in September, which would release liquidity and stimulate risk assets. Historical data shows that easing cycles often accompany Bitcoin bull markets: before the Fed raised rates in 2017, Bitcoin soared from $1,000 to $19,000; a similar scenario is unfolding now, with analysts predicting Bitcoin could reach $135,000 to $199,000 by the end of the year.

Volatility Persists

Despite the strong momentum, Bitcoin is not without risks. Historical volatility has reached 60%, and there have been multiple corrections this year. Quantum computing poses a threat to crypto security, with some experts believing it could crack Bitcoin's algorithm within 5-10 years. Additionally, seasonal factors indicate that August is often weak; 10x Research warns that if inflows slow, prices could break down. More fundamentally, excessive institutionalization could lead to "whale" manipulation: a single sell-off could trigger a chain reaction. Elliott Wave theorists predict a painful bear market in 2026. Investors should diversify their allocations and avoid leveraging to chase prices.

This article is for informational purposes only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。