Author: @BlazingKevin_, the Researcher at Movemaker

In Polymarket, each prediction market is essentially a "probability exchange for future events," where users can express their judgment on an event by buying a specific option (e.g., "Trump will win the 2024 U.S. election").

Since buying into probabilistic events differs from common trading, the pricing and liquidity mechanisms initially used by Polymarket are also different from typical AMM algorithms. The pricing mechanism of Polymarket has undergone significant changes from its initial version to the present, initially adopting an AMM mechanism to provide real-time liquidity and pricing, called Logarithmic Market Scoring Rule, abbreviated as LMSR. This algorithm is also used by some other crypto protocols, such as Ethos.

Understanding the characteristics of LMSR helps to comprehend Polymarket's pricing mechanism during most periods, the reasons other protocols choose LMSR, and the rationale behind Polymarket's upgrade from LMSR to an off-chain order book.

Characteristics, Advantages, and Disadvantages of LMSR

What is LMSR?

LMSR is a pricing mechanism specifically designed for prediction markets that allows users to buy "shares" of a specific option based on their judgment, while the market automatically adjusts prices based on total demand. The most significant feature of LMSR is that it can complete transactions without relying on counter-parties; even if you are the first trader, the system can price and execute your trade. This gives prediction markets a "perpetual liquidity" similar to Uniswap.

In simple terms, LMSR is a cost function model that calculates prices based on the "shares" of various options currently held by users. This mechanism ensures that prices always reflect the expected probabilities of different event outcomes in the current market.

Core Formula of LMSR

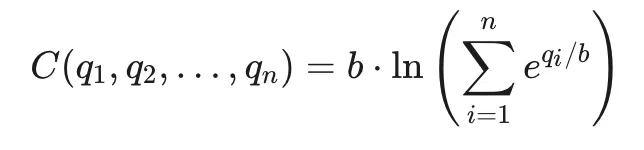

The cost function C of LMSR is calculated based on the number of shares sold for all possible outcomes in a market. Its formula is:

The symbols here represent:

- C(…): Cost function, indicating the total cost incurred by the market maker to maintain the current distribution of shares across all outcomes.

- n: Total number of possible outcomes in the market (e.g., for a "yes/no" market, n=2).

- qi: Represents the current purchased shares of the i-th option (can be understood as "voting rights" or "betting amounts").

- b: A liquidity parameter, where a larger value indicates a more "stable" market, and prices are less sensitive to new trades.

- C(q): Represents the cost to move the market from its current state to q.

The most important feature of this formula is that the sum of the prices of all outcomes equals 1 (∑Pi=1). When a user purchases a "yes" share, $q(YES) increases, causing P(YES) to rise while P(NO) falls, thus maintaining the total price sum at 1.

How is Pricing Generated?

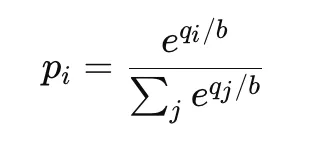

Another key point of LMSR is that the price is the marginal derivative of the cost function. That is, the price pi of the i-th option is the marginal cost you need to pay to buy one more unit of that option:

This means:

- If the purchase volume of a certain option increases (i.e., more people bet on it happening), its price will gradually rise;

- The final price will approach reflecting the market's subjective probability of each option occurring.

For example, in a "yes/no" binary prediction market, if most people buy "yes," then the price of "yes" may rise to 0.80, while "no" drops to 0.20, which is like saying "the market believes the probability of the event occurring is 80%."

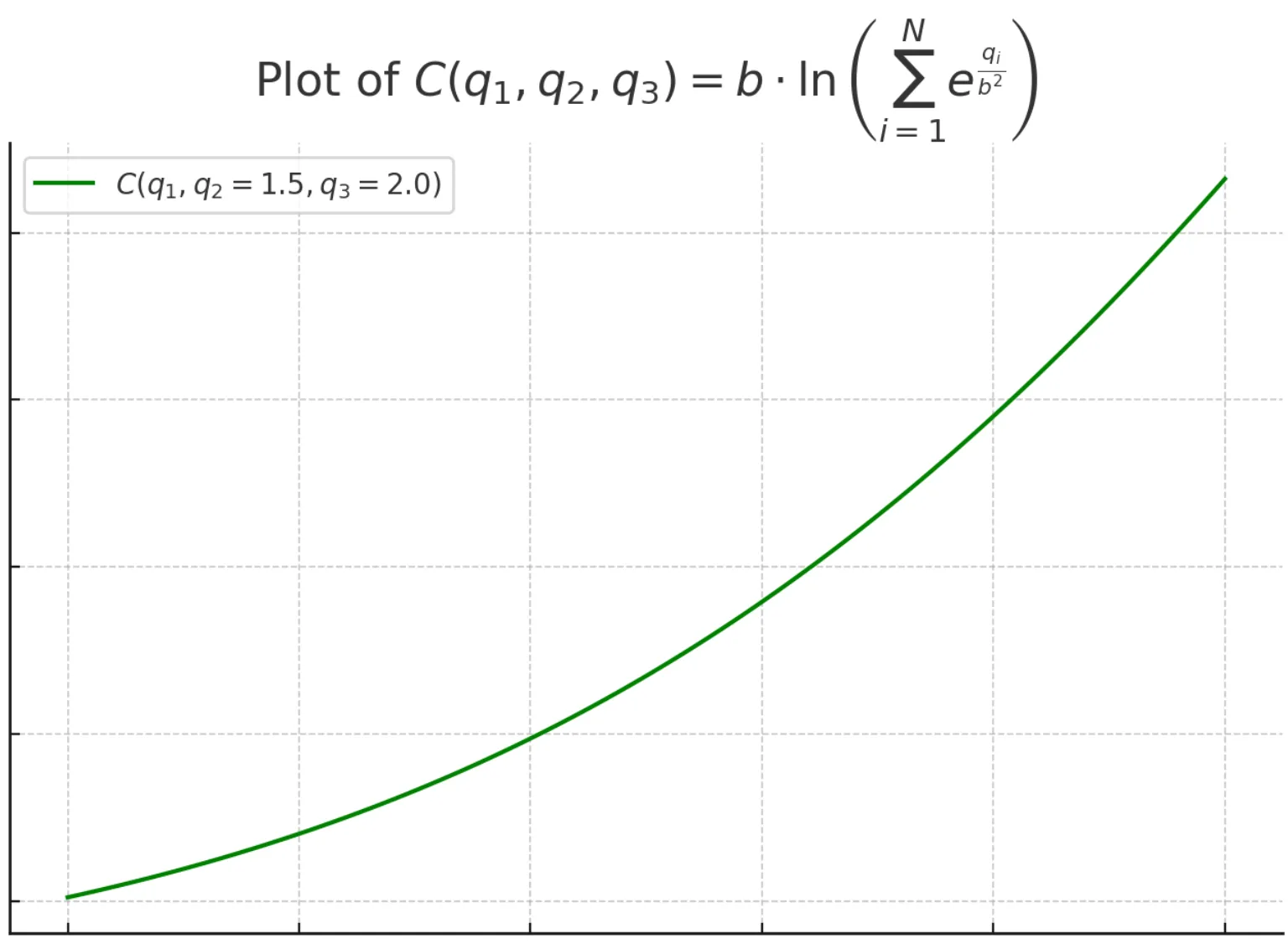

Moreover, regardless of the liquidity, the curve of the cost function always extends upwards. This means that the more shares purchased, the higher the total cost that needs to be paid.

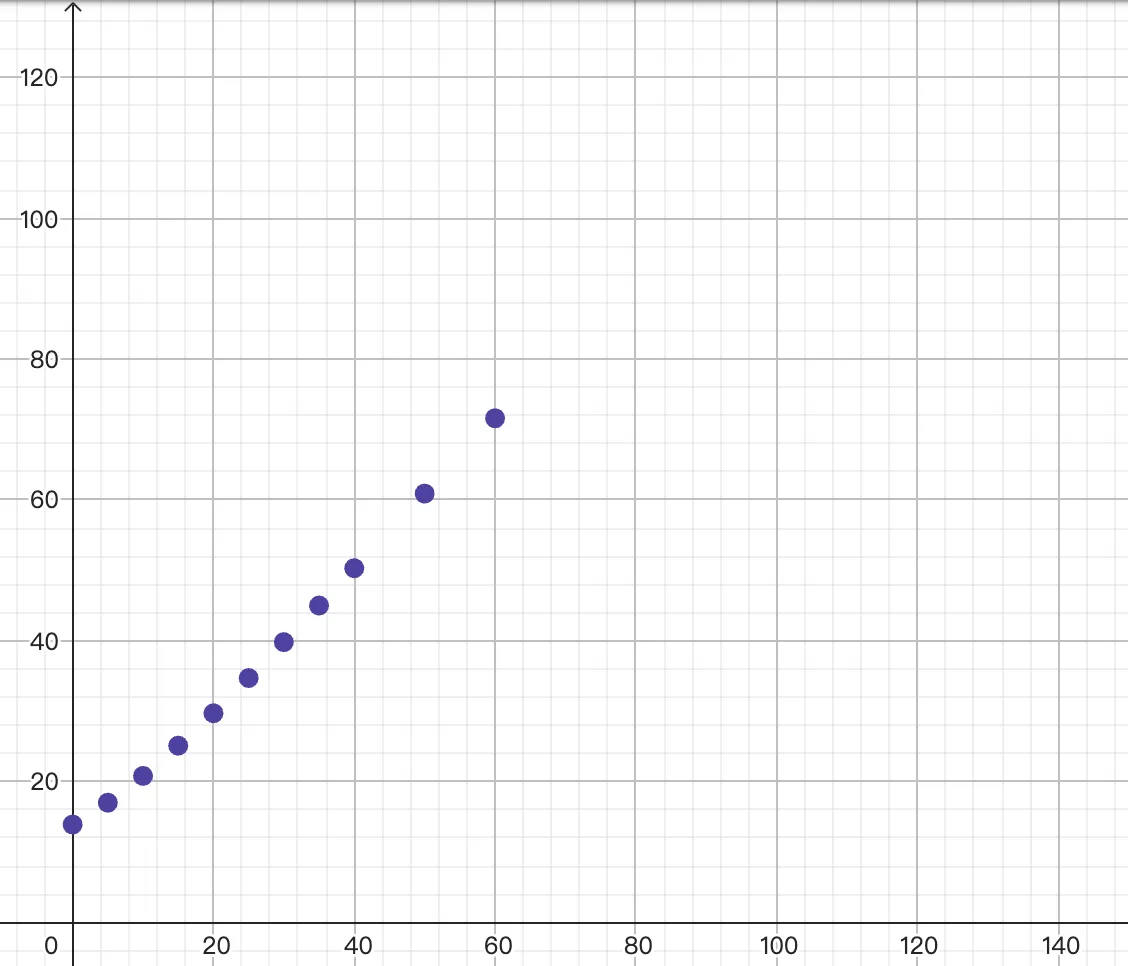

The Role of the Liquidity Parameter b: The size of the b value directly determines the "flatness" of the curve, which is the market's liquidity or "thickness."

- High Liquidity (left image, b=100): The curve is relatively flat. This means that even if you purchase a large number of shares, the price increase is relatively slow. Such a market can "absorb" large trades without causing significant price fluctuations.

- Low Liquidity (right image, b=20): The curve is very steep. This means that even a small purchase can lead to a sharp price increase. Such a market is very sensitive and has poor liquidity.

High liquidity (large b value) acts like a "buffer," allowing the market to absorb greater purchasing power without significant price changes (flat curve); low liquidity is very sensitive (steep curve).

Trade-offs of LMSR Mechanism and Polymarket's Paradigm Shift

Before discussing Polymarket's evolution to an order book model, it is necessary to analyze the LMSR mechanism it adopted in its early days. LMSR is not a simple technical option but a set of underlying protocols with a clear design philosophy and inherent trade-offs, which determine its historical positioning at different stages of prediction market development.

Core Mechanism and Design Trade-offs of LMSR

The fundamental design goal of LMSR is information aggregation, rather than market maker profit. It solves the most challenging "cold start" problem for prediction markets through an automated mathematical model, providing liquidity when there is a lack of trading counterparties in the early stages.

1. Advantage Analysis: Unconditional Liquidity Supply and Controllable Market Making Risk The core contribution of LMSR is that it ensures there is always a counterparty for trades at any point in time. Regardless of how unpopular or extreme the market view is, market makers can always provide a buy or sell quote. This fundamentally resolves the dilemma of traditional order books being unable to execute trades due to thin liquidity in early markets.

Correspondingly, the potential maximum loss for market makers providing this "unlimited" liquidity is predictable and bounded. The maximum loss is determined by the liquidity parameter "b" and the number of market outcomes "n," with the formula "Maximum Loss = b⋅ln(n)." The certainty of this risk makes the cost of sponsoring a prediction market controllable, eliminating the risk of unlimited losses, which is crucial for protocols or organizations needing to launch new markets.

2. Inherent Defects: Static Liquidity and Non-Profit Orientation However, the advantages of LMSR also bring about its insurmountable structural defects.

- The b Parameter Dilemma and Static Liquidity: This is the most critical constraint of LMSR. The liquidity parameter "b" is set when the market is created and usually remains unchanged throughout the market's lifecycle. A large "b" value means deep liquidity and stable prices but slow response to new information; a small "b" value means price sensitivity and quick aggregation of views but a fragile and volatile market. This static setting prevents the market from adaptively adjusting its depth and sensitivity based on actual changes in liquidity and information flow.

- The Subsidy Role of Market Makers: The theoretical mathematical expectation of the LMSR model is a loss. The losses of market makers are seen as the "information cost" they pay to obtain the collective wisdom of the market (i.e., the final accurate price formed by all trades). This positioning determines that it is essentially a system subsidized by the initiators, unsuitable for profit-seeking market maker models, and difficult to build a profitable ecosystem involving numerous decentralized LPs.

Moreover, when implemented on-chain, the logarithmic and exponential calculations involved consume more Gas compared to the common arithmetic operations in DEX, further increasing transaction friction in a decentralized environment.

Paradigm Shift: The Logical Necessity of Polymarket Abandoning LMSR

In summary, LMSR is an efficient and practical tool in the early stages of the platform when liquidity is scarce. However, as Polymarket's user and capital volume surpasses a critical point, its design that sacrifices efficiency for liquidity becomes a constraint on development. Its transition to an order book model is based on the following strategic considerations:

- Fundamental Demand for Capital Efficiency: LMSR requires market makers to provide liquidity across the entire price range from 0% to 100%, leading to a large amount of capital being tied up at price points with very low transaction probabilities, resulting in low capital efficiency. The order book allows market makers and users to concentrate liquidity precisely in the most active price ranges, which aligns closely with professional market-making strategies.

- Optimization of Trading Experience: The algorithmic characteristics of LMSR mean that any size of trade inevitably generates slippage. For markets with increasingly thick liquidity, this inherent trading friction can hinder the entry of large funds. In contrast, mature order book markets can absorb large orders through dense counterparty depth, providing lower slippage and a better trading experience.

- Strategic Need to Attract Professional Liquidity: The order book is the most common and familiar market model for professional traders and market-making institutions. Transitioning to an order book signifies that Polymarket is sending a clear invitation to professional liquidity providers in the crypto world and even traditional finance. This is a crucial step for the platform in moving from attracting retail participation to building professional-grade market depth.

Current Pricing and Liquidity Mechanism of Polymarket

Polymarket's upgrade is an inevitable choice after its user scale and platform maturity reach a critical point. Behind this transition is a systematic consideration of its goals regarding trading experience, Gas costs, and market depth. Its current architecture can be analyzed from two aspects: liquidity mechanism and price anchoring logic.

Hybrid Model of On-Chain Settlement and Off-Chain Order Book

Polymarket's liquidity mechanism adopts a hybrid architecture that combines on-chain and off-chain elements, aiming to balance the security of decentralized settlement with the smooth experience of centralized trading.

- Off-Chain Order Book: Users' limit orders are submitted and matched on off-chain servers, allowing for instant operations with no Gas costs. This makes Polymarket's trading experience similar to that of centralized exchanges, where users can intuitively see the market depth (buy and sell orders) formed by all limit orders. Liquidity thus comes directly from all trading participants themselves, rather than from passive liquidity pools.

- On-Chain Settlement: When buy and sell orders in the off-chain order book are successfully matched, the final asset delivery step is executed on the Polygon chain via smart contracts. This "off-chain matching, on-chain settlement" model retains the flexibility of the order book while ensuring the finality of trading results and the immutability of asset ownership. The displayed "price" is the midpoint between the best buy and sell prices in the off-chain order book.

Underlying Logic of Price Anchoring—Share Minting and Arbitrage Cycle

For prediction markets, the core mechanism is how to ensure that the total probability of the two outcomes, "yes" (YES) and "no" (NO), equals 100% (i.e., "$1"). The order book model itself does not enforce limit order prices through code but relies on a sophisticated underlying asset design and arbitrage mechanism to utilize the market's self-correcting power, ensuring that the total price always converges towards "$1."

1. Core Foundation: Complete Share Pair Minting and Redemption The cornerstone of this mechanism is an unshakeable value equation established at the Polymarket contract layer.

- Minting: Any participant can deposit "$1" USDC into the contract and simultaneously receive 1 YES share and 1 NO share. This operation establishes the underlying value anchor of "1 YES share + 1 NO share = $1."

- Redemption: Similarly, any participant holding 1 YES share and 1 NO share can combine them and return them to the contract at any time to redeem "$1" USDC.

This two-way channel ensures that the total value of a complete outcome is firmly anchored at "$1."

2. Price Discovery: Independent Order Book Trading Based on the above foundation, YES shares and NO shares act as two independent assets traded against USDC on their respective order books. Participants can freely place limit orders at any price, with no restrictions from the protocol layer. This free pricing mechanism inevitably leads to price deviations, creating opportunities for arbitrageurs.

3. Price Constraint: Market-Based Arbitrage Correction The profit-seeking behavior of arbitrageurs (usually automated bots) is key to ensuring price reversion. Once the sum of the trading prices of YES and NO shares deviates from "$1," a risk-free arbitrage window opens.

- When "P(YES) + P(NO) > $1" (e.g., "$0.70 + $0.40 = $1.10"): Arbitrageurs will execute a "mint-sell" operation: depositing "$1" into the contract, minting 1 YES and 1 NO share, and then immediately selling them on the order book at "$0.70" and "$0.40," respectively, earning a risk-free profit of "$0.10." This behavior occurs frequently, increasing selling pressure in the market, driving the prices of YES and NO down until their sum returns to "$1."

- When "P(YES) + P(NO) < $1" (e.g., "$0.60 + $0.30 = $0.90"): Arbitrageurs will execute a "buy-redeem" operation: buying 1 YES and 1 NO share on the order book at "$0.60" and "$0.30," respectively, then combining them and returning them to the contract to redeem "$1," earning a risk-free profit of "$0.10." This behavior increases buying demand in the market, driving the prices of both shares up until their sum returns to "$1."

The essence of this mechanism's design is that the protocol itself does not act as an arbiter but establishes a solid value anchor and open arbitrage channels, allowing the profit-seeking behavior of market participants to become the decisive force in maintaining the system's price stability.

The Possibility of Polymarket's Integration with DEX

Polymarket's choice to upgrade from AMM to an order book model is driven by the explosive increase in platform users, ample liquidity, and the fact that the order book experience is not poor; on the other hand, the upgraded pricing mechanism is more suitable for professional market makers.

With X officially announcing a partnership with Polymarket, Polymarket has also become the official prediction market for X. The asymmetrical user base between Polymarket and X will undoubtedly bring further new users to the former. In this process, Polymarket will also form an asymmetry in user base with crypto protocols, as user traffic will flow into the crypto industry through X and Polymarket.

Under this premise, we need to consider the new possibilities between Polymarket and crypto protocols, and further, the potential integration of Polymarket with DEX.

First, Polymarket provides native and efficient risk hedging tools for DEX ecosystem participants. Asset holders and LPs in DEX generally face exposure to impermanent loss, protocol risk, or macro volatility. Traditional hedging tools feel disjointed in DeFi, while Polymarket's event contracts can serve as a "mirror layer" for their risk pricing. For example, prediction contracts regarding "whether a certain stablecoin will de-peg" or "whether a certain protocol upgrade will succeed" can be directly used by DEX users to hedge potential losses in their on-chain positions. This model transforms risk management from passive absorption to active allocation, becoming a combinable financial "building block" in the DeFi ecosystem.

Secondly, the price data from prediction markets can serve as high-value leading indicators for centralized liquidity management in DEX. In concentrated liquidity models like Uniswap V3, the capital efficiency of LPs is positively correlated with risk, and the speed of response to market changes determines their profitability. Real-time odds on key events in Polymarket essentially represent the market's collective consensus on future probabilities, and their fluctuations often precede price movements of on-chain assets. Automated strategies can capture this leading signal to dynamically adjust LP's position ranges—widening the range or withdrawing when risk probabilities increase, and narrowing the range when certainty strengthens. This will transform LPs from passive liquidity "sandbags" into proactive, probability-based risk managers.

Furthermore, by linking core indicators of DEX with the outcomes of Polymarket events, entirely new structured financial products can emerge. The growth of protocols needs to be deeply tied to community interests, and Polymarket provides a transparent and fair external verification mechanism for this purpose. Protocols can design a "conditional" revenue distribution model: for example, linking the distribution of most trading fees to the outcome of the event "Can this quarter's trading volume exceed N hundred million dollars" on Polymarket. If the result is "yes," then stakers share the excess profits; if "no," the profits are used for buyback and destruction. This design transforms the protocol's KPIs into financial products that the community can directly participate in, creating a more direct community of interests and a closed loop of value capture.

In summary, the integration of Polymarket with DEX is not merely a simple functional overlay but a deep embedding at the infrastructure level. Polymarket is evolving into a "risk pricing layer" and "information oracle" for the entire crypto industry. As the traffic brought by X gradually permeates, its integration with foundational protocols like DEX will no longer be optional but a key variable determining whether the future DeFi ecosystem can move towards greater efficiency, maturity, and resilience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。