Bitcoin ( BTC) recovered from a late July 30 “flash crash” to trade just above $118,900 before declining to $118,738 by 2:40 a.m. EST on July 31. The top cryptocurrency’s rally came just hours after the U.S. Federal Reserve’s decision to leave interest rates saw BTC dropped rapidly from around $118,600 to reach a low of $115,784.

The flash crash triggered liquidations, with $431 million in long and short positions wiped out within 24 hours. As expected, long liquidations significantly outweighed short liquidations across the top five cryptocurrencies. Ethereum ( ETH) led in 24-hour long liquidations at a substantial $61.87 million, followed closely by BTC at $58.49 million. Solana ( SOL) followed with $27.33 million in 24-hour long liquidations, while XRP and dogecoin (DOGE) saw $14.70 million and $11.88 million, respectively.

The Dow Jones Industrial Average mirrored the crypto market’s unease, shedding a significant 300 points almost immediately after the Federal Reserve’s announcement confirmed its steadfast decision not to lower interest rates. Though the Federal Reserve’s decision to keep rates unchanged was widely anticipated, the days leading up to the announcement offered a glimmer of hope that the Jerome Powell-led institution would finally yield to pressure and cut rates, a longstanding demand of U.S. President Donald Trump.

First, Trump administration officials announced that the U.S. leader had begun the process to select the next Federal Reserve governor and Trump himself has amplified speculation that he could fire Powell. Trump’s visit to the Federal Reserve on July 24 and his very public clash with Powell over the ballooning construction of a Federal Reserve building appeared designed to pressure the governor into compliance. However, barely a week later, the Federal Open Market Committee (FOMC) upheld the decision to keep rates unchanged, citing rising inflation.

According to a Kobessi Letter post on X, the FOMC passed the measure to keep rates unchanged by a vote of 9-2. Notably, the dissent by two FOMC members marked the first time more than one member has voted against during the committee’s meeting. Nevertheless, the decision means the Federal Reserve is no closer to cutting rates by the 300 basis points that Trump is demanding.

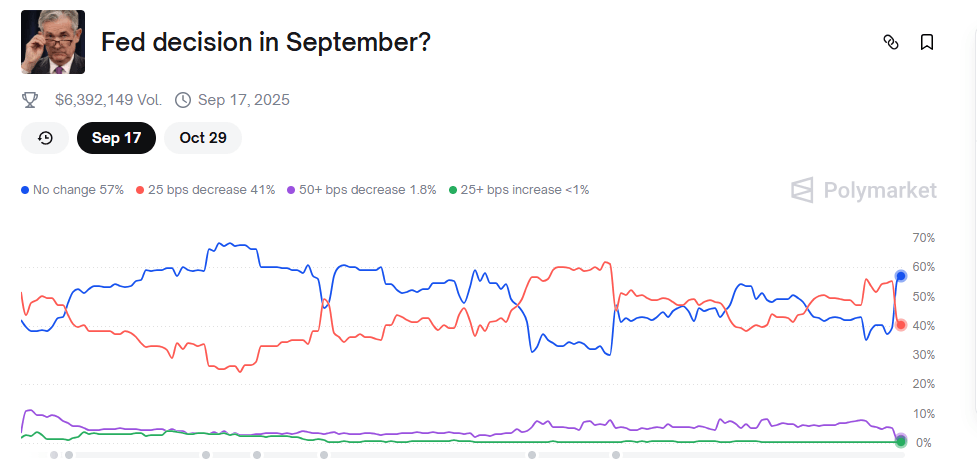

In fact, data from the blockchain-based predictions market Polymarket shows that the odds of the Federal Reserve keeping rates unchanged jumped from 38% to 57% after the FOMC vote.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。