Original | Odaily Planet Daily (@OdailyChina)

The crypto market is surging, with Ethereum leading this round of accelerated momentum.

In the past 48 hours, ETH has strongly broken through the psychological barrier of $4000, reaching a high of $4200, and is currently reported at $4194, marking a new high in 45 months (since December 2021). Since the low of $1385 on April 9, ETH has accumulated a rise of over 300%, with a monthly increase of 65% in July alone—significantly outperforming most altcoins and becoming the core target for capital absorption.

In contrast, Bitcoin's performance has been relatively weak, currently oscillating in the range of $112,000 to $119,000, with a current price of $117,200. Solana has rebounded from its low of $155.8 on August 3 to around $180, showing strong performance in the past two days as well. The altcoin sector is fully activated, with frequent positive news driving market sentiment, and the signals for an "altcoin season" are becoming stronger.

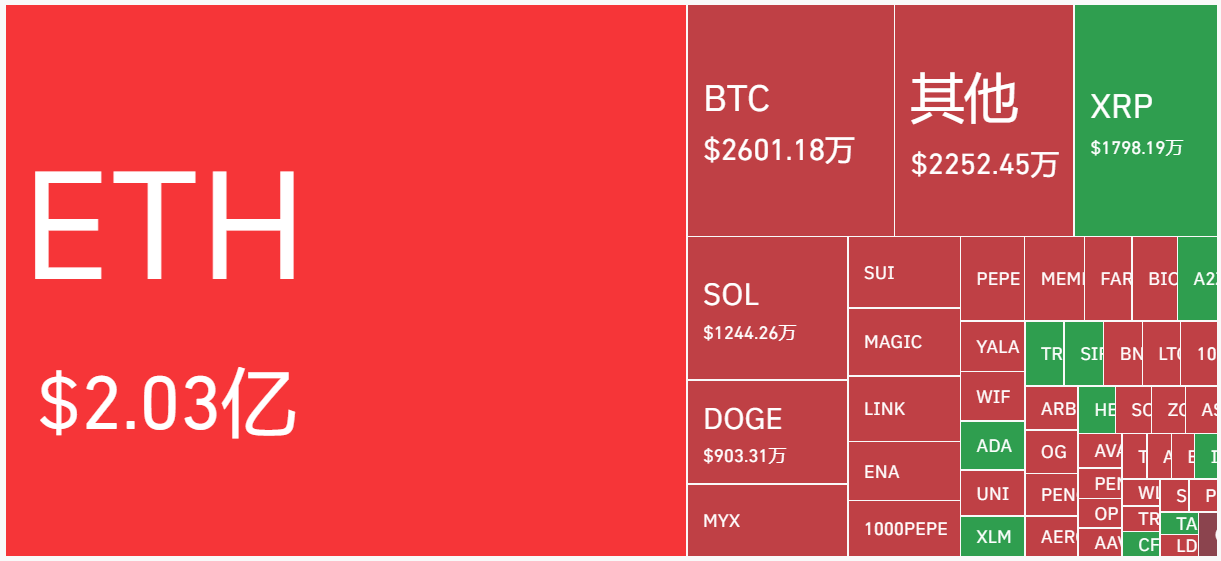

In terms of liquidation data, the total liquidation amount in the past 24 hours was $362 million; among them, long positions accounted for $78.14 million, and short positions accounted for $286 million, with ETH alone contributing $203 million to the liquidation scale; the largest single liquidation occurred in OKX ETH-USDT-SWAP, amounting to $10.6284 million.

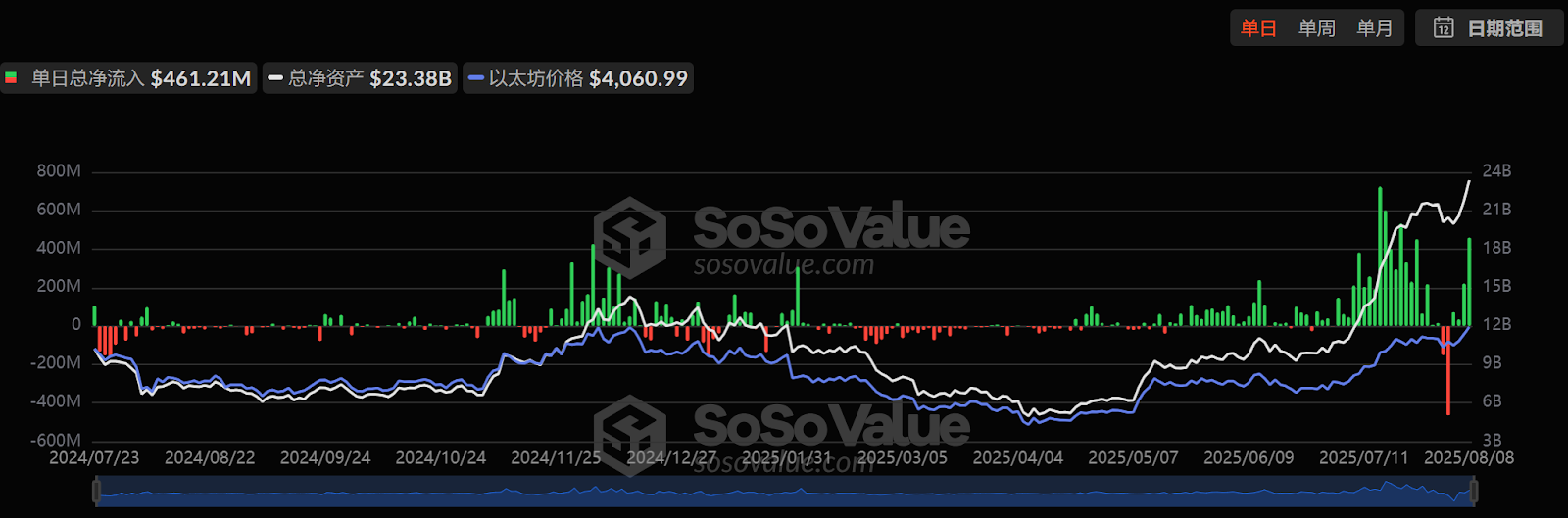

In terms of capital flow, Bitcoin spot ETFs have turned from net outflow to net inflow after four consecutive days of outflow; Ethereum spot ETFs have also ended their two-day net outflow trend, recording net inflows for four consecutive days, indicating that capital is accelerating back into the crypto market.

Macroeconomic Catalysts: Trump's Executive Order and Negative Factors Cleared

On August 7, Trump's executive order officially allowed 401(k) pension plans to embrace alternative assets such as cryptocurrencies, private equity, and real estate for the first time. With a management scale of up to $9 trillion, if even 2% is allocated to crypto assets, it could theoretically bring about $170 billion in incremental capital—enough to leverage the entire spot ETF market. Although the policy will take months or even years to fully implement, its symbolic significance is enough to ignite market imagination. (See details in "Cryptocurrency Officially Enters U.S. Pension Packages, Opening the Largest Incremental Gateway").

On the same day, the equal tariff executive order officially took effect, imposing tariffs of 15% to 41% on imported goods from 67 trading partners, with the long-awaited risk finally materializing, and negative factors gradually being digested.

Federal Reserve Policy Shift: Rate Cut Expectations Rise

San Francisco Fed President Mary Daly stated that considering the weakening job market and limited inflation pressure from tariffs, the window for rate cuts is approaching, and the Fed may cut rates by 25 basis points in September or December; if the labor market deteriorates further, there may be more rate cuts.

On Thursday, Trump nominated White House Council of Economic Advisers Chair Kevin Hassett to serve on the Federal Reserve Board. Analysts generally believe that as the designer of tariff policy, Hassett's appointment may lead to a more dovish Fed policy and exert pressure on Powell to cut rates.

Investment banks' analyses are converging: tariffs have pushed the trade-weighted average tariff rate close to 20%, and this cost shock will erode corporate profits, weaken household purchasing power, and may force the Fed to act earlier in the fall. Institutions like Fidelity International and Berenberg Bank have even warned that if the policy response is slow, the "lag effect" of 2021-2022 may repeat.

Capital Trends: Institutions Accelerate Layout

Michael Saylor, Executive Chairman of Strategy (formerly MicroStrategy), stated that Trump's gold tariffs will "catalyze a new wave of institutional adoption of Bitcoin." This is not just a confidence booster but a reaffirmation of the "digital gold" narrative.

Michael Martin, head of the Ava Labs incubator Codebase, expects that by 2025, venture capital firms will invest up to $25 billion in crypto startups, driven by a perfect storm of factors such as Circle's IPO, market recovery, Stripe's acquisition of Privy, Wall Street's increased focus on blockchain, and clearer regulatory rules.

The flow of funds this year has already hinted at the prelude to this storm. Martin pointed out that so far this year, $13.2 billion has flowed into crypto project financing, up 40% from the entire last year, and is expected to exceed PitchBook's forecast of $18 billion. However, he also cautioned that if the performance of listed companies like Circle and Coinbase falls short of expectations, or if the macro environment worsens due to tariff policies, the pace of capital deployment may slow down.

On-chain Data: Multiple Sectors Rising Together

On-chain indicators are also telling a story of recovery. According to DappRadar data, the total value locked in DeFi protocols reached a historical high of $270 billion in July, a month-on-month increase of 30%. Tokenized stocks have become a growth highlight, with the number of active wallets surging from about 1,600 to over 90,000, and market capitalization increasing by 220%.

During the same period, NFT trading volume increased by 96% month-on-month to $530 million, with about 3.85 million daily active wallets interacting with NFT DApps, slightly higher than DeFi. Although the market warmed up in July, NFT trading volume is still below the peak in 2021.

Stablecoins continue to play a foundational role in market liquidity. The total circulation reached a historical high of $265 billion, with a growth rate of 5% over the past 30 days. Although it did not experience the double-digit explosion seen at the beginning of the year, this rebound, in the context of continuous low-speed growth, indicates that funds are beginning to re-establish on-chain, waiting for the next peak.

Tracking Recent Events of Three Major Assets

According to on-chain analyst Yu Jin's disclosed data, since July 10, over 1.035 million ETH (worth approximately $4.167 billion) have been accumulated by multiple unknown whales/institutions through exchanges or institutional business platforms. Most of the ETH accumulated in these addresses likely belongs to institutions or U.S. companies holding ETH reserves (excluding SBET addresses), with an average purchase price of about $3,546.

The address of Sharplink Gaming has been tracked. It currently holds a total of 532,914 ETH, valued at $2.07 billion. On August 7, SharpLink announced that it had raised $200 million through a private placement at $19.5 per share, with new funds intended to expand its Ethereum treasury. Following its previous pace, a new round of large buy orders is on the way.

The story of Solana is somewhat different. The Solana digital asset treasury company, led by Joe McCann, originally planned to raise up to $1.5 billion through a merger with Gores Holdings X's SPAC. However, this plan was suddenly halted recently, with the reasons not disclosed. Previous reports indicated that McCann's hedge fund Asymmetric had lost nearly 80% this year, and this suspension has led the market to speculate: has the capital environment changed, or has the team's strategy shifted?

Altcoin Tracking: Four Stories Worth Watching

Ripple (XRP): Six-Year Lawsuit Concludes

The tug-of-war between XRP and the SEC has finally ended. Both parties jointly withdrew their appeal in the Second Circuit Court and will each bear their own litigation costs. This means that the ruling made by Judge Analisa Torres in 2023 officially takes effect: secondary market transactions do not constitute securities behavior, but large sales to institutions are considered illegal securities issuance, with Ripple fined $125 million and permanently banned from future violations. For further reading, see "With a July Increase of Over 70%, Surpassing Pepsi and BlackRock, How Did XRP's 'Resilience' Come About?".

Ripple CEO Brad Garlinghouse stated that the company will completely end this legal dispute and focus on more important matters—building the "value internet." Meanwhile, Ripple's USD stablecoin RLUSD saw its supply exceed $600 million in July, a month-on-month increase of 32%, with trading volume reaching $3.3 billion, setting a historical high.

Digital Wealth Partners Management, LLC (DWP Management) also announced that since April, its series of private investment funds have raised approximately $200 million. As a private fund manager accepting physical digital asset investments, all physical contributions have been completed in XRP.

Ethena (ENA): Stabilizing Confidence Through Buybacks

On July 21, Ethena Labs announced a $360 million PIPE (Private Investment in Public Equity) deal with stablecoin issuer StablecoinX, which plans to go public on Nasdaq under the ticker "USDE" (the same name as Ethena's stablecoin USDe). At the same time, the Ethena Foundation launched a $260 million ENA token buyback plan, expected to invest about $5 million daily over the next six weeks to build ENA reserves. For further reading, see "ENA's 'Confidence Game': $260 Million Buyback Stabilizes Price, $360 Million Infusion for StablecoinX's IPO".

DeFiLlama data shows that Ethena's synthetic stablecoin USDe has reached a market capitalization of $9.293 billion, with a growth of 75.13% over the past month. USDe is currently the third-largest stablecoin by market capitalization, following USDT and USDC.

Chainlink (LINK): Locking Revenue on the Chain

Chainlink has announced the launch of Chainlink Reserve, a strategic on-chain reserve for LINK tokens, which plans to convert user fees from enterprise integrations and on-chain service fees into LINK tokens to support the long-term sustainable growth of the Chainlink network. This also signifies a long-term and continuous buyback plan.

Chainlink co-founder Sergey Nazarov stated that the market demand for Chainlink has generated hundreds of millions of dollars in revenue for the project, most of which comes from large enterprises. The reserve has already accumulated LINK tokens worth over $1 million in its early stages and will continue to grow in the future.

BounceBit (BB): A New Play in CeDeFi

BounceBit has partnered with Wall Street asset management giant Franklin Templeton to launch a new product, BB Prime, and simultaneously initiate a token buyback plan. This product integrates Franklin Templeton's tokenized money market fund, creating a CeDeFi structured product that combines basis arbitrage with government bond yields. This tokenized fund belongs to the BENJI product series and will serve as collateral and a settlement tool in investment strategies. Through this approach, investors can not only gain the underlying government bond interest but also stack other sources of income. The announced BB token buyback plan is supported by over $10 million in protocol revenue, aimed at strengthening the long-term value support of the token.

Overall, this round of rebound is fueled by macro policies, supported by on-chain data, and propelled by capital sentiment. Whether it is the acceleration of ETH breaking through barriers or the collective warming of the altcoin sector, the market seems to be accelerating towards a familiar yet exciting rhythm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。