Original Author: miya

Translation | Odaily Planet Daily (@OdailyChina); Translator | Ethan (@ethanzhangweb3)_

Editor’s Note: After 18 months of frenzied expansion, the popularity of meme coins on Solana is rapidly cooling: trading volume has significantly shrunk, bot trading has surged, and retail investors' risk appetite continues to decline—every sign suggests that the "super cycle" may have reached its end.

While many projects are still fighting for existing traffic, the two major "launchpads," PumpFun and LetsBonk, have dramatically swapped roles: on the surface, LetsBonk leads in deployment volume, revenue, and market share; while PumpFun has chosen to "contract its frontlines and conserve ammunition," focusing on the next narrative inflection point.

What does this "win or lose" really mean? Is the meme coin sector no longer worth heavy investment? What is the connection between PumpFun's low-key accumulation of strength and the new round of ICM promoted by Solana Labs? In this article, the author provides an answer that is starkly different from mainstream views: perhaps the "winner" is not the current frontrunner, but rather the "invisible player" who timely hit the brakes before the bear market arrived, reserving ammunition for transformation.

It should be noted that the views in the article carry a clear stance and inference and are not investment advice. Odaily Planet Daily encourages readers to cautiously judge based on their own risk tolerance while referencing the author's data and arguments.

Original Content

First of all, this is not an attack on LetsBonk; I believe the Bonk team, led by Tom, has performed excellently in capturing the mental market share of meme coins, making any counterattack not worth it. LetsBonk has won the meme coin battle and will continue to dominate in this field.

PumpFun is winning. You might initially think I’m talking nonsense. Let’s look at some data that seems to indicate PumpFun has not won.

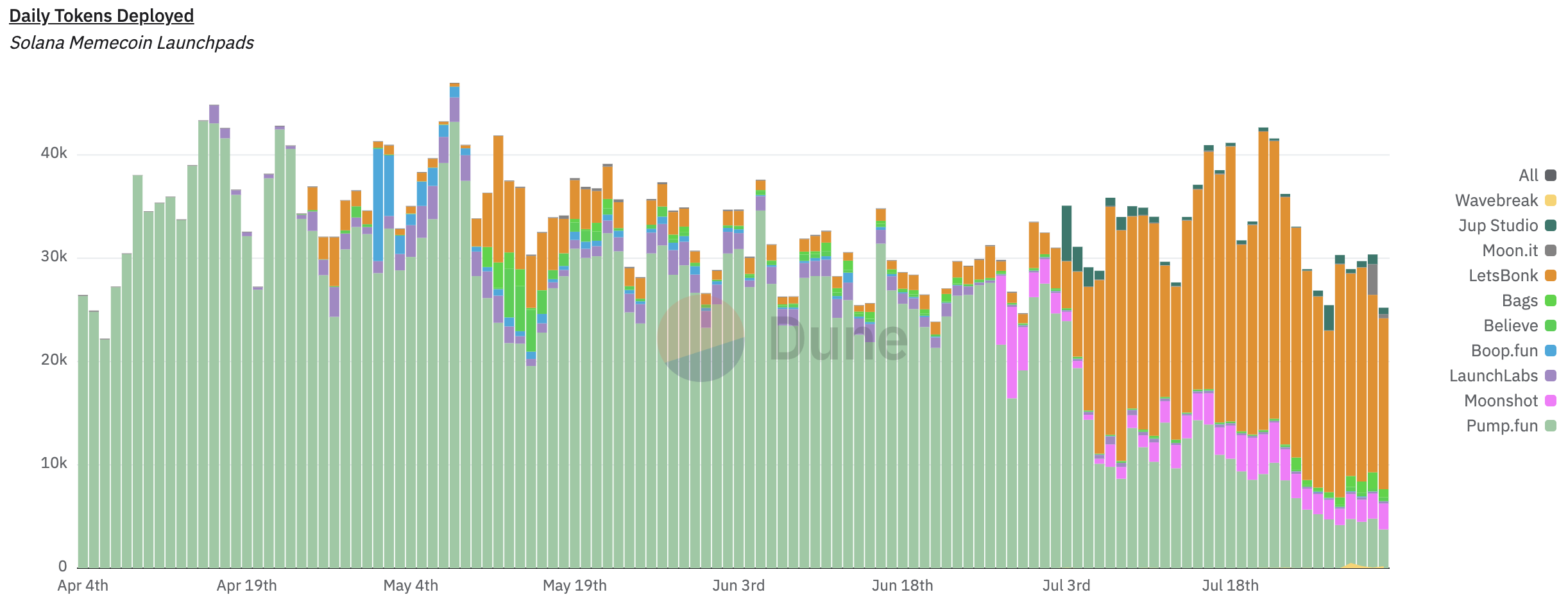

LetsBonk has not only captured some attention in daily token deployment numbers but has also become the "absolute" leader in deployment volume.

Currently, LetsBonk's token deployment volume is about 3.7 times that of PumpFun, capturing 65.1% of the market share in just one month. In terms of the number of graduated projects, LetsBonk is about 7.8 times that of PumpFun. However, PumpFun issues more tokens per graduated project, making it a more cost-effective trading launchpad.

So, since all indicators and charts show PumpFun lagging, why do I still say it is winning? Let me explain:

To understand why PumpFun has executed nearly perfectly to date, we need to look at the bigger picture.

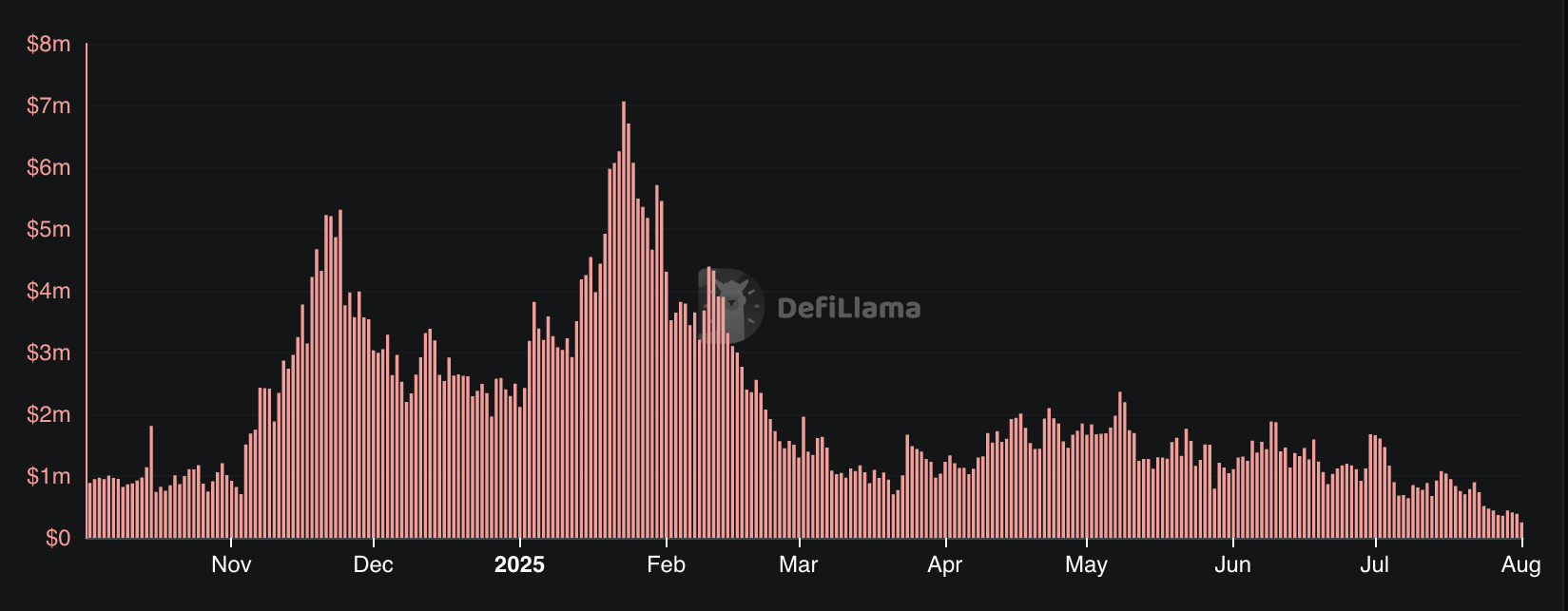

In the past month, PumpFun's 24-hour peak revenue plummeted from $7.07 million to $469,000, a decrease of about 93.4% (a drop of $6.6 million).

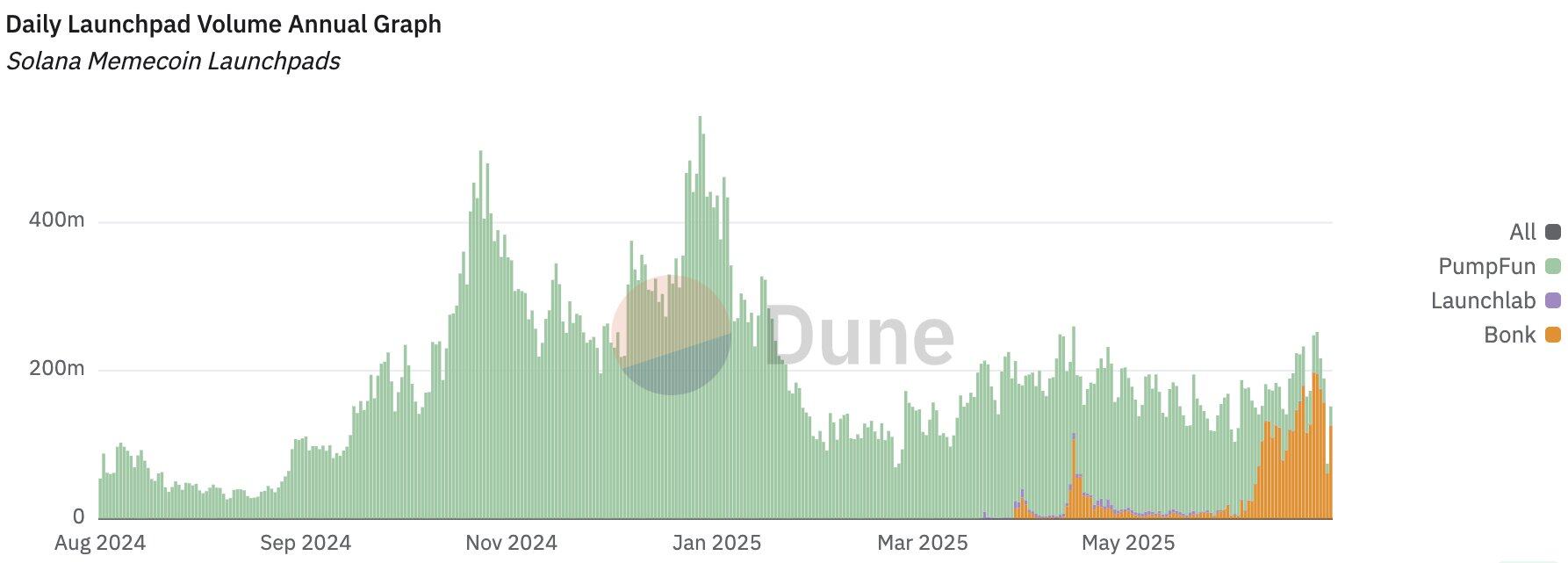

Meme coins are in decline. Since February 2025, the overall scale has been continuously shrinking. Not only has PumpFun's daily revenue dropped by 93.4%, but the overall market where LetsBonk operates is also shrinking.

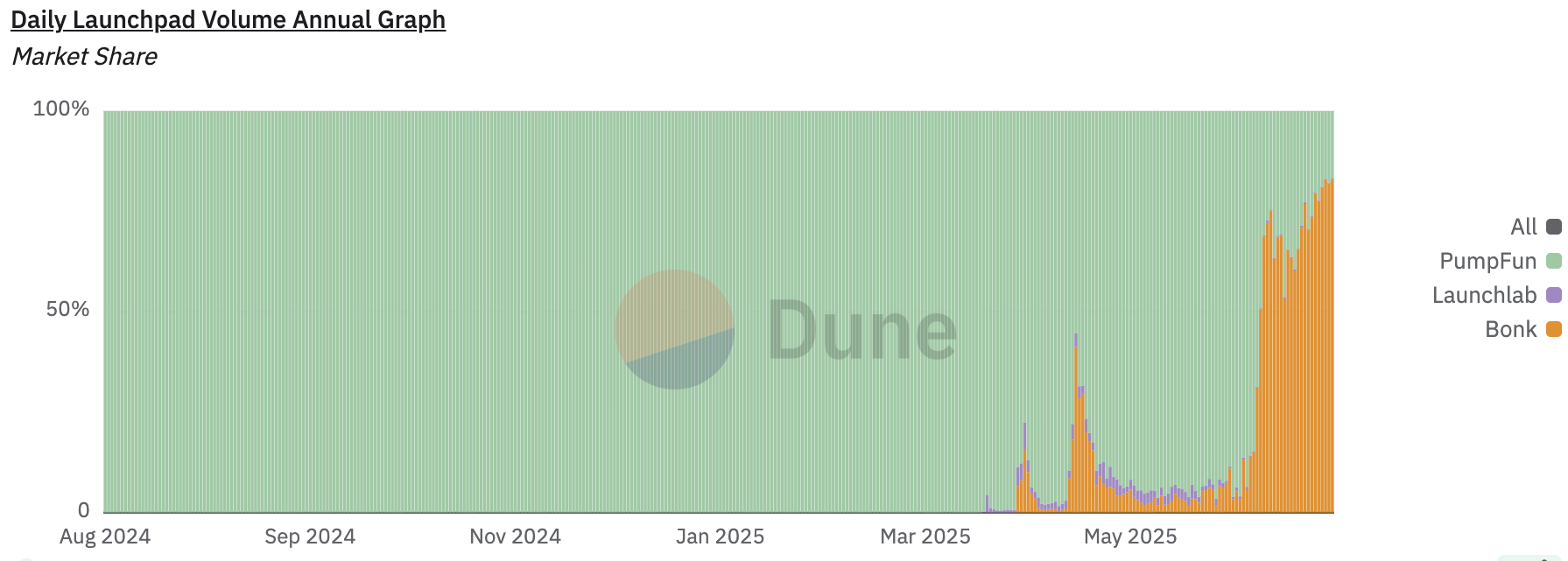

From the perspective of trading volume share, it may seem that way:

But the actual market size where the two are truly competing looks like this:

What’s worse is that bot trading has significantly increased, and the decline in the number of real users is actually even greater.

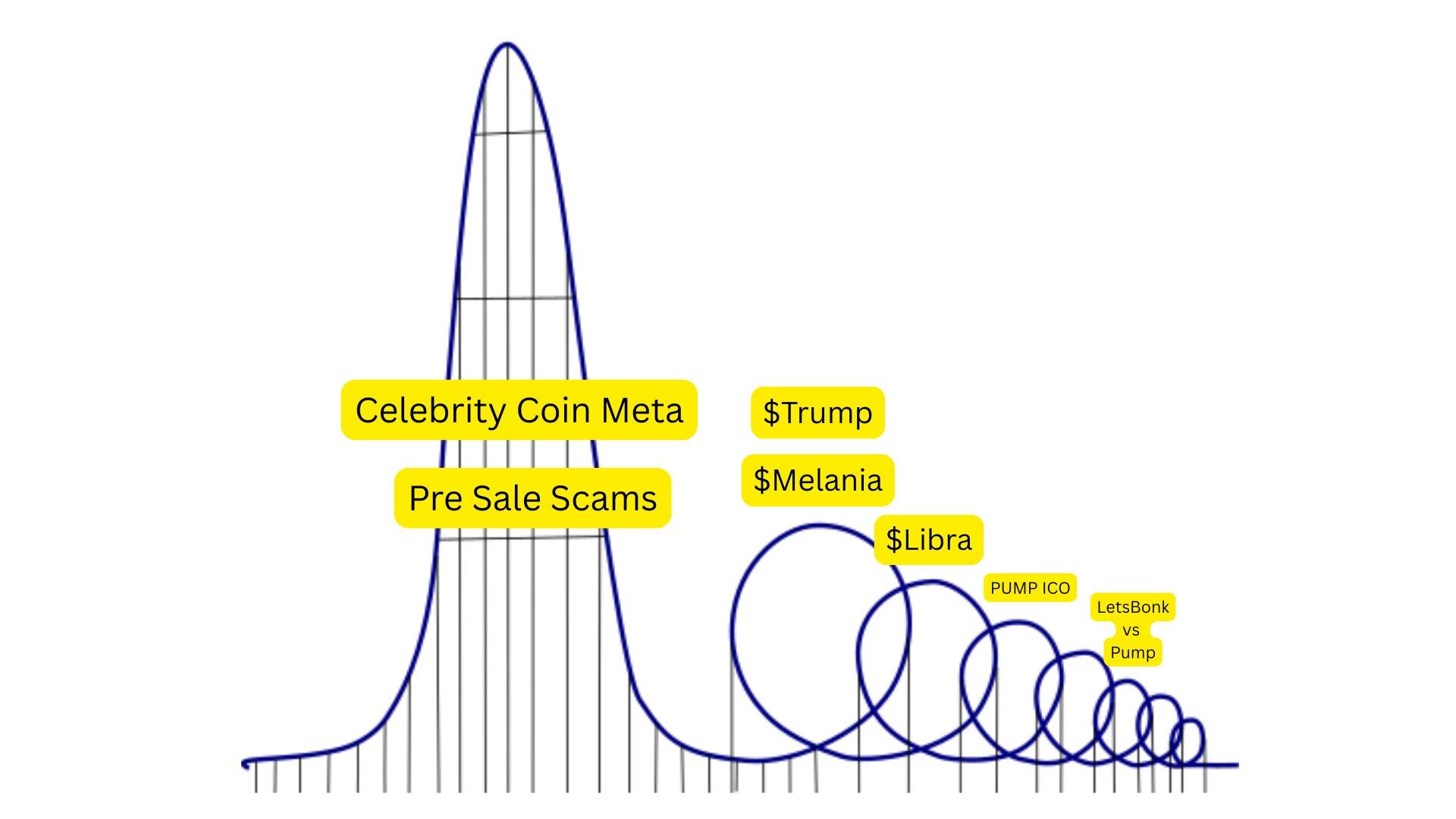

Since the hype around celebrity coins, the risk appetite for Solana meme coins has been declining. Major "harvesting" events like MELANIA and LIBRA have accelerated this process.

Retail investors' risk appetite is declining.

It is safe to say that meme coin trading is no longer what it used to be. To understand why the reality is worse than it appears, you can refer to my previous three series articles. (Article link: Solanas 'Crime Gap')

The meme coin super cycle has entered its final phase.

For a company planning to last at least two years, meme coins are not an ideal future investment. Today's meme coin trading is not just an ordinary "casino," but a gambling game with increasingly negative expected value.

“Oh, they are already addicted; just keep squeezing retail investors' funds.”

Even the most addicted gamblers are leaving the meme coin market because they know the outcome will inevitably lead to injury. Moreover, more mature participants in the market have advanced tools and information advantages (frontline funds, internal coins, etc.), and ordinary traders will be increasingly left behind, unable to turn back—this is a one-way process where information advantages gradually expand and the profit space for ordinary funds gradually shrinks.

Back to the title: Why will PumpFun win?

Perspective Shift: If you were PumpFun CEO Alon, what would you do?

Option 1: Use massive funds to buy back $PUMP

Suppose he sets up a $200 million fund now, continues to buy back over the next 31 days, and uses all fees for buybacks. Would that solve everything? No. Meme coins are still on the decline, and PumpFun still carries the inherent label of a "meme coin launchpad." Buybacks cannot reignite risk appetite or bring back the liquidity needed for organic "dark horses." Short-term sentiment might be boosted, but it cannot resurrect meme coins—this is a money-burning but unsustainable business.

Option 2: Airdrop $PUMP to users, injecting liquidity

This would only inject funds into a declining market, and PumpFun faces the risk of giving away "free money that can never come back," which may even flow to competitors.

So far, Alon has executed the "restrained investment" strategy almost perfectly.

PumpFun must evolve. It is not worthwhile to stubbornly fight in the increasingly declining meme coin gambling sector.

So what is happening now?

LetsBonk is redirecting most of its fees back to BONK and GP, but it has not formed a large-scale capital reserve. Insiders are allocating huge amounts in coins like BONK and USELESS, which is their way of cashing out. No matter what happens next, they may have traffic, but they cannot hold onto cash.

They may have won the meme coin battle, but the market's expectations for this sector are so low that "winning" is actually worse than "losing."

Community KOL @rasmr_eth suggested that PumpFun invest $200 million to create the next ChillHouse-level dark horse on the platform. I think this is completely unnecessary and would only further indicate that PumpFun is still competing in a declining sector. In fact, if PumpFun still wants to revive meme coins, they wouldn’t have gone a week without tweeting, nor would they have given up on direct competition with LetsBonk.

I may not know the specific actions within PumpFun, but I know Solana Labs is preparing ICM (Increased Chain Utility) to build strength for the upcoming bear market.

Regardless of how the subsequent narrative unfolds, PumpFun is financially prepared to surpass any competitor.

Some say Alon will abandon PumpFun? I find that laughable.

PumpFun has a solid brand, deep connections, and a clear company structure. No one would abandon a well-functioning company after cashing out. This argument only comes from gamblers who are used to the "pump and dump" routine. I don’t think he will reinvest 100% of the income back into the business, but I am almost certain that in the upcoming bear market, he will successfully enter the next track of Solana.

If you believe this cycle will last another year, $PUMP may be one of the long-term holdings worth considering during the bear market. As a hedge against my judgment that "this round is nearing its end," I hold spot PUMP; among many altcoins with considerable liquidity, it is the most fitting choice for this bet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。