JPMorgan believes that although Labubu's search popularity has declined by 5% from its peak, this is not a signal of waning interest, but rather a normal phenomenon in the development process of a hit IP. The lifecycle of top IPs can last for decades, such as Mickey Mouse for 97 years and Hello Kitty for 51 years. Additionally, Labubu's collaboration T-shirts with Uniqlo are set to be released, and the animated series "Labubu and Friends" will premiere this summer.

Written by: Long Yue

Source: Wall Street Insights

The recent decline in the popularity of the trending IP Labubu has caused market jitters, but an analysis from an investment bank suggests that this may just be a false alarm.

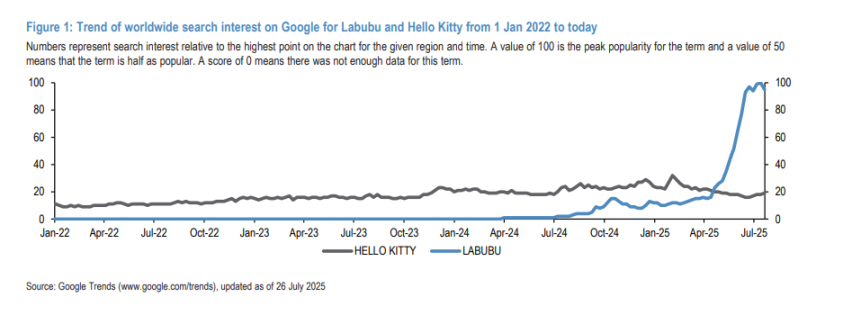

For investors in Pop Mart, any fluctuations regarding its IP Labubu are closely watched by the market. Recently, its global Google search index fell by 5% from its peak, raising concerns about whether its growth myth can continue.

However, according to news from the trading desk, JPMorgan has clearly stated in its latest research report that such fluctuations are a normal phenomenon in the lifecycle of a hit IP, rather than a dangerous signal of declining popularity. The lifecycle of top IPs can last for decades, such as Mickey Mouse for 97 years and Hello Kitty for 51 years, while ordinary IPs only last 6-24 months. An initial surge in popularity indicates a longer lifecycle.

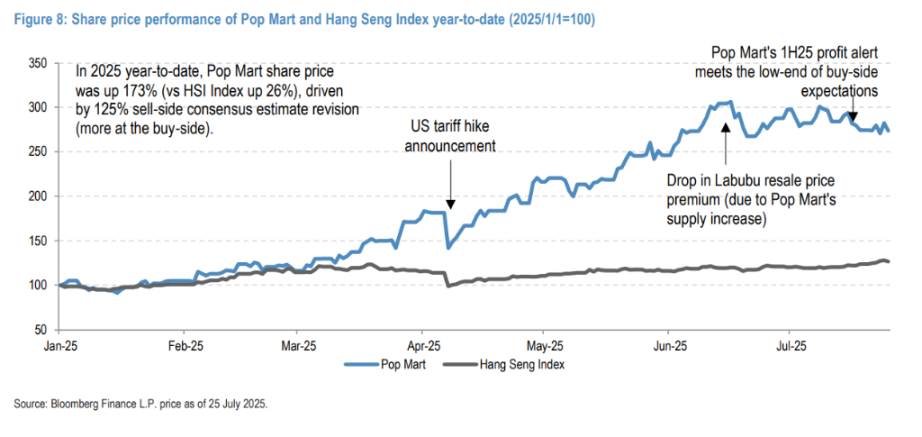

This viewpoint comes in the context that since the strong half-year performance forecast released on July 15, Pop Mart's stock price has fallen by 7%, while the Hang Seng Index has risen by 3%. The market attributes this performance to the fact that, despite impressive growth—over 200% increase in sales and over 350% increase in net profit in the first half of the year—it only reached the lower limit of some buyers' expectations. Meanwhile, the decline in Labubu's resale prices and search popularity has also heightened investor anxiety.

JPMorgan has countered this pessimistic view. Analysts Kevin Yin and Yibo Wu emphasized in the report that for a newly popular IP, the search index is an effective leading indicator of new user acquisition speed, but it may not be directly linked to continuous sales. Once a brand establishes widespread recognition, consumers often go directly to shopping platforms, leading to a natural decline in search volume.

Search Popularity Declines but Remains in Leading Position

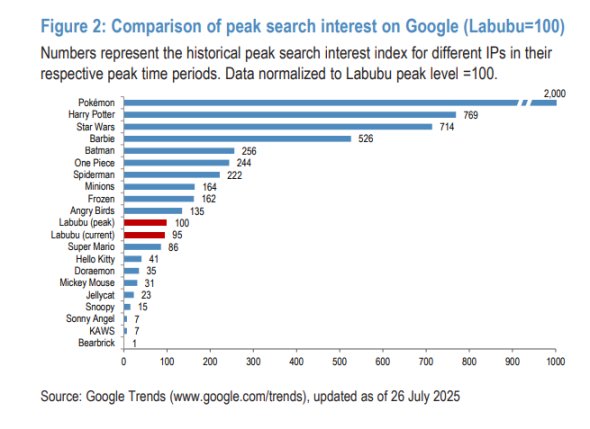

Although Labubu's search index has dropped by 5% from its peak on July 13, this has not shaken its leading position in the trendy toy sector.

JPMorgan's data shows that even after the decline, Labubu's current search index is still 13 times that of KAWS and Sonny Angel, 3 times that of Doraemon, and 2.5 times that of the classic IP Hello Kitty.

The bank believes that when an IP quickly becomes popular, new consumers will search to learn about, discuss, and share it, thereby boosting the search index. However, once brand recognition reaches a certain threshold, loyal fans and repeat customers will tend to make purchases within e-commerce apps rather than through search engines. Therefore, a decline in the search index can occur simultaneously with sustained sales growth.

Learning from History: The Experience Curve of Hello Kitty

Historical data provides strong support for this viewpoint. JPMorgan conducted a retrospective analysis of the Hello Kitty case. The data shows that in the fiscal year 2013, when Hello Kitty's search index fell from a peak of 55 to 37 in the fiscal year 2014, its parent company Sanrio's sales growth slowed from 30% to 20%, but still maintained positive growth.

The research found that a year-on-year decline in IP sales typically occurs after the search index drops to a certain "critical level" far below its peak. In the case of Hello Kitty, this critical point was 21% of the peak.

Additionally, the report mentioned Pokémon, whose search index in 2023 was only 15% of its peak in 2016, yet its global merchandise trading volume (GMV) was three times that of 2016. This indicates that for mature IPs, the correlation between search popularity and commercial value gradually weakens.

Supply Bottlenecks and Six Potential Catalysts

In addition to demand-side analysis, the report also reveals the current situation on the supply side. JPMorgan recently communicated with a leading toy manufacturing supplier and learned that due to more IP brands moving their supply chains out of China, overseas global toy OEM capacity is currently in a state of shortage. This has directly led to continued shortages of popular products like Labubu and Crybaby.

As capacity bottlenecks ease, its growth potential is expected to be further released. JPMorgan reiterated its "overweight" rating on Pop Mart and considers it a top choice in the industry.

Looking ahead, JPMorgan listed six potential catalysts, including the upcoming release of the 2025 first-half financial report in mid-August, the launch of Labubu's collaboration T-shirts with Uniqlo, the premiere of the first season of the animated series "Labubu and Friends" this summer, and the potential launch of the Labubu 4.0 series before the end-of-year holidays. These concentrated operations and product releases are expected to provide sustained momentum for Pop Mart's growth story.

- 2025 first-half performance release (mid-August);

- Two newly opened "POPOP" jewelry stores will sell Labubu and Crybaby products;

- The first season of "Labubu & Friends" animation will premiere this summer (20 episodes of 2-minute videos);

- Labubu x Uniqlo T-shirts will be launched in August;

- Labubu 4.0 preview/release before Christmas/Spring Festival holidays;

- Possible launch of interactive/AI toys.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。