1. Market Observation

On Tuesday, Trump hinted that he is "very likely not" seeking a third term, with current Vice President Vance being the "most likely" Republican presidential candidate for 2028, although he emphasized that it is "too early" to make a final decision. In this context, Trump stated that he will decide on a new Federal Reserve Board member this week, narrowing the candidates for the next chair to four, including former Fed governor Kevin Warsh and National Economic Council Director Kevin Hassett, while planning to announce new tariffs on drugs and chips within the next week.

At the macroeconomic level, former Treasury Secretaries Paulson and Geithner jointly warned that the U.S. Treasury market, with a scale of up to $29 trillion, is facing multiple threats from an unsustainable fiscal path and political system issues. Geithner pointed out that although the current 10-year Treasury yield is at a relatively moderate level, supporting factors such as the rule of law and Fed independence are facing unprecedented gloom. This concern further fermented after President Trump fired the head of the Bureau of Labor Statistics (BLS), raising market doubts about the credibility of official data, particularly posing potential risks to the $2.1 trillion inflation-protected securities (TIPS) market linked to the CPI. However, weak employment data has led Wall Street to generally expect a turning point in Fed policy. Institutions like Goldman Sachs and Citigroup predict that the Fed may start cutting interest rates as early as September, with a potential reduction of 25 or even 50 basis points, ultimately bringing the policy rate below 3%.

In the digital asset space, the Web3.0 layout in the Hong Kong market is showing positive effects. HashKey Chief Analyst Jeffrey Ding noted that Hong Kong-listed companies are entering Web3.0 through financing, not only promoting financial innovation through applications like RWA and DeFi, broadening financing channels and enhancing market liquidity, but also optimizing their own supply chain management and operational efficiency through the integration of blockchain technology, thereby enhancing their global competitiveness. This trend is attracting global capital and talent, laying a solid foundation for Hong Kong to build a mature and regulated digital asset ecosystem and become a Web3.0 hub.

Bitcoin has seen over $1 billion in leveraged long positions liquidated after falling below the short-term support range of $115,000 to $118,000 in the past two weeks. Analyst Material Indicators warned that due to weak buying support above $110,000, prices may further dip to the $109,000 area. Analysts AlphaBTC and KillaXBT also believe the market may test the support level of $112,000, and if it breaks, it could trigger a deeper correction. KillaXBT plans to establish long positions in the range of $111,953 to $110,649, setting a stop loss above the monthly opening price of $115,600. Analyst Murphy emphasized that $112,000 is a key lower support for the MVRV pricing channel, and if it holds, the rebound peak could reach the upper price of $124,000. Currently, the $117,000 to $118,000 range is the most critical resistance level, with the ideal scenario being price consolidation in the $112,000 to $117,000 range to build momentum for a subsequent breakout. QCP Capital also believes that the recent pullback is more like a correction, with options markets showing bets on a price rebound to $124,000. From a longer-term perspective, analyst Arndxt predicts that Bitcoin's price peak could reach $135,000 to $150,000 around September 2025 based on liquidity models and historical halving cycles.

Ethereum's price has risen to around $3,650, driven by sustained institutional interest. Despite its ETF experiencing a record net outflow of $465 million on August 4, on-chain data shows that institutions and whale addresses are still actively buying through over-the-counter transactions. Notably, an entity-controlled multi-signature wallet received over $363 million worth of ETH in the past two days.

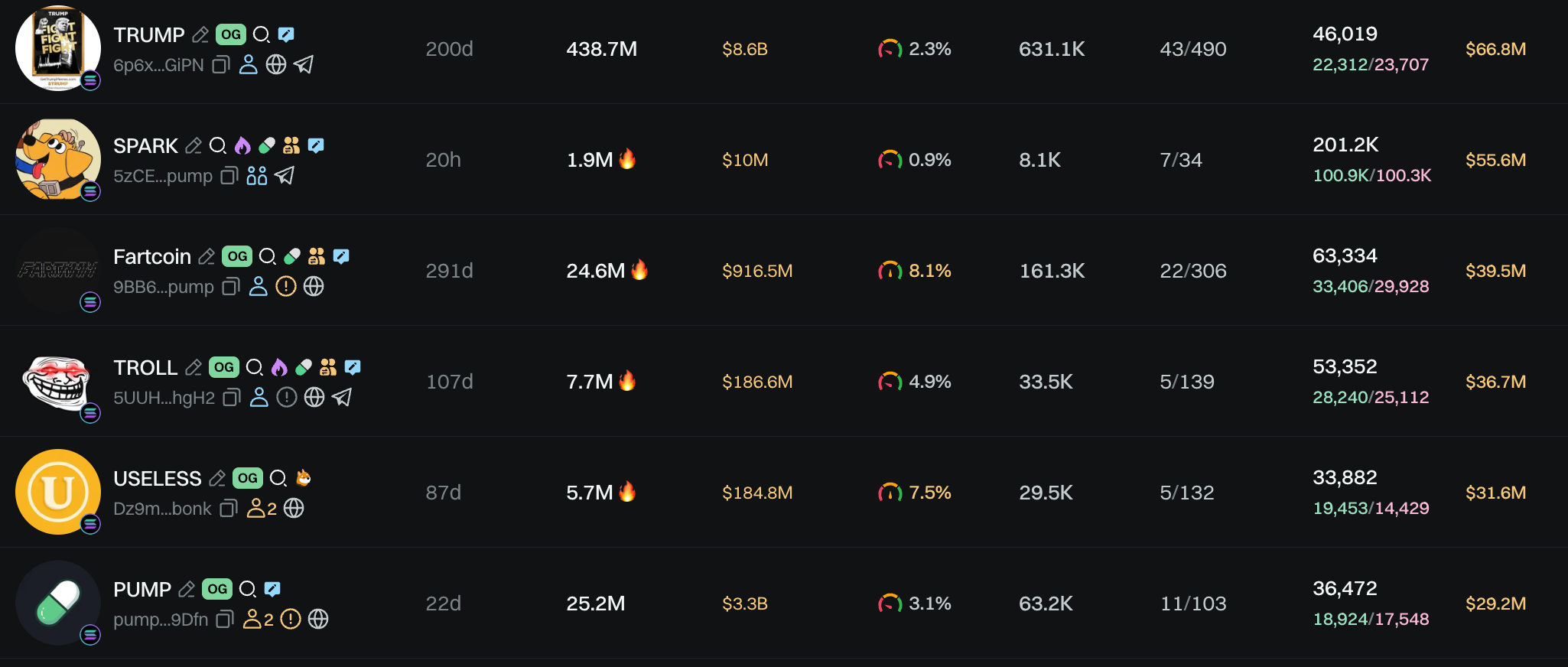

Pump.fun's trading volume and token minting in the past 24 hours have unexpectedly surpassed Bonk.fun, with data showing that the platform purchased approximately 8,740 SOL worth of $PUMP over the past six days, accounting for 102% of total revenue. Pump.fun co-founder Alon stated that meme coins like Fartcoin have succeeded purely based on community consensus, and other projects within the Pump.fun ecosystem, such as $TROLL, $USDUC, and $TOKABU, are performing strongly. Influenced by this, tokens like Fartcoin, TROLL, and PUMP have ranked high in trading volume over the past 24 hours, with TROLL token seeing a nearly 100% increase. The market cap of the fast-paced token SPARK on Pump reached a peak of $18.8 million last night but has since fallen back to around $10 million. Meanwhile, the decentralized derivatives protocol MYX has surged 16 times in the past week and hit a historical high of over $2.12 this morning, with a 24-hour increase of 72%. On-chain data suggests that the price surge may be linked to manipulative activities involving spot and contract interactions. Notably, the Chinese Ministry of State Security issued a warning about the risks of biometric data collection, which, while not naming names, closely aligns with the Worldcoin project.

2. Key Data (as of August 6, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $113,525 (YTD +21.98%), daily spot trading volume $36.389 billion

Ethereum: $3,582.39 (YTD +8.91%), daily spot trading volume $27.522 billion

Fear and Greed Index: 54 (Neutral)

Average GAS: BTC: 0.23 sat/vB, ETH: 0.40 Gwei

Market share: BTC 61.1%, ETH 11.8%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, GAS, SOL

24-hour BTC long-short ratio: 48.13%/51.87%

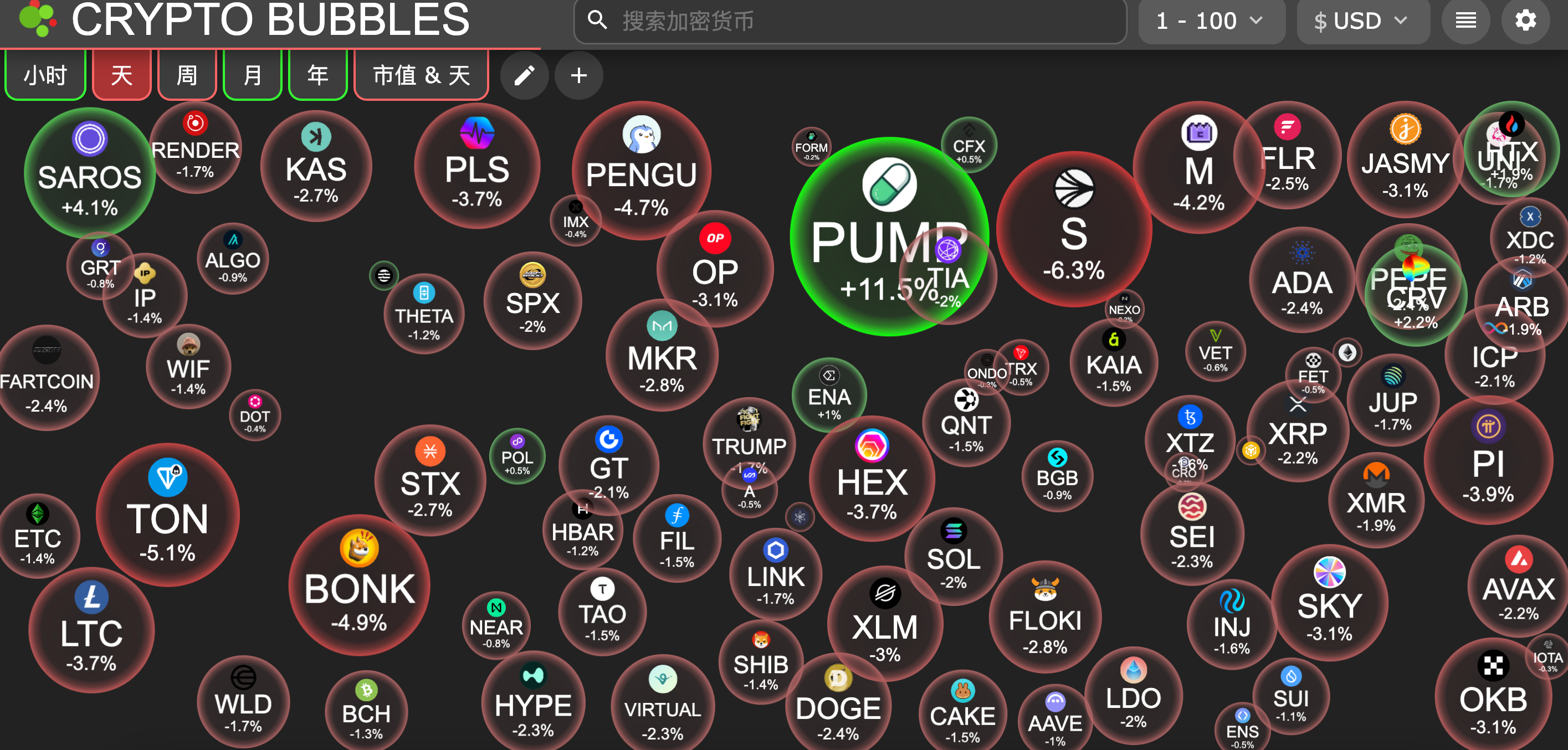

Sector performance: NFT sector down 5.56%; SocialFi sector down 4.89%

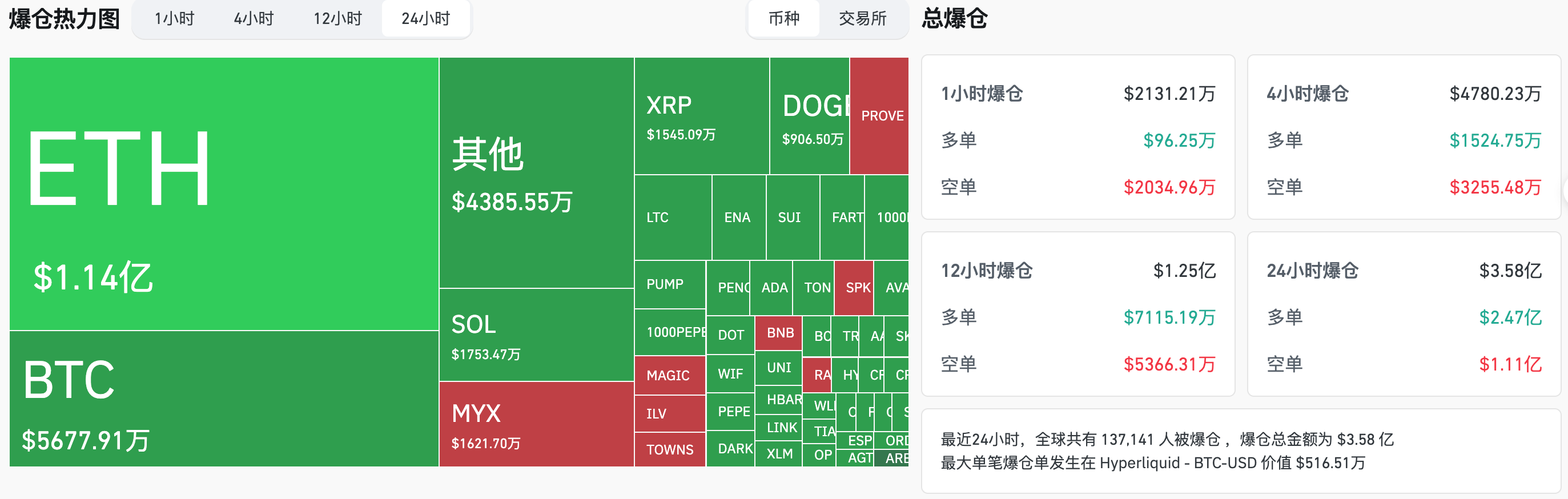

24-hour liquidation data: A total of 137,141 people were liquidated globally, with a total liquidation amount of $358 million, including $56.779 million in BTC liquidations, $114 million in ETH liquidations, and $17.53 million in SOL liquidations.

BTC medium to long-term trend channel: upper line ($116,574.45), lower line ($114,266.04)

ETH medium to long-term trend channel: upper line ($3,637.20), lower line ($3,565.17)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 5)

Bitcoin ETF: -$196 million, continuing 4 days of net outflow

Ethereum ETF: +$73.222 million

4. Today's Outlook

Trump's equivalent tariff effective date delayed by a week to August 7

Binance Alpha and contract platform will launch INFINIT (IN) on August 7

Heroes of Mavia (MAVIA) will unlock approximately 11.89 million tokens at 8 AM on August 6, accounting for 23.03% of the current circulation, valued at approximately $1.9 million.

EigenCloud (formerly EigenLayer) will unlock approximately 1.29 million tokens at 3 AM on August 6, accounting for 0.40% of the current circulation, valued at approximately $1.4 million.

Jito (JTO) will unlock approximately 11 million tokens on August 7, valued at approximately $21 million.

Top 100 largest gains by market cap today: Pump.fun up 11.5%, Saros up 4.1%, Curve DAO up 2.2%, HTX DAO up 1.9%, Ethena up 1%.

5. Hot News

Hack VC has transferred out $2.157 million worth of MYX received from the airdrop claiming contract

Jito proposes to allocate 100% of block engine fees to the DAO treasury

Suspected entity received over $360 million worth of ETH through four wallets in the past two days

Zhao Changpeng applies to dismiss the $1.76 billion claim filed against him by the FTX trust

Over 955,000 Bitcoins held by a hundred global listed companies

Ethereum's on-chain recovery trend is evident in July, with trading volume approaching $240 billion

Pexi company's SOL holdings exceed 2 million, with a market value of over $300 million

This article is supported by HashKey, HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and the most trusted fiat gateway for crypto assets in Asia. It aims to set a new benchmark for virtual asset exchanges in terms of compliance, fund security, and platform protection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。