撰文:VanEck

编译:AIMan@金色财经

数字资产财库正在快速发展,最常见的选择是 BTC 和 ETH。最初,实体选择 BTC 是因为其通过货币政策所创造的强大价值存储属性。这种政策结构的关键在于 BTC 的可预测发行量,这导致了 BTC 的总供应量有限。最近,专注于以太坊的 DAT(数字资产财库)应运而生。这些新兴的 DAT 认为 ETH 是运营数字资产财库的更佳选择,因为精明的公司可以参与一些新颖的金融活动,以比 BTC 更快的速度积累 ETH。

BTC 财库可以通过融资额外购买、实施复杂的期权策略或借出 BTC 来增持 BTC,而 ETH 财库则拥有更大的灵活性。ETH DAT 可以复制 BTC DAT 的金融策略,并质押其 ETH 以获得以太坊网络收益和通胀增发。此外,他们还可以参与 DeFi 以获得额外收入。然而,在讨论中,人们忽略了以太坊与比特币之间基本原则的差异。以太坊可能会形成一个比 BTC 更有利于其代币持有者的经济体系。

以太坊于 2025 年 7 月 30 日迎来 10 岁生日。以太坊的初始通胀率远高于比特币,分别为 14.4% 和 9.3%。然而,以太坊随后进行了两项重大的经济政策调整,使其通胀率低于比特币。

第一次调整是 EIP 1559,该调整于 2021 年 8 月实施,并引发了 ETH 基础交易费的「销毁」。这一变化的后果是,以太坊活动的增加导致 ETH 的总供应量减少。

第二项重大政策变化是以太坊从工作量证明 (PoW) 过渡到权益证明 (PoS)。此次过渡被称为「合并」,发生在 2022 年 9 月。合并使得以太坊的通胀发行量从约 13,000ETH/ 天降至约 1,700ETH/ 天,因为它不再需要补偿维护其网络的矿工。

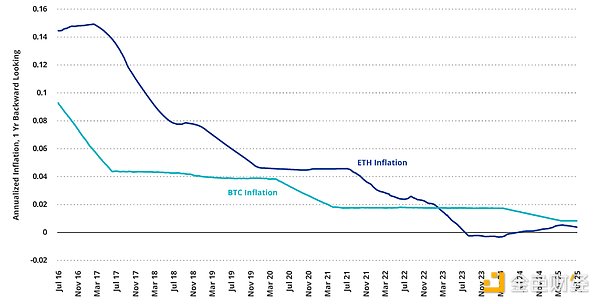

结果是,从 2023 年 3 月 8 日起,以太坊的通胀率已低于 BTC。自此之后,ETH 的供应量仅增长了 +0.2%,而 BTC 的供应量则增长了 +3%。事实上,这两次升级的结合导致以太坊的 ETH 供应量暂时减少。

2022 年 10 月 7 日至 2024 年 4 月 4 日期间,ETH 总供应量有所下降,从约 1.206 亿枚跌至约 1.201 亿枚,在此期间实现了年化通胀率 -0.25%。此后,由于以太坊交 TPS 的提升,ETH 的销毁量有所减少,以太坊网络也积累了 +0.5 % 的额外供应量。与此同时,BTC 的供应量却同期有所增加 +1.1%。

2023 年 3 月 8 日起,ETH 通胀率低于 BTC 通胀率

数据来源:Glassnode,截至 2025 年 7 月 31 日。

然而,ETH 通胀政策的优越性可能不会持续太久。比特币在 2024 年 4 月的减半不出所料地使其通胀率下降了 -50%。目前,ETH 过去一年的年通胀率为 +0.38%,而 BTC 的通胀率为 +0.84%。在接下来的几次减半中,BTC 的通胀率将接近 +0%。相反,以太坊的通胀率很难预测,可能高达 +0.5%,也可能为负。即使 ETH 目前的通胀轨迹保持不变,BTC 的通胀率也要到 2028 年才会低于 ETH。

一个被严重低估的动态是比特币安全预算问题。比特币维持通胀增发作为对矿工的激励,如果没有通胀增发,就必须依赖网络交易费。去年,矿工从交易费中获利 2.78 亿美元,并从网络通胀中获利 146.4 亿美元。显然,如果矿工不得不仅依赖交易费,他们的经济状况将不得不进行彻底调整。随着减半的发生,BTC 的价格必须上涨以弥补网络通胀降低的差额,以维持矿工的经济可行性。如果这种价格轨迹没有出现,网络安全可能不得不采用不同的经济模式。这个问题有很多潜在的解决方案,任何改变都不会对比特币产生最终的影响。但货币政策的调整必然会有赢家和输家。

例如,解决安全预算困境的一个选择是比特币通过硬分叉引入通货膨胀。无论其具体实施方式如何,它都会削弱社区对以太坊的核心批评之一,即以太坊的经济政策过于灵活。更重要的是,它会让比特币持有者承担有利于矿工的税收。这些政治经济决策并非零和博弈,而以矿工为中心的比特币系统更倾向于矿工的利益,而非代币持有者的利益。在像以太坊这样的权益证明系统中,代币所有权决定了验证者将遵循哪个分叉,因为权益将转移到选择优先分叉的验证者手中。相比之下,比特币的分叉选择规则最终由维护网络安全的矿工和节点决定。从身份上讲,存在着巨大的利益冲突,有利于那些希望出售比特币来资助其运营的人。而采用权益证明 (PoS) 机制的以太坊则缺乏这种动态机制。

虽然每个系统都存在固有的经济权衡,但 ETH 的一系列权衡利弊对 ETH 持有者有利,因为他们最终决定了网络的发展方向。虽然 BTC 持有者确实对比特币网络有影响力,但他们对网络发展的影响远不及 ETH 持有者对以太坊的影响力。因此,ETH 或许终将被证明是一种比 BTC 更好的资产。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。