Key Points

The core of RWA is to bring assets on-chain, referring to the digital processing of various real-world assets in traditional financial markets, such as bonds, real estate, stocks, artworks, and private equity, through blockchain technology. The RWA market is vast with significant growth potential; Ripple and Boston Consulting Group (BCG) estimate that by 2033, the RWA market size will reach $18.9 trillion. Meanwhile, traditional asset management giants like BlackRock, Franklin Templeton, and Fidelity have also begun to lay out their strategies for RWA, further promoting the blockchainization of traditional financial assets such as bonds, real estate, and commodities.

In March 2024, BlackRock launched the BUIDL tokenized treasury fund in collaboration with digital asset company Securitize, primarily targeting institutional investors, with a minimum participation threshold of $5 million. As of the time of writing, the BUIDL fund has exceeded $2 billion in size, with 85 holders, an APY of 4.5%, and a management fee of 0.2%-0.5%. The fund's size has increased by 68.37% within 30 days, with assets mainly distributed on the Ethereum chain. Franklin Templeton began its fund tokenization attempts in 2021, launching the tokenized money market fund FOBXX first. As of the time of writing, this fund has a size of $700 million, with 561 holders, an APY of 4.55%, and a management fee of 0.15%, with a monthly growth of 2.36%. The holdings are relatively diversified, with assets mainly distributed on the Stellar chain. Fidelity submitted a filing to the U.S. Securities and Exchange Commission (SEC) on March 21 to register a blockchain-based tokenized U.S. money market fund, officially entering the RWA space.

As of the time of writing, the total market value of on-chain RWA assets (excluding stablecoins) has surpassed $20 billion, up from about $10.3 billion in April 2024, representing a year-on-year growth of approximately 105%. Currently, the top three asset categories in RWA are private credit, U.S. Treasuries, and international alternative funds. RWA assets are primarily concentrated on the Ethereum chain, followed by ZKsync Era and Stellar. Additionally, with the development of compliance technology and regulatory frameworks, the RWA sector is gradually moving towards compliance, mainly reflected in clearer regulations, an increase in pilot projects, the gradual maturation of infrastructure, and attempts at regulatory cooperation mechanisms.

However, RWA also faces developmental challenges, with its core challenges currently including insufficient liquidity and lack of market depth, high investment thresholds limiting retail market participation, difficulties in asset valuation and security risks, compliance barriers, and cross-border transaction restrictions. This is particularly manifested in the lack of sustained on-chain use cases for RWA, leading to a disconnection between asset and market prices, and insufficient liquidity preventing the full release of the potential value of assets, making it difficult to achieve true market free circulation.

In response to the aforementioned issues in the RWA sector, some projects began exploring commodity tokenization and compliance as early as 2017. According to incomplete statistics from Coingecko, there are currently over 300 projects in the RWA sector, with more than 270 tokens issued. This report selects leading projects based on comprehensive dimensions such as project business logic and operational level, and analyzes some key solutions from three directions: digital asset tokenization, physical asset tokenization, and RWAFI.

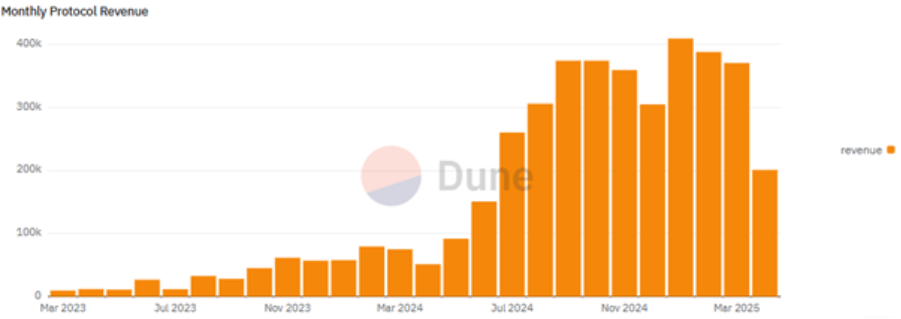

In the direction of digital asset tokenization, this report focuses on Ondo Finance, Ethena, and Maple, and briefly discusses Aave Horizon, Centrifuge, Goldfinch, Noble, and Backed. Ondo Finance ranks third in the RWA sector by TVL, with a TVL of $999 million. The project's main revenue source is from the Ethereum chain, with an average daily income of about $600,000. Ethena's total issuance of USDe has surpassed $4.98 billion, making it one of the fastest-growing non-traditional stablecoin projects in DeFi. According to Dune data, the staking rate of USDe is 38.14%, with a total of about $1.9 billion staked. However, it is worth noting that Ethena has experienced an outflow of funds over the past three months. Maple focuses on the institutional lending market, connecting capital providers and borrowers through a "lender representative" system, becoming an early representative project in the on-chain credit market. Additionally, a report released by Grayscale Research in March also highlighted Maple as a key focus in the RWA field.

In the direction of physical asset tokenization, this report focuses on Securitize and Propy, and briefly discusses six other projects including VeChain, Parcl, and Lofty. Securitize is one of the few compliant platforms in the U.S. that has obtained SEC registration as a transfer agent, FINRA recognition as a broker-dealer, and ATS (Alternative Trading System) licensing, giving it a compliance advantage in the RWA sector. Propy is a typical case study in real estate tokenization, but in terms of actual data performance, Propy currently has sold no more than 10 properties in RWA, and the circulation of digital assets like NFTs is also very limited. From the project's business logic perspective, it has not yet formed a closed-loop effect.

In the RWAFI direction, this report focuses on Plume, Injective, and GAIB. Plume aims to create a complete RWA asset platform for institutional clients, becoming an important infrastructure linking traditional finance and DeFi. As of the time of writing, the Plume ecosystem has attracted over 180 projects, with more than 280 million transactions, available assets exceeding $4 billion, and over 18 million total addresses. However, recent on-chain activity has seen a decline, and user growth faces certain fluctuations. Injective is gradually expanding into the RWA sector, providing underlying support for the on-chain issuance and trading of traditional assets through partnerships with off-chain asset providers, compliant issuance platforms, and asset custodians. However, the Injective ecosystem is still in its early stages, and the actual implementation of RWA will require time to verify. GAIB attempts to address issues such as resource misallocation, financing difficulties, and low capital efficiency in the AI computing power market, providing flexible on-chain participation paths for institutional investors and developers. GAIB views GPU computing power as a real asset supported by cash flow, using tokenization to map it on-chain, and has built an RWA infrastructure that integrates trading, yield distribution, and KYC compliance functions. GAIB is a representative exploration of RWAFI in the AI infrastructure sector.

Table of Contents

Against the backdrop of Trump's tariff policy triggering global market risk aversion, both U.S. stocks and the crypto market are under pressure, with the overall macro environment filled with uncertainty. However, amidst the turmoil of mainstream assets, RWA (Real World Assets) has shown a counter-trend growth momentum, with Wall Street giants like BlackRock and Fidelity entering the field, highlighting the strategic value and long-term growth potential of RWA.

The core of RWA lies in the tokenization of real assets such as real estate, government bonds, and corporate credit on-chain, combined with smart contracts to achieve transparency, liquidity, and global circulation of assets. It not only provides a more efficient financing method but also injects a more stable and predictable asset structure into DeFi, thus offering investors a configuration option that combines yield and risk resistance in a volatile market.

As the market's dual demand for stable returns and on-chain efficiency increases, RWA is becoming a key structural opportunity connecting TradFi and DeFi, gradually establishing itself as a core element in the crypto market. In a cycle of rapidly shifting risk preferences, RWA provides not only a hedging channel at the asset level but also a pathway for reshaping financial infrastructure. This report will deeply analyze the development logic, core challenges, and key solutions of RWA, and provide in-depth reflections on the development trends of RWA.

1. The Key to Linking the Real World: RWA

1.1 Overview of RWA

The core of RWA is to bring assets on-chain, referring to the digital processing of various real-world assets in traditional financial markets, such as bonds, real estate, stocks, artworks, and private equity, through blockchain technology. This process transforms assets into tokenized forms, enabling them to be traded, mortgaged, and lent on the blockchain. Through asset tokenization, RWA can significantly enhance the liquidity of assets, breaking down barriers in traditional financial markets, such as high intermediary fees, lengthy transaction settlement times, and liquidity constraints. RWA maps the "asset value" off-chain to "programmable assets" on-chain, thus achieving efficiency improvements and financial innovation.

RWA is not a new concept; early projects like stablecoins, security tokens, and gold tokens can be seen as its prototypes. In recent years, RWA has become one of the main focal points in the narrative of linking the crypto world with the real world. According to statistics from RWA.xyz, RWA currently mainly covers the following types of assets:

Stablecoins USDT: Cryptocurrencies backed by fiat or other assets, aimed at maintaining price stability, commonly used for trading and payments.

U.S. Treasuries: Debt instruments issued by the U.S. government, including U.S. Treasuries, known for their high safety and liquidity.

Global Bonds: Including non-U.S. government bonds and corporate bonds, providing a diversified fixed-income investment option.

Private Credit: Referring to debt financing in non-public markets, such as private loans and structured credit products, typically issued by professional institutions.

Commodity Assets: Tokenization of physical assets like gold and oil, allowing investors to trade these traditional commodities on-chain.

Institutional Funds: Tokenization of fund products issued by traditional financial institutions, such as money market funds and bond funds.

Stocks: Tokenization of traditional stocks, enabling them to be traded and managed on the blockchain.

1.2 Why Focus on RWA

As an intermediary layer linking the on-chain world with the traditional financial system, RWA is not only an important path for DeFi to seek sustainable returns but also the main entry point for institutional funds into the crypto space. The market potential of RWA is mainly reflected in the following points:

The RWA market is vast, with significant growth potential. The global bond market exceeds $130 trillion, and the real estate market exceeds $300 trillion; even 1% on-chain represents a trillion-dollar opportunity.

On-chain yield assets are scarce, and RWA can provide stable cash flow. Compared to DeFi models that rely on token incentives and leverage, RWA projects can introduce stable, low-risk cash flows like U.S. Treasury yields, providing a more reliable yield foundation.

The main entry point for institutional participation, traditional financial institutions have successively laid out RWA strategies, participating through on-chain funds and tokenized bonds; compared to native crypto assets, RWA offers greater compliance, familiarity, and controllability for institutions, making it the preferred entry point for genuine "on-chain experiments."

Promoting the integration of TradFi and DeFi, RWA can further drive DeFi 2.0, bringing more possibilities to on-chain finance. DeFi projects can construct a matrix of financial products with controllable risks and predictable returns through RWA, further attracting mainstream users.

3. Layout of Asset Management Giants in RWA

Since 2020, traditional asset management giants have gradually deepened their involvement in RWA. This report analyzes the strategies of leading firms such as BlackRock, Franklin Templeton, and Fidelity in the RWA space.

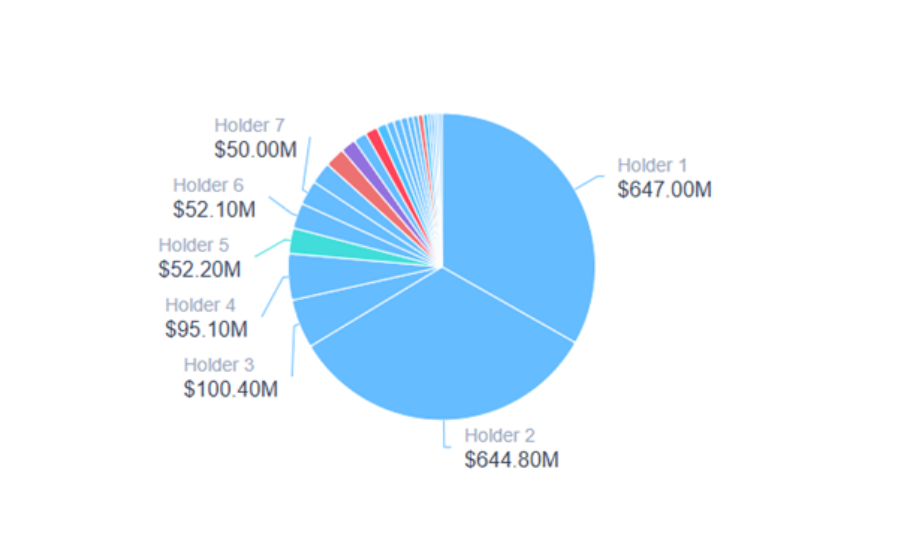

BlackRock launched the BUIDL tokenized treasury fund in March 2024 in collaboration with digital asset company Securitize, primarily targeting institutional investors, with a minimum participation threshold of $5 million. On-chain data shows that as of the time of writing, the BUIDL fund has exceeded $2 billion in size, with 68 holders, an APY of 4.5%, and a management fee of 0.2%-0.5%. The fund's size has increased by 68.37% within 30 days, with assets mainly distributed on the Ethereum chain. In terms of holding proportions, leading institutions occupy the majority share, with the largest holding $647 million, accounting for approximately 31.7% of the total fund size.

Source:app.rwa.xyz

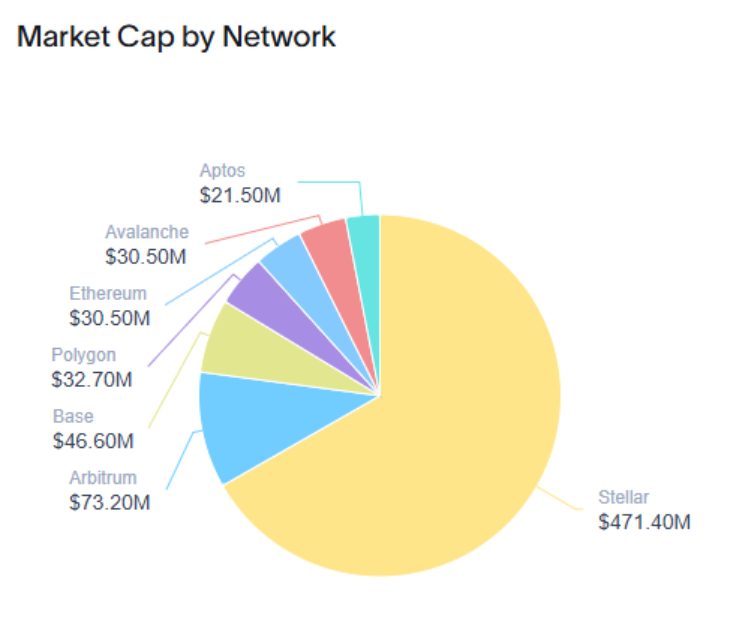

Franklin Templeton began its fund tokenization attempts in 2021, launching the tokenized money market fund FOBXX first. In April 2025, it registered in Luxembourg again to launch a fully tokenized UCITS SICAV product, namely the Franklin OnChain U.S. Government Money Fund BENJI. This fund primarily targets institutional investors in Austria, France, Germany, Italy, the Netherlands, Spain, and Switzerland. As of the time of writing, the fund size is $700 million, with 561 holders, an APY of 4.55%, and a management fee of 0.15%, with a monthly growth of 2.36%. The holding proportions are relatively diversified, with assets mainly distributed on the Stellar chain, followed by Arbitrum and Base.

Source:app.rwa.xyz

Fidelity submitted a filing to the U.S. Securities and Exchange Commission (SEC) on March 21 to register a blockchain-based tokenized U.S. money market fund, officially entering the RWA space. The fund is named Fidelity Treasury Digital Fund, with the code FYHXX. Currently, the fund's asset size has reached $240 million, with 5 holders, and 100% of the assets allocated to U.S. Treasuries, with an annualized yield of approximately 4.12%-4.15%. The average maturity period is 53 days. It is worth noting that Fidelity is also one of the issuers of Bitcoin and Ethereum spot ETFs in the U.S., managing $16 billion in FBTC assets and $600 million in FETH assets. Therefore, Fidelity's involvement may bring more traditional capital flow to RWA.

II. Market Overview of RWA

- Market Size and Trends of RWA

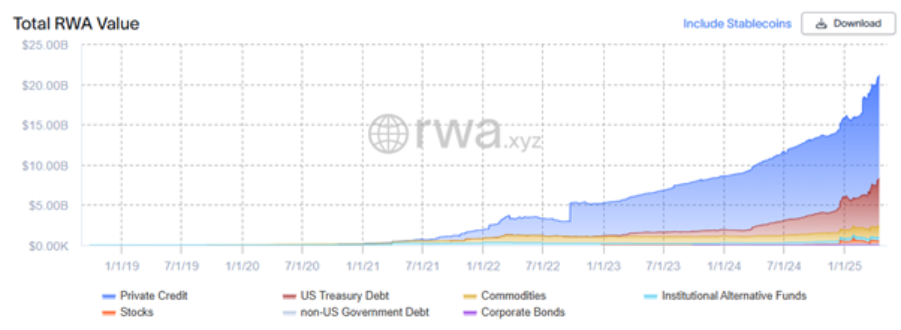

As of the time of writing, the total market value of on-chain RWA assets (excluding stablecoins) has surpassed $20 billion, compared to approximately $10.3 billion in the same period in 2024, representing a year-on-year growth of about 105%. Ripple and Boston Consulting Group (BCG) estimate that by 2033, the RWA market size will reach $18.9 trillion.

Source:app.rwa.xyz

- Asset Class Proportions

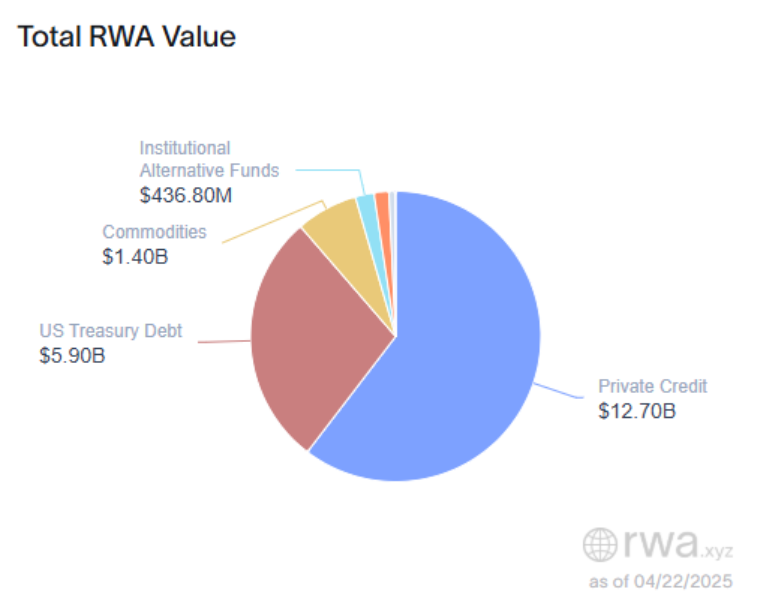

In terms of asset class proportions, the top three are private credit, U.S. Treasury debt, and international alternative funds. Private credit dominates, valued at $12.7 billion, accounting for 61% of the total value; U.S. Treasury debt is valued at $5.9 billion, accounting for 28%; commodities are valued at $1.4 billion, accounting for 6.64%; and international alternative funds are valued at $437 million, accounting for 2.1%. Additionally, stocks, non-U.S. government debt, and corporate bonds have relatively small proportions. This indicates that RWA has begun to gradually take on the custody and circulation of income-generating assets in traditional finance.

Source:app.rwa.xyz

- Public Chain Proportions

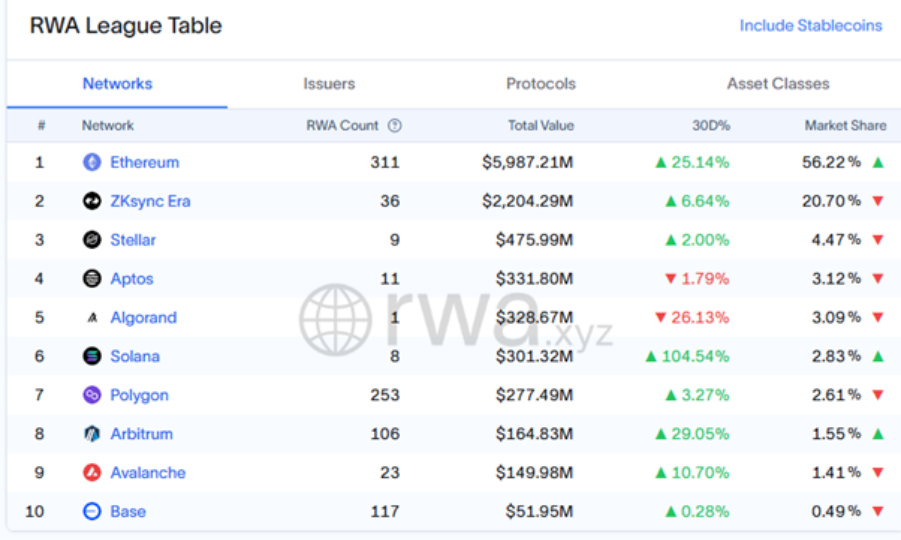

According to on-chain data, RWA assets are primarily distributed across Ethereum, ZKsync Era, Stellar, Algorand, Aptos, Solana, Polygon, Avalanche, Arbitrum, and Base chains. The top three public chains are Ethereum, ZKsync Era, and Stellar, with Ethereum holding the majority share at 56.22%. On the Ethereum public chain, the highest asset value is in stablecoins, accounting for 94.83% of the total asset value; followed by ZKsync Era, accounting for 20.7%. On the ZKsync Era public chain, the highest asset value is in private credit, accounting for 88.43% of the total asset value; Stellar accounts for 4.47%, with U.S. Treasuries being the highest asset value on the Stellar public chain, accounting for 55.93% of the total asset value. Additionally, it is noteworthy that Solana has seen the highest growth among public chains in the past 30 days, with an increase of 104.54%.

Source:app.rwa.xyz

- Compliance Status

With the development of compliance technology and regulatory frameworks, the RWA sector is gradually moving towards a "compliance track," and projects with the ability to issue legally and access widely in the future will have higher moats and growth potential. Currently, the compliance status of RWA is mainly reflected in the following points:

4.1. Clarification of Regulations and Increase in Pilot Projects

U.S. SEC/CFTC: More detailed scrutiny of whether assets constitute securities, promoting registration pathways, etc.; CFTC focuses more on derivatives of commodity assets, such as commodity ETFs or structured token products based on physical assets; products under Ondo Finance, such as OUSG, follow a fully compliant path, having obtained SEC exemption for the registration and compliant sale of U.S. short-term Treasury tokens.

Europe MiCA: The "Markets in Crypto-Assets Act" (MiCA) was passed in 2023, providing a unified regulatory framework for crypto assets, including stablecoins and asset-backed tokens; asset tokenization projects can register under either the "electronic securities" or "asset tokens" frameworks; Germany's BaFin has approved multiple security token issuances, such as Bitbond and BrickMark.

Asia-Pacific markets such as Singapore/Hong Kong: Singapore's MAS encourages licensed token issuances, promoting tokenization of government bonds, bills, etc., through Project Guardian; Hong Kong's SFC updated virtual asset guidelines in 2023 and promoted pilot projects such as "tokenized green bonds" in collaboration with institutions like Standard Chartered and UBS; various regions are using "regulated pilot sandboxes" as a transitional form to accelerate the landing of asset tokenization.

4.2. Gradual Maturation of Infrastructure

On-chain compliance tools are gradually maturing, providing modules for KYC/AML, whitelist management, permission control, etc., supporting compliant issuance of institutional-level assets; RWAFi project modular compliance support allows more projects to issue compliant bonds, fund shares, etc.

4.3. Attempts at Regulatory Cooperation Mechanisms

The Bank for International Settlements (BIS) collaborates with various central banks to research "tokenized central bank bonds" and "cross-border RWA settlement standards"; financial infrastructure institutions like DTCC are also participating in the standardization of the "Tokenized Collateral" mechanism, promoting the circulation of RWA within mainstream clearing systems.

III. Core Challenges Facing RWA

- Insufficient Liquidity and Lack of Market Depth

Currently, the RWA market is primarily dominated by institutional investors, and the investment threshold is relatively high. Taking the leading BlackRock BUIDL fund as an example, its fund market value accounts for 32.4% of the total RWA market value. However, in the past 30 days, its on-chain holders numbered only 85. Additionally, the BUIDL fund employs a restricted liquidity mechanism. Currently, the BUIDL fund only allows investors to exchange BUIDL tokens for USDC on the Securitize platform at a 1:1 ratio. This restricted liquidity mechanism leads to fewer application scenarios for the assets, which in turn negatively impacts asset liquidity. Overall, the current lack of liquidity in RWA means that assets do not have sufficient application scenarios, and their potential value cannot be fully released, making it difficult to achieve true market free circulation.

- High Investment Thresholds Limiting Retail Market Participation

The high investment threshold in the RWA market makes it difficult for retail investors to participate. Currently, many tokenized products primarily target institutional investors and set minimum investment amounts of up to several million dollars. For example, the participation threshold for the BUIDL fund is $5 million, limiting opportunities for ordinary investors. Additionally, most traditional retail investors have low awareness and acceptance of tokenized assets.

- Difficulty in Asset Valuation and Security Risks

Currently, the valuation of RWA assets is complex, especially for illiquid or unique assets such as real estate and artworks. Due to the lack of unified valuation standards, the valuations of these assets in the market often exhibit significant volatility, which in turn affects investor confidence. Meanwhile, the asset valuation of RWA relies on off-chain audits and manual disclosures, lacking on-chain verifiability, which presents certain risk blind spots.

- Compliance Barriers and Cross-Border Transaction Restrictions

Currently, the RWA market lacks a globally unified regulatory standard. The regulatory frameworks for tokenized assets vary significantly across different countries and regions, resulting in a lack of universally accepted standards, which complicates cross-border transactions and limits the global development of the market. Additionally, due to the differences in national regulations, cross-border transactions of tokenized assets face varying degrees of legal and compliance obstacles, increasing operational costs and legal risks.

IV. Key Solutions

In response to some of the challenges faced in the RWA sector, several projects began exploring areas such as commodity tokenization and compliance as early as 2017. According to incomplete statistics from CoinGecko, there are currently over 300 projects in the RWA sector, with more than 270 tokens issued. This report selects leading projects based on comprehensive dimensions such as business logic and operational level, and analyzes some key solutions from three directions: digital asset tokenization, physical asset tokenization, and RWAFI.

- Digital Asset Tokenization

1.1. Ondo Finance

Project Overview

Ondo Finance focuses on the tokenization of U.S. Treasuries, providing users with an on-chain channel to obtain returns similar to short-term U.S. Treasury ETFs, with a current annualized return of about 4%. The bond assets offered by Ondo Finance are custodied by compliant institutions such as BlackRock, strictly adhering to U.S. securities regulations to ensure the legality and transparency of the assets. Additionally, through tokenization, these fund tokens can not only be freely traded on-chain but can also be embedded into other permissioned or open DeFi protocols, enhancing capital efficiency. In February 2025, Ondo Finance further launched Ondo Chains, which will better integrate TradFi and DeFi, promoting seamless interaction in tokenized finance.

Main Products

1.1.1. Tokenized U.S. Treasury Fund OUSG

OUSG provides qualified purchasers with investment opportunities in short-term U.S. Treasuries and money market funds, offering 24/7 stablecoin minting and redemption services. The fund fee cap is 0.15%, and the management fee cap is also 0.15%, with free participation for investors until July 1, 2025. Its TVL is approximately $405 million, primarily investing in BlackRock's short-term U.S. Treasury SHV ETF, providing a low-risk return of about 4.08%. The product features are as follows:

- Stable Returns: Annualized return of about 4.08%, with returns sourced from BlackRock's SHV ETF, primarily allocated to short-term U.S. Treasuries.

- Clear Compliance System: Adopts a Reg D/S compliance framework, strictly limiting circulation within compliant investors.

- Robust Security Mechanism: Assets are custodied by the ETF under a legally structured isolation.

- Supports Public Chains: Ethereum, Polygon, Solana.

1.1.2. Dollar Yield Token USDY

USDY is a "yield-bearing stablecoin" aimed at retail investors, primarily serving non-U.S. users, who must wait a cooling-off period of 40-50 days before transferring assets. USDY is backed by short-term U.S. Treasuries and bank demand deposits, with a TVL of approximately $584 million and an annualized yield of about 4.25%. Its structural design emphasizes over-collateralization, statutory priority, and daily audits, with assets custodied by traditional financial institutions such as Morgan Stanley. USDY has a minimum investment of $500, supporting on-chain minting and wire transfer participation, providing higher yield capabilities than mainstream stablecoins while ensuring safety and compliance. The product features are as follows:

- Low Investment Threshold: Participation requires only 500 USDC, suitable for individual investors and small to medium-sized capital allocation needs.

- Slightly Higher Yield: Annualized yield of about 4.25%, slightly higher than OUSG, with returns sourced from short-term Treasuries and bank deposits.

- Globally Compliance-Friendly: Product architecture is designed for the international market, complying with regulatory frameworks in multiple regions.

- Multiple Security Measures: Assets are supported by over-collateralization, combined with bank custody and daily audits.

- Supports Public Chains: Ethereum, Mantle, Solana, Sui, Aptos, Noble, Arbitrum, and Plume.

Business Status

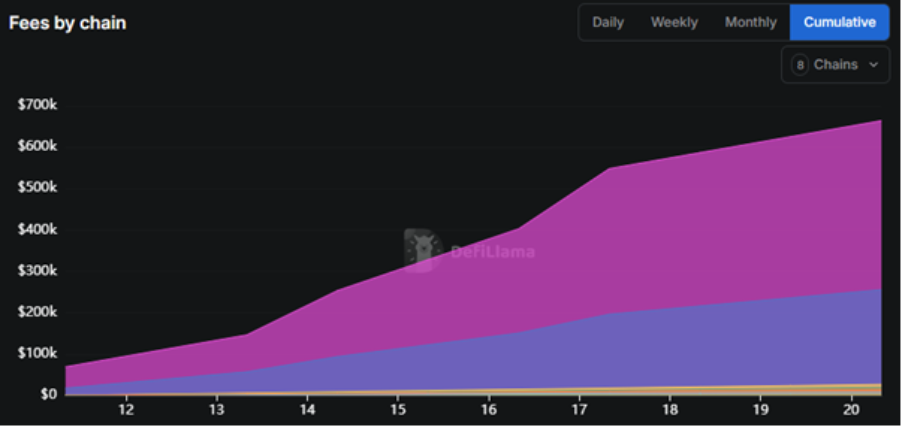

Ondo Finance was established in 2021, initially focusing on the DeFi sector. In January 2023, it transitioned to RWA, and after nearly three years of development, Ondo Finance has emerged as a leading representative project in the RWA sector. According to Defillama data, Ondo Finance's TVL ranks third in the RWA sector, with a TVL of $999 million. The project's main revenue source is from the Ethereum chain, with an average daily income of about $600,000, and the entire revenue curve shows a positive growth trend.

Source:defillama

1.2. Ethena

Project Overview

Ethena is a DeFi protocol focused on stablecoins and structured yields, having launched a synthetic stablecoin USDe suitable for the DeFi space, and is gradually expanding into the RWA sector. In 2024, Ethena Labs launched the USDtb stablecoin, developed in collaboration with Securitize and BlackRock, designed for the RWA sector. USDtb is backed by BlackRock's digital liquidity fund BUIDL, aiming to promote the on-chain tokenization and liquidity release of traditional financial assets through stablecoin products. In 2025, Ethena Labs partnered with Securitize to launch Layer1 Converge. The core goal of Converge is to bridge the gap between RWA and DeFi. By collaborating with financial institutions such as Securitize and BlackRock, Ethena is building an asset bridge connecting TradFi and DeFi, promoting the tokenization and circulation of dollar-denominated assets on-chain.

Main Products

1.2.1. USDtb

USDtb is a fully collateralized dollar stablecoin designed for institutional-level risk management and on-chain liquidity, with the following main features:

- Fully Collateralized and Institutional-Level Security: Approximately 90% of USDtb's reserves come from the BUIDL fund launched by BlackRock and Securitize, investing in cash, U.S. Treasuries, and repurchase agreements. Its legal structure achieves bankruptcy isolation, with multiple independent entities layered for regulation, ensuring asset independence and operational transparency.

- High Scalability: USDtb can be deployed on mainstream public chains such as Ethereum, Arbitrum, Solana, and Base, supporting multi-chain interoperability. Its minting system supports 24/7 operations, ensuring sufficient liquidity for on-chain stablecoins even during holidays and non-trading hours, backed by institutional custodians.

- KYC/AML Compliance System: USDtb adopts a strict KYC/AML system, authorizing only compliant users for minting and redemption, and providing complete legal, audit, and on-chain transparency disclosures.

1.2.2. Converge Chain

The main goal of the Converge chain is to achieve fast block confirmation times, allowing users to pay gas fees using Ethena's USDe and USDtb tokens, while relying on its Converge validator network to ensure system security and protection mechanisms. Converge has not yet officially launched, with the mainnet scheduled for the second quarter of 2025. Currently, Converge has established partnerships with Arbitrum, Celestia, Pendle, Centrifuge, and others, with its on-chain TVL exceeding $1 billion. Its main features are as follows:

- Compliance-First Public Chain Architecture: Converge is a public chain launched in collaboration between Ethena and Securitize, adopting a dual-layer architecture that supports permissionless DeFi applications and permissioned institutional-level applications, meeting the compliance needs of different users. At the same time, Securitize provides comprehensive compliance solutions, including KYC, KYB, asset custody, and security token issuance, offering compliance advantages.

- CVN Validator Network: Converge will introduce the Converge Validator Network (CVN), maintaining network security through staking ENA tokens.

Business Status

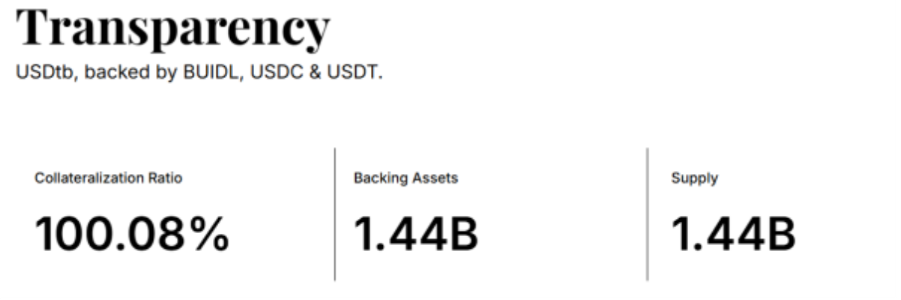

USDtb

USDtb launched in 2024, and as of now, the total minted amount of USDtb has exceeded $1.44 billion, corresponding to fully custodied USDT reserves jointly regulated by Anchorage and Ceffu. From a custody perspective, USDtb assets are primarily distributed across several institutional platforms. According to the latest custodian distribution data, the top three custodians are Komainu, holding approximately 31.08% of the assets; Copper, holding approximately 30.81% of the assets; and Coinbase custody, holding approximately 9.71% of the assets.

Source:usdtb.money

Converge

- Mainnet Launch Approaching: The Converge mainnet is scheduled to launch in the second quarter of 2025 and is currently in the testnet phase. The platform will introduce the Converge Validator Network (CVN), maintaining network security through staking ENA tokens.

- Asset Migration and Collaboration: Ethena and Securitize plan to migrate over $7 billion in assets to the Converge network, including USDe, USDtb, and tokenized assets issued by Securitize.

1.3. Maple

Project Overview

Maple is an institutional-grade on-chain lending platform founded in 2020, with the core goal of revolutionizing traditional financial lending processes. Since 2023, it has entered the RWA sector. Maple focuses on unsecured or partially secured loans, providing credit services to crypto-native companies, market makers, funds, and enterprises.

Maple targets the institutional lending market, connecting capital providers and borrowers through a "lender representative" system, becoming an early representative project in the on-chain credit market. Notably, a report released by Grayscale Research in March 2025 also highlighted Maple as a key focus in the RWA field, ranking it among the top 20 crypto assets.

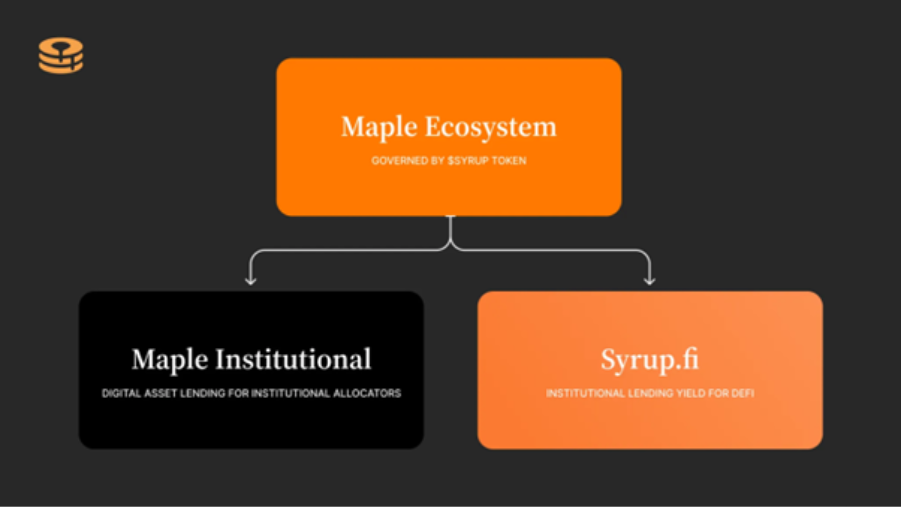

Main Products

Maple has two core products: Maple Institutional and Syrup.fi. Maple Institutional is a "compliance credit market" for qualified institutions, emphasizing regulation, transparency, and the connection to real-world assets, making it a typical product that merges CeFi and DeFi. Syrup.fi is an open platform aimed at DeFi users, offering greater on-chain composability, flexibility, and decentralization, serving as Maple's new product to expand retail users and on-chain asset efficiency.

In the latest planning for 2025, Maple has made detailed distinctions between the two. The positioning of Maple Institutional is to further expand capital and trust, while Syrup.fi aims to empower DeFi and achieve institutional-level yields. Through the closed loop of these two products, it promotes the positive development of the project, with specific differences outlined as follows:

S

Source:maple.finance

- Maple Institutional

- Target Audience: Non-U.S. institutional qualified investors

- Core Product: Cash management pool

- Investment Target: Short-term U.S. Treasuries (T-Bills)

- Management Mechanism: Operated through regulated asset managers using an SPV structure

- Positioning Direction: Create an on-chain version of a money market fund

- Target Audience: DeFi native users

- Core Product: Various decentralized lending pools covering on-chain assets and some RWAs

- Investment Target: Primarily stablecoins like USDC and USDT, with funds used to provide over-collateralized fixed-rate loans to institution borrowers vetted by Maple, with collateral including BTC and ETH

- Management Mechanism: Introduces a new governance and incentive token, $SYRUP

- Positioning Direction: Explore hybrid lending of RWAs and on-chain collateral

Business Status

According to Dune data, as of the time of writing, Maple's TVL has surpassed $900 million, with approximately $200,000 in revenue over the past 30 days. The total loan amount exceeds $6.7 billion, with a collateralization rate over 165%. The liquidity reward token $SYRUP has a staking annual yield of 2.65%, with total staked $SYRUP around 490 million tokens.

Source:dune

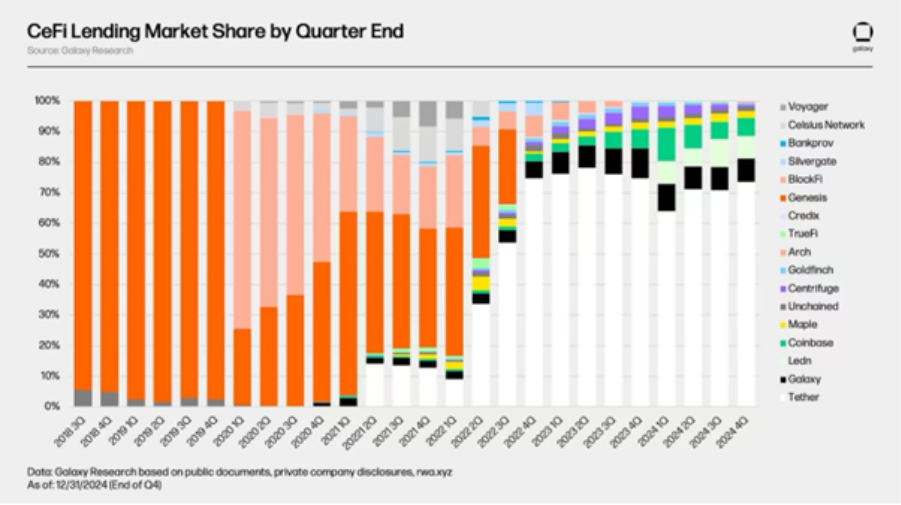

Additionally, according to Grayscale Research data, by the end of 2024, Maple ranks fifth among the largest CeFi lending institutions by outstanding loan book size, only behind Coinbase.

Source:Grayscale Research

It is important to note that Maple also carries certain risks, as detailed information about its underlying off-chain assets still relies on centralized entities, which may lead to information asymmetry and the possibility of "black box" operations. Meanwhile, the borrowers served by Maple are mostly participants in the crypto market or TradFi institutions. In extreme market conditions, if there are defaults by market makers or deteriorating debt repayment capabilities of enterprises, it could trigger large-scale defaults, creating on-chain transmission risks that impact the overall security of the asset pool. Furthermore, most of Maple's products have lock-up periods and redemption window mechanisms, lacking sufficient secondary market liquidity.

1.4. Others

Aave Horizon is an RWA-focused project proposed by Aave in March 2025, aiming to promote institutional adoption of DeFi by introducing RWAs into the DeFi space. Horizon allows institutions to use tokenized money market funds as collateral to borrow USDC or GHO stablecoins. Aave DAO opposed the proposal to issue new tokens for Horizon, believing it could undermine the value and governance weight of existing AAVE tokens. Therefore, Aave Labs founder Stani Kulechov stated that they would respect community consensus and no longer pursue the new token issuance plan. Currently, after the community vote did not pass, there have been no further updates. However, this indicates that the leading DeFi project Aave is also beginning to lay out RWA.

Centrifuge is an important infrastructure project in the RWA sector, dedicated to the on-chain tokenization of traditional financial assets such as invoices, receivables, and real estate, connecting asset issuers with DeFi investors through its core platform Tinlake, providing transparent and programmable financing tools. The project has partnered with several real-world asset issuers and is gradually establishing a solid position in the stablecoin and institutional DeFi ecosystem.

Goldfinch focuses on unsecured loans, combining off-chain credit assessments with on-chain capital matching to provide dollar liquidity to lenders in emerging markets. Goldfinch's innovation lies in solving the connection issue between the crypto world and traditional credit systems through trust networks and pre-funding mechanisms. However, Goldfinch has previously experienced bad debts and multiple borrower defaults (such as Lend East and Tugende), where borrowers were unable to repay the corresponding funds in a timely manner, leading to a trust crisis.

Noble is the asset issuance layer in the Cosmos ecosystem, focusing on providing native issuance and transfer infrastructure for RWAs in a cross-chain environment. Its core advantage lies in its deep integration with the Cosmos IBC protocol, allowing RWAs such as stablecoins and fiat-backed assets to circulate efficiently and securely across chains. Noble's most representative collaboration is with USDC issuer Circle, deploying native USDC in the Cosmos ecosystem, becoming an important landing for compliant cross-chain asset issuance.

Backed is a Swiss project focused on the tokenization of real-world financial assets, primarily issuing compliant tokens (bTokens) corresponding to traditional tradable securities such as bonds and ETFs, and providing their circulation and trading on-chain. Backed aims to achieve on-chain expression and programmability while maintaining the legal structure of traditional assets, having launched multiple regulated asset token products on chains such as Ethereum and Polygon.

- Physical Asset Tokenization

2.1. Securitize

Project Overview

Securitize initially focused on RWA and was founded in 2017, headquartered in Miami. Its core mission is to achieve compliant digitization of traditional financial assets, such as private equity, bonds, and real estate funds, through blockchain technology, enabling comprehensive on-chain asset issuance, trading, and management. Securitize is one of the few platforms in the U.S. that has obtained SEC-registered transfer agent status, FINRA-licensed broker status, and ATS licensing, giving it a compliance advantage in the RWA sector.

The "security tokenization" path promoted by Securitize differs from traditional asset securitization paths, allowing private funds, bond issuers, and even asset management giants to mint their investment products into on-chain securities, significantly improving settlement efficiency while ensuring KYC/AML compliance. Meanwhile, Securitize is continuously expanding its business scope. On April 16, Securitize announced the acquisition of a subsidiary of MG Stover, becoming the world's largest digital asset fund management company, which expanded the service range of Securitize Fund Services. As of now, Securitize manages total assets exceeding $38 billion, managing a total of 715 funds.

Main Products

Digital Securities Trading Platform Securitize Markets: Provides secondary market trading support for registered qualified investors, with a complete KYC/AML process and compliance review mechanism, allowing users to freely buy and sell tokenized private equity shares, REITs, debt instruments, etc. It is currently one of the most active on-chain RWA securities markets in the U.S.

Digital Securities Protocol DS Protocol: A compliant protocol under the SEC regulatory framework, supporting the full lifecycle management of tokenized securities from issuance, holding, voting, to dividends. The DS Protocol can be embedded to run on mainstream public chains such as Ethereum, Avalanche, and Polygon, with high scalability.

Asset Management Subsidiary Securitize Capital: Provides fund structure services, tokenized custody, and portfolio management for RWA assets, with fund products including a private equity token fund launched in collaboration with Hamilton Lane.

Business Status

Asset Issuance Scale: The total value of on-chain assets issued by Securitize exceeds $3 billion, covering various assets such as private equity, debt securities, and fund shares.

Registered Investor Accounts: The platform has gathered over 550,000 compliant accounts, including those from institutions and qualified individual investors.

Representative Clients: Leading global financial institutions such as BlackRock, Hamilton Lane, K33, Komainu, Onramp, and SBI Digital Asset Holdings.

Public Chain Deployment: Ethereum, Avalanche, Polygon, Algorand, Base, Solana.

Source:securitize.io

Securitize is a pioneer in the RWA field, supporting the issuance and trading of traditional assets such as private equity and bonds on-chain through compliant digital securities infrastructure. This report details the operational logic using the example of private equity issuance and trading on-chain. Securitize tokenizes traditional private equity through a compliance process, allowing investors to subscribe to digital securities representing equity on the platform after completing KYC and qualified investor certification. After a lock-up period, these securities can be freely transferred and traded with other qualified investors through its regulated secondary market, achieving on-chain issuance and circulation of private equity.

Currently, Securitize has not issued tokens. It is important to note that Securitize still faces uncertainties arising from changes in traditional financial regulatory policies, especially regarding cross-border issuance restrictions in different jurisdictions.

2.2. Propy

Project Overview

Propy is a U.S. technology company focused on integrating real estate assets with blockchain technology, founded in 2016 and headquartered in Silicon Valley. Its core mission is to achieve an "automated, trustless" real estate transaction process. Propy aims to represent and trade physical real estate assets as NFTs on-chain, making them composable, divisible, and capable of cross-border circulation, thereby addressing issues such as poor liquidity, cumbersome processes, and frequent fraud in the real estate market.

Propy's technological core consists of "smart contracts + NFT property certificates + on-chain custody," facilitating the entire process from property sale information, bidding, contract signing, fund settlement, property rights transfer to on-chain registration. It is one of the few projects that have completed real estate transactions on-chain. Propy's positioning is not only as a real estate technology company but also as a representative project that brings RWA into the real estate sector.

Business Status

Transaction Volume and Customer Base: As of Q1 2025, the Propy platform has supported real estate transactions exceeding $4.2 billion, with users spread across the Americas and the Middle East and North Africa.

Revenue Model: Propy's revenue primarily comes from three parts: SaaS subscriptions, providing smart contracts and property record systems for real estate brokerage firms; transaction commissions, charging fees for NFT sales services; and Web3 tool value-added services, such as PropyKeys and identity domain binding services.

Compliance Progress: Former SEC Commissioner Michael Piwowar has joined the advisory team to assist in regulatory strategy deployment, aiming to promote more regional compliance by 2025.

NFT Real Estate Transactions: Currently, there are not many cases of NFT real estate transactions. According to the official website, the latest property sold in NFT form had a transaction price of $250,000, but its NFT property had only 188 views on Opensea.

Source:opensea

Overall, Propy is a typical research case for real estate tokenization, gaining attention from outlets like Forbes. Propy has also partnered with Coinbase to explore custody services, supporting BTC or ETH as collateral to lend real estate digital assets. However, in terms of actual data performance, Propy currently has sold no more than 10 properties as RWA, and the circulation of NFTs and other digital assets is very limited. From the project's business logic perspective, a closed-loop effect has yet to be formed.

2.3. Others

VeChain focuses on supply chain management and business process optimization, utilizing the VeChainThor blockchain and a unique dual-token system (VET and VTHO) to support efficient and secure asset tracking and management. Through strategic partnerships with industry giants like Walmart and BMW, VeChain has promoted the practical application of blockchain technology in retail, automotive, luxury goods, and energy sectors. Notably, VeChain was included in Grayscale's TOP 20 watchlist released on April 10.

Parcl focuses on on-chain derivatives protocols for real estate price indices, allowing users to trade based on real-time housing price data from cities worldwide. Its core product is the "Parcl Price Feed," currently covering cities like New York, Miami, Los Angeles, Tokyo, and Dubai. Users can trade long and short positions through Parcl, implementing investment strategies similar to real estate ETFs or futures.

Lofty is a platform focused on real estate tokenization, allowing users to participate in real estate investments with a minimum of just $50. The entire process is convenient and efficient, typically completed within five minutes. The properties listed on the platform are evaluated by its unique AI model and verified by an offline team to ensure asset quality and return potential.

RealT is a platform focused on the tokenization of U.S. real estate assets, allowing global investors to participate in the U.S. real estate market with low barriers. Each token represents a portion of ownership in a property, and holders receive proportional rental income distributed on-chain, achieving liquidity, transparency, and automated management in traditional real estate investment.

Paxos has issued a total of five assets: USDG, USDL, USDP, PYUSD, and PAXG. Among them, PAXG is a gold tokenized asset launched by Paxos, with each token representing one ounce of physical gold stored in a London vault, allowing users to redeem it for physical gold bars at any time.

Tether XAUt is a gold tokenized product issued by Tether, with each token backed by a corresponding amount of physical gold stored in a secure vault in Switzerland. Its goal is to bring gold, a traditional safe-haven asset, into the on-chain world, enabling users to conveniently hold, transfer, and participate in DeFi applications globally. It is one of the representative projects of gold-related RWAs. However, it is worth noting that Tether XAUt's Twitter has stopped updating as of May 2024, and there have been no recent updates.

- RWAFI

RWAFI refers to an innovative model that transforms RWA assets into digital securities or synthetic financial products that can circulate freely in DeFi through blockchain technology and compliance frameworks. It retains the legal attributes and value support of real assets while integrating the efficient trading, automated contracts, and openness of DeFi, facilitating seamless connections and value release between traditional assets and decentralized finance.

3.1. Plume

Project Overview

Plume is the first modular Layer 1 designed specifically for the RWAFI track, dedicated to providing compliant, efficient, and composable on-chain issuance infrastructure for traditional assets. By building an end-to-end ecosystem for asset issuers, investors, and compliance intermediaries, Plume aims to become an important infrastructure for the circulation and trading of RWA assets on-chain, thereby promoting the integration of traditional finance and crypto-native capital markets.

Main Products

Plume's main products include Plume Chain, Arc Engine, stablecoin pUSD, and wallet Plume Passport. The following sections of this report will provide detailed explanations of these products.

Source:plumenetwork.xyz

- Plume Chain — Dedicated Public Chain for Real-World Assets

Plume Chain is a modular Layer 1 created by Plume, supporting the compliance, privacy, and settlement mechanisms required for asset tokenization, and is compatible with the OP Stack, ensuring its composability and security within the Ethereum ecosystem. Plume Chain supports the entire process of smart contract deployment, asset registration, and value transfer, forming an RWAFI infrastructure aimed at institutions and DeFi users. Plume Chain allows asset issuers to access identity verification, permission control, auditing, and other modules as needed. At the same time, it provides users with a low-cost, high-performance interactive experience, enabling RWA project parties to easily build on-chain products such as fund tokens, real estate certificates, and carbon credits, bridging the last mile of traditional asset on-chain.

- Arc Engine — Everything Can Be On-Chain

Arc is the issuance engine within the Plume ecosystem that enables the on-chain representation of real assets. It provides asset parties with a one-stop asset tokenization toolkit, covering asset modeling, on-chain registration, auditing information synchronization, and circulation permission settings, lowering the threshold for RWA project development and deployment. Arc supports standardized on-chain processes for various asset types, including real estate, debt instruments, commodities, copyrights, and fund shares. Through built-in compliance tools and API connections, Arc can adapt to regulatory requirements in different jurisdictions, helping issuers quickly and legally bring real assets on-chain, and can work with Plume Chain to achieve complete asset lifecycle management.

- pUSD Stablecoin — Settlement Medium for the Plume Ecosystem

pUSD is the ecological stablecoin launched by Plume Network, serving as the core circulating asset for RWAFI transactions and settlements. The value support mechanism of pUSD is that users deposit USDC into the on-chain smart contract system, which then mints pUSD at a 1:1 ratio. USDC is its only collateral asset, and pUSD itself does not hold cash or funds in bank accounts. pUSD supports 1:1 on-chain anchoring to the value of the U.S. dollar and serves as the unit of yield valuation in the Nest protocol, as well as the core payment medium for the entire ecosystem's protocols such as trading, lending, and payments. Through pUSD, users can conveniently conduct asset purchases, yield distributions, and protocol governance within the Plume ecosystem. Its stability and liquidity provide the necessary price anchoring mechanism for the on-chain transformation of real assets, promoting value integration between RWA and DeFi.

- Plume Passport — Dedicated RWAFI Wallet

Plume Passport is a smart wallet tailored for RWAFI scenarios, providing a gas-free interactive experience and built-in identity compliance support. Users can easily access all RWA applications on Plume through this wallet without configuring complex chain information or undergoing off-chain authentication. Plume Passport integrates modules for compliant identity, automatic on-chain yield distribution, and transaction signature custody, making it particularly suitable for new users or institutional clients. Plume Passport serves as both an entry point to access ecosystem applications and as the infrastructure for building on-chain credit and identity, facilitating trustworthy connections between asset and capital sides.

Business Status

As of now, the Plume ecosystem has attracted over 180 projects for deployment, with total transaction counts exceeding 280 million, available assets over $4 billion, and total address counts exceeding 18 million. Projects within the ecosystem cover various fields, including lending protocols, perpetual contracts, real estate, hotel bookings, synthetic assets, and luxury goods.

In addition, after securing financing from YZi Labs in March, Plume received further investment from Apollo Global Management, a leading asset management firm on Wall Street with over $700 billion in assets under management, on April 8. However, the specific amounts of these two financing rounds have not been disclosed.

Plume's mainnet went live on January 21. According to blockchain data, since the mainnet launch, the average daily number of unique addresses on Plume exceeded 40,000, but after reaching its peak, the number of unique addresses began to decline significantly, currently averaging around 500.

Source:etherscan.io

Plume's full-stack architecture provides significant support for the digitization, liquidity, and composability of traditional financial assets. Plume is committed to building a complete RWA asset platform that serves institutional clients, becoming an important infrastructure linking traditional finance and DeFi. However, recent on-chain activity has seen a decline, and user growth is facing some fluctuations. Overall, with top VC support, ecosystem aggregation effects, and strong application expansion capabilities, Plume is still expected to occupy a core infrastructure position in the RWA track.

3.2. Injective

Project Overview

Injective is an interoperable Layer 1 focused on building decentralized derivatives and asset trading infrastructure. In recent years, Injective has gradually expanded its infrastructure into the RWA space by collaborating with off-chain asset providers, compliant issuance platforms, and asset custodians to provide underlying support for the on-chain issuance and trading of traditional assets.

In January 2025, Injective launched inSVM, the first upgraded version based on Solana SVM in the IBC ecosystem. With the introduction of EVM, Injective can directly leverage Ethereum's developer ecosystem and technical accumulation to attract more EVM-familiar developers, lowering their migration barriers and accelerating ecosystem expansion. inSVM has received support from Google Cloud validation nodes and has participated in the U.S. Blockchain Association, establishing partnerships with companies like Coinbase.

Main Products

Compliance Asset Issuance Module: Injective's asset layer embeds KYC/AML mechanisms, supporting embedded compliance controls. Through licensing mechanisms, identity verification rules, and access restrictions, it ensures that tokens meet regulatory requirements during initial issuance and subsequent transfers.

TruStake: Injective has launched TruStake in collaboration with TruFin, a liquidity staking solution designed for institutions, featuring embedded validation and access permission management to provide a verifiable and compliant staking environment for institutions.

Business Status

Permissioned Token Module: Injective launched a natively supported Permissioned Token standard in early 2024, allowing for the setting of address whitelists, geographic area restrictions (e.g., limiting U.S. users), and integration of third-party identity verification services.

On-Chain Test Assets: Developers have deployed several test version compliant asset contracts, including region/address-restricted token contracts and USDC mirror assets with embedded compliance strategies.

Launching Tokenized Asset Market Prototype Development: Injective's ecosystem projects, such as Mito, are developing trading and issuance functions supporting RWA-type assets, targeting tokenized government bonds, structured notes, commercial paper, and more.

Injective possesses native asset tokenization, on-chain compliance, and cross-chain interoperability capabilities, while also supporting interoperability across multiple chains to meet institutional-level security requirements. However, the Injective ecosystem is still in its early stages, with relatively limited developer activity and application richness, and the actual landing effect of RWA still requires time for validation.

3.3. GAIB

Project Overview

GAIB focuses on the assetization of high-performance GPU computing resources, aiming to build a combination of AI infrastructure and RWA. By tokenizing physical GPU hardware, GAIB seeks to address issues such as resource mismatch, financing difficulties, and low capital efficiency in the AI computing market, providing flexible on-chain participation paths for institutional investors and developers. GAIB represents a significant exploration of RWAFI in the AI infrastructure track.

Notably, GAIB completed its latest round of financing of $10 million on July 30, led by Amber Group, with funds primarily aimed at promoting the on-chain tokenization of GPU assets and building an AI-driven on-chain economic system. Previously, GAIB had completed a $5 million Pre-Seed round of financing in December 2024, with investors including well-known institutions such as Hack VC, Faction, Hashed, and Animoca Brands.

Main Features

- GPU Yield Tokenization

GAIB transforms enterprise-level GPUs into tradable, yield-generating tokens, achieving liquidity and investment value for AI infrastructure. In March 2025, GAIB partnered with Aethir to launch a GPU yield tokenization pilot project based on BNB Chain. GAIB provides investors with direct opportunities to participate in the AI computing economy while offering computing service providers a more efficient financing channel.

- AI Synthetic Asset AID

AID aims to provide a more efficient and liquid financing channel for AI computing infrastructure. AID is supported by diversified assets such as GPU yields, financing transactions, and government bonds, bringing users real AI returns. The operational mechanism of AID is as follows: when $1 enters the GAIB protocol or the investment portfolio generates $1 in yield, 1 AID will be minted; when the yield is paid, the corresponding amount of AID will be burned, ensuring its market value matches the underlying asset value. Investors can stake AID to receive sAID as proof, sharing in the dividends of AI computing capacity growth while maintaining liquidity.

Business Status

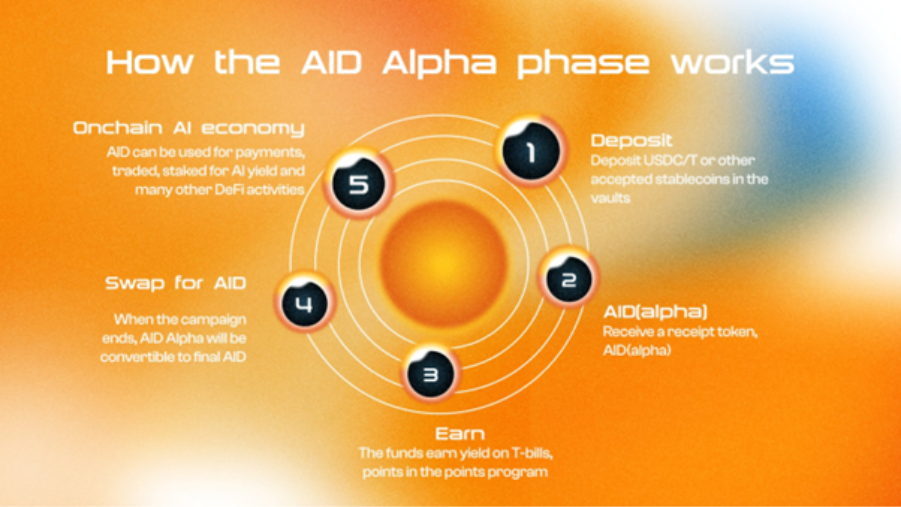

As of now, the project is still in the early testing phase. The team has completed preliminary collaborations with multiple AI resource providers and Web3 infrastructure providers. Additionally, Alpha AID is about to launch. Alpha AID is a yield-bearing token in the Alpha phase. The operational logic of Alpha AID and AID is as follows:

User Deposits Funds: Users deposit USDT or USDC into the AID Alpha treasury;

Receive Certificate Tokens: After depositing, they will receive Alpha AID;

Funds Generate Yield: The deposited funds are used to purchase U.S. Treasury Bills (T-Bills), generating stable income;

Exchange Both: Upon maturity, the user's Alpha AID is proportionally exchanged for AID.

Source:@gaib_ai

GAIB innovatively introduces AI computing resources as underlying assets into the Web3 financial system, providing a new observational case for the expansion of RWA categories and the construction of RWAFI. However, GAIB is still in its early stages, and the asset materialization and liquidity mechanisms have not yet fully materialized. While GPU assets have real value, their valuation, usage status, and depreciation cycles are variable, and the project's endorsement still needs to be strengthened.

3.4. Others

Pendle is a DeFi protocol focused on yield tokenization, actively expanding into the RWA field in recent years. By integrating traditional financial assets such as MakerDAO's Boosted Dai Savings (sDAI) and Flux Finance's fUSDC, Pendle enables users to obtain yields from traditional financial markets on-chain. Additionally, Pendle has partnered with Ondo Finance to further enrich its RWA product line, supporting more types of traditional asset tokenization.

Anzen aims to seamlessly integrate RWA into the DeFi ecosystem with its stablecoin USDz. USDz is always collateralized by excess real assets on-chain, ensuring its security and stability. These collateral assets primarily come from the private credit market, which is approximately $70 trillion in size. Users can mint USDz on networks like Ethereum and Base, participating in liquidity mining and staking in DeFi protocols like Aerodrome to obtain stable returns.

OpenEden is a smart contract treasury operated by regulatory agencies, designed to provide round-the-clock access to U.S. Treasury Bills (T-Bills). Its core product, the TBILL treasury, is an on-chain liquidity fund pool aimed at bringing real-world assets into Web3, helping stablecoin holders obtain sustainable returns. The TBILL treasury supports 1:1 backed TBILL tokens, allowing investors to directly invest in Treasury securities held by special purpose vehicles (SPVs) with bankruptcy isolation characteristics, while also supporting USDC and dollar reserves to ensure stable returns and enhance asset transparency.

Canton Network is a blockchain network jointly developed by several financial institutions and technology companies, aimed at achieving secure, interoperable, and privacy-compliant financial transactions. The network employs a "network of networks" architecture, allowing participating institutions to link through a shared synchronization layer while maintaining their independent ledgers.

Redbelly Network utilizes a leaderless consensus mechanism (DBFT) combined with zero-knowledge proofs to ensure transaction security and transparency while protecting user privacy. Redbelly has partnered with Liquidise to tokenize $500 million worth of private equity assets.

V. Future Outlook and Thoughts

- Driving Forces for RWA Development

RWA is one of the most aligned directions for compliance expectations in the current crypto application landscape. Its development momentum is gradually extending from on-chain to off-chain, and in the future, it is more likely that traditional asset issuers will actively go on-chain, with off-chain feeding back into on-chain becoming a mainstream trend. Specifically, the core driving forces for RWA include the following aspects:

Strong Demand for Stable On-Chain Yields

Traditional DeFi yield rates are highly volatile and lack sustainability, creating an urgent market need for on-chain alternatives to stable return assets like "U.S. Treasuries." RWA can bring stable cash flows from off-chain to on-chain, providing the DeFi ecosystem with real value anchoring and long-term growth logic.Off-Chain Institutions Gradually Entering the Market, Promoting Asset Tokenization

Franklin Templeton, BlackRock, and other leading institutions participating in RWA issuance indicate that RWA has the potential to attract compliant capital, with traditional finance actively entering the on-chain market as issuers.

- Accelerated Global Compliance Process

Major markets such as the U.S. and Europe are gradually establishing digital asset regulatory frameworks, such as the EU's MiCA framework, providing clear compliance pathways for custody, KYC, tokenized issuance, and other aspects, lowering the participation threshold for institutions and enhancing policy certainty.

- Exploration of RWA Development Forms

2.1. From Asset Tokenization to On-Chain Native Issuance

Currently, RWA primarily achieves on-chain verification by mapping off-chain assets to on-chain tokens. However, this method relies on off-chain issuers and compliant entities, facing issues such as low liquidity and long cycles. As regulations become clearer and on-chain compliance infrastructure improves, more traditional institutions are exploring the compliant issuance of securities assets natively on-chain. In the future, RWA development may no longer be a simple asset tokenization process but rather utilize the chain as a native issuance platform, forming a complete closed-loop of "issuance-custody-trading" and driving the reshaping of the on-chain asset market.

2.2. From Static Verification to Dynamic Liquidity

Traditional RWA typically consists of hold-to-maturity products, similar to bonds or notes. However, the composable and programmable advantages of on-chain assets are leading to more structural designs for RWA assets, such as interest and principal splitting, early interest locking, and market-making mechanisms. This indicates that the long-term development opportunities for RWA lie in structuring, trading, and liquidity, transforming traditional yields into on-chain operable financial instruments. In the future, assets may exist in diverse composite structures, such as bonds, derivatives, and ETFs.

- Logic and Thoughts on Participating in RWA

As infrastructure continues to improve and mainstream financial institutions gradually accept on-chain finance, the narrative around RWA is shifting from concept to substantial implementation. For investors and builders, RWA is not just a technical direction but a reshaping of institutional evolution and capital flow logic, warranting consideration from a long-term perspective and through multiple pathways.

3.1. Long-Cycle Structural Opportunities

RWA is not merely the tokenization of real assets on-chain; its essence lies in enhancing the liquidity, transparency, and composability of traditional assets through smart contracts. From a macro perspective, RWA serves as a linking entity between TradFi and DeFi, playing a crucial role in key areas such as on-chain credit systems, stablecoin anchoring systems, and institutional compliance entry. Therefore, for investors who prioritize fundamentals and medium to long-term trends, RWA is an indispensable part of DeFi's journey to mainstream adoption, representing a long-cycle track with policy friendliness and industry integration.

3.2. Multidimensional Participation Paths

Currently, there are three types of ways to participate in RWA. The first type is investing in protocol tokens to participate in governance and yield tokens of projects like Maple, representing a bullish expectation for the protocol's future growth, more suitable for investors with medium to high-risk tolerance. The second type is participation at the protocol level (LP/lending/staking), suitable for participants with moderate risk tolerance seeking stable returns. The third type involves ecosystem-level construction, including compliance solutions, KYC identity systems, and on-chain credit assessment mechanisms.

3.3. Future Outlook

RWA is the most "real value-anchored" development direction within the Web3 system, connecting cash flow assets in the real economy with on-chain financial systems, offering greater stability and sustainability than most native crypto assets. In the future, as regulations clarify and infrastructure matures, RWA is expected to become an important channel for attracting mainstream capital. It will not only reshape the asset structure behind stablecoins but also has the potential to drive large-scale entry of institutional and sovereign capital, becoming one of the core driving narratives of the next crypto bull market.

Reference Links

https://docs.ethena.fi/solution-overview/protocol-revenue-explanation

https://maple.finance/insights/turning-vision-into-action-scaling-maple-in-2025

https://etherscan.io/token/0x4C1746A800D224393fE2470C70A35717eD4eA5F1#tokenAnalytics

https://www.grayscale.com/blog/general-updates/assets-under-consideration-current-products

https://www.coingecko.com/learn/what-is-plume-network-rwa-tokenization

https://github.com/gaib-ai/gaibindustryreports/blob/main/RWAfi%20Report.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。