Yiwu and Hangzhou are not far apart; what flows is not just mineral water, but also stablecoins.

Written by: Zuo Ye

From the underground businesses of Asia, Africa, and Latin America to Indian expatriates in the Arabian Sea, a curtain of iron has been drawn across the continents of the Third World.

Behind this iron curtain lie all the barriers of banks and FinTech—Bank of America, big and small Morgan Stanley, non-bank institutions, Wall Street, K Street, the four major state-owned banks, as well as Washington and Silicon Valley.

These famous fortresses and the flow of funds are all located within the sphere of influence of TradFi, all of which, in one way or another, have not only fallen under the influence of stablecoins but have also been increasingly controlled by USDT and Sun Ge.

Tether's Unfocused Strategy

Messari has just released its 2025 stablecoin report, which, aside from a plethora of logos and endless business deals, can also serve as the opening speech for the stablecoin war. Whether it’s payment stablecoins, cross-border settlements, or C2C remittances, they are all built on the alliance of USDT and Tron, with only USDC and CPN (Circle Payment Network) barely able to compete.

However, the kingdom of USDT is not stable; Sun Ge's Tron chain is dominant, and Tether's thoughts are too scattered. On one hand, USDC is "sharing profits" with Coinbase and Binance to capture the market, while on the other, Ethena is binding CEX through a "bribery mechanism" to capture hedging profits.

Image caption: Tether's non-stablecoin business, image source: @MessariCrypto

Gold Dollar—> Oil Dollar—> Stablecoin Dollar

After surpassing BlackRock with a net profit of $14 billion in 2024, stablecoins have officially swept away the shadow of the UST collapse, re-entering the mainstream view of various countries. This is the direct motivation behind the GENIUS Act, which specifically manages stablecoins—not only can stablecoins make money, but they have also surpassed the entities of countries like Germany, becoming new contractors for U.S. Treasury bonds.

The golden combination of the dollar and U.S. Treasury bonds superficially appears to be the oil dollar, backed by military hegemony. However, stablecoins are changing the sales pattern of short-term debt, becoming a new form of the dollar, either as a supplement to the dollar or as a new form of the dollar itself.

But Tether's focus is not on challenging or reconciling; rather, it is on BTC mining, password management, African solar nodes, and entering the institutional settlement market through Plasma, along with a hobby similar to that of Twitter's former co-founder Jack—making Bitcoin bigger and stronger.

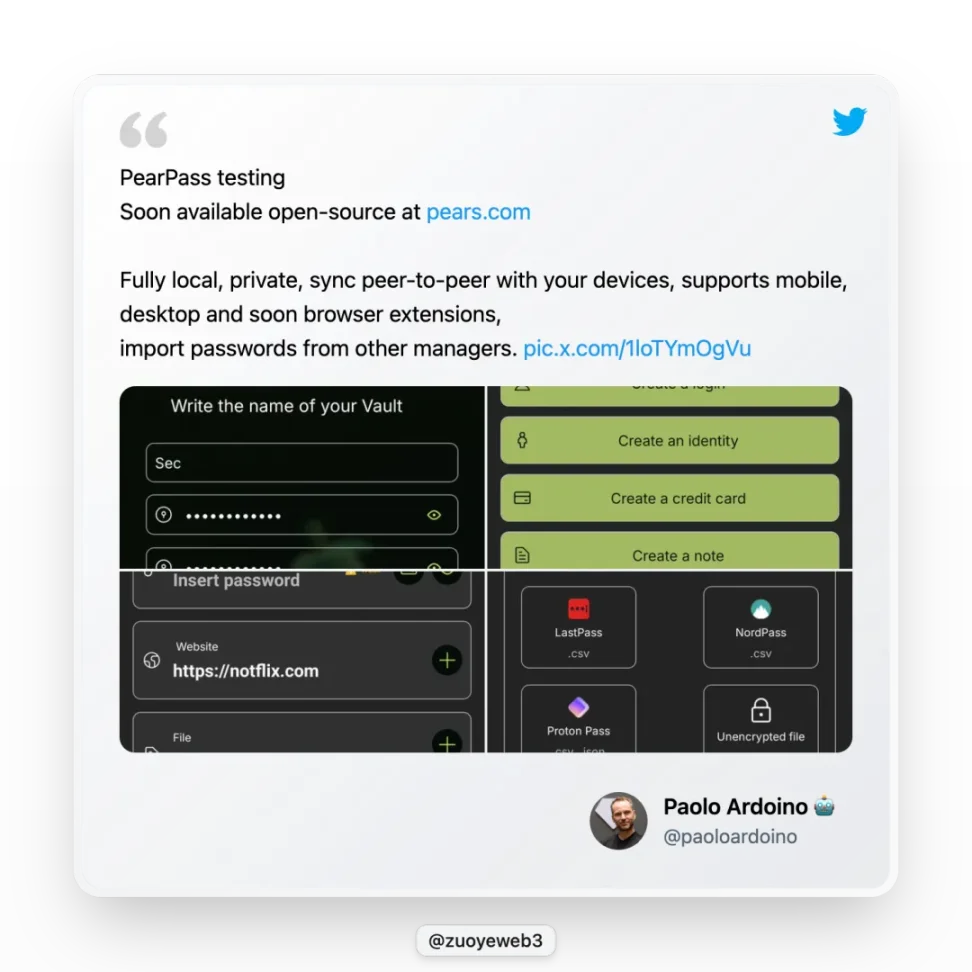

Image caption: Tether releases password manager Pears, image source: @paoloardoino

On June 29, Tether CEO Paolo released the open-source free password manager Pears. This does not directly strengthen Tether's business, but you can believe in Tether's technology and original intention; they do this out of passion, not for profit.

Tether's view on Bitcoin is "she is different."

Of course, this is just a daily pastime for the wealthy. In Tether's diversified investments, building the Bitcoin ecosystem and payment network is key. The former values Bitcoin's long-term worth, while the latter is a daily escape from Sun Ge.

As a side note, Sun Ge and Tether are also drifting apart. Sun Ge attempts to escape the strong reliance on USDT with TUSD, USDD, and FDUSD, while Tether frequently tries new emerging networks. However, the two are tightly bound by fate; Bitcoin is true love, while Sun Ge is merely an accident, but they cannot be separated.

Tether's investment and construction in Bitcoin have remained consistent. The earliest USDT was issued on the Bitcoin Omni chain, ultimately ending in failure. Recently, it has been deployed on the Bitcoin sidechain network Rootstock, and its support for Plasma also regards BTC and USDT as first-class citizens.

This fervor is hard to say is purely a "sign" of orthodoxy; it feels more like genuine love. Anyway, I am not optimistic about the future of Omni or Rootstock. Bitcoin should just be the digital gold for humanity, and while Plasma has market potential, the competition it faces is too intense, far from the time when USDT dominated the payment field.

Orthodoxy Struggle: Scar and Hyena Alliance

Great empires fall due to internal strife, and the interest alliance of USDT is not stable.

Who will be Tether's heir, Plasma or Stablechain? On the surface, it seems to be Plasma, but the relationship between USDT and USDT0 is ambiguous. USDT0 appears more like a hidden branch of Tether outside of Plasma, and the competition for the heir will be quite exciting in the future.

Of course, this is an internal ecological dispute. Externally, USDC is leading the way toward compliance. The GENIUS Act clearly outlines compliance details. Previously, Circle had already communicated on-chain through CCTP and accepted the ISO 20022 standard into the SWIFT network, integrating on-chain and off-chain.

If Circle is Scar, then USDG is the Hyena Alliance. As the issuer of BUSD's predecessor Paxos, it competes with clearing networks/chains like CPN, Stablechain, and Plasma, represented by the Global Dollar Network (GDN). Its ecological alliance includes exchanges like Kraken, Bullish (evolved from EOS's parent company, holding 164,000 BTC), BTC ecosystem giant Galaxy, and the currently hottest brokerage, Robinhood.

Image caption: GDN members, image source: @global_dollar

Overall, the current stablecoin alliances mainly consist of four teams:

USDT: Binance-Tron-Tether-Bitfinex

USDC: Coinbase-Circle-Binance

USDG: Paxos-Bullish-Galaxy Digital-Kraken-Robinhood

USDe: Ethena-Arthur Hayes-Bybit

These basically cover all aspects of payment, settlement, and pricing, but maintaining their operation is not glorious, mainly relying on a "bribery" mechanism. Originating from the Curve War, Convex, and shining during the Pendle War LST/LRT era, Penpie and Equilibria belong to this category.

They do not directly lobby relevant stakeholders but attract more funds through mechanism design for unified management, gaining scale advantages over other competitors, and taking more profits from Curve or Pendle to distribute to their own users.

A simpler and more straightforward approach is Lido's method, which allows more retail investors to avoid the investment of building their own nodes, only needing to pay fees to Lido. In this sense, Lido is the largest bribery platform for Ethereum.

USDC is similar; by sharing 60% of profits with Coinbase and Binance, it successfully secured a market position second only to USDT. Earning less is still earning, but the strong binding relationship has its benefits. When Silicon Valley Bank (SVB) collapsed, USDC de-pegged to 0.87 but was not abandoned by Coinbase.

Ethena's USDe also falls into this category. Investors in USDe include almost all CEXs, such as Binance (YZi Labs), OKX, Bybit, Deribit, Bybit (Mirana), Gemini, and MEXC. It welcomes all CEXs, which is also its most ingenious aspect. These CEXs obtain ENA, exchanging it for USDe for hedging arbitrage and price stability.

Now, a slight crack has appeared in the USDT alliance. In the wave of institutional settlements, it is not only lagging behind USDC's entry but even Ethena has partnered with BlackRock to issue USDtb and collaborated with Securitize to issue the institutional chain Converge.

Following suit, USDG has promised that ecological participants can receive 97% of the issuance profits. Even if it means losing money to gain attention, it aims to secure the third position outside of USDT/USDC. In the battle of takeout red, yellow, and blue, who will ultimately be hurt in the stablecoin war?

Conclusion

The long stablecoin war, starting from the issuance of USDT in 2014, has now entered its 11th year. The offshore RMB stablecoin did not appear later than USDT, and its operational scale is also comparable. For example, Huobi once directly supported RMB pricing, just as Kraken does now with USD pricing.

I hope this time, the market can change the situation of one entity dominating, and not let the pricing power of Bitcoin's computing power fall into the hands of others again.

After all, water can flow back, but money, once gone, will never return.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。