Suddenly, it seems that the most eye-catching aspect of the US stock market is no longer AI, but a bunch of junk companies on the verge of delisting. Over the past few months, the US capital market has been experiencing an unprecedented wave of reverse mergers with increasingly larger amounts.

Public companies have completely abandoned their original main businesses, turning cryptocurrencies into their fundamentals, with stock prices skyrocketing several times or even dozens of times in a short period. Now, the US stock market has become a playground for the crypto world to conduct financial experiments. This time, crypto VCs have truly brought their stories to the ears of Wall Street.

US Stock Market: "Firestarter" Launching DAT Fireworks

Three months ago, when investing in Sharplink, Primitive Ventures had no idea that this new crypto track in the US stock market would become so crowded in such a short time. "At that time, not many people were discussing these investment cases; the current market heat is simply incomparable, but it was really just a month or two ago," said Primitive partner Yetta.

In June of this year, Sharplink Gaming announced the completion of a $425 million financing, becoming the first Ethereum reserve company in the US stock market. After the announcement, the company's stock price soared, at one point increasing more than 10 times. Primitive, as the only fund from the Chinese circle participating in this investment case, attracted attention within the community.

"Because we found that the liquidity in the crypto market is not good, yet the purchasing power from institutions is very strong. The Bitcoin ETF volume has always been good, and the open interest of Bitcoin options on CME even exceeds that of Binance." In April last year, Primitive held an internal meeting for a major review, after which they set a new investment direction of "integration of CeFi (Centralized Finance) and DeFi (Decentralized Finance)." Now, they have become one of the busiest VCs in the crypto space.

Today, Primitive receives emails from investment banks every day, inviting the fund to participate in investments in crypto reserve companies. In this wave of investment, investment banks act as intermediaries, responsible for helping project parties find and coordinate all investors and assisting teams in roadshows for capital providers.

In the past month, Primitive has discussed no less than 20 cryptocurrency reserve projects. However, currently, the only projects they publicly participate in are Sharplink and another company, MEI Pharma, which is focused on Litecoin reserves. This cautious investment approach stems from concerns about market overheating; since May of this year, the team has begun closely monitoring various top signals.

"We do feel that the level of market bubble is significantly higher than a few months ago," Yetta told Beating. The team now prepares daily market reports and assesses appropriate exit strategies based on the situation, "Crypto reserve companies are financial innovations; you can be bullish on their underlying assets in the long term, but there is also a risk of severe deleveraging and bubble bursting during market downturns."

Unlike Primitive, Pantera is rolling up its sleeves and preparing for a big push. This well-established crypto VC with 12 years of history has even coined a new term for this field—DAT (Digital Asset Treasury). In early July, Pantera established a new fund named the DAT Fund.

In the fundraising memorandum, Pantera partner Cosmo Jiang wrote: "As an investor, it is very rare to find oneself at the starting point of a new investment category. Recognizing this and responding quickly to seize early investment opportunities is crucial."

The story Pantera tells investors is very simple: if a company holds an increasing amount of Bitcoin per share each year, then owning the company's stock will allow you to accumulate more and more Bitcoin.

The underlying logic of Bitcoin reserve companies led by MicroStrategy, as well as other cryptocurrency reserve companies, is to leverage financial instruments such as directed share issues, convertible bonds, and preferred stocks to raise funds from the market when the value of their crypto assets is at a premium relative to their market capitalization, and to purchase more crypto assets. Because the stock is at a premium, the company can accumulate more assets at a lower cost.

Investors generally use the mNav metric (Market Cap To Net Asset Value) to measure its premium multiplier to assess the company's financing capability. "Clearly, the stock market is volatile; sometimes the market overestimates certain assets. At this time, launching financial instruments for financing is essentially selling that volatility. From this perspective, the premium can actually be maintained in the long term," Cosmo told Beating.

In April of this year, Pantera invested in Defi Development Corps (DFDV), which reserves Solana's public chain token SOL, making it the first company in the US stock market to use cryptocurrencies other than Bitcoin as reserve assets. Its stock price has increased more than 20 times in the past six months.

However, for Pantera, this was definitely a contrarian investment, as no one was willing to invest in the project at its inception, and the company's $24 million financing came almost entirely from Pantera.

Most DFDV members come from senior positions at Kraken, and the CFO has operated Solana validation nodes. The team's deep understanding of Solana and their expertise in traditional finance were key factors that impressed Pantera. "Even so, we still set some downside protection measures in the transaction structure, but DFDV's astonishing success was something we completely did not anticipate."

"I believe the real catalyst was Coinbase being included in the S&P 500 index, which forced all fund managers around the world to consider crypto." Since Trump's election, the crypto industry has been making great strides in traditional capital markets. Circle's IPO has attracted global attention to stablecoins, and Robinhood's entry into RWA has pushed the tokenization of securities to the forefront. Now, DAT is becoming a new concept for the relay.

Less than a month after investing in DFDV, Cantor Equity Partners also came knocking. DFDV's success accelerated SoftBank and Tether's plans for a Bitcoin reserve company, ultimately raising about $300 million in external funding for CEP, with Pantera once again becoming its largest external investor.

The funds for investing in DFDV and CEP come from Pantera's flagship venture fund and liquid token fund. The team initially thought these would be the only two investments in this field for the fund.

However, market developments quickly exceeded Pantera's expectations. Due to limitations in investment portfolio frameworks and concentration in the aforementioned two funds, Pantera soon decided to establish a new fund.

On July 1, the DAT Fund began fundraising, targeting $100 million. On July 7, it was officially announced that the fundraising was completed. Due to high enthusiasm from LPs, Pantera subsequently launched the fundraising for a second DAT Fund. By the middle of the month, when interviewed by Beating, the funds from the first DAT Fund had already been fully deployed.

In the publicly disclosed investment cases, Pantera often plays the role of "Anchor," being the largest investor. Due to the initial poor liquidity of DAT companies, which can easily lead to discounts, the team needs to first bring in heavyweight investors off-market to build a foundational base, ensuring liquidity and narrowing the price gap.

On the other hand, being an "Anchor Investor" is also a strategy for Pantera to penetrate the market. "In the past two months, we have received nearly a hundred proposals from DAT companies. Pantera is usually the first call they make because we entered early enough to form a leading understanding in this field, and they also see that when we invest, we are real investors who can place significant bets and dare to write large checks."

Of course, Pantera does not invest in every opportunity. For DAT companies, the fund also values their ability to create "cognitive leadership" in marketing. Their investments in Sharplink and Bitmine are largely based on this consideration. Among them, Bitmine is the first investment of the DAT Fund, and Pantera also played the "Anchor" role in the transaction.

On June 2, Ethereum community core figure Joseph Lubin led the completion of Sharplink's reverse merger, marking the birth of the first Ethereum reserve company. On June 12, Joseph and other Ethereum core members released an Ethereum fundamentals report through Etherealize, introducing the investment value of Ethereum to institutions.

On June 30, the second Ethereum reserve company, Bitmine, was born, with "Wall Street cryptocurrency expert" Thomas Lee stepping in to promote it and beginning to frequently appear in mainstream media to interpret investment opportunities in Ethereum. During this period, Sharplink's stock price began to rise, and the "Ethereum arms race" quickly became the hottest topic in the industry.

"To truly open the channel for financial leverage, the market capitalization of DAT companies must reach at least $1 to $2 billion," Cosmo told Beating. Only by reaching this scale can the company truly obtain valuation premiums in the market and open another door to institutional capital through tools like convertible bonds or preferred stocks.

But before that, DAT companies need to tell their story to ordinary investors, not just crypto-native investors, but a broader mainstream retail investor group in the stock market. "We need to make them understand this story and be willing to participate. The market must first 'believe it will happen' for the entire model to be established."

Establishing sustained trust with the market is another key factor for the success of DAT companies. The traditional financial market requires guarantees of "transparency + discipline." The team must be sufficiently "Crypto Native" while also possessing the sensitivity of traditional finance, managing and disclosing information for public companies effectively, and being clear about SEC rules and processes to ensure the company can efficiently and professionally access the US capital market.

"We spend a lot of time conducting due diligence; what really matters is not the static number of mNav. Is there a clear management structure? Can financing be conducted stably? Is there the capability to build new business models? These are what make a truly excellent 'DAT entrepreneurial team.'"

In addition to Bitcoin, Ethereum, and Solana reserves, Pantera has recently invested in several other large-cap altcoin reserve companies. From Bitcoin to mainstream coins to altcoins, the story told to investors in the crypto space is also layered: compared to Bitcoin, DAT relies entirely on financial engineering for growth, mainstream tokens can generate returns through staking and DeFi activities, while altcoin protocols have mature application scenarios and revenue as their fundamentals in the crypto market, allowing stock market investors to gain exposure to their growth through DAT.

Unlike the financing paths of Bitcoin and mainstream coins, many altcoin DATs have their initial reserves coming directly from the protocol foundation itself or its token investors.

The initial reserves of Hyperliquid's strategic reserve company Sonnet BioTherapeutics (SONN) were directly injected into the company by top crypto VC Paradigm, which purchased over 10 million HYPE tokens at the end of last year. According to Beating, the establishment of the strategic reserve company StablecoinX by Ethena was also led by the Ethena Foundation, allowing PIPE round investors to directly use their ENA tokens or USDC to participate in the financing.

Due to poor liquidity, altcoin DATs often experience rapid surges in price following the announcement of financing news, providing insider trading opportunities for many informed participants. In the case of SONN, the official announcement was made on July 14, but the stock price had already surged fourfold starting from July 1, the night before the news was released.

Recently, the BNB reserve company CEA, backed by YZi Labs, encountered similar issues. According to Beating, to prevent participants from learning the company name in advance, the team purchased several US shell companies ahead of time and randomly selected one at the last moment. However, even so, there were still instances of front-running just hours before the official announcement on July 28.

On the other hand, many investors are also concerned about the potential risks of "left hand to right hand" in altcoin DATs. Due to the poor liquidity in the crypto market, it is difficult for high market cap, high price tokens to exit without a discount. However, by injecting crypto assets into DAT companies, the false liquidity of the tokens themselves becomes real liquidity in the US stock market.

Therefore, whether to "provide growth exposure" or "seek exit liquidity" requires careful discernment by investors. "Many DATs choose to operate in regulatory gaps, such as listing on low-threshold trading boards. But this kind of short-term operation makes it difficult to establish stable information disclosure and compliance mechanisms. If they cannot obtain real capital premiums, it is essentially a game of hot potato."

Regulation is also one of the risks faced by DAT companies. If the SEC classifies altcoins and other on-chain assets as securities, the structure of DATs will need significant adjustments. Nevertheless, Primitive and Pantera still believe this is a better battleground. "Because the liquidity in the US stock market is indeed better, and investors in public companies have more protections, so for us, investing in DATs now is likely to have better odds and payouts than pure crypto investments," Yetta said.

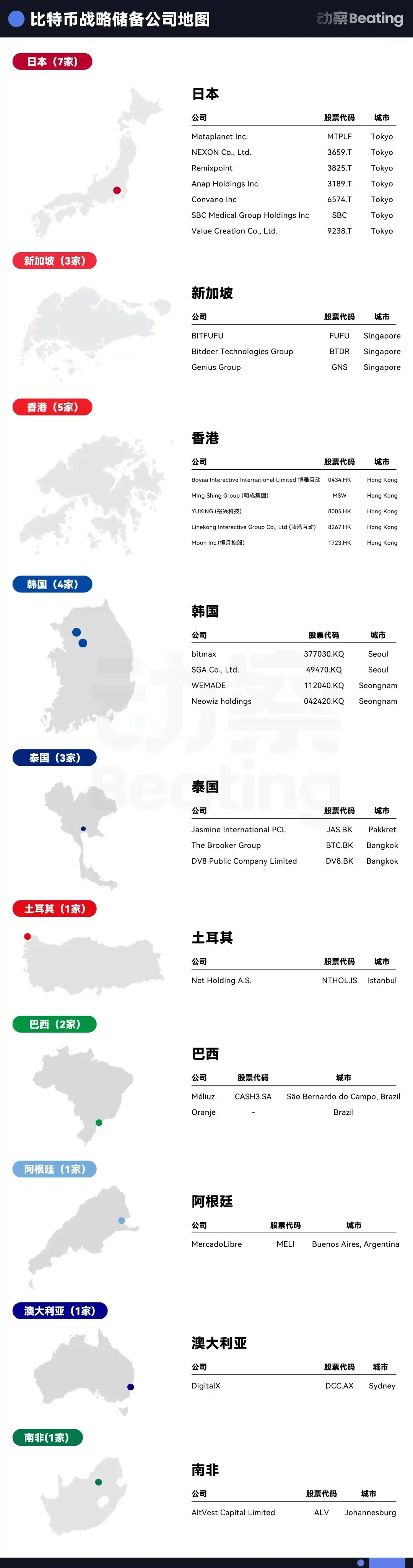

The World Outside the US Stock Market is Competing for the "First MicroStrategy"

The US stock market is recognized as the most efficient, inclusive, and liquid capital market, and investors agree that if one wants to replicate the next MicroStrategy, Nasdaq is still the best place. However, this does not mean that other capital markets lack opportunities; outside the US stock market, everyone's goal is to become the next Metaplanet.

Over the past year, the stock premium of Metaplanet has risen sharply, bringing investors returns of over 10 times. This "Asian miracle" success has made more people see the opportunity for regional arbitrage.

The Asian market is a pioneer in Bitcoin reserves. In mid-2023, Waterdrop Capital partnered with China Pacific Insurance Investment Management (Hong Kong) Co., Ltd. to establish the Pacific Waterdrop Fund, subsequently investing in the Hong Kong-listed company Boyaa Interactive, which had just launched a Bitcoin purchasing plan. In 2024, as MicroStrategy's stock surged, Waterdrop further confirmed this industry trend. Currently, Waterdrop has invested in five Hong Kong-listed companies and plans to invest in at least ten by the end of the year.

"It is clear that the current US market for Bitcoin and mainstream coin reserve companies is already very crowded, and the next incremental growth is more likely to come from capital markets outside the US," said Nachi, a crypto trader who is now also participating in the wave of reserve company investments. This year, he invested in the Bitcoin reserve company Nakamoto Holdings and quickly achieved a tenfold return.

At the beginning of the year, Nachi invested in Mythos Venture as a personal LP, a fund focused on "Asian Bitcoin reserves." Their most recent investment was in the Thai-listed company DV8, which recently announced the completion of a 241 million Thai baht financing, becoming the first Bitcoin reserve company in Southeast Asia.

In addition, he has also personally participated in several other Bitcoin reserve project investments in different regions, most of which are in the seven-figure dollar range. For example, the first Bitcoin reserve company in Latin America, Oranje, completed its acquisition in April this year, receiving support from Brazil's largest commercial bank, Itaú BBA, and raising nearly $400 million in its first round of financing.

"We believe there is still room in markets like Japan, South Korea, India, and Australia to establish Bitcoin reserve companies." After joining Mythos, Nachi's role gradually shifted from LP to "quasi-GP," looking for investment opportunities alongside other members. His task is to find publicly listed companies interested in acquisitions, and "shell owners" in the Asian region have become the focus of Nachi's recent meetings.

"Striving to be the first" is key to succeeding in capital markets outside the US stock market. This not only allows the team to accumulate first-mover advantages but also helps the company capture more market attention. However, this also means that the narrative of Bitcoin reserve companies and regional arbitrage is a race against time.

In the acquisition phase, there are significant differences between shell companies; some can be bought for $5 million, while in the case of Thailand's DV8, several participants spent about $20 million.

From acquiring a shell to listing and trading, the entire process generally takes 1 to 3 months, with regulatory approval efficiency being the main variable. However, from discovering an opportunity to executing the deal, it takes at least 6 months or even longer.

The acquisition of DV8 took nearly a year, officially completing in July of this year. The leading investors in this acquisition were UTXO Management and Sora Venture, who are also the main architects behind Metaplanet.

Recently, Sora also orchestrated the acquisition of the South Korean software service company SGA. "The Asian, especially Southeast Asian, capital market is relatively closed, but the volume here is actually very large; many foreign investors are simply unaware of the activity level in these markets," said Luke, a partner at Sora Ventures.

"Now everyone is racing against time, but in the Asian market, I believe very few can compete with Sora." In Luke's view, local regulations pose a significant barrier for many overseas capital sources, and most VCs lack complete experience in acquisitions and communication with regulators, making them unfamiliar with the Asian market.

Sora Ventures' strategy is to bring in a large number of local partners to help connect with stock exchanges and regulatory bodies to accelerate project implementation. In the case of South Korea's SGA, the team took less than a month from initial discussions to finalizing the deal, setting a record for the fastest acquisition in the history of the Korean stock exchange.

The financing rhythm and market strategy of the company are another barrier. "mNav is a late-stage valuation model that only becomes valid after Bitcoin accumulates to a certain amount. Early-stage companies have completely different strategies and premium logic compared to MicroStrategy." Thanks to equity structure designs like super voting rights, US DAT companies can ensure team control while continuously diluting equity.

However, Asian listed companies generally do not have such mechanisms, so the team's dilution space is relatively limited. This means the team needs to accurately grasp the financing rhythm while using cash flow from their main business to repurchase stocks for reverse dilution. It is understood that Thailand's DV8 has obtained relevant local licenses and will soon launch a cryptocurrency trading platform.

Currently, Sora is accelerating the finalization of an acquisition deal in the Taiwanese market while advancing the establishment of a second Bitcoin reserve company in Japan. In May of this year, the team acquired a 90% stake in the Hong Kong luxury distribution company Top Win, which will soon be renamed Asia Strategy. "Our goal is to create 9 to 10 'Metaplanets' in Asia and then integrate them into a US-listed parent company, allowing US stock market investors to indirectly gain exposure to the premium of Asian companies."

Top Win has participated in the acquisitions of Metaplanet, Hengyue Holdings, DV8, and SGA, and the company is about to complete its initial round of financing. Sora Ventures continues to adopt a "multiple players + small funds" model, with a total fundraising amount of less than $10 million and a 6-month lock-up period.

Luke hopes that Top Win will eventually present a capital layout of 30% holding in Asian companies and 60% in Bitcoin reserves, to tell investors a relatively different narrative. Of course, all of this is just the team's vision and story; whether the premium in the Asian market is sustainable and whether US stock market investors will buy into the Asian narrative remains to be seen by the market and time.

"It must be acknowledged that the Asian market has a high floor and a low ceiling; if one truly wants to achieve a certain scale, it can only be in the US stock market, which attracts investors and players from all over the world." Although investors are trying to chase the Alpha of Bitcoin reserve narratives in various countries, all investors share a consensus that the Beta sustaining everything still comes from the favorable drive of US regulation.

"If the legislation for Bitcoin as a national reserve truly materializes, the US government's purchasing behavior will drive other regional governments and sovereign funds to synchronize their allocations, and Bitcoin could continue to rise," Nachi said.

Saved by "Coin Stocks"

Compared to the bleak crypto market, the current DAT track appears particularly lively. This new wave not only captures attention but also seems to provide a "lifeline" for capital trapped in the crypto space. "Now, all the top 100 crypto projects by market cap are considering doing DAT," an investor told Beating.

From the end of 2024 to early 2025, most crypto VC funds will reach their maturity and begin a new round of fundraising, but poor DPI data has deterred many LPs. Since the beginning of the year, many crypto funds have been shutting down.

Since 2022, the valuations in the primary market of the crypto field have continued to swell, with many projects able to raise tens of millions of dollars in seed rounds, but very few have actual innovation and practical scenarios. With the development of cryptocurrency ETFs and the FinTech + Crypto sector, VCs have become the last choice for LPs to allocate crypto assets.

On the other hand, the shrinking market liquidity is also making it more difficult for projects to exit. Retail investors are no longer buying "VC coins," and at the same time, projects need to pay high costs for "listing." "Now, listing on top trading platforms generally requires giving up at least 5% of the token quota; based on a $100 million market cap, that cost is $5 million. Acquiring a shell company in the US is about the same price."

However, the open regulatory environment in the US has provided new hope. Cryptocurrency reserve companies not only found the best exit channels for tokens but also provided a new narrative for attracting institutional funds to the crypto space.

In addition to crypto VCs, mid-tier investment banks have also benefited from this wave. According to Bloomberg, DAT transactions occupy 80% of the work time for many mid-tier investment bank brokers, and it is expected that business in this field will grow by 300% before the end of the year.

Now, the industry is eager to move the $2 trillion cryptocurrency market into the US stock market. In less than two months, dozens of DAT companies have emerged in the market.

According to Pantera's vision, the DAT field will see significant consolidation within three to five years. As the downward trend arrives, small DAT companies that cannot achieve economies of scale will fall into a negative premium dilemma and be acquired by larger competitors at very low prices. "DAT is a 'new type of financial asset model experimental field,' not a center for technological innovation. In the end, only two or three companies will survive."

However, it seems that the music has just begun. Cosmo believes that it will take at least another six months for the track to reach a boiling point. "Ultimately, who will win is completely unknown; all we can do is support those teams we believe have the potential to become one of the 'two or three' in the future."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。