From early June to early July this year, $IMF, as a MemeFi project on the Ethereum mainnet, surged nearly 70 times. Although it gradually retraced by 50% after reaching a historical high market cap of $70 million, a massive drop of nearly 85% yesterday shook the market.

The drop in $IMF shocked Zhu Su.

What exactly happened that caused such a significant drop in $IMF?

What is IMF?

IMF (International Meme Fund) is a decentralized financial platform tailored for meme projects on the mainnet, allowing users to collateralize meme coins like $PEPE, $JOE, $MOG, etc., to borrow stablecoins $USDS without needing to sell. At the same time, through modules like Accelerate and Amplify, project teams or whales can leverage their positions, engage in circular borrowing to support prices, or even create a false appearance of "locked positions," effectively allowing for early exits and shadow fund management.

Through IMF, circular borrowing of meme coins can be achieved, enabling a "left foot stepping on the right foot" strategy, for example:

- Buy $10,000 worth of PEPE

- Deposit PEPE into IMF and borrow $5,000 in USDS

- Convert USDS back to PEPE

- Deposit the remaining $5,000 worth of PEPE to reduce the loan-to-value (LTV) ratio

Currently, IMF's Total Value Locked (TVL) is approximately $166.5 million, with about $54 million in $USDS deposited, and around $29.22 million in $PEPE, approximately $20.58 million in $stETH, about $44.4 million in $MOG, around $5.88 million in $JOE, about $4.94 million in $SPX, and approximately $7.5 million in $IMF as collateral.

Why did $IMF plummet?

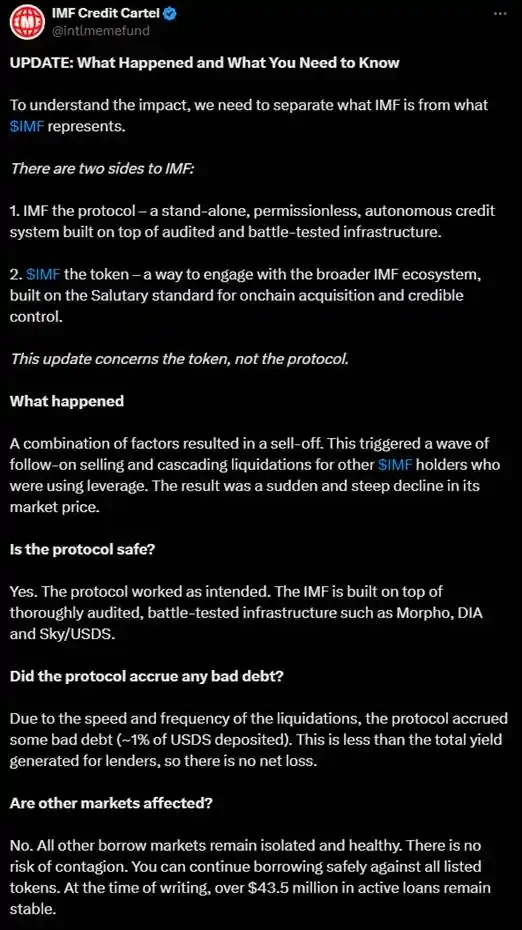

According to a tweet from IMF's official account, the sudden drop in $IMF was not due to issues with the protocol itself, but rather because the $IMF token faced selling pressure, which triggered further panic selling and a chain of liquidations that led to a significant price drop.

The official account also stated that due to the speed and frequency of liquidations, some bad debts accumulated (approximately 1% of the USDS deposited). This is below the total earnings generated by lenders, so there was no net loss. Additionally, the issues in the $IMF lending market do not affect other lending pairs on the platform.

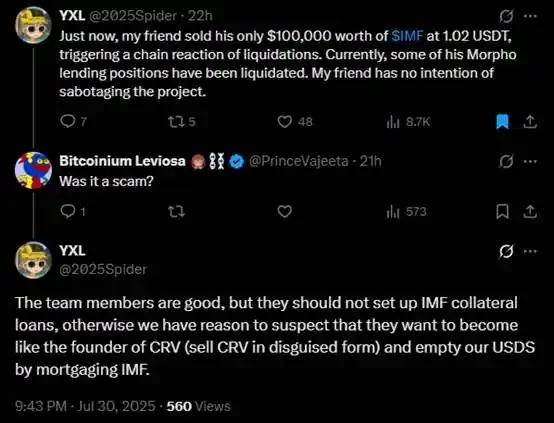

@2025 Spider tweeted that his friend sold $100,000 worth of $IMF at a price of $1.02, triggering a chain of liquidations. He stated that his friend did not intend to harm the IMF project and suggested that the project team should close the IMF lending positions, or else USDS would face significant risks. He also mentioned that the team's oracle update speed was very slow, and when most IMF/USDT positions were unable to repay, the oracle still had not updated to the latest price in a timely manner.

Regarding the decision to allow the collateralized lending of its own platform token $IMF, both @2025 Spider and Chinese KOL "Professor Su" raised concerns:

Someone asked @2025 Spider in the comments, "Is IMF a scam?" @2025 Spider replied that the team members are good, but they should not allow the collateralized lending of $IMF, or else there would be reason to believe they want to cash out their own tokens like the founder of CRV. He also pointed out that the loan limit given to $IMF exceeded the $IMF's UniSwap pool itself, which is also not advisable from a risk control perspective.

"Professor Su" directly questioned the IMF team through on-chain records, suggesting that they collateralized to create FOMO and then sold the tokens for cash:

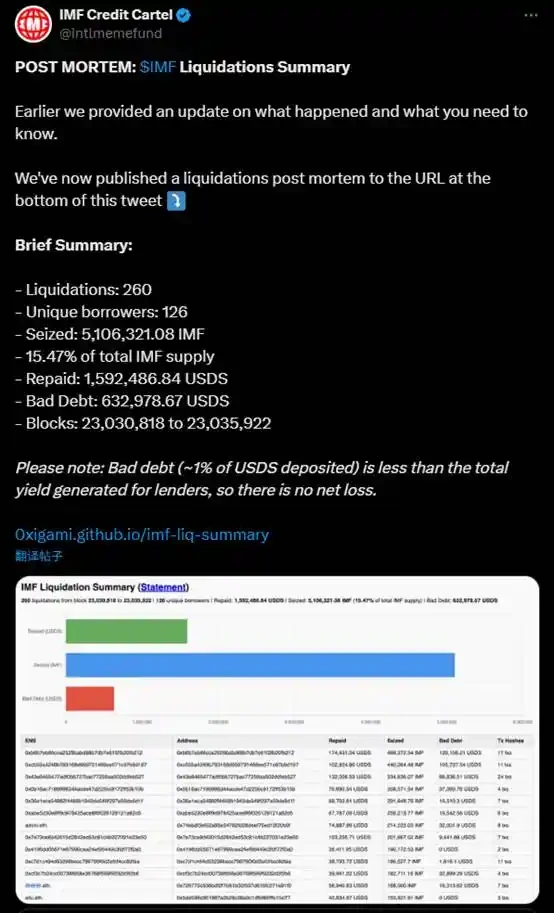

The official IMF Twitter account published a detailed report on the chain liquidation event this afternoon. A total of 260 liquidations occurred, involving 126 independent borrowers, accounting for 15.47% of the total supply of $IMF being liquidated.

Conclusion

After the incident, $IMF rebounded nearly 4 times from its lowest point, and currently, it is still about 3 times higher than the lowest point, with a market cap recovering to nearly $21 million.

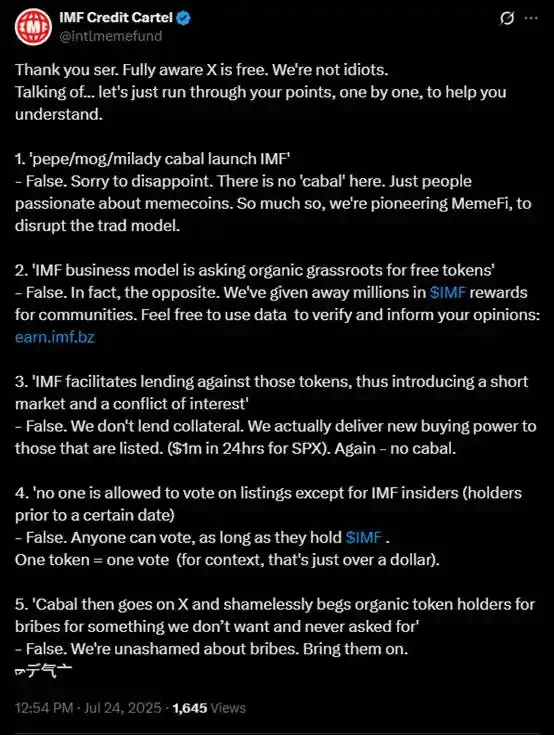

However, the controversy surrounding $IMF is unlikely to end soon. On July 24, a major holder of the well-known meme coin $APU on Ethereum, @alex_eph 612, criticized IMF. He stated that IMF was initiated by a conspiracy group involving $PEPE, $MOG, and Milady, and that its business model essentially solicited free tokens from other organic meme coin communities in exchange for the short-term buying pressure that IMF could generate, after which the conspiracy group would sell the tokens:

IMF quickly countered, claiming that they did not solicit any bribes, and that the standards for listing lending pairs were public and voted on by $IMF holders:

The "meme flywheel" on Ethereum is likely to face more storms ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。