The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

Finally, we have reached the end of July. For me, Lao Cui, the entire month has been a theme of losses. Looking solely at contracts, the overall situation has only recovered half of the losses. Making profits from shorting is akin to snatching food from a tiger's mouth; the brief success is also nerve-wracking. This is the main reason I haven't published much in the past couple of days. My focus has returned to myself. Starting today, I will temporarily abandon my personal layout and shift my focus back to the market. Many friends have questions regarding tariffs, and more and more coin friends are questioning the tariff issues in the EU and Japan. Why, despite tariffs increasing by nearly 15%, is the overall economic trend generally one of growth? It's easy to understand for bulk commodities, as the fluctuation in tariffs will inevitably lead to an increase in essential products. This growth is more reflected at the tariff level, while the actual producers and intermediaries are further reducing profits. Today, I will briefly discuss the pros and cons of tariffs and their impact on the trends in the cryptocurrency space.

The purpose of tariffs is simply to eliminate trade discrepancies, at least to achieve a subtle balance. The strategy of relaxing restrictions on chips and graphics cards reveals some clues. Additionally, the agreements between the EU and Japan are more about negotiation leverage in US-China talks. These two not only impose a 15% tariff but also made investments in the US, which looks more like a protection fee. So why, during the period of increased tariffs, is the entire stock market performing robustly? In fact, this vibrant feeling is more of an illusion. Before tariffs are raised, there is often a crazy stockpiling period. Foreign trade will show a retaliatory increase in a short time, which is why the US's non-farm employment data and other indicators are performing increasingly well. Thanks to the US's strategy of bringing manufacturing back, there is a certain degree of compromise among countries. Whether it's TSMC, ASML, or local Apple, there are signs of repatriation.

However, the employment data in the US is not primarily provided by the manufacturing sector. Most investments are speculative in nature. For example, Japan and the EU are expected to provide nearly 100,000 jobs, but these have not yet materialized. More technical talent is flowing in first, while the service and trade sectors are seeing a surge in job openings. The US is using traditional methods, targeting the financial sector and intellectual property, but these are no longer effective in curbing its perceived adversaries. Tariffs are more of a trump card effect. Trump's idea is quite simple: unilaterally increase tariffs, and then through stablecoin legislation, increase the inflow of US dollars to stimulate domestic capital circulation. It seems like a genius idea, but the actual implementation is very difficult. Manufacturing appears to have no technical content; it is entirely a replicable model. The timeline for future negotiations also indicates that we will soon be negotiating with ASEAN, and all of this is leverage at the negotiation table.

This round of tariff negotiations will be extremely important. After resolving the previous two issues, the current manufacturing system in the US may be affected to some extent. What the US wants to express is very straightforward: if we cannot reach an agreement, it may lead to manufacturing shifting to ASEAN. The initial negotiations were able to delay tariffs due to the role of rare earths, with both sides making certain compromises regarding what they lack. The pain points have basically been resolved. From domestic news, the heat has already subsided, and everyone should be able to understand this correctly. Challengers on the path of struggle will inevitably face some losses. The US's initial idea was to impose about 25% tariffs on Europe, South Korea, and Japan, and now it has been discussed down to 15%, which is already considered a short-term benefit. As for us, it is 35%, and the final result will depend on this negotiation, which is unlikely to differ significantly. It is likely that US debt, dollar holdings, and other aspects will require detailed discussions.

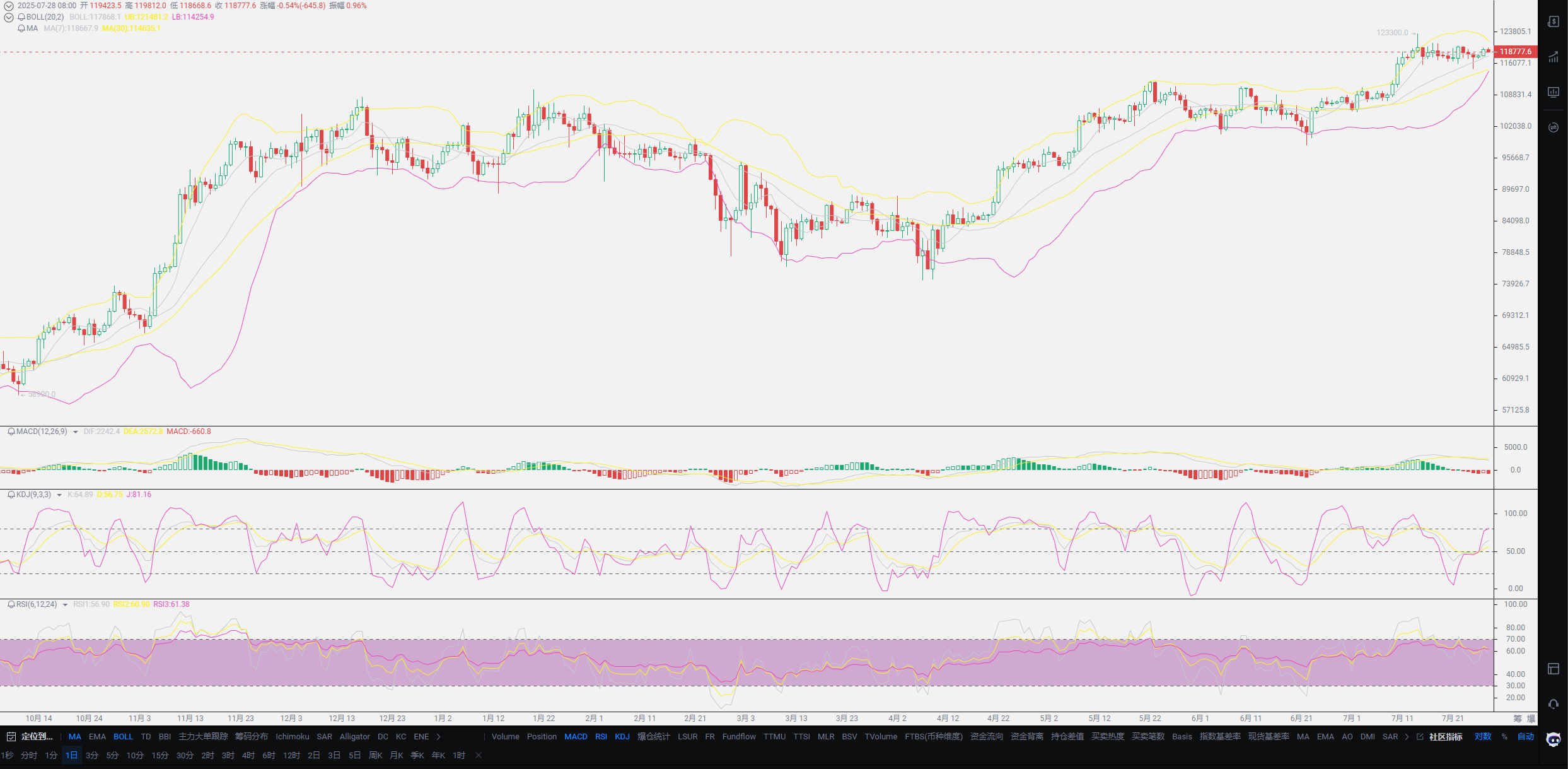

If the final tariff is below the previously estimated 35%, it will still stimulate the economy in the short term. After the talks, there will also be a certain amount of time for a buffer, similar to Huawei's chips, which may have a few months of stockpiling time. From the perspective of the overall financial environment, it is merely a boomerang on the timeline, and it will eventually feedback into finance. If both sides impose tariffs, it will inevitably trigger a new round of inflation; we won't speculate on advanced strategies. Just after we finish discussing tariffs, the US's data will also be released, and this data will certainly be favorable for the US, so it may determine the date for interest rate cuts. The fluctuations in the market over the past couple of days also reveal some clues. It is precisely because of the short positions experienced in these two days that I say that shorting is like snatching food from a tiger's mouth. Fortunately, I did not lead everyone to go long; it is better for everyone to observe the spot market. Currently, holding cash is probably the best choice.

The end of this month to the beginning of August will be a crucial period for the cryptocurrency space and even the entire financial market. If the tariff negotiations come in below the expected 35%, it will drive a wave of growth, but this is only at the short-term level. Before the interest rate cuts, there will definitely be a wave of corrections, and do not expect too deep a pullback. This will not interfere too much with spot users; everyone just needs to hold on. For contract users, it is best to wait until after the tariff and non-farm employment data are released before making plans. This round of tariffs will set the tone for next year's trends, and only time can prove the results. After the tariffs, there will be lingering concerns, so it will definitely not be good news for the financial market; everyone should not misunderstand. Compromise is merely a reluctant move based on long-term strategy; time is always on our side. The process of a weak dollar will also drive related industries linked to the dollar, so everyone can slightly pay attention to stable investment focuses.

Lao Cui's summary: For the cryptocurrency space, the main theme of the bull market remains unchanged. The only miscalculation is that the EU's compromise came so quickly; one moment they were visiting China, and the next they surrendered. Perhaps this is the nature of Europe. This main reason is certainly because we have not reached an agreement, and the short-term continuous rise has exceeded my expectations. Therefore, my short-term strategy has been to capture the depth of pullbacks at new highs. I will not intervene in long positions, as there is still spot trading alive in the market. My advice to everyone is to hold off and wait for a pullback before making plans. If you do not consider holding costs, buying Bitcoin and SOL will definitely be profitable by the end of the year; SOL's profit potential will be greater. XRP can also be selectively held, but I do not recommend holding too much Ethereum; the current price compared to the returns is still too risky, and the returns will definitely not be as good as SOL and XRP. For spot users, it is merely a matter of holding costs, so everyone does not need to worry too much. On the contrary, the DOGE I attacked at the beginning of the year has performed poorly this year, so everyone needs to be cautious. I also advised everyone at the beginning of the year to give up DOGE and invest in other coins, and those losses have long been recovered. Now may be your last chance; there are still many coins similar to DOGE, and I hope everyone can wake up early! That's all for now. If anyone has any questions, feel free to message me directly!

Original article created by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。