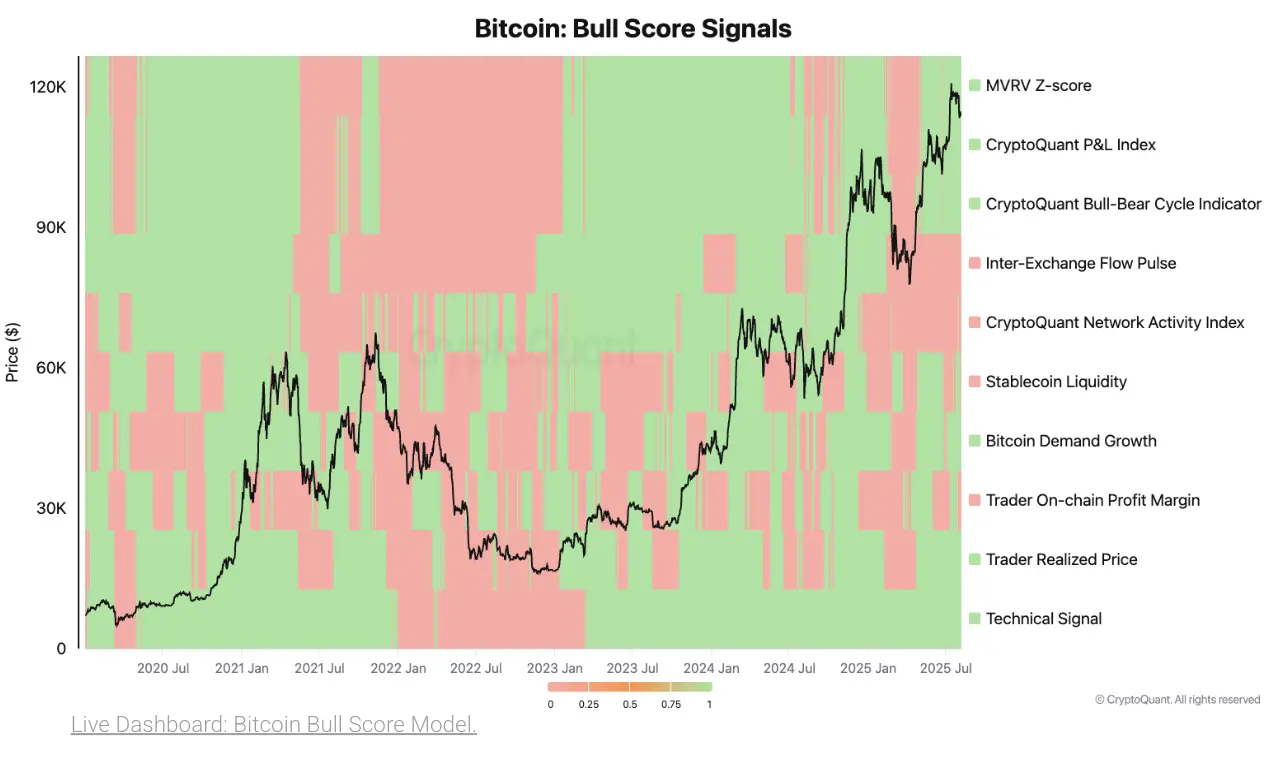

比特币的快速上涨在达到123,000美元的历史新高后暂停,进入了Cryptoquant的机构洞察报告所称的“看涨冷却”阶段。该公司的看涨评分指数从80降至60,显示出动能减弱,但仍保持在看涨区域内。

研究人员指出,链上趋势的减弱推动了这一放缓。稳定币流动性增长——新资本的关键指标——已经降温,在Cryptoquant的仪表板上变为红色。网络活动有所减少,BTC流入像Coinbase这样的顶级交易所也有所放缓,暗示投资者的短期需求减弱。

大量获利了结也在发挥作用。Cryptoquant的交易者链上利润率信号变为红色,显示许多参与者已经锁定了可观的收益,现在持有的未实现利润减少。再加上市场典型的夏季低迷,这些因素正在塑造当前的整合期。

来源:Cryptoquant的机构洞察报告

估值指标现在徘徊在一个关键的牛熊转折点附近。牛熊周期市场指标、盈亏指数和MVRV Z-score都接近于任何进一步价格下跌可能将其推入熊市区域的水平。如果发生这种情况,Cryptoquant分析师表示,牛评分指数可能会在2023年4月以来首次降至40以下。

目前,该公司将前景描述为谨慎中性。整体市场周期仍然倾向于看涨,但由于获利了结、流动性扩张放缓——特别是USDT的增长在60天内减速至96亿美元——以及动能减弱,价格可能会整合或小幅回调。

Cryptoquant的研究人员指出,这一阶段使市场暴露在外,需要新的看涨驱动因素来启动下一轮上涨。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。