📌 Binance HODLer 空投第 29 期 | Treehouse @TreehouseFi $TREE 项目简析 & 投资分析——

“DeFi 的固定收益市场,终于来了。”

看到 Treehouse 上线的时候我第一时间想到的就是这句话!

如果你像我一样,早期玩过很多高 APY 却不可持续的 DeFi 协议,一定会发现一个问题:链上收益波动太大,无法定价。

TradFi 固收市场的体量是股票市场的 5 倍,而 DeFi 固收几乎还是空白。

Treehouse 正是为了解决这个问题而生的,而 $TREE 就是整个链上固定收益协议的核心驱动。

1️⃣ Treehouse 是什么?它想干嘛?

简单说,Treehouse 就是在为 DeFi 建一整套「固定收益」市场基础设施。

它的核心有两个产品:

tAsset(tETH):类似 LST,但内建套利策略,提供“更稳健”的链上收益工具。

DOR(Decentralized Offered Rate):一个链上的基准利率机制,有点像链上版 SOFR / LIBOR。

听起来像是“传统金融在链上的翻版”?

是的!

但这套东西放在链上,意义就变了:它不止于产品,而是可以支持一整个 DeFi 固收市场的底层利率基础设施。

所以我认为:Treehouse 是把 TradFi 的「$6 万亿市场」平移上链的尝试。虽然很早期,但格局很大,结构上也做得非常严谨。

2️⃣ TREE 代币机制:不是纯激励币,而是「利率协议的燃料」

$TREE 代币的定位并不是简单的空投激励币,而是一个串联 tAsset 与 DOR 的激励&治理中枢。

其主要用途包括:

1)参与 DOR 预言 & 共识机制(质押 / 投票 / 分润)

2)收集查询费用(类似 “链上利率预言机”)

3)DAO 治理与生态资助(治理/激励兼顾)

4)如果 DOR 能成为链上标准利率协议,TREE 的需求将具备一定粘性和不可替代性。

所以不是 narrative-only 的“发币仪式”,而是一套「机制嵌入」设计的代币系统。

3️⃣上币 & 空投情况:HODLer 空投 + TGE 多平台同步上线

Binance HODLer 空投已经到了钱包,目前确认上线平台包括:Binance、Bybit、KuCoin、MEXC、HTX、OKX(还有更多待公布)

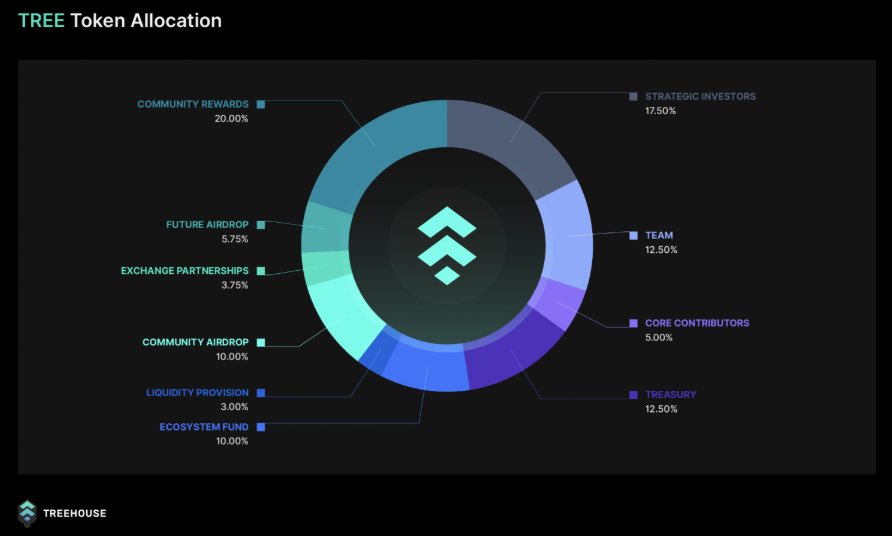

代币经济方面,初始流通占比不到 20%,其中一半是分发给忠诚用户的空投代币;投资人 / 团队全部锁仓 6 个月,早期抛压极小;

这一系列设计说明了一个信号:项目方对 TGE 表现和二级价格非常有信心。

4️⃣关于空投领取和质押?

空投领取开放中!

只要你参与过 GoNuts S1 或持有 Treehouse Squirrel Council(TSC)NFT,就可以到 Gaia 官网查看资格、领取代币:

查询入口:http://gaiafoundation.xyz

然后其实仔细分析会发现,Tree 的质押机制是“合理 + 高收益”的代表:质押进 panelist vault 可获得50–75% APR 的年化回报;

所有奖励来自系统的真实收入+生态释放,不是“印币刷钱”,再考虑到 $TREE 的初始流通和实际用户参与度——

这是一个“正收益、低释放”的组合,用空投币换“持续收益权”,这笔账很好算。

5️⃣价格分析:

短期有空间,中期看 narrative 能否持续。

目前 Binance Alpha 报价在 $1 - $1.2 区间浮动,Spot 开盘若按这个价格上限推算,空投收益 + 质押 APR 的综合收益率极具吸引力。

再叠加早期解锁压力低、TGE 多平台同步、DeFi 固收 narrative 稀缺等因素——

短期价格表现有望继续高波段震荡,若生态能顺利上线更多 tAsset 和协议接入 DOR,TREE 有机会从一次空投走向一个「赛道叙事锚点」型资产。

Treehouse 是我近期少见愿意深度参与的协议之一,不只是因为它是“币圈第一次认真做固定收益”,也因为它让我看到了:DeFi 不只为博弈者而生,它也可以为“长期有耐心的人”提供真正有支撑的回报。

如果说 LDO 改变了以太坊质押格局,那么 TREE 正在开启链上固定收益的新时代。

期待上线后的更好表现!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。