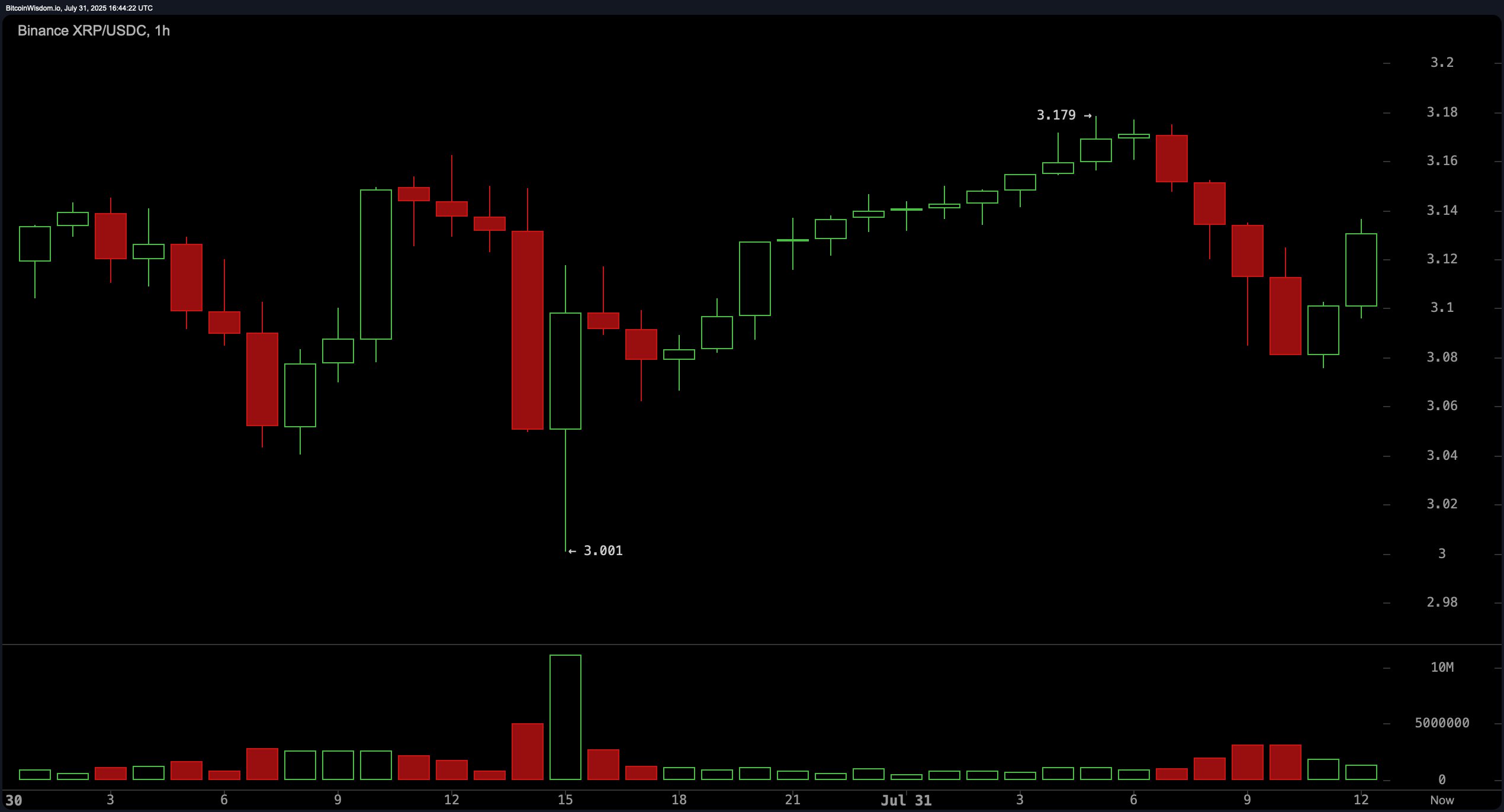

在1小时图上,XRP显示出在$3.179被拒绝后进入微观整合阶段的特征。这导致连续五根红烛的出现,伴随轻微的恢复迹象,暗示可能出现短期挤压。波动性正在收窄,通常是更大方向性移动的前兆。技术图形暗示潜在的牛市旗形,前提是$3.12支撑位保持有效,并且确认突破$3.18以上。这个水平对预期反弹至更高阻力区的交易者来说仍然至关重要。

XRP/USDC通过Binance的1小时图,2025年7月31日。

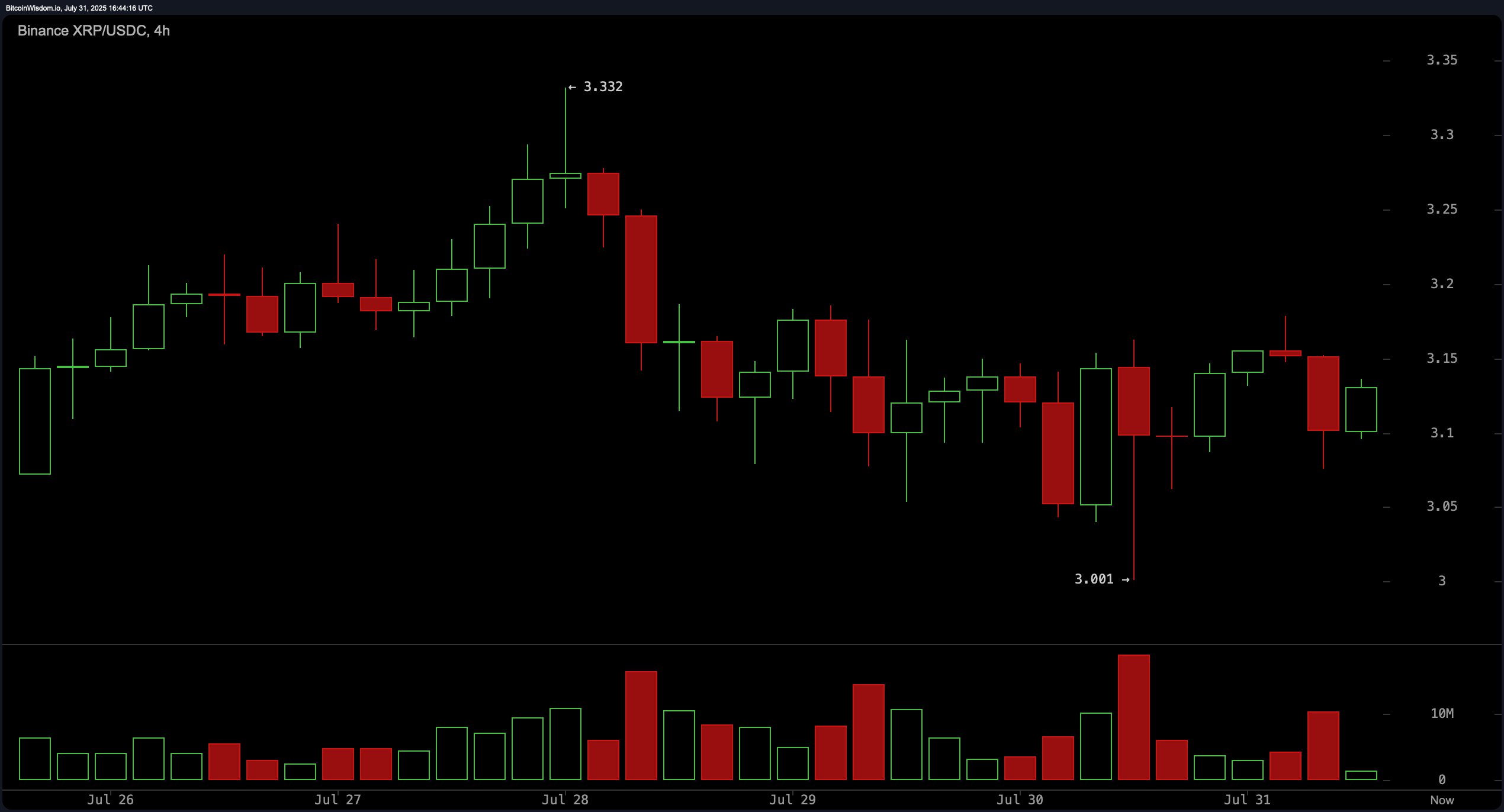

4小时图进一步强化了看跌到中性的偏见,自最近的高点$3.332以来,反映出一系列更低的高点和更低的低点。明显的下降三角形,水平支撑在$3.00附近巩固,而阻力则向下趋势。值得注意的是,卖出量超过了买入量,突显出当前的看跌情绪。尽管$3.00成功支撑了两次,但缺乏向上的跟进使得看涨动能受到质疑。如果未能果断突破$3.20,可能会导致再次测试$3.00支撑位。

XRP/USDC通过Binance的4小时图,2025年7月31日。

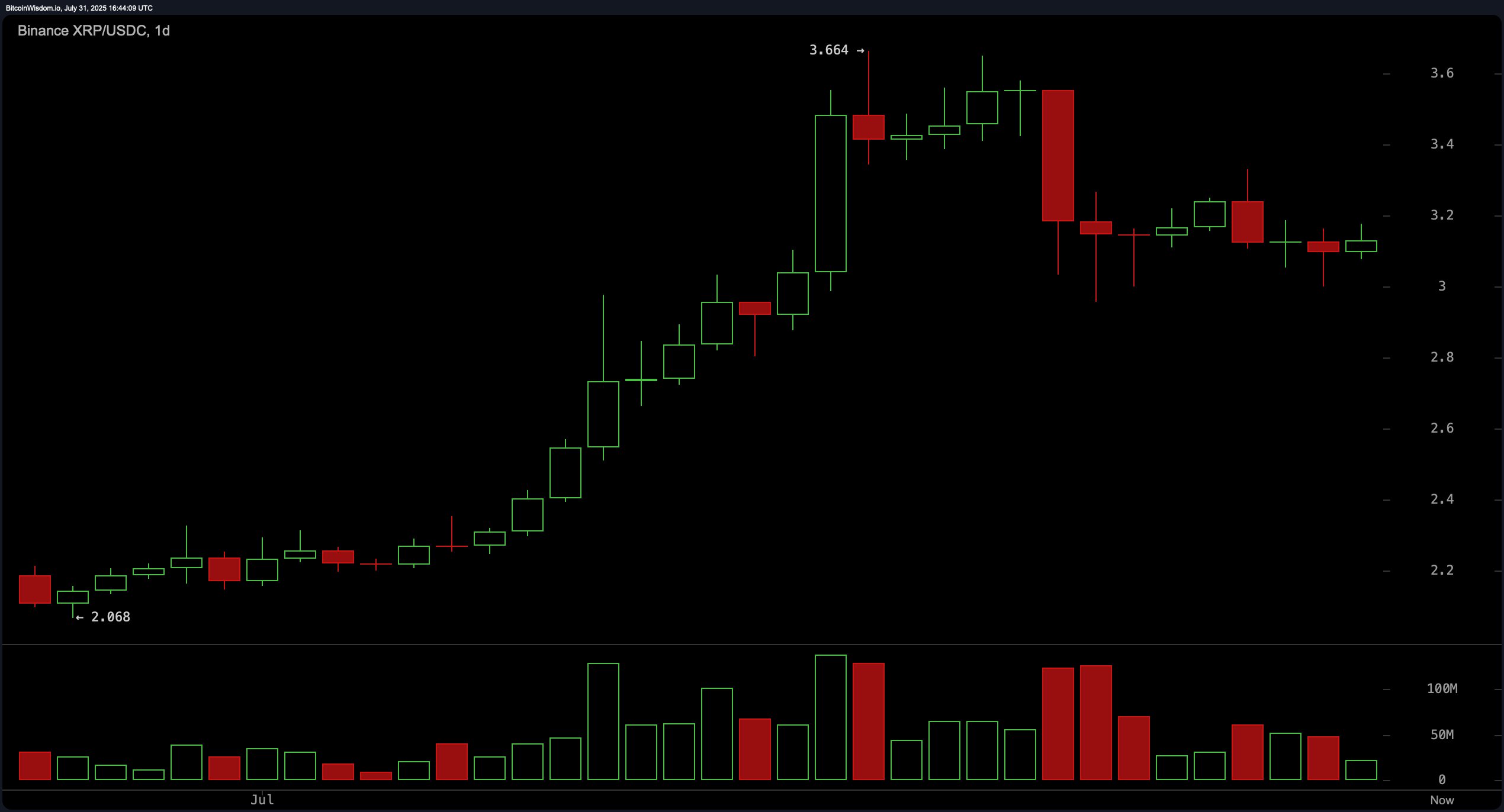

在日线图上,XRP经历了从约$2.07到$3.66的强劲反弹,随后遇到陡峭的阻力并回撤。目前在$3.10–$3.20区间的整合表明可能处于分配阶段或趋势反转的早期阶段。峰值时的成交量激增和随后的动能下降与这一叙述相符。从技术上看,形成更低的高点增加了进一步下行的风险,除非价格以显著的成交量突破$3.40–$3.66的阻力区间。就目前而言,短期日线偏向中性到看跌。

XRP/USDC通过Binance的日线图,2025年7月31日。

振荡器读数呈现出混合的情绪景观。相对强弱指数(RSI)为57.65,反映出中性动能,而随机振荡器则在25.30处显示出适度的超卖恢复,也被归类为中性。商品通道指数(CCI)为−17.82,平均方向指数(ADX)为43.93,均表明缺乏方向性强度。惊人振荡器打印为0.336,保持中性,但动量指标注册为−0.416,发出看跌信号。同时,移动平均收敛发散(MACD)水平为0.1527,支持看跌偏见,并有相应的负面标识。

移动平均线(MAs)进一步证实了市场结构的分化。10期指数移动平均线(EMA)在$3.1617,10期简单移动平均线(SMA)在$3.1912均发出看跌信号。然而,中长期指标偏向看涨,20、30、50、100和200期的EMA和SMA均显示出积极的条件。这包括50期EMA在$2.7745和200期EMA在$2.3190。这种分歧表明,尽管短期存在修正压力,但强劲的长期上升趋势仍然保持完好。

看涨判决

XRP的长期看涨结构保持完好,一系列中长期移动平均线确认了向上的动能。尽管短期内存在疲软和整合,但在$3.00附近关键支撑位的保持以及突破$3.18的潜力表明,向上的机会仍然可行。若能以成交量重新夺回$3.40,可能会重新启动看涨反弹。

看跌判决

技术面显示出日益增加的短期压力,下降三角形的形成、恢复停滞以及多个振荡器显示出看跌信号。若未能果断突破$3.20,XRP面临进一步下行的风险,可能会跌向或低于$3.00支撑区。动量指标和MACD的看跌信号在短期内加强了谨慎的立场。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。