1. Introduction

This tutorial will guide you on how to manually create a full-coin DCA strategy on AICoin.

2. Steps

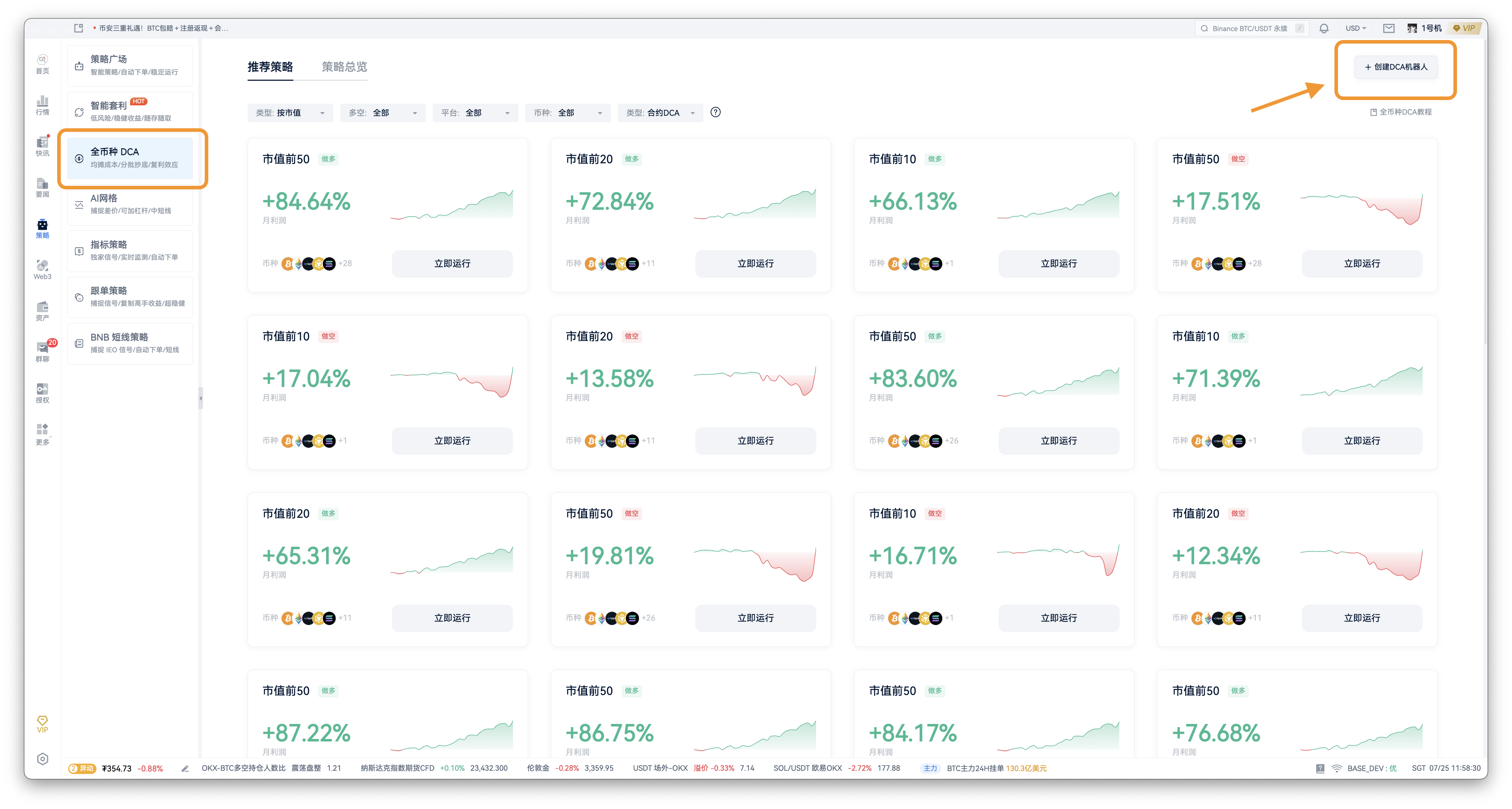

Step 1: Enter the Manual Creation Page for Full-Coin DCA Strategy

Step 2: Set Basic Information

Strategy Name: Enter the strategy name.

Type: Choose "Contract DCA" or "Spot DCA" based on trading preferences.

Order Currency: You can choose from the following four order combinations.

Combination Type

Target Audience

Market Cap Combination

Beginner Investors

Sector Combination

Investors with Research in Specific Sectors

Custom Combination

Investors with Clear Investment Goals or Preferences

Customized Combination

Professional Investors

(Contract) Direction: Choose "Long," "Short," or "Both."

(Contract) Leverage: Select the leverage multiple and account mode.

Step 3: Set Opening Parameters

Initial Margin: Set the amount for the first position.

Price Difference for Adding Positions: Set the percentage change in price that triggers adding positions.

DCA Activation Conditions: Choose one of the following four trigger conditions:

RSI Trigger, TD Trigger, TD13 Trigger, MACD Trigger

Margin for Adding Positions: Set the amount for each additional position.

Maximum Number of Additions: Set the maximum number of times to add positions.

Price Difference Multiple for Adding Positions: Set the adjustment multiple for the price of additional orders (default is 1x).

Amount Multiple for Adding Positions: Set the adjustment multiple for the amount of additional orders (default is 1x).

Step 4: Set Closing Parameters

Single Take-Profit Target: Set the profit target for each trade.

Single Currency Stop-Loss: Set the stop-loss percentage for a single currency; once the percentage is reached, that currency will be stopped out (default is not set).

Total Investment Stop-Loss: Set the stop-loss percentage for total investment; once the percentage is reached, the DCA strategy will terminate (default is not set).

Step 5: Advanced Settings (Optional)

Parameter

Description

Maximum Number of Held Currencies

Limit the number of currencies held.

Maximum Number of Open Orders

Maximum number of simultaneous open orders for a single currency.

Cooldown Time

Interval between trading rounds.

Minimum Daily Trading Volume

Set a trading volume threshold to filter low liquidity currencies.

Automatic Closing at Expiration

Set to automatically close positions at a specified time.

Profit Reinvestment Percentage

Set the percentage of DCA profits to reinvest in the next round of trading.

Sell All at Termination

Choose whether to close all positions when the strategy ends.

Step 6: Preview and Create

- Check the "Account Information" section to confirm settings and ensure sufficient account funds.

Minimum required amount for the strategy: Initial amount for a single currency + amount for additional orders.

Percentage of available balance: The minimum required amount as a percentage of the account balance.

Check the "Parameter Preview" section to confirm parameter settings.

Click "Create DCA" to create and run the strategy.

Tip: Please regularly monitor the strategy's performance, especially during periods of high market volatility, and adjust parameters or terminate the strategy as needed.

3. Advantages of Manually Creating DCA Strategies

1. Completely Personalized Investment Strategy

Flexible combination configurations support free selection of three combination modes:

● Market Cap Combination (e.g., currencies ranked in the top 10/20/50 by market cap), suitable for beginners to follow market trends;

● Sector Combination (e.g., DeFi, AI sectors), convenient for investors with research in specific fields to concentrate their investments;

● Custom Combination, allowing professional investors to add currencies entirely based on personal judgment, accurately matching investment views.

2. Refined Risk Control System

Multi-level stop-loss mechanism

● Single Currency Stop-Loss (0.1%-99.99%): Prevents losses from a single currency from expanding, timely stopping out weak assets;

● Total Investment Stop-Loss (0.1%-99.99%): Protects the overall strategy's principal safety, avoiding systemic risks;

● Time Stop-Loss (e.g., automatically exit if not taking profit within 24 hours): Avoids risks of insufficient market liquidity or stagnant market conditions.

Dynamic parameter adjustments

● Supports setting multiples for price differences for adding positions, amount multiples, maximum number of additions, etc., optimizing position management.

3. Greater Space for Strategy Optimization

Advanced parameter customization (achieved through "Advanced Settings"):

● Position and Order Limits: Control the maximum number of held currencies and open orders to prevent excessive diversification;

● Liquidity Filtering: Set a minimum daily trading volume threshold to automatically exclude low liquidity currencies;

● Automated Exit Mechanism: Supports automatic closing at expiration and selling all positions at termination;

● Compound Interest Enhancement: Through "Profit Reinvestment Percentage," roll over profits into the next round of trading to improve capital efficiency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。