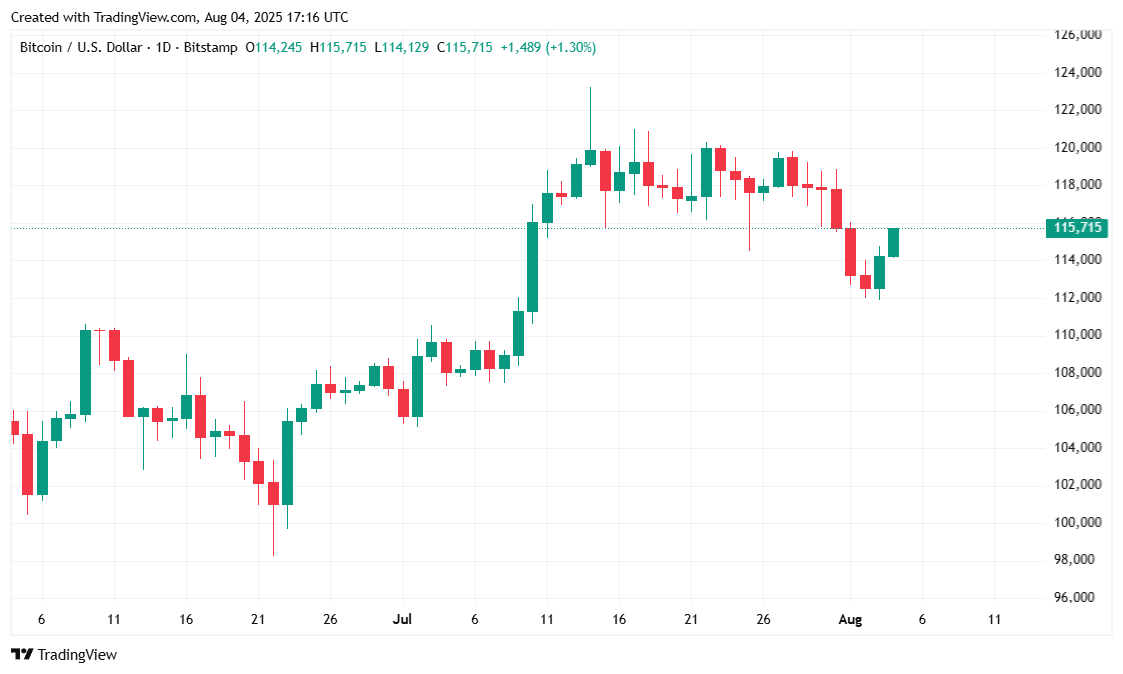

在经历了上周的过山车行情后,比特币的价格暴跌至$112K,周六触底,随后在周一的盘前交易时段回升至$115K。上周的宏观环境好坏参半,强劲的GDP数据被低于预期的就业报告所抵消。美联储将联邦基金利率维持在4.25-4.50%的区间,这在预期之中,但或许由于中央银行与特朗普政府之间日益紧张的关系,比特币在美联储主席杰罗姆·鲍威尔周三的公告后迅速下跌。

美国经济前景不仅影响了加密市场;股市也经历了类似的血腥洗礼,但它们也已恢复。报告时,标准普尔500指数、纳斯达克和道琼斯指数分别上涨了1.30%、1.75%和1.12%。Coinmarketcap的数据也显示,加密市场上涨了1.88%。

一些专家,如彭博社分析师埃里克·巴尔丘纳斯,认为机构资本降低了比特币的波动性。2024年1月首个现货比特币交易所交易基金(ETF)的批准和推出为加密货币生态系统注入了数十亿资金。随后,比特币国库公司应运而生;这些公司在其资产负债表上持有大量比特币。如果巴尔丘纳斯的说法正确,这可能意味着比特币价格剧烈波动的日子已经一去不复返。

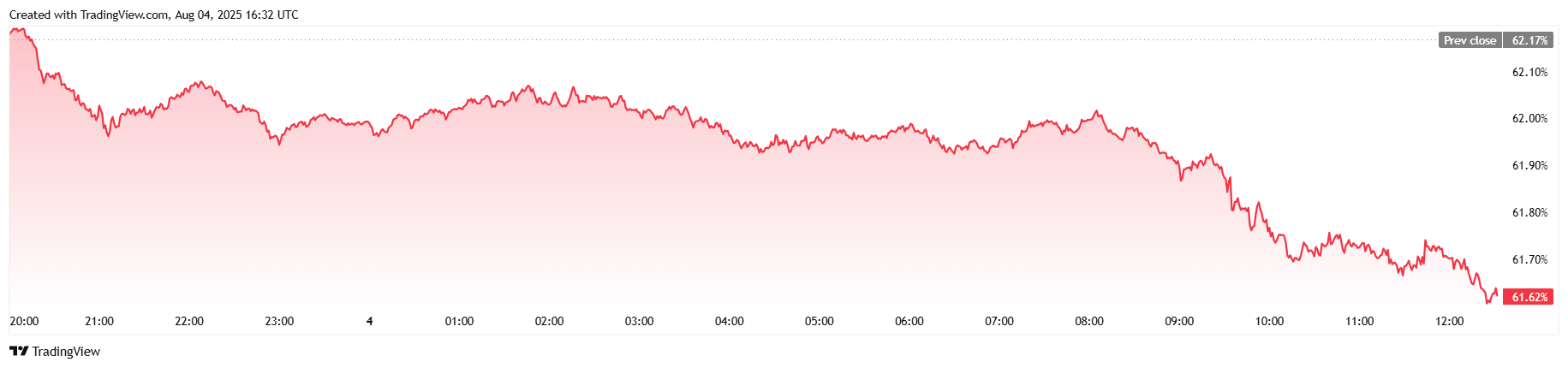

“自ETF推出以来,比特币的波动性大幅下降,”巴尔丘纳斯在X上的一篇帖子中写道。“90天滚动波动率首次降至40以下,而在ETF推出时超过60。”

根据Coinmarketcap的数据,截至撰写时,比特币的交易价格为$115,491.54,自周日以来上涨了1.24%。然而,这种数字资产本周下跌了2.05%,在过去24小时内徘徊在$113,966.97和$115,561.82之间。

(比特币价格 / Trading View)

当天的交易量意外平稳,达到了$53.43亿,较昨日下降了2.21%。市场总市值略微上升0.89%,在报告时为$2.28万亿。比特币的市场主导地位在24小时内下降了0.91%,降至61.56%。

(比特币主导地位 / Trading View)

当天比特币期货的未平仓合约总数为$79.89百万,下降了0.47%。自周日以来,比特币的清算总额为$39.25百万,其中$34.40百万来自空头头寸,而多头清算占总额的$4.85百万。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。