Original | Odaily Planet Daily (@OdailyChina)

On July 29 at 6 PM, the stablecoin USD1 experienced a brief de-pegging, dropping to a low of 0.9934 USDT, deviating from its 1:1 dollar peg. Subsequently, the price of USD1 gradually rebounded, stabilizing at 0.9984 USDT as of now. This brief fluctuation has attracted market attention.

The Truth Behind USD1's De-pegging

From the current discussions and speculations within the community, the direct trigger for this de-pegging event may be closely related to the IKA Launchpad event initiated by Gate Exchange on July 26. This event offered a total of 200 million IKA tokens for subscription, allowing users to participate using USD1 or Gate's native token GT, with a subscription price set at 1 IKA = 0.001424 GT = 0.025 USD1. According to data disclosed by Gate, as of July 28, the total subscription amount for the USD1 pool had already exceeded 200 million dollars. Such a large-scale subscription volume indicates strong market enthusiasm for the IKA project, but it may also lay the groundwork for selling pressure on USD1.

We note that the IKA subscription event officially ended at 1 PM on July 29. Looking at the price trend, the initial drop of USD1 began shortly thereafter and continued until around 6 PM that afternoon. This timeline closely aligns with the de-pegging event, further confirming the possibility that "funds flowing out after the event's conclusion led to a surge in selling pressure." Some participating users may have chosen to quickly liquidate their USD1 after completing their subscriptions, resulting in concentrated selling.

USD1 is issued by World Liberty Financial (WLFI), which officially positions it as a "low-volatility digital asset option," aiming to provide users with a stable medium for cryptocurrency transactions through a 1:1 peg to the dollar. According to its white paper and audit report, the reserve assets of USD1 mainly include U.S. short-term government bonds and dollar deposits, theoretically providing strong redemption capability and price anchoring mechanisms.

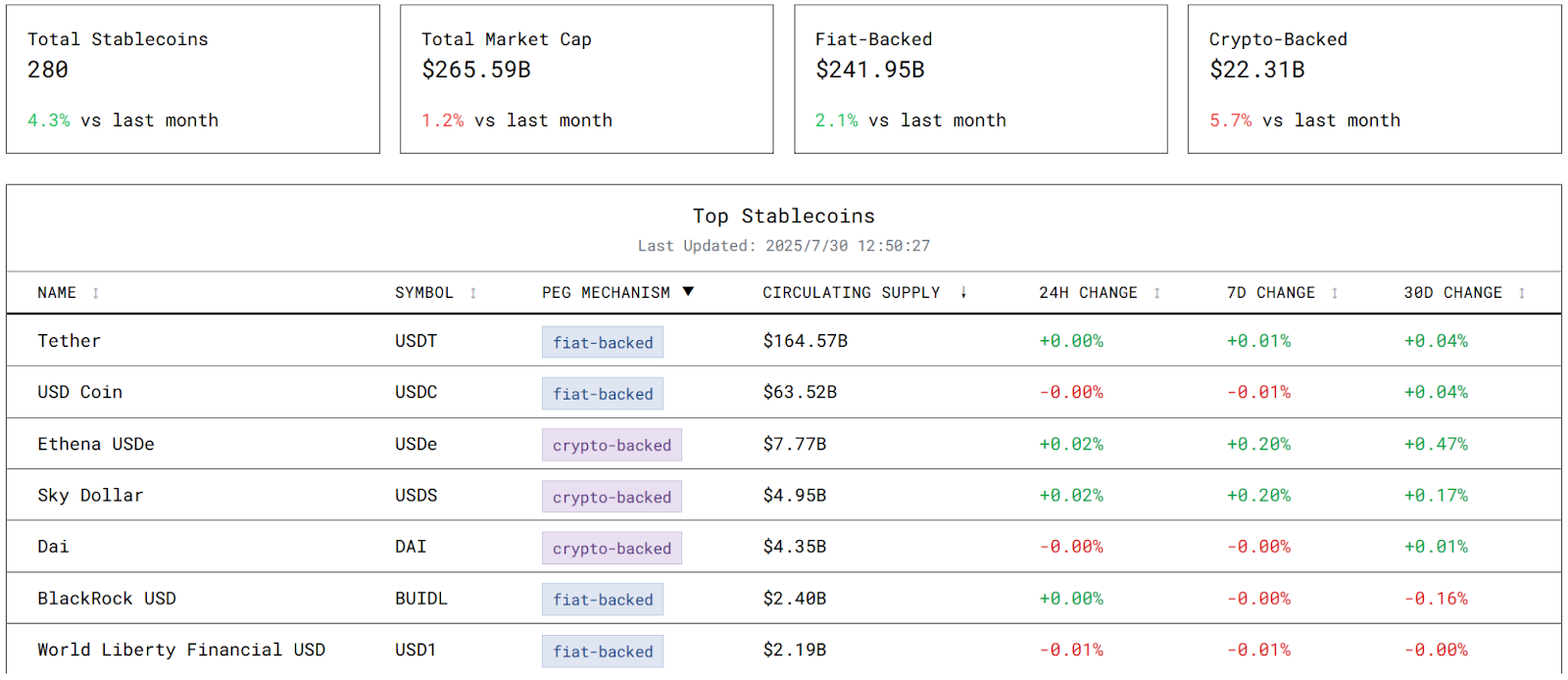

However, from a more macro perspective, this de-pegging exposes the vulnerability of small to medium-sized stablecoins under high-intensity capital movements. According to data from stablecoins.asxn.xyz, the current total market size of stablecoins has reached 265.59 billion dollars, with USDT holding an absolute leading position at 164.57 billion dollars, while the circulation size of USD1 is only 2.19 billion dollars, accounting for about 1.3%. In absolute terms, such a market size is insufficient to bear large-scale application pressure, let alone the sudden influx and rapid exit of 200 million dollars in subscription funds. For USD1, this is not just a practical test but more like a passive stress test.

Backed by Trump, Resource Advantages Emerge

At present, although USD1 experienced a brief de-pegging during this event, it also confirms its advantages in terms of market resources from another perspective. Unlike traditional stablecoins that rely on self-rolling growth paths within on-chain ecosystems, USD1 is backed not only by the financial resources of World Liberty Financial but also by the political and capital network of the Trump family as endorsement. Because of this, USD1 has been able to quickly enter fundraising, transaction settlement, and Launchpad phases of various crypto projects, becoming a "strategic stablecoin" option that more and more platforms are willing to guide users to use.

However, having "backers" does not mean "no worries ahead." The de-pegging lesson from the IKA Launchpad event has fully demonstrated that market recognition of resource backgrounds cannot replace the verification of mechanism security. When USD1 becomes a key entry point in crypto applications, its own pressure resistance, liquidity design, and user confidence mechanisms are the true determinants of whether it can be "used" in the long term.

Especially when facing liquidity shocks of hundreds of millions of dollars in a short period, the issues exposed by USD1 deserve high attention from WLFI. The political halo of the Trump family can bring repeated attention dividends, but only by transforming attention into use cases and solidifying use cases into ecological inertia can USD1 potentially grow from an empowered chip into a strong participant in the stablecoin landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。