Recent Economic Downturn Expectations: Bitcoin's Decline and Contract Review

I really didn't expect that this review would take so long, and I almost faced another liquidation situation. This review actually covers two weeks of data, but unfortunately, due to a habitual action, my profit turned into a loss. Fortunately, I didn't get hit this time and was able to boast successfully.

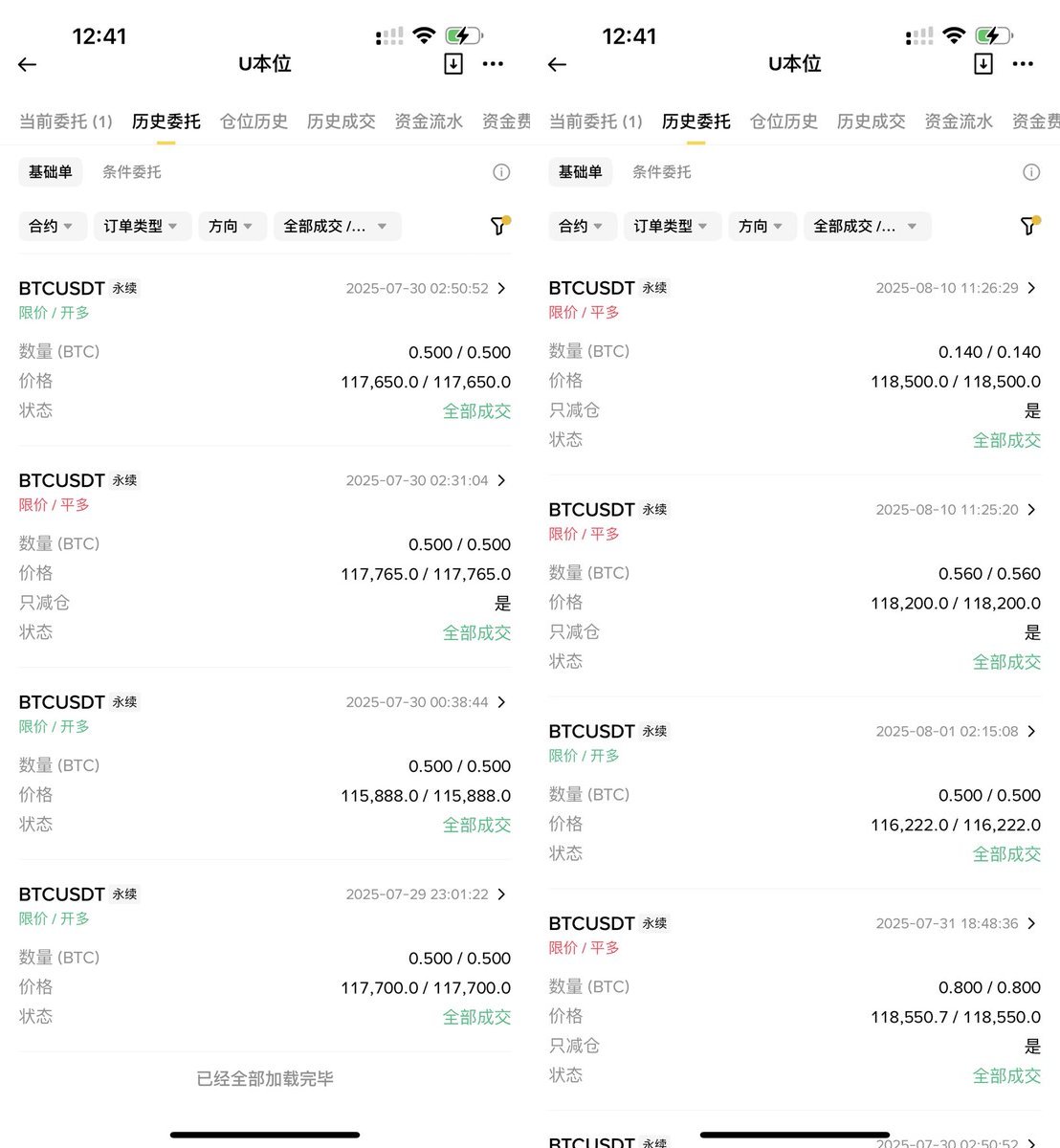

The first order was opened on July 29. This order was actually unintentional; I forgot to withdraw a previous order and ended up in a position I originally intended to trade short. Unexpectedly, on July 30, due to the non-farm payroll data and risk-averse sentiment, the price dropped. At that time, I also mentioned in the weekly report that the current game was between Trump and Powell, a direct contest between the dovish and conservative factions.

So, even though the price continued to drop, I still opened a long position at $115,888 because I believed the impact of the data would be short-lived. I thought the drop was about over, so I added to my long position, which by then was already 1 BTC.

Then, as expected, two hours later, Bitcoin's price returned to above $117,500. I closed half of my long position at $117,765, thinking it was about time. However, considering the market sentiment was still decent, I decided to chase a bit more and added another 0.5 BTC at $117,650, bringing my total position back to 1 BTC.

The subsequent trend went as expected. On July 31, BTC returned to the $118,500 level. I felt that the sentiment had fermented enough, and even if it continued to rise, the potential upside might be limited. So, I closed 80% of my position at $118,550, leaving 20% to see how high it could go. I also casually added another long position at $116,222. At that moment, I wasn't really thinking; I just acted on impulse. This action almost led to my liquidation.

On July 31, suddenly, due to import and export data, the market predicted an economic downturn, leading to risk-averse sentiment and a rapid drop in BTC. If I hadn't added to my position at $116,222, I would have probably waited to see how things developed. It was precisely because of that position that I almost faced liquidation. My liquidation price was $111,500, and at the lowest point, it was $111,910. So, I placed my third order at $111,222, thinking that if it liquidated, I could likely buy in.

Fortunately, it didn't liquidate, but the margin was close. My reasoning was that Trump wouldn't let the U.S. fall into a recession, especially with tariffs not yet implemented. I repeatedly mentioned this issue in my daily and weekly reports. Trump's game regarding the data was no longer important; what mattered was placing his people within the Federal Reserve to increase the probability of rate cuts and market expectations.

It turned out my judgment was correct, but there was also an element of luck involved. Although there was a rebound on Sunday, it was only around $114,000. Kugler's sudden resignation opened up Trump's chances, and expectations for a rate cut in September began to soar. Several Federal Reserve officials made dovish statements, and the smooth progress of Trump's tariffs, along with various positive announcements from the SEC, caused Bitcoin's price to rebound quickly.

My viewpoint is to trade Trump. My contract trading is based on this foundation.

By the weekend, BTC had stabilized around $117,000. By this time, I had held the position for 10 days, incurring funding fees daily. In yesterday's analysis, I noted that there might be some macro data challenges next week, so my plan was to close the position before Tuesday. My biggest hope was that during low liquidity on Sunday, investors would FOMO into $ETH's rise, thereby driving BTC's price up. Yesterday, while in the car with @Trader_S18, I mentioned that my expectation was to exit around $118,000.

As a result, today at noon, it suddenly surged above $118,000. Initially, I planned to exit at $118,500, but seeing that the rise wasn't very smooth, I closed 80% of my position at $118,200, achieving a 35% profit. I then placed an order to close the remaining 20% at $118,500, and I just completed that.

In total, I earned over $2,700, which is about 50% of my initial investment. My total capital has reached $15,000, up from $2,000 four months ago, a 7.5 times increase. Of course, this is still a small amount, and each order is only 0.5 BTC, mainly seeking stability. More importantly, it reflects my analytical judgment.

Analysis should serve trading. If you don't believe in your own analysis, how can you expect others to? So, although it's small, I wanted to give it a try. Each small order allows for enough margin for error and opportunities to start over. However, I must emphasize that contract trading carries significant risks; the higher the leverage, the greater the risk. My main position remains in spot trading, while contracts are more of an experiment.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。