Bitcoin mining firm Mara Holdings (Nasdaq: MARA) has raised $950 million by issuing interest-free senior convertible notes to private qualified investors, according to a Monday press release. The funds will be used to purchase “additional bitcoin and for general corporate purposes.”

Mara (formerly Marathon Digital Holdings) tips the scales at $5.98 billion in market capitalization, making it the world’s largest bitcoin ( BTC) mining firm. The company is also the second largest bitcoin holder among publicly listed entities, boasting a stash of 50,000 BTC at the time of writing. Mara is only second to Strategy, which currently holds a dizzying 607,770 BTC, more than twelve times Mara’s bitcoin balance.

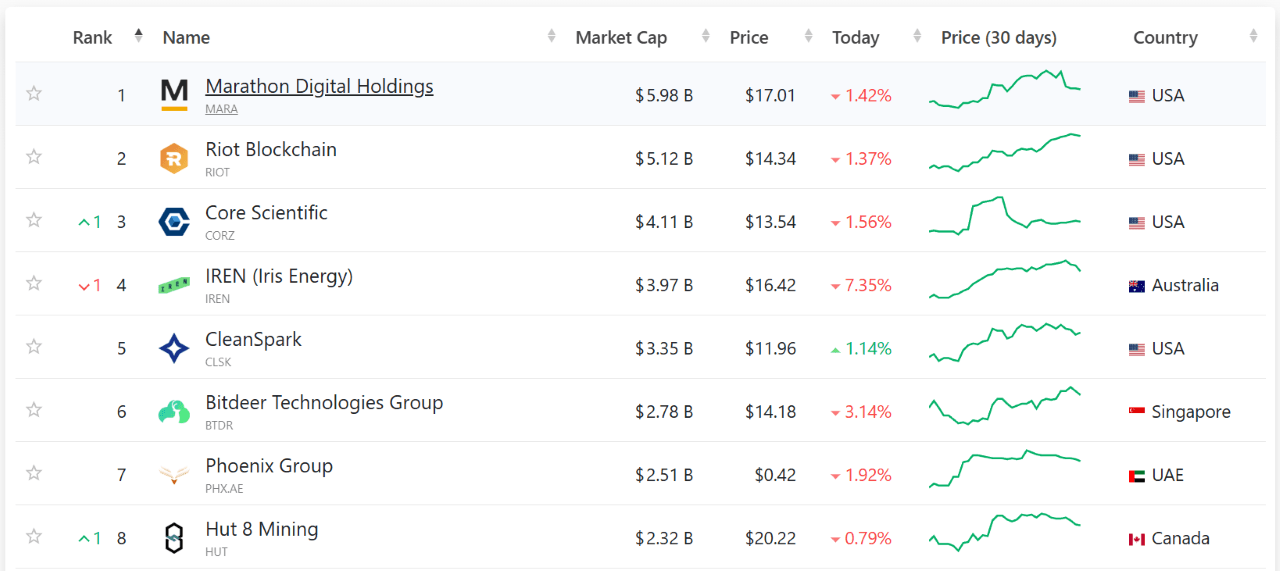

(Mara holdings is the largest bitcoin mining firm in the world by market capitalization / companiesmarketcap.com)

But now, armed with almost a billion dollars in capital, the largest bitcoin miner may be seeking to close in on the lead Strategy has created. Its sizeable BTC holdings have even sparked speculation that Mara has morphed into a bitcoin “shadow bank” that augments its returns by lending out the cryptocurrency for a fee.

“MARA is building a shadow bank powered by bitcoin,” said one X user quoted in a July 18 article on Bitcoin.com. “In Q1 2025, they had ~47,531 BTC on the balance sheet. Instead of selling into the market, they lent out ~14,269 BTC to institutions.”

Mara is not a financial institution, but it’s possible that, like other companies such as Metaplanet, the mining giant may end up making a full pivot to a bitcoin treasury strategy.

“The net proceeds from the sale of the notes were approximately $940.5 million,” the release states, before listing several expenses the firm will have to pay after the fundraising effort. “Mara expects to use the remainder of the net proceeds to acquire additional bitcoin and for general corporate purposes.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。