作者:Grayscale 研究团队

翻译:金色财经 xiaozou

本文要点:

•2025年7月,以太坊网络ETH代币价格涨幅近50%。投资者将目光聚焦于稳定币、资产代币化及机构采用率——这些领域正是这个元老级智能合约平台区别于同行的关键优势。

•《GENIUS法案》的通过成为稳定币及加密资产类别的分水岭。市场结构立法仍需较长时间才能在美国国会通过,但监管机构可通过其他政策调整继续支持数字资产行业——例如批准加密投资产品中的质押功能。

•加密资产估值短期内可能出现盘整,但我们认为该资产类别在未来数月仍前景光明。加密资产不仅能提供区块链创新敞口,还可能规避传统资产的特定风险(包括美元持续走弱的风险)。基于这些原因,比特币、ETH及其他众多数字资产预计将持续获得投资者青睐。

2025 年 7 月 18 日,特朗普总统签署生效《GENIUS 法案》,这项新立法为美国稳定币提供了全面的监管框架。某种程度上,该法案的颁布可视为加密资产类别「初始阶段的终结」:公链技术正从实验阶段转向受监管金融体系的核心。关于区块链能否为主流用户带来益处的争论已告终结,监管机构已将重心转向确保行业发展的同时,建立适当的消费者保护与金融稳定保障机制。

加密市场对《GENIUS法案》的通过表示欢迎,7月利好的宏观市场环境也提供了支撑。全球多数地区股票指数上涨,固定收益市场回报率以高风险板块领先,如美国高收益公司债券和新兴市场债券。受益于波动率下降的策略同样表现优异。富时/灰度加密行业市值加权指数——一个可投资数字资产的市值加权指数——上涨15%,比特币价格上涨8%。表现最亮眼的是以太坊网络的ETH,7月涨幅达49%,自4月初低点以来累计上涨逾150%。

图表1:加密资产7月份整体表现稳健,ETH大放异彩

1、请别称之为「反弹」

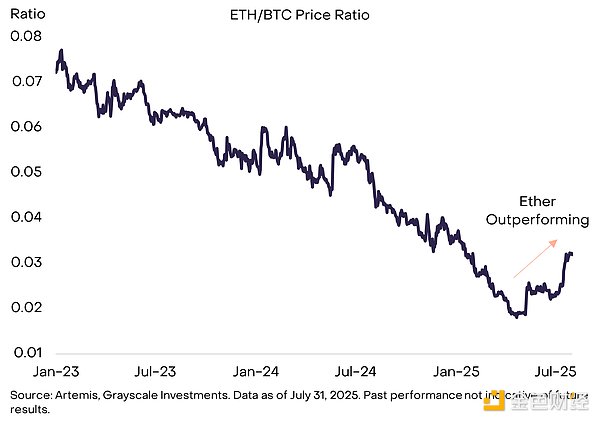

以太坊作为市值最大的智能合约平台,是基于区块链的金融体系关键基础设施。然而直到最近,ETH价格表现都显著落后于比特币——以及Solana等其他智能合约平台——这引发市场对其发展战略及行业竞争地位的质疑(图表2)。

图表2:五月份以来ETH表现超越比特币

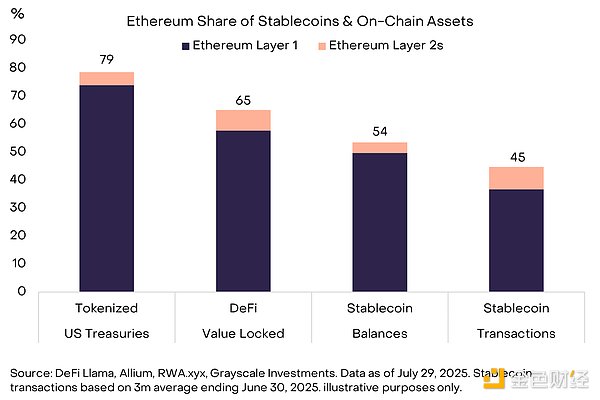

市场对以太坊及ETH重燃的热情,很可能反映了当前焦点正集中在稳定币、资产代币化及机构区块链应用这些领域——而这正是以太坊区别于其他竞争平台的核心优势(图表3)。例如,若计入其二层网络,以太坊生态承载着超50%的稳定币余额,并处理约45%以美元计价的稳定币交易。该平台还占据去中心化金融(DeFi)协议总锁仓价值的65%,以及近80%的美元国债代币化产品。对于Coinbase、Kraken、Robinhood和索尼等布局加密领域的机构而言,以太坊始终是其首选底层网络。

图表3:以太坊是稳定币与代币化资产的领先区块链

稳定币和代币化资产采用率的提升,将同时利好以太坊及其他智能合约平台。Grayscale Research认为,稳定币有望通过更低成本、更快结算速度和更高透明度,重塑全球支付行业的部分格局。这涉及两类与稳定币相关的收入来源:一是由稳定币发行方(如Tether、Circle)获得的净息差(NIM),二是处理交易的链所获得的交易手续费。由于以太坊在稳定币领域已占据领先地位,其生态系统很可能随着稳定币采用率提升而获得更高的交易手续费收益。

代币化领域同样如此——这一过程旨在将传统资产引入区块链。当前代币化资产市场规模尚小(总计约120亿美元),但已显现增长潜力。目前,代币化美国国债是规模最大的资产类别,而以太坊在该领域占据市场主导地位。在另类资产方面,Apollo Global近期与Securitize合作推出了链上信贷基金。代币化股权虽然规模较小但增长迅速:Robinhood推出了SpaceX和OpenAI等私营公司的代币化股票,eToro也宣布了在以太坊上代币化股票的计划。Apollo的产品支持多链,而Robinhood和eToro的代币化股权产品将仅在以太坊生态内供应。

2、ETP资金流入及其后续影响

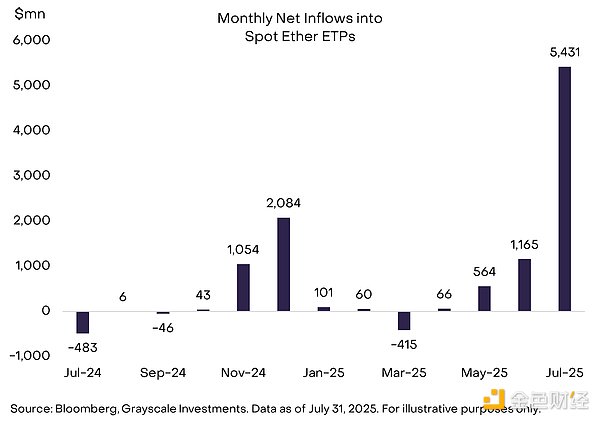

投资者对以太坊的兴趣推动现货ETH交易所交易产品(ETPs)实现显著净流入。2025年7月,美国上市的现货ETH ETPs净流入达54亿美元——这是自去年产品推出以来单月最大净流入规模(图表4)。目前ETH ETPs总持仓约215亿美元(折合近600万枚ETH),约占ETH流通总量的5%。根据美国商品期货交易委员会(CFTC)《交易商持仓报告》数据,我们估算其中仅10-20亿美元净流入反映对冲基金的"基差交易",其余均属纯多头资金。

图表4:ETH ETPs净流入突破50亿美元

多家上市公司也开始增持ETH,通过股权工具为投资者提供代币敞口。目前持有ETH最多的两家"加密资产金库公司"分别是Bitmine Emersion Technologies(股票代码:BMNR)和SharpLinkGaming(股票代码:SBET)。这两家公司合计持有超100万枚ETH,总价值达39亿美元。第三家上市公司BTCS(股票代码:BTCS)在7月下旬宣布,计划通过发行普通股和优先股筹集20亿美元用于增持ETH(BTCS目前持有约7万枚ETH,现价值约2.5亿美元)。除了ETH ETP产品的资金净流入外,来自企业金库公司的买入需求可能也推动了ETH价格上涨。

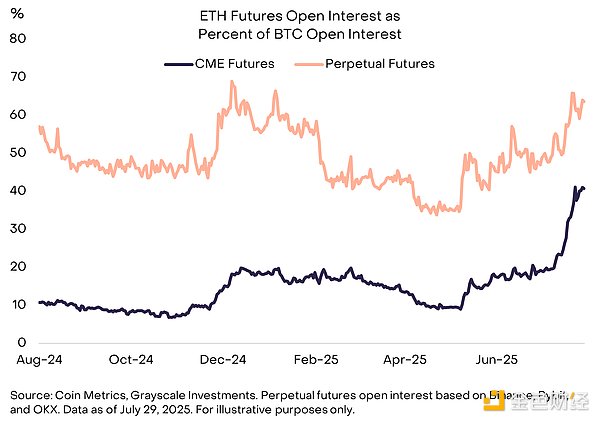

另一方面,以太坊在加密衍生品市场的份额本月有所提升,表明市场对该资产的投机兴趣正在增加。在芝加哥商品交易所(CME)上市的传统期货合约中,ETH期货未平仓合约(OI)增长至比特币(BTC)期货OI的40%左右(图表5)。永续期货合约方面,ETH的OI增长至BTC OI的65%左右。本月ETH永续期货的交易量也超过了BTC永续期货。

图表5:ETH期货未平仓合约增长情况

尽管以太坊在7月备受瞩目,比特币投资产品仍保持稳定的资金流入。美国上市的现货比特币ETPs当月净流入60亿美元,当前持仓量估计达130万枚BTC。多家上市公司也拓展了比特币资金管理策略:行业龙头Strategy(原MicroStrategy)发行25亿美元新型优先股用于增持比特币;比特币早期先驱、Blockstream首席执行官Adam Back宣布成立新型比特币资金管理公司Bitcoin Standard Treasury Company(股票代码:BSTR),该公司将以Back及其他早期采用者持有的比特币作为资本基础,同时进行股权融资。BSTR的运作模式与Cantor Fitzgerald此前为Twenty One Capital设计的SPAC(特殊目的收购公司)交易高度相似——后者是由Tether和软银支持的比特币资金管理公司。

3、山寨币种热潮

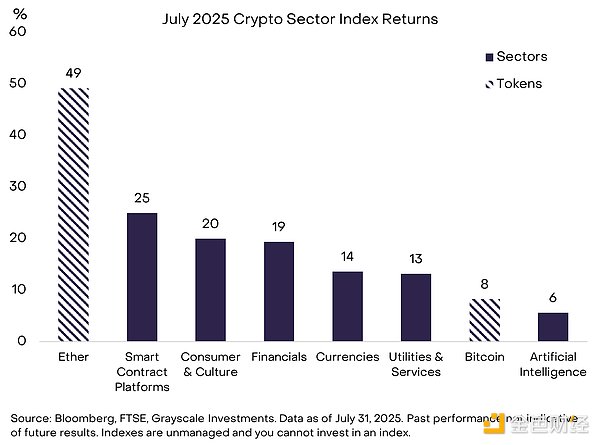

7月加密市场各板块估值全面攀升。从加密行业分类来看,表现最佳的是智能合约板块(受益于ETH 49%的涨幅),表现最弱的是人工智能板块(受个别代币的特殊性疲软拖累)(图表6)。当月多数加密资产的期货未平仓合约与资金费率(杠杆多头头寸的融资成本)同步上升,表明投资者风险偏好增强且投机性净多头增加。

图表6:7月加密市场全线上涨

在经历强劲回报周期后,估值总存在回调或盘整风险。《GENIUS法案》的通过虽为加密资产类别提供了重大利好催化剂(这解释了绝对收益与风险调整后收益的双重强势表现),但短期内立法驱动力或将减弱。美国国会虽正审议加密市场结构立法(众议院版本《CLARITY法案》已于7月17日获两党支持通过),但参议院尚在推进自身版本,且9月前难有实质进展。

尽管如此,我们仍看好该资产类别未来数月的前景。首先,监管红利无需立法亦可持续释放:白宫近期发布的数字资产专项报告提出94项具体发展建议(其中60项属监管机构职权范围,剩余34项需国会或跨部门协作)。其次,监管机构可通过批准质押功能、扩大现货加密ETPs产品矩阵等措施完善投资工具,持续引导增量资金入场。

另外,我们预计宏观环境将继续利好加密资产——这类资产既能提供区块链创新敞口,又可规避传统资产的特定风险。除7月签署加密相关立法外,特朗普总统还签署了《OBBBA法案》(One Big Beautiful Bill Act),该法案将未来十年的联邦政府巨额预算赤字制度化。特朗普还明确表示希望美联储降息,强调美元走弱将有利于美国制造商,并对多种产品和贸易伙伴加征关税。巨额预算赤字和较低的实际利率可能持续压制美元价值,尤其是在白宫默许的情况下。比特币和ETH等稀缺性数字商品或将从这一环境中受益,并可作为投资组合中对冲美元持续走弱风险的部分工具。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。