作者:ignas

翻译:善欧巴,金色财经

时间来到2032年:

你在四季酒店醒来,略感疲惫。昨晚的两杯 Negroni 还在头脑中作祟。手机弹出一条通知:你在 iPhone 23 XXL 上查看 Rabby 钱包。比特币隔夜下跌了3%。又是 Saylor 策略引发的恐慌情绪。

不过,即便如此,比特币价格仍高达 120 万美元。你笑了笑——那个疯子 Udi 果然说对了!你早已「退休」整个家族的经济负担——当初虽然是在 11.4 万美元时才入场,但用上了 3 倍杠杆,靠着 Hyperliquid 成功上车。尽管 Cobie 的预测稍有偏差:真正艰难的是从 8 万到 25 万的阶段,而 25 万到 100 万才是「轻松之路」。

2024 至 2029 年的牛市的确不同寻常——那一年,四年一轮的周期宣告终结,而你那笔 3 倍杠杆的交易也奇迹般没有被清算。多亏了川普的第三任期,美国成功持有了全球 5% 的比特币储备。

你心中隐约浮现一丝遗憾:如果当初没有把部分 ETH 换成 OpenAI 和 SpaceX 的私募股权,现在的资产应该更多。可惜,这两家公司最终都没有上市,而是直接在 NASDAQ 的以太坊 Layer 2 网络上实现了代币化。

尽管如此,那些代币化股权在 Aave 和 Fluid 上作为抵押资产仍发挥了巨大作用。

你的脑海里又开始描绘更大的梦想:

Monad 主网即将上线,测试网的空投也即将到来。一旦到账,你就会在安提瓜和巴布达购置第二套房产,顺便办理一本护照。等到明年欧盟开始实施 50% 的「加密团结税」,你就能自由行动了。

不过,你的朋友们就没那么幸运了。

他们听信了《金融时报》和 BBC 专家的建议,把资金投入了年化 4% 的欧盟防御债券,持有 EUR-CBDC,只是为了存首付买套一居室。而如今通胀高达 8%,就算每月领取 2500 欧元的全民基本收入,这个目标也越来越遥不可及。

你感到难过,但你问心无愧:你曾劝他们投资加密货币,他们没听。

收拾心情,你开始穿衣、刷牙。打开 X 应用——突然跳出一条提示:「请使用政府颁发的身份证验证年龄才能登录。」

糟糕,VPN 又断了。你迅速把 IP 切换到阿富汗,再次打开 X,终于成功登录。在英国访问朋友,总是让人感觉格外不同。是时候「工作」一下,然后搭机回家了。

加密货币贩卖梦想

加密世界最强有力的卖点,是它能激发人们对更好、更富足生活的梦想。

这种信息的力量,在当前地缘政治和经济环境下尤其凸显——人们为账单发愁,找不到工作,隐私也在不断被侵蚀(例如英国的《网络安全法案》)。你打开新闻、刷 TikTok、逛 Instagram,信息流充斥的都是无力感和绝望。

但 Crypto Twitter 上的氛围完全不同。加密货币和比特币被视为解决财务困境的钥匙。这也是为什么我在2032年的开头故事中,特地提到了你那些没买加密货币的朋友们的困境。

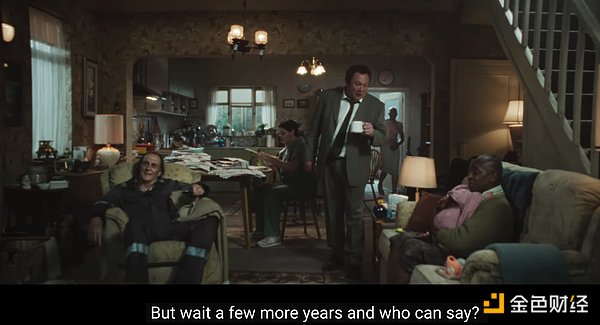

Coinbase 明白这一点,而且他们的传播方式做得非常到位。

他们那支「一切都好」的广告,讽刺英国现状让我笑出声,但他们并没有说错。

我之所以热爱加密货币,是因为它是一个能让人敢于做梦的地方。可也正因如此,加密怀疑者才不喜欢我们。

他们不相信我们的故事,觉得这些梦想不切实际,太过遥远。区块链能改变社会?他们眼里,这不过是「高级电子表格」罢了。

但正如 Nat Friedman 所说:「悲观主义听起来很聪明,乐观主义赚钱。」

加密货币之所以能激发远大梦想,是因为它不设门槛、没有许可。这同样也是为什么骗子热衷于这个行业——他们打着「更富裕生活」的旗号贩卖幻想,结果却毁掉了现实。

但我不是骗子。你也不是。

我们是真心相信,加密货币可以对人们的生活和整个社会带来积极的影响:

1)它强化了个人财产的保护,

2)它为金融和互联网中的自由与隐私提供了保障。

尽管加密行业在短短几年间取得了巨大成就,但我感觉,许多加密圈的人正在忘记如何拥有远大的梦想。

我们都忘了怎么做梦了

曾经,我们那些宏大的梦想,吸引了无数散户涌入这个行业。但现在,为什么还会有新的散户愿意买入 ETH?如果连最资深的加密用户都还在沿用上轮牛市时的目标价——$10,000?

这几年 ETH 的进展如此巨大:现货 ETF 获批、传统金融接纳、稳定币生态壮大、监管推进、现实资产代币化(RWA)、Robinhood 推出 L2 网络……

结果这一切只换来 2~3 倍的涨幅吗?

也许,我们太渴望「被主流认可」。所以当传统金融加入后,「兰博跑车」和「一飞冲天」的故事就从加密叙事中淡出了。

如今,只有那些「傻币」(XRP、ADA 等)和比特币还能激起人们的梦想。至少 BTC 还在画一个「通往百万美元」的未来蓝图。

而 ETH 和大部分山寨币,已经不再讲大梦想了。但 ETH 仍有希望重新找回梦想。

多年来,以太坊社区一直推动「超音速货币」的叙事。但随着网络扩容成功、Gas 费用降低,这个通缩叙事也随之破灭了。技术团队和营销团队,最终没能同步前进。如今,叙事又回到了基本盘:机构采用、稳定币、现实世界资产(RWA)。

虽然这些都不是新概念,但这次讲述这些故事的,是更响亮、也更有公信力的声音,比如 Thomas Lee 和 Joseph Lubin。

谁讲这个故事,和故事本身一样重要。越来越多上市公司将 ETH 纳入资产负债表,也成为一个推动因素。这给予那些还在观望的投资者更多信心。甚至连看空者都开始承认,这一策略正在奏效。

但如果一切的努力,最终只是为了让 ETH 达到 $10,000 的目标价?

那 ETH 需要一个更性感、更有想象空间的故事——一个能让人愿意长线持有 ETH 的理由。

BTC 是数字黄金。那 ETH 是什么?数字石油?我相信,那个新故事终将出现。我对 ETH,依然看涨。

再看看 Solana。

2024 年,Solana 通过 memecoin 带来「草根逆袭」的故事,一度风光无限。但随着大多数 meme 投资者亏损,Solana 与 $SOL 的吸引力也随之下降。$SOL 既不是像 ETH 那样的传统金融链,也不像 BTC 那样具备储值属性。当人们在 memecoin 上接连亏钱,这个故事也就不再让人心潮澎湃了。

如何重新点燃人们的梦想?

「当我买一个代币时,我想要拥有远大的梦想。」

然而如今,大多数项目只专注于宣传技术特性,而不是描绘他们的宏大愿景。

「代币的真正意义,是为社区带来梦想。」——DefiIgnas(发表于 X)

回头看,令人惊叹的是,一个预言机协议 ChainLink 的 $LINK,竟然也能让我们所有人都拥有远大的梦想。

我曾这样对自己说:「LINK 是我们见过最具平等精神的东西。它的野心极大,如果成功,足以重塑整个社会结构。」

或者看看 Compound 的 COMP。一个借贷协议,有什么好让人兴奋的?一个 DEX 聚合器?一个跨链基础设施?又如何?

这些代币曾经之所以激动人心,是因为它们不是孤立存在,而是属于一个更大的运动——去中心化金融(DeFi)。「做自己的银行」,如果你不喜欢团队的方向,可以用手中的治理代币在 DAO 里投票——你能影响未来!

那时,真的是一种革命感。

但现在,人们已不再相信 DAO。DeFi 代币沦为一种投资资产,只看营收和手续费回报,彻底失去了叙事的性感。

当年,LINK、COMP、UNI、YFI 等项目发布时,它们是整个市场的先锋,是 DeFi 的开拓者、第一批弄潮儿。它们代表着一种前所未有的创新。

但如今,再出现一个新的 DEX、新的借贷协议、新的预言机或基础设施项目——很难再激发人们的想象力。这难道就是加密逐渐「成熟」为资产类别所付出的代价?现在,X 平台上的大多数新项目或 TGE 公告,几乎没有令人兴奋的感觉。因为这些项目要么只是对现有巨头的边际升级,要么只是创始人和 VC 想通过发币快速变现他们的个人「大梦想」,而非服务社区。

我给项目创始人的建议是:投入时间和金钱,打造一个连贯的故事,并通过讲故事来传达远大的梦想。营销不仅仅是在 X 上发布付费技术帖子、漂亮的 UI 界面,以及通过社交媒体经理发布一些表情包。

这确实很辛苦,但它会让你脱颖而出。

投资者寻求远大梦想的支持。然而,那些兜售远大梦想的人往往缺乏技术创新的支持,或者纯粹是骗子。

话虽如此,这里有一些在推销大梦想方面做得很好的项目(但不一定是最好的项目)。

那些擅长「贩卖大梦想」的项目与代币

SPX6900

说实话,我到现在也不确定这个代币到底是干什么的。看起来只是个梗,对吧?但 Murad 是个讲故事的高手,而这个代币已经上涨了约15,000%。

他在 X 上置顶的帖子标题是:「SPX6900 市值将达 1 万亿美元的 150 个理由。」

要知道,这可是以太坊当前市值的两倍!离谱?荒谬?也许吧,但谁在乎呢?关键是他让社区的人敢做梦。

Murad 的叙事也是从那个老对比切入:不投加密,AI 会取代你的饭碗,你就注定失败。你可能觉得这听起来像传销,但他确实在死拿这些币,而不像那些发完就砸盘的项目方。很多加密创始人应该向他学习。

(免责声明:我自己并没有持有 SPX6900。)

Pudgy Penguins

胖企鹅是我最喜欢的加密品牌,没有之一。

你很难不喜欢它:可爱、价格上涨(我买 NFT 时是 $2000),而它的使命是在元宇宙传播正能量。社交媒体上总播放量已经达到数十亿次,胖企鹅是目前最有机会成为加密行业对外形象代表的项目。更重要的是,$PENGU 是唯一原生于 Web3 的顶级 memecoin,不像 DOGE、PEPE、SHIBA 那样是从 Web2 文化借来的。所以说,胖企鹅其实是我们整个行业的公关代表,帮助修复公众对加密的负面认知。

Worldcoin

你可以不喜欢他们那颗让人不适的 AI 虹膜扫描球,或是它高度集中的代币模型,但有一点你无法否认:他们的野心。

Worldcoin 的使命是构建一个全球性的身份与金融网络,将人类与 AI 区分开,并推动全球经济参与。这不正是加密最初的核心使命之一吗?

Farcaster

Farcaster 的 X 简介,可能是你能在整个加密行业里看到最「没野心」的一句话:「一个足够去中心化的社交网络。」

「足够去中心化」听起来平平无奇。但其实 Farcaster 静悄悄地在做一件大事。它正在构建一个开放社交网络——像 X 一样好用,但抗审查、用户真正拥有。它没有把一切都搬上链来牺牲用户体验,而是精准地只去中心化关键部分:用户名、消息内容、网络读写权限。

这就足以保障自由,同时避免完全上链带来的各种麻烦。任何人都能基于它开发新应用,没有人能「封杀」你。是的,某些前端 UI 可能会封你,但你可以随时换平台继续发声。Base 把它原生集成到新版 App,已经证明 Farcaster 的方法行得通。迫不及待想看到它发币。

Hyperliquid

这个就不用多说了。

但说实话,在 OKX 和 Binance 联手打压 Hyperliquid 之前,我还不算是真正的信徒。

如今,HYPE 已经不只是一个交易协议,而是一个去中心化交易运动:要把所有交易从中心化交易所(CEX)转移到链上(DEX)。

超越币安。这野心不够大吗?这不够让你做梦吗?目前 HL 在永续合约市场已经很强了,我相信它未来会在现货市场也占据主导地位。Hyperliquid,正在写一个新故事。

Polymarket

在这个时代,制造虚假信息、散播假新闻所需的成本极低——几乎不费吹灰之力。但要回答类似「疫苗会导致自闭症吗?」这样的问题,却需要数十亿美元的研究经费与漫长的时间投入。

真相的代价非常高昂。

而在这个充斥假新闻与 AI 垃圾信息的世界,真正了解「发生了什么」比以往任何时候都更有价值。Polymarket 已经证明了它的价值——在预测美国大选结果上,比传统媒体更准确。这就是为什么 Polymarket 是让我敢于做梦的协议之一。期待他们的空投能早点到来。

Liquity

自从 Terra 崩盘后,大多数人已经放弃了构建「真正去中心化稳定币」的希望。Maker 转向了传统金融和 RWA。甚至就连 Vitalik 曾力推的非法币稳定币项目 Rai,也改变了方向。

而 Liquity 可能是我们最后一个机会——去实现一个真正去中心化、最小治理的稳定币系统。尽管 Liquity V2 正在缓慢发展,目前 TVL只有约 $1.36 亿美元,LQTY 的市值也还不到 $1 亿。从用户采用来看,它还有很长的路要走。但他们的野心,令人敬佩。

加密世界终有一天会再次需要一个去中心化的稳定币。Liquity,可能就是那个答案。

Fluid

我知道我是他们的品牌大使,但这正是因为 Fluid 是唯一一个我愿意亲自参与的项目。当他们宣布目标是在交易量上超越 Uniswap——尽管自己是个借贷协议时,我震惊了。但同时也深受鼓舞。而他们真的做到了:有那么一天,Fluid 在以太坊上的交易量短暂超越了 Uniswap。

随着 Fluid DEX Lite 的上线,我对他们的交易量、借贷 TVL、以及 FLUID 代币价格的目标——就是 「起飞」。

提高你的目标

加密货币梦想的巅峰,是在 2017/18 年那一轮周期。

那时,每一个代币都怀抱宏大愿景:区块链版的 Uber、Airbnb,物联网(IOTA)、供应链管理(VeChain)、去中心化广告市场(Brave)、去中心化银行(Bankera)等等。但那时候,这一切仅仅停留在白皮书阶段——没有真正的技术支撑。

2020/21 年则不同:DeFi 与自我治理的理想,背后有智能合约与真实可用的 dApp 支撑。然而,DAO 治理和真正链上的去中心化至今仍未落地:DeFi 最终只是变成了链上的金融系统。

到了这轮周期,市场的焦点变成了外部推动力:ETF、现实资产代币化(RWA)、合规监管。于是,我们行业内部的梦想越来越小,价格目标也越来越保守——尽管这几年一直有利好不断。

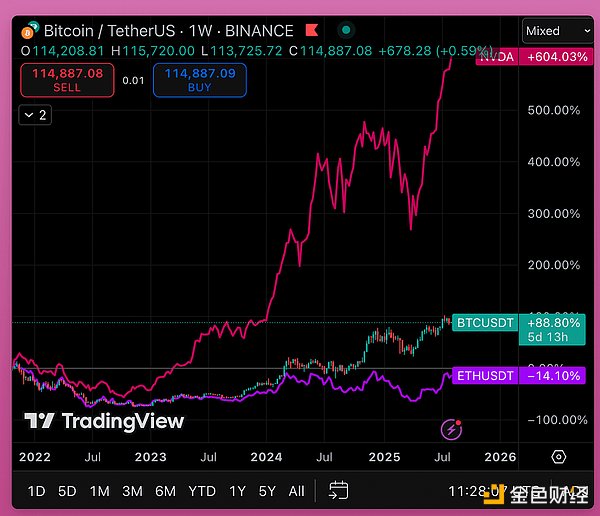

我们正处在加密大规模普及的十字路口,但许多人却不愿抱有更大的梦想。你们所有的目标价,都定得太低了。光是一家 NVDIA,其市值就超过了整个加密货币市场总市值。而且过去几年里,NVDIA 的股价还上涨了604%。

如今,加密正在越过「卢比孔河」:亲加密监管政策落地,传统金融加入赛道。该做更大的梦了,把你的目标价提高——提高好几倍!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。