为什么以太坊价格在上涨?Bit Digital,$8K目标,ETF流入

忘记比特币——今天以太坊正占据风头。本月已有超过20亿美元悄然流入这一加密货币,而Bit Digital刚刚发布了10亿美元的重磅消息。这是将ETH价格推向$8K的火花吗?加密世界中正在酝酿一些重大事件,你并没有太晚。

$30亿冲击波:今天是什么推动以太坊价格上涨?

它正乘着一波看涨的浪潮,数字证明了这一点。根据吴区块链的数据,仅在7月25日,其现货ETF的净流入就达到了惊人的4.53亿美元。

这标志着连续16天的以太坊ETF流入,而贝莱德的ETHA ETF在一天内主导了4.4亿美元的流入。

与此同时,今天ETH上涨的原因备受关注。截至撰写时,其交易价格为$3,772.36,24小时内上涨1.39%,市场资本的复苏得益于机构采用、质押和主要鲸鱼活动。

Bit Digital ETH国库转变:为何要为质押三倍增发股份?

在一个令人震惊的举动中,Bit Digital(BTBT)申请将其授权股份从3.4亿股增至10亿股。为什么?为了购买更多这些代币。

来源: Coin Bureau

来源: Coin Bureau

该公司旨在重新配置其国库,资产价值达到10亿美元,标志着迄今为止最大的公共国库转变之一。因此,毫无疑问,今天的Bit Digital新闻是推动以太坊价格上涨的最大原因之一。

不仅仅是一个参与者:鲸鱼正在大规模购买以太坊

这家公司的积累可能引发了头条新闻,但它是一个更大链上趋势的一部分。根据Lookonchain的数据,在过去几周:

自7月9日以来,仅8个新钱包就积累了583,248个币(价值21.7亿美元)

170个新鲸鱼钱包每个持有10,000个以上的币加入了网络

在7月26日,另有1.59亿美元(42,788个代币)被新实体收购

此外,SharpLink Gaming据报道将1.45亿美元的USDC转移到Galaxy Digital的场外交易台,可能是在为另一次机构以太坊购买做准备。

从加密分析师的角度来看,这种行为强烈表明了长期布局,而非短期投机。

今天以太坊价格上涨:反弹还是过热风险?

尽管所有的兴奋,技术指标在短期内建议保持谨慎。其相对强弱指数(RSI)为78.61,明确处于超买区域,表明可能会回调,根据TradingView的图表分析。

然而,动能依然看涨:

MACD线(301.8)> 信号线(276.3)——表明持续上涨

直方图条形正在缩小——潜在降温的早期迹象

即时阻力区在$3,900和$4,050,而支撑位仍在$3,600和$3,450附近。

ETH现实价格目标:短期热度,长期火焰

根据市场信号和机构行为,以下是价格可能接下来的走势:

**短期(1–2周)目标:$3,850 – $4,050

**情景:如果维持在$3,700以上,突破$3,900可能会触发对$4,000的测试。由于RSI过热,可能会出现小幅回调至$3,600。

**中期(2–3个月)目标:$4,400 – $5,200

**催化剂:Bit Digital ETH国库转变的执行以及FOMC后持续的ETF流入

**长期(到2025年底)目标:$7,000 – $8,800

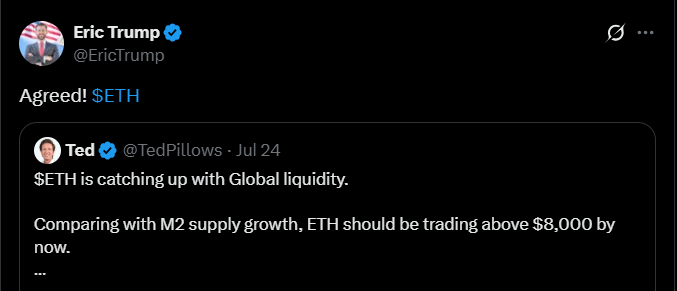

**展望:它可能成为标准的企业国库资产,类似于2021年的BTC。值得注意的是,Eric Trump最近预测以太坊将达到$8,000,引用了与全球M2货币供应的历史相关性。

结论:以太坊是企业国库的新比特币吗?

随着ETF流入超过20亿美元,Bit Digital的10亿美元押注,以及鲸鱼累计超过21.7亿美元的资产,信号清晰明了——今天以太坊的价格上涨不再仅仅是另一波山寨币的激增。

它正成为核心的机构资产,得到了现实世界质押的支持。虽然短期波动无法忽视,但企业行动、ETF需求和鲸鱼信心的汇聚可能很快会触发ETH的新价格目标$8K。因此,请关注其支撑和阻力水平,以见证即将到来的突破。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。