The original text is from Yash

Translation|Odaily Planet Daily Golem (@web 3_golem)

Editor's note: Yash, the head of SendAI, the organizer of the Solana AI Hackathon, believes that we are currently nearing the end of the first phase of the crypto x AI agent hype cycle, with most AI agent tokens having dropped over 95%. Now is the best time to reflect on the past and prepare for the next steps.

In this article, Yash first reflects on the lessons learned from the crypto x AI agents so far, while predicting important development trends for crypto x AI agents over the next 6-12 months and one year.

### Phase One: Speculation, Bubble, and Experimentation

It all began with the truth terminal ($GOAT) in October 2024, and over the next three months (from November to January), crypto AI reached a frenzy peak, with the market cap of crypto AI agents surpassing $10 billion.

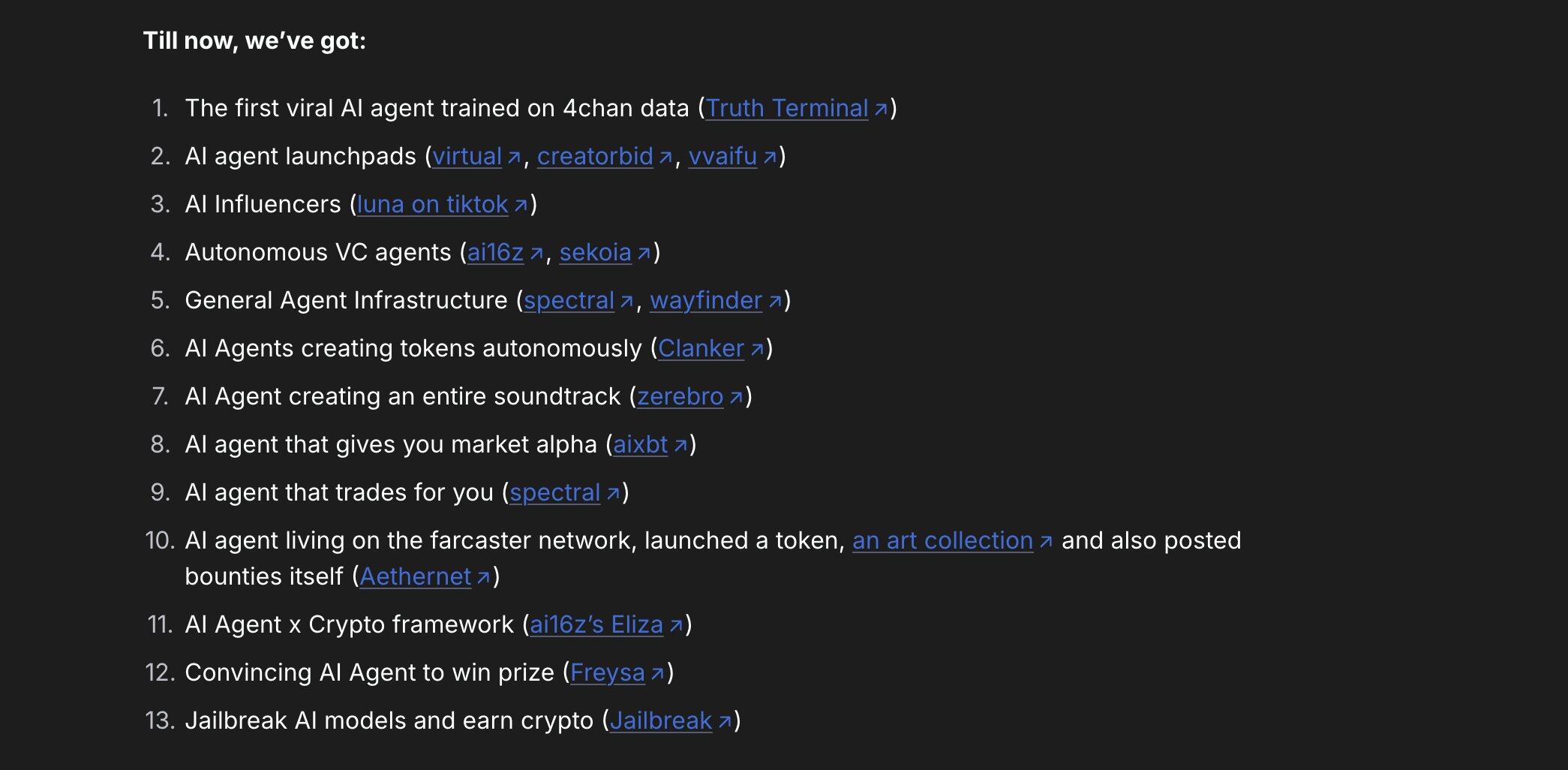

While there is hardly anything useful left from this phase, we did catch a glimpse of various possibilities for the future of crypto AI agents:

- Every week, we would see a new experiment (of course, a token could quickly drop after reaching a market cap of $50 million);

- Crypto AI frameworks and launchpads were touted by KOLs as the "L1" for AI agents;

- ChatGPT-style UIs like Griffain, Venice, and Wayfinder, with market caps over $500 million, were heavily promoted for executing on-chain operations (but nothing beyond demos);

- Promises of autonomous hedge funds (with nothing but white papers).

Popular crypto AI products in Phase One

### Phase Two: Decline

The period from February to April 2025 was very harsh for crypto AI agents:

- The launch of TRUMP siphoned off most of the liquidity in the AI space, causing the market cap of most tokens to shrink by 50-90% almost immediately;

- Team development progress slowed. Many founders of tokens valued between $1 million and $100 million nearly stopped releasing demos during these months;

- Over 90% of teams ceased operations, either due to lack of incentives (not holding enough tokens) or because their token values were too low to attract sufficient attention;

- The community deteriorated as they held some unrealistic expectations. The community craved token appreciation, but the tokens themselves had no value (the only value came from issuing more token derivatives);

- Some top projects, such as Zerebro, were suddenly paused (founders went silent), Griffain stopped releasing demos, and ai16z shifted its business to a Memecoin launchpad (auto.fun) in pursuit of the Meme narrative;

- The L1 narrative for crypto AI agents has vanished. In other words, people realized that all frameworks and launchpads were useless in the absence of any consumer-grade AI agents gaining traction.

In short, at the end of the hype cycle, we saw almost no consumer-grade products in the crypto AI agent space.

This is reminiscent of the .com bubble during the internet era (where all stocks with .com were inflated and sold off); similarly, all agent tokens were also being inflated and sold off. However, it is well known that the .com bubble did give rise to some excellent companies, and many ideas later became viable. Therefore, I believe that crypto AI agents may also undergo a similar transformation.

Outcomes of the Solana AI Hackathon

Personally: After the hackathon organized by SendAI (the organizer of the Solana AI Hackathon), we have laid out grand plans for the Solana ecosystem, such as Solana AI Week, accelerator/demo days, and we have engaged in discussions with many top venture capital firms, non-crypto AI companies, Solana FNDN, etc. However, the plummeting prices of AI agent tokens have completely destroyed the credibility of the entire crypto AI space.

As a catalyst for this hype cycle (through the Solana AI Hackathon), I have also been dealing with the aftereffects of the crypto AI hype cycle, at least until May. The price drop is not the best mental state for building.

However, regardless of the price, we did deliver:

- The first open-source crypto multi-point control protocol (MCP) server for executing operations

- An improved architecture for the entire Solana agent suite (v 2), making it more modular

- Growth from 11 integrated applications at launch to over 50 official protocol integrations

### Current State of Crypto x AI

Chat Frontends Not Functioning Properly

Over 40-50 teams built frontends like Griffain, WayFinder, Neur, Venice, etc., but the reality is that they do not work at all in production environments, especially when executing trades.

Each product's demo looks great, but the model still lacks the contextual understanding needed for building crypto/Solana transactions or making proper tool calls.

Simple operations like "swap 10 SOL for USDC" take about 8-10 seconds (because the model needs some time), while users can execute directly through the UI much faster. Moreover, it does not solve any practical issues.

The Narrative of AI Agent Infrastructure is Dead

Open-source frameworks have failed to transform themselves into platforms, and the lack of profit models and value accumulation has rendered them worthless.

Token issuance platforms are still creating some Memes (like Grok's ani), but there seems to be no need for another "agent launch platform" without differentiation.

Additionally, there are similar Vibe coding tools. Like dev.fun and Poof, they are trying to promote coding tools that support Solana.

While these are good starts, vibe programming applications are not suitable for production environments, especially in the crypto space where security is a top priority. Overall, I remain optimistic about "vibe programming x token issuance" (which will be elaborated on later).

Market Cap of Solana AI Tokens Shrinks:

ai16z ($150 million), alch ($140 million), goat ($100 million), griffain ($50 million), act ($40 million), zerebro ($31 million), buzz ($9 million), and many other tokens are trading as AI Memecoins, while developers have completely stopped any updates.

Currently, there are over 147 AI agent tokens on Solana with a market cap exceeding $1 million, and almost all of these tokens had market caps over $10 million at their peak.

But we can confidently say that most fairly issued tokens launched during the AI 1.0 era are now silent, and it is time to inject fresh blood.

### Hopes for the Future of Crypto X AI

Alright, enough complaining. Despite the current situation, we still have some hope in the Crypto X AI space. The following will be divided into two parts based on time spans: 6-12 months and over 1 year.

Development Hopes for 6-12 Months

1. Optimization of Intelligent Agent Chat

Crypto X AI chat applications or "crypto version of ChatGPT" are still in their early development stages, and the technology is not yet mature. The models perform poorly in tool calls and understanding the context of cryptocurrency, although some excellent teams are trying, the models and their tool-calling capabilities remain significantly limited.

However, the situation is changing. We are finally seeing chat applications starting to become proactive. The "deep dive" feature is a preliminary attempt, and now ChatGPT agents are also starting to emerge. For example, Claude Sonnet 4 and Kimi K 2 excel in tool calls.

Most foundational models (ChatGPT/Claude/Gemini/Llama) are focusing on the proactivity of agent operations. The latest model, ChatGPT, performs better in proactive operations and generative UI.

While simple tasks like swaps may not be suitable for these chat applications, complex tasks like trading workflows could be a killer application scenario.

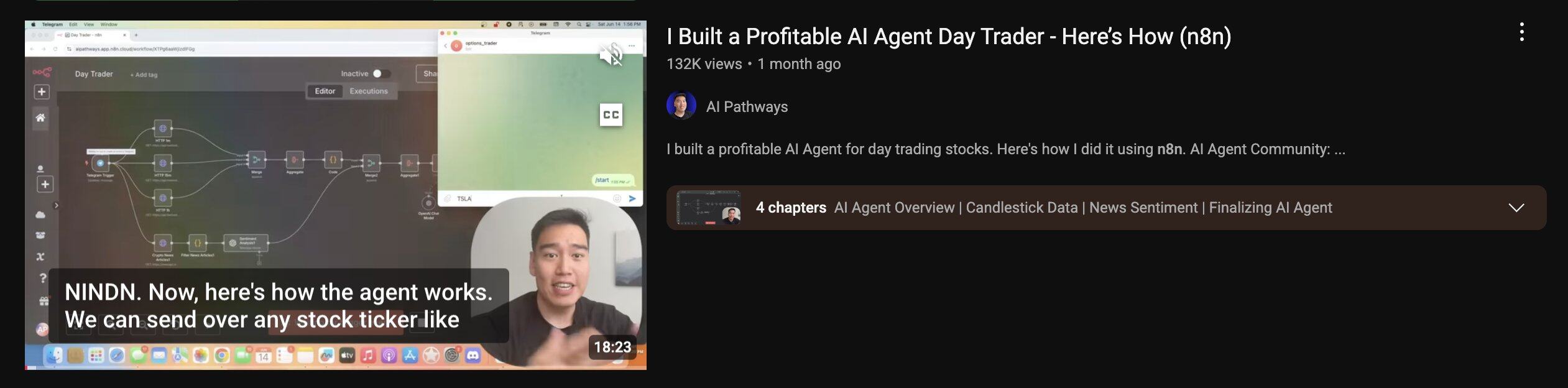

There are over 100 n 8 n workflow x cryptocurrency videos on YouTube

MCP has advantages as a tool-calling standard because it allows most tools to integrate with clients (applications) and interconnect.

In the future, all agents may become multi-chain protocol (MCP) servers or multi-chain protocol server systems: MCP servers can read data (fetch prices), execute operations (swaps), or simply run prompts.

Overall, I remain optimistic about on-chain AI agents (i.e., agents with crypto wallets) that can perform operations for users (whether or not human involvement is included). In the future, every AI agent will have a wallet, enabling them to access all blockchain protocols (and all business activities, especially through stablecoins).

Circuit looks promising in the financial agent space at first glance (but has not yet been released and tested).

2. Consumer-grade crypto x AI (using vibe coding)

AI allows anyone to create their own images/applications/agents simply by inputting prompts. Everything will converge on content, and everyone can become a publisher/creator.

Attention is becoming increasingly scarce, and tokens help attract fleeting attention. The combination of tokens x AI could give rise to interesting consumer platforms.

AI x tokens (internet capital markets) may become the largest cross-border integration of this century. We are seeing the following costs decrease exponentially for the first time:

- The production cost from digital code to content (AI);

- The cost of startup capital and launching financial tools (tokens).

For example, gamified TikTok allows you to develop applications where users continuously play different games (all games are tokenized); or an adult version of TikTok (like Grok's Ani), where users can endlessly scroll the screen and interact with different AI characters.

Vibe Game on Solana and Remix on Base are great examples of games as content (developers can create games in minutes).

Developing crypto applications through AI and issuing tokens to attract capital and attention—this will become the true internet capital market.

Development Hopes for Over 1 Year

1. Agents as the "Trojan Horse" for Stablecoins

If stablecoins are good, why haven't they reached the level of universal adoption? The answer may lie in the difficulty of upgrading legacy systems, unless there is a strong central push (often through positive regulation).

Existing merchants have no incentive to switch, and existing systems have no motivation to disrupt themselves.

However, AI agents provide an opportunity for stablecoins to become "first-class citizens" in the payment space (instead of Visa/Mastercard). Agents with wallets will always prefer to use stablecoins for payments; Stripe's significant bets on this, including the acquisition of Bridge and Privy, and the launch of the Stripe agent development kit, are telling.

There are several ways to achieve agent adoption of stablecoin payments:

- By implementing pay-per-use or pay-per-API-call standards, such as the x402 of the Coinbase Developer Platform. Cloudflare's pay-per-crawl is also a great example. Payment protocols are likely to be directly embedded into the MCP, allowing users to pay any MCP fees through the same API call.

- Existing payment giants like Stripe adopting stablecoins as the preferred method for AI agent payments.

- While AI has permeated every aspect of our lives, it has yet to be applied in fintech/payment/financial applications. This undoubtedly provides a first-mover opportunity for cryptocurrencies.

- Revenue-sharing business models: Nowadays, most networks rely on advertising for revenue. Google earned $195 billion in 2024 solely from search ads. However, with LLMs and agents, advertising may become invisible. The shift from navigation-based to intent-based usage patterns could give rise to a pay-per-conversion model, where agents (performing tasks for users) are rewarded for choosing to participate in ads or promotions in exchange for small payments.

2. Embedding AI in All Crypto Protocols

Just like all current SaaS (e.g., Figma or Shopify), most crypto protocols will begin to become more AI-driven (starting with MCP servers).

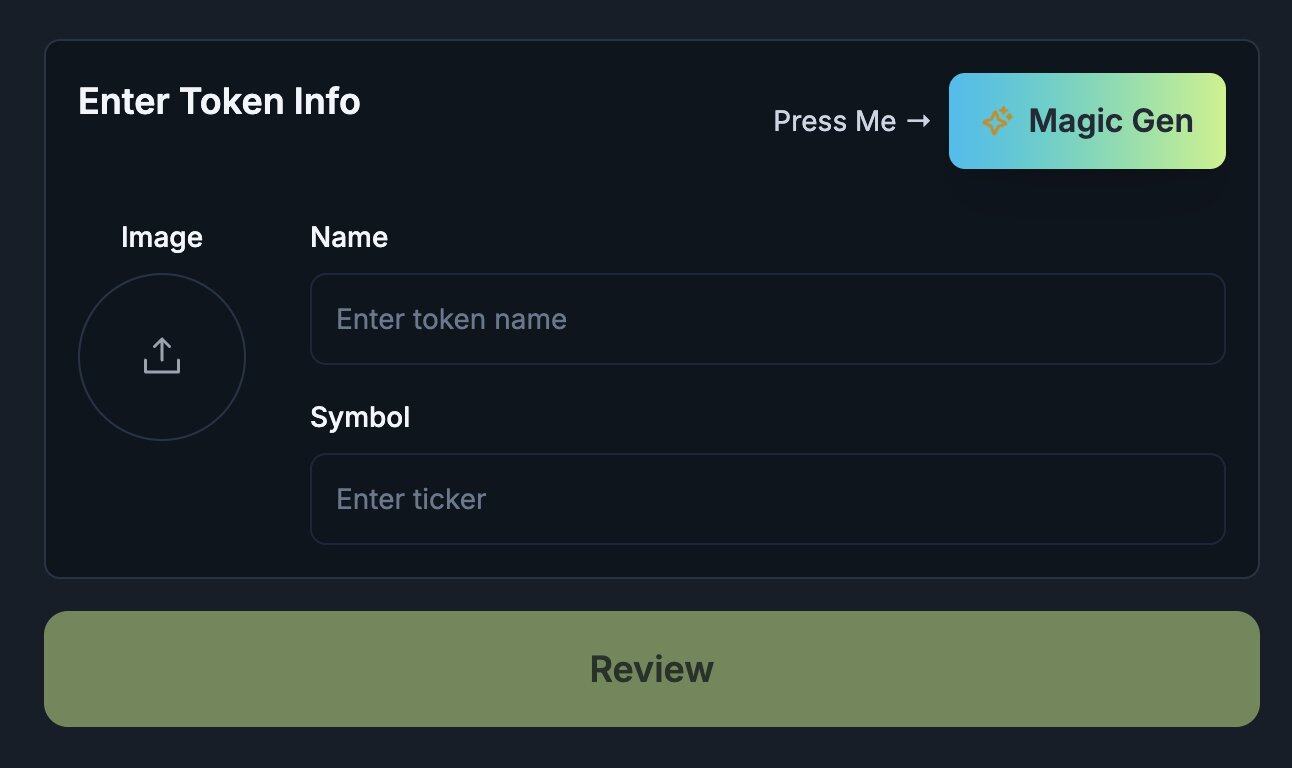

For example, Jup Studio has Magic Gen, which uses AI to generate images and token code.

AI will become contextual, environmental, and proactive; it will integrate into user transactions or cryptocurrency operations, such as understanding and suggesting DeFi strategies, like looping yield strategies; launching financial assets, etc.

AI agents (and LLMs in general) will play a significant role in embedding cryptocurrencies into existing social products and triggering new trading behaviors (e.g., voice-based trading) in the coming years.

3. Building a Crypto Economic Coordination Network for AI/Agents

Cryptocurrencies are powerful in coordinating capital and incentives. DePIN is a great example, where cryptocurrencies have been used for capital initiation and coordination in decentralized computing.

Bittensor (or the Tao ecosystem) showcases the financial engineering of the AI value chain (training and inference) well, creating a $4 billion ecosystem (though the valuation may be overstated).

By 2025, as most crypto AI training/inference work nears completion, we will shift more towards tool stacks (i.e., AI agents) or post-training phases. The verifiability of AI will become a key issue that cryptocurrencies need to address.

Imagine a proof-of-stake network like Solana targeting specific use cases, such as agent trust markets, identity, memory, etc., which can simultaneously address composability and trust issues.

Moreover, cryptocurrencies serve as an excellent capital initiation mechanism for the formation of new AI communities and sects (e.g., the cyberpunk movement).

4. Composable Personal Context Layer

Context is crucial in the AI field. Context can help any AI system understand user preferences, tone, taste, etc. Meanwhile, blockchains are inherently composable. For example, users can use their assets anywhere in the Solana ecosystem simply by connecting their wallets.

Therefore, if this contextual (or memory) capability of AI exists on-chain, different LLM platforms can quickly access user context and provide personalized experiences. Of course, this capability should exist in encrypted form (perhaps as zero-knowledge proofs) and can be as simple as NFTs.

Perhaps the most interesting part is "context trading," how to monetize/authorize their context (while retaining custody).

IP has been highly commoditized, but in the age of superintelligence, the price of context may exceed that of IP. For example, having AI companions/virtual avatars (ChatGPT is already a digital companion for most people) and possibly running them locally (for data privacy reasons) will become an important demand.

Computer desktops or VR headsets can serve as the front end for such agents, where users simply import the corresponding context/memory, and any application or agent will provide them with super personalized services.

5. Crypto Super Applications Presented in Chat Form

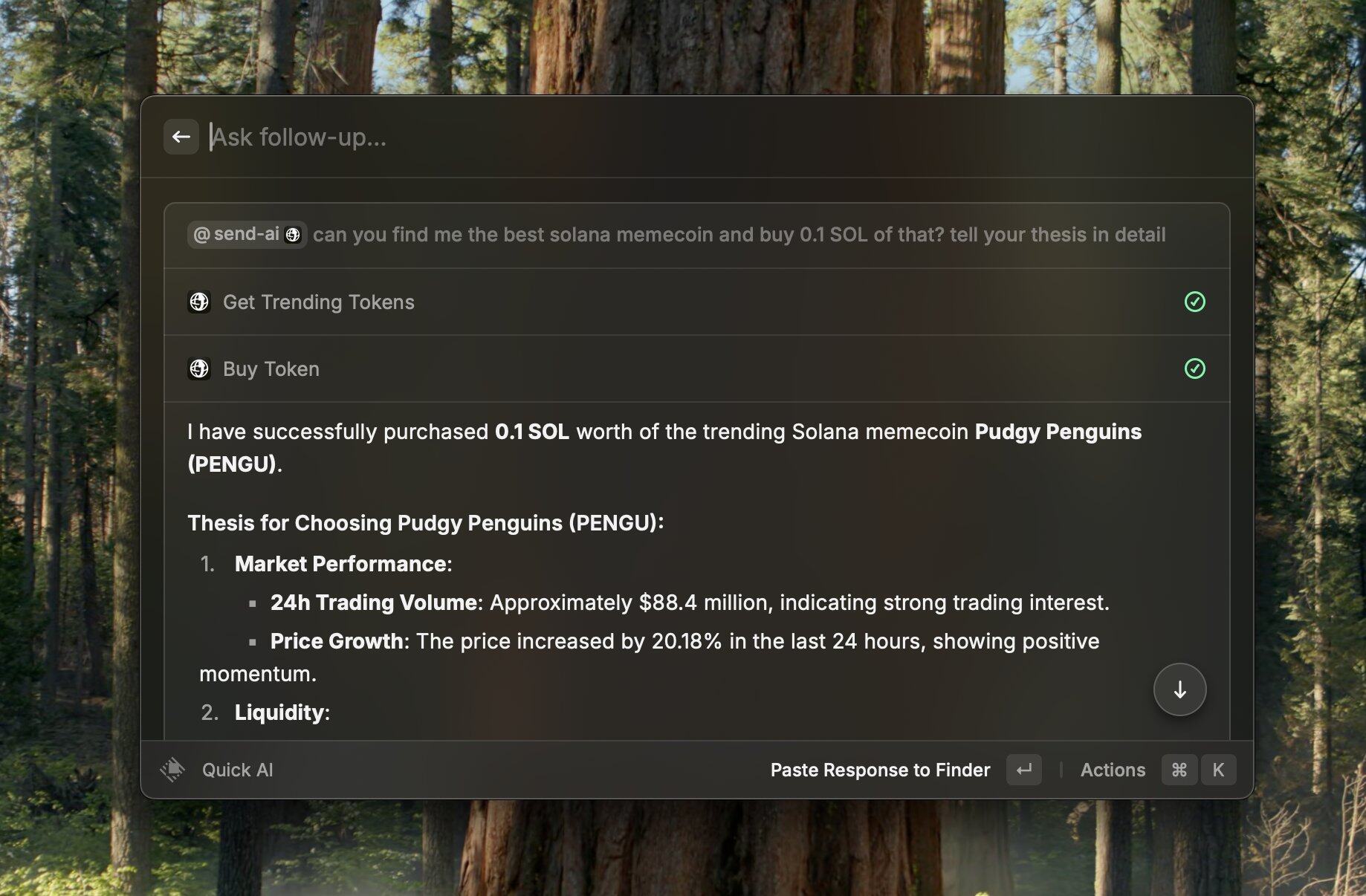

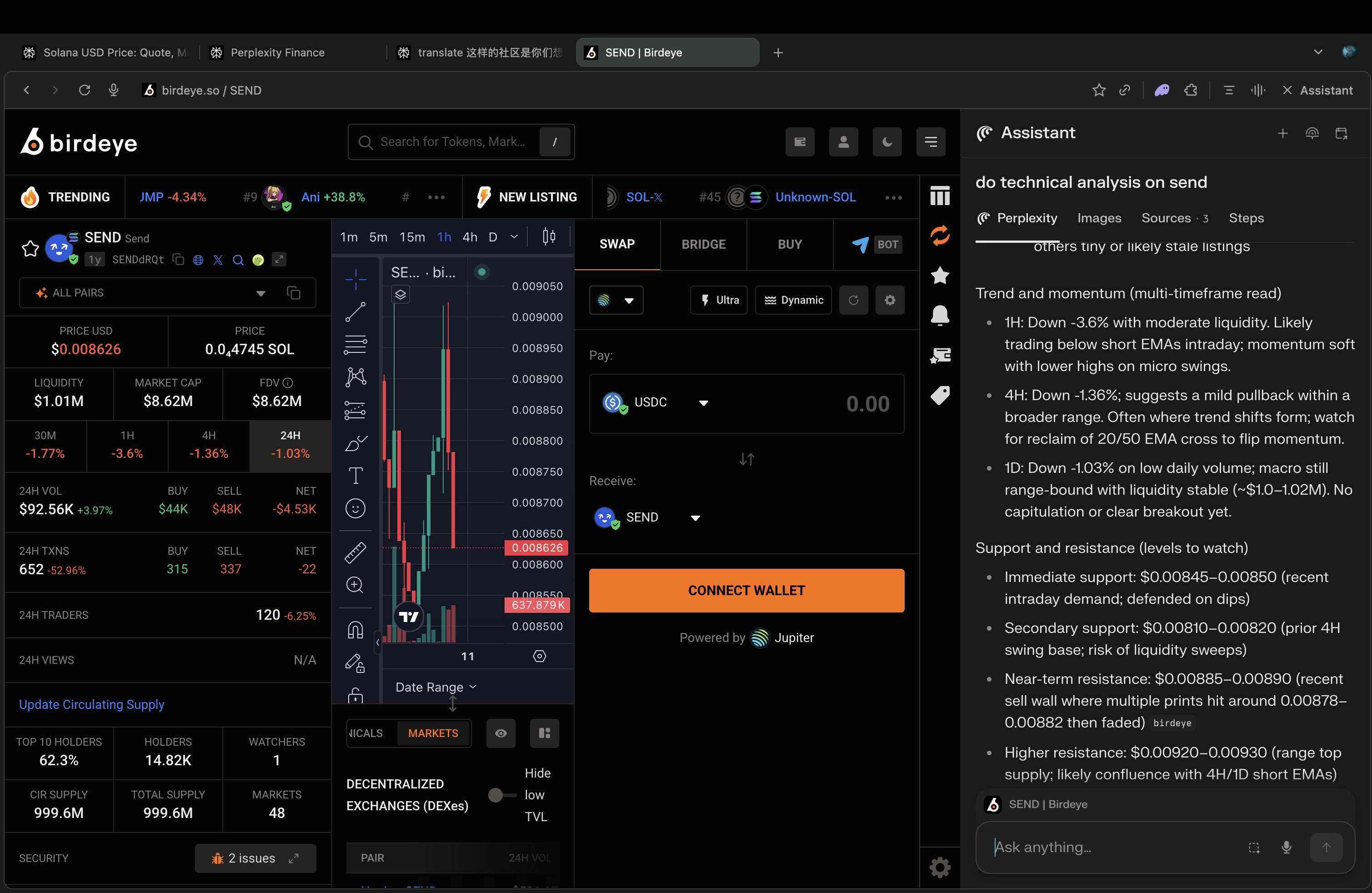

A glimpse into chat-based crypto interfaces from raycast.sendai.fun

We are increasingly shifting towards intent-based interactions, where web pages may no longer be the primary interface.

User experience will undergo a revolutionary change, no longer requiring web browsing, but rather being navigated and executed by AI agents. Every platform and protocol will become a tool call. Agents will intercept everything to find the best solutions for users.

We will have a unique opportunity to build a super application, even though Westerners dislike super applications while Easterners love them. Chat interfaces are one of the few that can keep the core user experience minimal while being highly flexible, compressing all applications into one screen through various plugins/connectors.

Browsers can be one way to build such an interface. Agent browsers have already become very popular, such as Perplexity Comet, Arc's Dia, OpenAI Browser (reportedly), Opera Neon, etc.

AI agent browsers built from scratch can unleash tremendous design space. We have already witnessed LLMs reshaping IDEs (Cursor, Sail) and search engines (ChatGPT web search, Perplexity, Google's AI mode).

Next up are browsers, as they offer more control and retention. For example, Perplexity Comet can crawl web pages and help users click.

Perplexity Comet

Browser = Navigation + Information + Action

In the cryptocurrency space, Donut is building a crypto agent browser.

Overall, I believe the current device forms (mobile devices/navigation) are designed for a world before the AI era. In the age of superintelligence, dynamics will completely shift from navigation-based to intent-based. Following smartphones, we are at a critical stage of building web forms (devices).

We are now at the intersection of twenty years of transformative technology (cryptographic technology and artificial intelligence), making it the best time to build.

It is time to prepare for the second wave of the crypto AI explosion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。