产品创新:每日双币机制提升灵活性

Matrixport日前推出了全市场首创的“每日双币”结构化理财产品。这款创新产品在传统双币理财产品(DCP,即 Dual Currency Product)的基础上,引入了“每日敲入/敲出观察”机制。简单来说,以往双币理财仅在到期日根据价格决定是否敲入或敲出,而每日双币则是每日监测标的资产价格,当价格触及预设的目标价(敲入价或敲出价)时,可于次日提前结束产品周期并结算收益。不论哪种情形,投资者都可获得既定票息收益。这一机制大幅提升了产品的灵活性,实现更快速的止盈与动态收益锁定,改善了用户体验。

值得一提的是,Matrixport的每日双币产品细分为看涨和看跌两种类型,以满足不同投资策略需求:

在每日观察机制下,无论市场向上或向下触碰目标价位,“每日双币”都能灵活捕捉机会,及时锁定收益,让投资者进可攻、退可守。

市场背景:低波动行情下的创新需求

当前,比特币(BTC)、以太坊(ETH)等主流加密资产的波动率持续走低,价格长时间在相对窄幅的区间内震荡。对于投资者而言,这种低波动、盘整行情降低了通过趋势获利的机会,也使传统双币理财产品较难在短期内触发敲入或敲出条件。举例来说,在传统DCP中,投资者往往需要等到到期日才能确定是否按挂钩价兑换资产;如果整个周期内价格始终未达到行权价,即使中途曾接近目标,最终也无法实现转换或提前止盈。这不仅令投资者错失短暂出现的价差机会,也影响了收益体验。在这种市场环境下,投资者亟需更加灵活的工具来管理收益预期、提高资金使用效率。

Matrixport的每日双币产品正是为了解决这一痛点而推出。通过每日观察价格并允许随时触发产品结算,它帮助投资者在震荡市中也能及时捕捉价格波动带来的收益。当市场行情一有风吹草动触及预设价位,产品机制便会自动执行相应策略,不再错过稍纵即逝的市场窗口期。这种创新设计使投资者在低波动行情中依然可以主动出击,高效实现既定的收益目标。

产品机制解析与实例

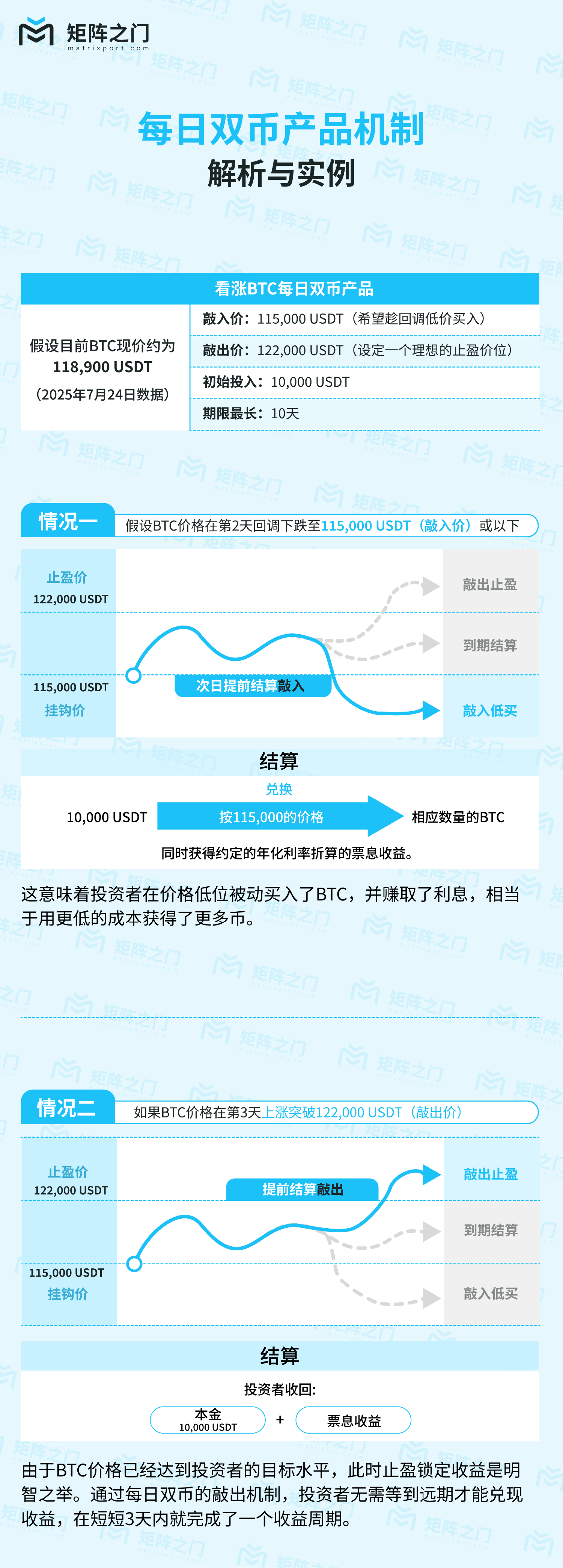

为了更直观地理解每日双币的运作方式,我们以BTC为例。假设目前BTC现价约为118,900 USDT(2025年7月24日数据)。

一位看涨后市的投资者购买了一款看涨每日双币产品,并设定敲入价为115,000 USDT(希望趁回调低价买入),敲出价为122,000 USDT(设定一个理想的止盈价位)。初始投入为10,000 USDT,期限最长设定为10天。

通过上述实例可以看到,每日双币产品借助每日观察和双重目标价,大大加快了收益实现的进程。在区区几日内,投资者就可能完成一次投资循环,然后将本金和收益用于下一次交易机会。这种短周期、快结算的特点,使其在当前市场环境下魅力凸显。同时值得注意的是,Matrixport的每日双币目前不仅支持BTC,也支持ETH等主要加密资产,投资者可以根据自己对不同币种的行情判断来选择相应产品。

对比分析:每日双币 vs. 传统双币理财

两种产品机制的差异,直接体现在波动行情中的表现:

简而言之,传统DCP像一趟固定行程的班车,只能在终点站决定去向;而每日双币更像是随叫随停的专车,沿途一旦到站(达到目标价),立刻下车锁定成果。这种区别使得每日双币在震荡或趋势行情中都能帮助投资者从容应对、及时收获。

Matrixport的创新优势

作为行业领先的加密金融服务平台,Matrixport在结构化理财领域的创新能力有目共睹。“每日双币”产品的推出,再次印证了Matrixport敏锐把握市场需求、快速迭代产品的实力。相比其他平台,Matrixport在以下方面具有显著优势:

市场环境与投研视角

近期的市场动态也印证了推出此类灵活收益产品的价值所在。一方面,美国国会正加速推进关键的加密合规立法:例如7月中旬众议院高票通过了稳定币监管法案以及数字资产市场结构法案等,为加密行业建立更清晰的合规框架。这提振了机构入场的信心,越来越多传统机构开始认真考虑配置数字资产及相关理财产品。另一方面,香港特区也率先落地了专门针对稳定币的监管条例(将于2025年8月正式生效),监管环境的明朗化为亚洲加密市场注入了强劲信心。在全球主要经济体竞相制定加密监管规则的背景下,市场参与者对于合规、稳健的加密投资渠道需求愈发迫切。

与此同时,加密市场本身正处于波动率低位期。随着前期大涨后进入盘整阶段,比特币等资产的价格起伏趋缓,不少投资者感到短线交易盈利变难。但正因如此,大家对收益类理财产品的兴趣显著回升,希望通过结构化产品获取稳健回报。在这种环境下,Matrixport每日双币的出现恰逢其时:它既迎合了投资者在低波动行情中获取额外收益的愿望,也契合了市场对产品合规性和创新性的双重期待。从投研视角看,每日双币为看好后市的投资者提供了高效利用震荡的工具,也为倾向避险的投资者提供了灵活管理仓位的新思路。

结语:灵活收益新工具,助力稳健增值

在当前的市场背景下,“每日双币”无疑是兼顾收益与灵活性的优秀工具。它通过机制创新,将数字资产投资中的低买高卖策略融入结构化产品,实现了收益和风险的动态平衡。对于看好加密市场长期价值、希望高效捕捉币价波动的投资者而言,每日双币提供了一条省心而专业的途径:既能获取可观的票息收益,又不失时机地把握行情变化带来的额外回报。

未来,随着市场的进一步成熟和监管环境的完善,像每日双币这样的创新产品有望得到更广泛的应用和认可。Matrixport也将持续发挥自身在产品设计和风控方面的优势,为全球用户带来更多兼具创新性与实用性的数字金融产品,助力投资者在瞬息万变的加密市场中稳健前行,实现资产的长期增值。

作者:Daniel YU, Head of Asset Management(本文仅代表作者个人观点)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。