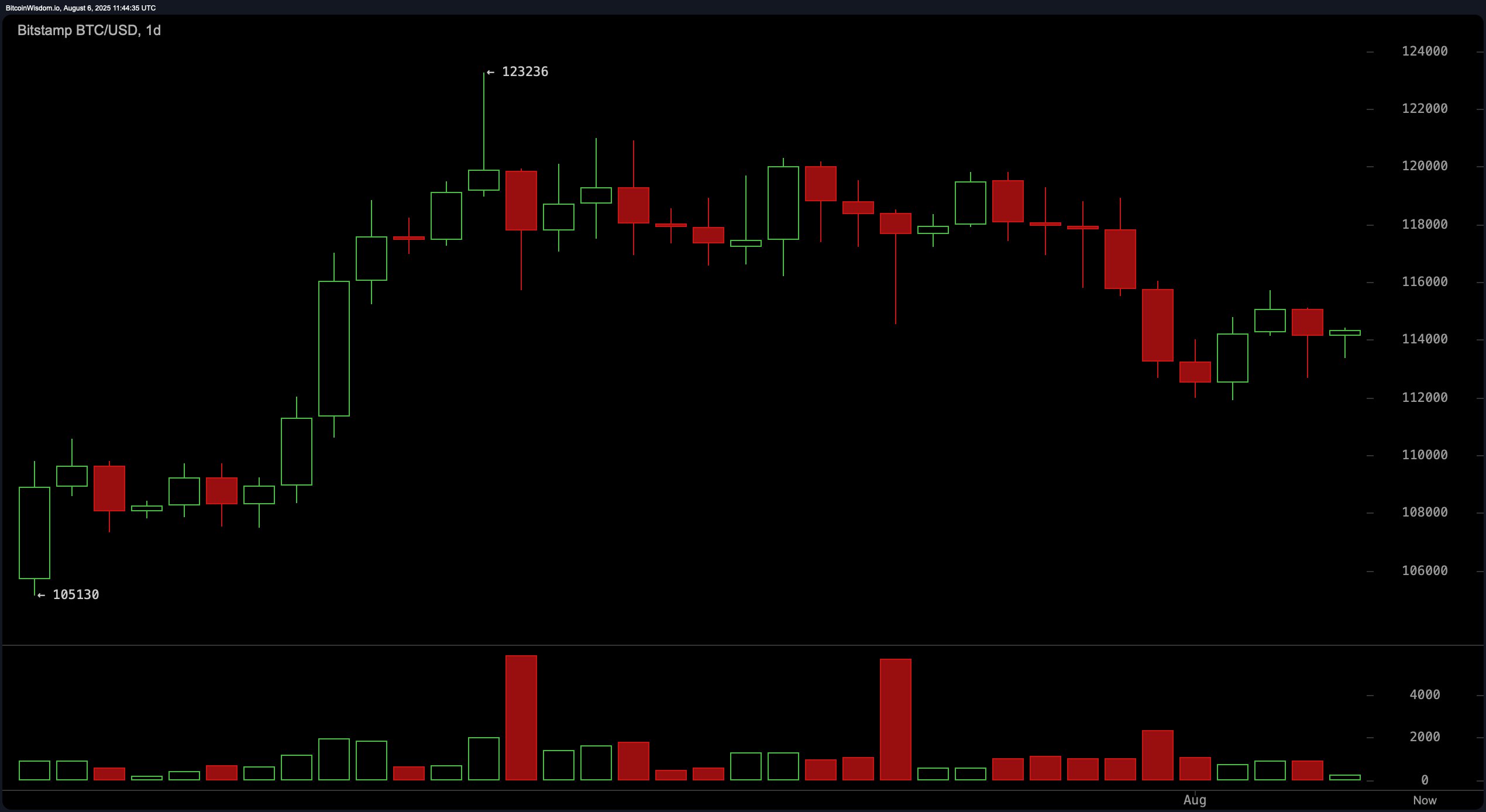

日线图显示,比特币从大约105,130美元上涨至接近123,236美元的峰值,然后回落至114,000美元区域。顶部的成交量激增,暗示着分配,而价格走势随后形成了类似潜在双顶的低高点。关键阻力位在118,000–120,000美元区间,而112,000美元区域仍然是关键支撑;如果果断跌破该支撑,可能会加速下行压力。短期偏向看跌,但除非买家重新夺回118,000美元,否则更广泛的日线趋势保持中性。

BTC/USD 1日图,来源于Bitstamp,日期为2025年8月6日。

在4小时图上,自8月1日的高点以来,比特币的动能已经恶化,滑落至111,919美元,随后小幅反弹停滞在115,000美元。下跌过程中,卖出量持续超过买入量,价格在看似熊旗的形态中盘整。交易者关注115,500美元以确认看涨突破;如果无法维持在113,000美元上方,可能会引发另一波下行,朝向日线支撑区。

BTC/USD 4小时图,来源于Bitstamp,日期为2025年8月6日。

BTC/USD的小时走势波动剧烈,形成了一个由低高点和紧密区间构成的下降通道。成交量的激增与红色蜡烛相对应,突显了卖方在短时间内的控制力,但短线交易者在113,500美元和114,500–114,800美元的阻力区间之间找到了机会。从通道支撑反弹可能会迅速上行至上边界,而突破则可能会测试在更高时间框架图表上识别出的112,000美元区域流动性口袋。

BTC/USD 1小时图,来源于Bitstamp,日期为2025年8月6日。

振荡器的信号混合。相对强弱指数(RSI)中性,值为47,随机振荡器(Stochastic)为31,同样中性。商品通道指数(CCI)为−106,发出看涨信号,而平均方向指数(ADX)为19,反映出趋势疲软。强势振荡器显示为−1,839,表明动能中性,但动能指标本身为−5,171,显示出卖压。移动平均收敛发散(MACD)水平为62,同样指向看跌偏向。

移动平均(MA)宽度突显了短期和长期参与者之间的拉锯战。10、20和30周期的指数移动平均(EMA)和简单移动平均(SMA)聚集在115,009美元和116,801美元之间,悬浮在现货价格之上,强化了短期阻力。相反,50周期的EMA在113,110美元和SMA在112,645美元已转为看涨信号,而更深的支撑则由100周期的EMA在108,278美元、SMA在108,370美元、200周期的EMA在101,017美元和SMA在99,456美元支撑。这种堆叠结构表明,尽管空头在短期内占据主动,但长期上升趋势结构仍然完好。

看涨判决:

如果比特币能够在强劲成交量下重新夺回115,500–118,000美元的阻力区间,可能会触发动能转变,重新打开通往120,000美元的路径,并可能重新测试123,236美元的高点。50周期的指数移动平均(EMA)和简单移动平均(SMA)对多头的支持进一步增强,尤其是长期趋势结构仍然偏向上行延续。

看跌判决:

如果无法维持在113,000美元支撑区域,可能会加速下滑至112,000美元日线支撑区,如果卖压加剧,进一步下滑至108,000美元水平的风险也在增加。比特币4小时图上的当前熊旗,加上多个短期移动平均线作为上方阻力,使得短期偏向倾向于卖方。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。