在周五令人震惊的就业增长下调后——这导致加密货币价格暴跌——ISM服务业PMI突然开始持续显示出经济活动低于预期的迹象。

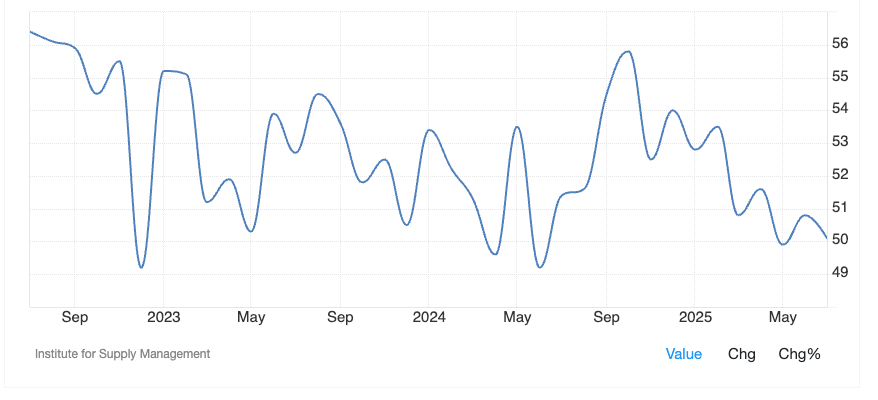

7月份的ISM服务业指数为50.1,远低于预期的51.5。高于50的数字表示经济扩张,而低于该水平则表示收缩。

这一疲软的数据值得注意,因为这已经是连续三个月的疲软模式,5月份的数字为49.9,6月份为50.8——与前几个月相比大幅放缓。

报告中嵌入的滞涨信号进一步加重了经济疲软的迹象,支付价格子指数飙升至周期高点69.9。

“关税导致额外成本,因为我们继续购买设备和供应品……成本显著到我们不得不推迟其他项目以适应这些成本变化,”报告中的一条评论写道。

无论是加密货币市场还是传统市场都对周二的数据反应冷淡,比特币(BTC)从114,000美元以上回落至112,800美元,在过去24小时内下跌近2%。纳斯达克指数从早前的涨幅转为下跌0.5%。

美联储现在会降息吗?

“当经济处于拐点时,比如衰退,数据总是会经历大幅修正,”经济学家马克·赞迪在周五的大幅就业下调后写道。

“经济正处于衰退的边缘,”他继续说道。“消费者支出已经停滞,建筑和制造业正在收缩,就业也将下降。随着通货膨胀上升,美联储很难出手相救。”

霍辛顿投资管理公司的长期经理拉西·亨特和范·霍辛顿对此并不确定,认为美联储无法再等待。亨特和霍辛顿称关税带来的通货膨胀增幅是暂时的和第一轮效应,他们表示第二轮、第三轮及后续的收缩效应更为重要。

“美联储需要迅速转向宽松政策,”他们总结道。“美联储等待将是错误的……更为关键的考虑是全球经济活动即将收缩。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。