比特币(BTC)以其波动性而闻名,但周五3%的回撤让许多人感到意外。在过去24小时内,这种数字资产的交易范围异常宽广,最高达到119,535.45美元,最低跌至114,759.82美元。虽然一些人对波动性感到沮丧,但机构却在进行加密货币购物。

电动汽车(EV)制造商Volcon, Inc.(纳斯达克代码:VLCN)根据该公司周五发布的新闻稿,以每枚117,697美元的平均购买价格购买了3,183.37 BTC。该公司表示,它在上周刚刚启动了一项比特币国库策略。

(Volcon制造电动汽车,如这款多功能作业车(UTV),但该公司最近也采用了比特币国库策略。/ volcon.com)

“我们的国库策略反映了我们对比特币作为一种持久的、长期的价值储存和强大的国库储备资产的信念,”Volcon的联合首席执行官Ryan Lane表示。“作为比特币的持续聚合者,我们将利用团队数十年的对冲基金经验,实施创造性的方法来降低比特币的有效购买价格。”

看起来Volcon才刚刚开始。该公司表示,它希望在115,000美元、116,000美元和117,000美元的价格区间“购买更多的比特币”,这些数字与当前加密货币的价格范围完全吻合。

另一家公司The Smarter Web,一家公开的英国网页设计公司,也在周五宣布了比特币购买。该公司在2023年开始接受比特币支付,并在2025年4月实施了一项为期10年的比特币收购策略,根据其新闻稿。Smarter Web购买了225个比特币,现在在其国库中总共持有1,825个比特币。

如果机构在比特币回撤时立即涌入“抄底”,那么一些人所说的比特币冬天的日子可能已经成为过去。

在报道时,比特币的交易价格为115,890美元,过去一天下跌2.74%,七天内也下跌了1.72%。如上所述,波动性相对较高,价格徘徊在114,759.82美元和119,472.65美元之间。

(BTC价格 / Trading View)

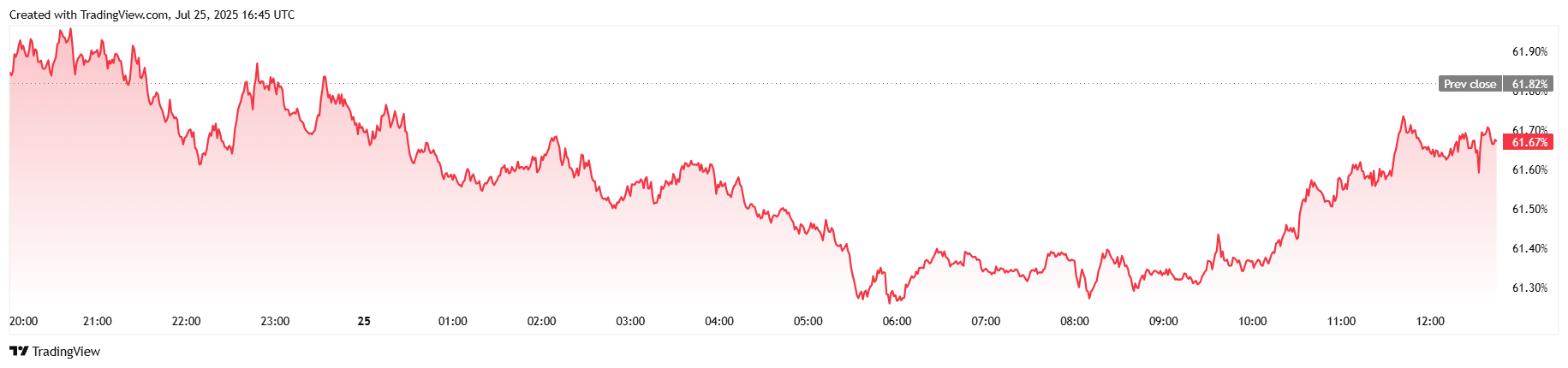

24小时的交易量几乎跃升了40%,达到1,024.2亿美元,但比特币的市值下跌了2.65%,降至2.3万亿美元。比特币的主导地位也下降了0.21%,降至61.67%。

(BTC主导地位 / Trading View)

根据Coinglass的数据,总的比特币期货未平仓合约增加了3.86%,达到875.5亿美元,全天的比特币清算总额为1.6208亿美元。多头持有的多头头寸占据了这一总额,清算金额达到1.4612亿美元,而空头持有的空头头寸清算金额为1595万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。