U.S. President Donald Trump will sign an executive order on Thursday that paves the way for 401(k) retirement plans to hold alternative assets such as private equity, real estate, and crypto, according to multiple mainstream media outlets. Bitcoin jumped 1.15% on the news, but stock markets were mixed.

Retirement plans have traditionally avoided alternative assets, which typically have a higher risk profile than mainstream investments like stocks and bonds. But avoiding alternative assets also means missing out on their above-average returns. Between 2000 and 2020, U.S. private equity yielded a 10.48% return, almost twice that of the S&P 500 which was roughly 5.91% for the same period, according to investment firm Cambridge Associates.

(Bitcoin has been the “best-performing asset class for eight out of the past eleven years,” according to VanEck / vaneck.com)

Global investment manager Vaneck recently published data showing that bitcoin has been the best performing asset in eight of the last eleven years. “Despite its infamous volatility, bitcoin has managed to outshine other asset classes over the past decade,” Vaneck states. And now, with Trump’s executive order on the way, retirement funds may soon be able to gain exposure to those returns.

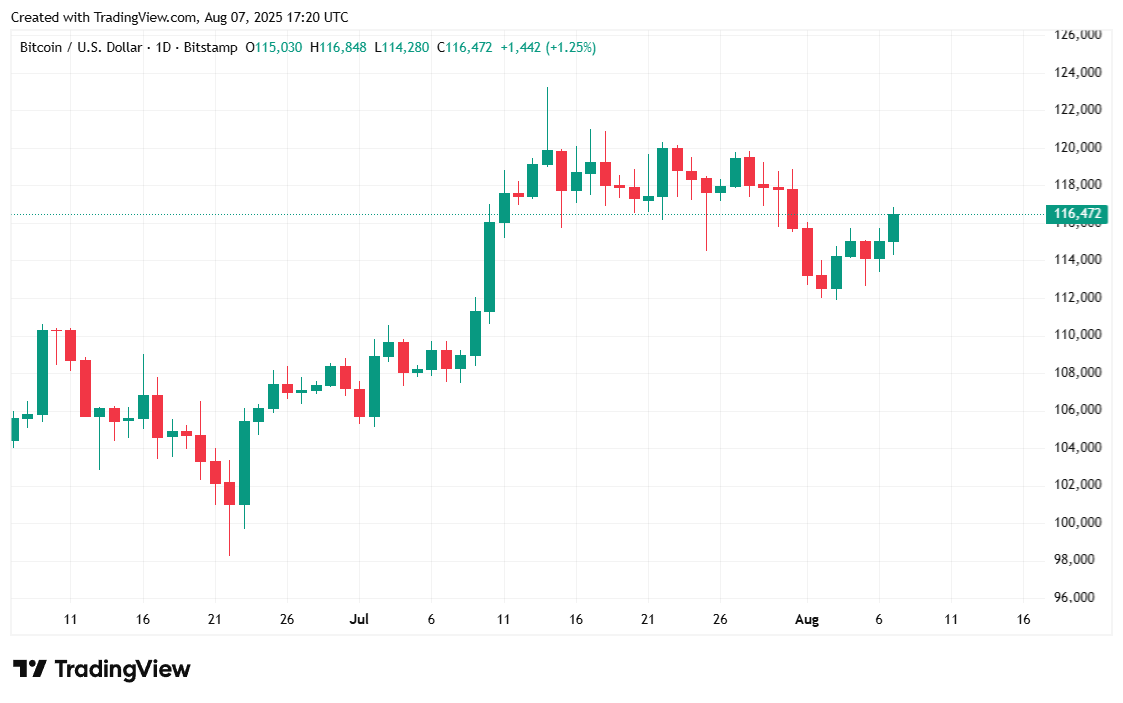

Bitcoin was priced at $116,326.23, up by roughly 1.00% over the last 24 hours, but still down by 1.73% since last week, according to Coinmarketcap at the time of writing. The digital asset has been trading between $114,279.71 and $116,844.08 since yesterday.

( BTC price / Trading View)

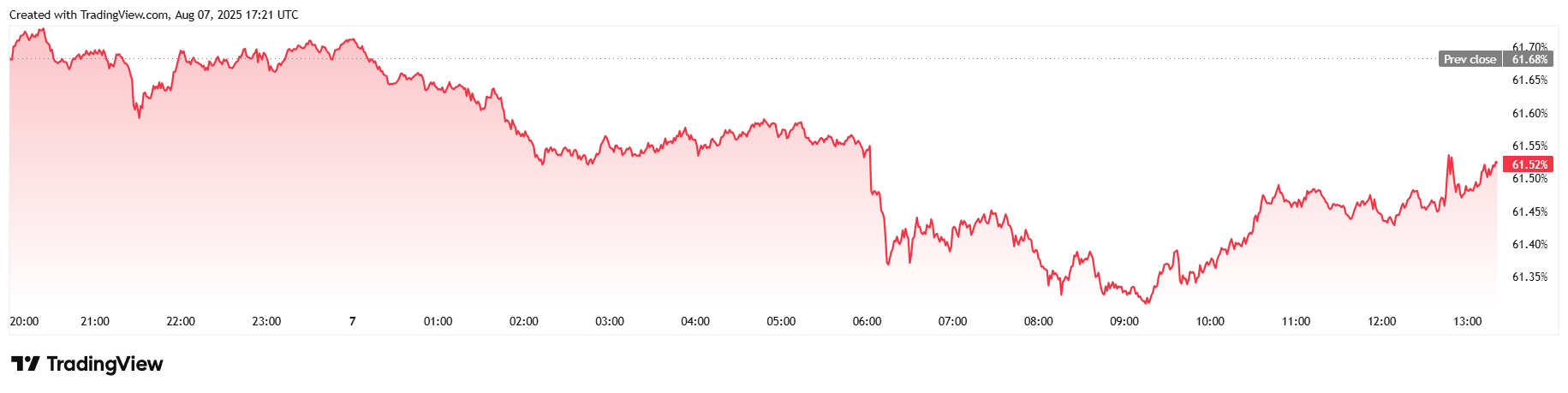

Twenty-four-hour trading volume was up 5.82% at $60.27 billion, and market capitalization also climbed 1.06% to reach $2.31 trillion. Bitcoin dominance fell to 61.52%, a decrease of 0.27% over 24 hours.

( BTC dominance / Trading View)

Total BTC futures open interest jumped to $80.44 billion, a 1.95% increase since yesterday, and bitcoin liquidations came in at $39.58 million in the last 24 hours. That liquidation total is the sum of $31.12 million in short positions that were wiped out and a smaller $8.46 million in long liquidations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。