True faith is never weak; it only needs crises time and again to prove that it is worth protecting.

Written by: Daii

This is not a rhetorical question, but an increasingly pressing reality proposition.

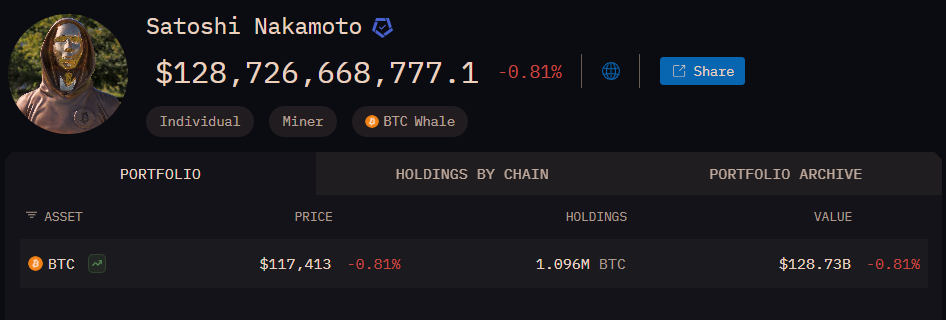

In the world of Bitcoin, Satoshi Nakamoto's 1.096 million Bitcoins have never moved, as if they are the system's original "faith anchor"—symbolizing the purity of decentralization, as well as the creator's retreat and non-intervention.

But now, a technological variable is pushing this pile of "sacred objects" to the forefront.

Not because it may or may not be used, but because it is almost "destined" to be cracked—only this time, the ones doing the cracking are not hackers, but quantum computers.

After my article "The Biggest Bomb of Bitcoin Hasn't Exploded Yet—But This Might Be Your Biggest Opportunity" was published on Zhihu, there has been a consensus on this:

This bomb is no longer a question of "whether it will explode," but rather "when it will explode."

Thus, a more sensitive and controversial question has been brought to the spotlight:

In the face of quantum threats, should we process Satoshi Nakamoto's Bitcoins?

If we act, we might avoid disaster;

If we don't act, we might preserve faith.

This debate does not tear apart the code itself, but rather the philosophical wound deep within the decentralized world:

When protecting faith itself harms the real foundation of that faith—how should we choose?

Before delving into such profound questions, let us first review: how did decentralization become a faith?

1. Decentralization, a kind of faith?

"Decentralization" is not a new term, but in the context of Bitcoin, it has long transcended technical architecture and has gradually been revered as a non-negotiable faith.

To understand the power of this faith, one must first understand its "opposite"—the deep structure of the centralized world.

In the traditional financial system, institutions like banks, clearinghouses, and central banks monopolize the final interpretation of the ledger. Whether an account is frozen, whether a transaction is valid, whether a person is "trustworthy" has never been determined by you, but by the "power structure" behind the system.

This structure appears to be order, but in reality, it is a conditional grant of property rights: what you own is not your "right," but the "qualification" they allow you to use temporarily.

The birth of Bitcoin was a radical attempt to dismantle this system from its roots.

In Bitcoin:

You do not need to apply, do not need authorization, do not need identity;

Anyone can initiate a transaction, and any node can verify its legitimacy;

The ledger is driven by a proof-of-work mechanism, and once written, history cannot be altered;

There is no "administrator," no "backdoor," no "exceptions."

Decentralization, here, does not mean "many people maintaining it together," but rather that no one has the privilege to maintain it.

This structure has given rise to Bitcoin's three core principles:

Immutability: Once written to the ledger, it is never changed;

Censorship Resistance: No one can stop you from transacting;

Permissionless: Everyone inherently has the right to use it, without approval.

These three principles are not moral declarations written in a white paper for people to circulate; they are encoded into the protocol, validated in operation, believed in as consensus, and ultimately elevated into a spiritual lighthouse resisting power intervention.

Thus, for many Bitcoin believers, decentralization is no longer a mere engineering mechanism, but a belief worth exchanging volatility for, sacrificing convenience for freedom, and even willing to risk existence to protect.

They believe:

A ledger not controlled by anyone is more trustworthy than a compromise world that anyone can understand.

But the problem lies precisely here.

Because once you acknowledge "certain exceptions," such as freezing a high-risk address, modifying a historical record, or cooperating with a regulatory requirement, then the sacred inviolability of Bitcoin transforms from "absolute rule" to "consensus negotiation."

In other words, decentralization is no longer faith, but merely a "strategy."

The arrival of quantum computers is the first real test of this faith system.

It is not challenging technology, but challenging human hearts: When the system truly faces life and death, are you still willing to choose non-intervention?

This is no longer about how nodes synchronize, but about whether humanity can still uphold the "untouchable" bottom line in a crisis.

2. Quantum computers, triggering a crisis of faith?

The faith in Bitcoin is not as abstract as the word "consensus." Its security is rooted in one of the most solid foundations of the real world—cryptography.

Bitcoin uses the Elliptic Curve Digital Signature Algorithm (ECDSA). The security basis of this algorithm is the "Elliptic Curve Discrete Logarithm Problem," which means:

Given a public key, deriving the private key is almost impossible to accomplish—at least, it is so on classical computers.

However, quantum computing changes the game.

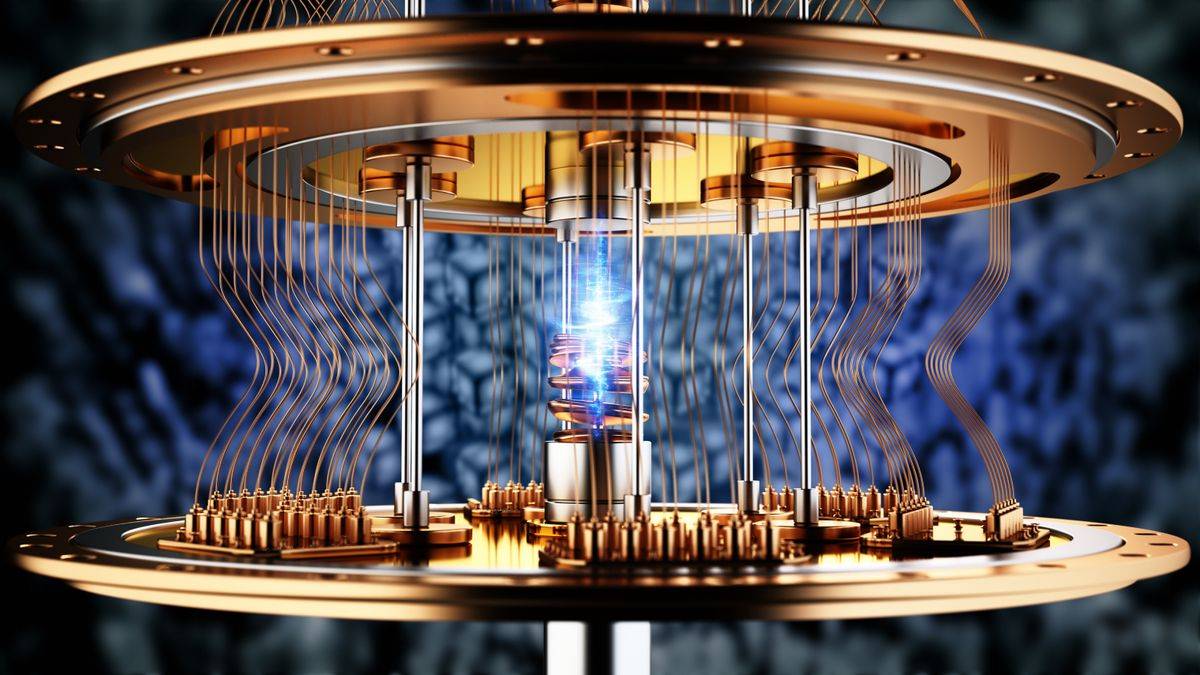

In 1994, mathematician Peter Shor proposed a quantum algorithm (Shor's algorithm) that can efficiently solve large number factorization and discrete logarithm problems on quantum computers. This means that once the number and stability of quantum bits (qubits) reach a threshold, the existing ECDSA security mechanism will be completely dismantled.

According to research from a joint team of MIT and Google, cracking a 256-bit Bitcoin address theoretically requires about 2330 stable logical qubits and millions of gate operations【Source: Google AI Quantum + Nature, https://www.nature.com/articles/s41586-019-1666-5】.

What would take traditional computers billions of years to exhaustively search for can theoretically be cracked by quantum computers in a few hours or even minutes.

This is not alarmism. As early as 2019, Google announced it had achieved "quantum supremacy"—a 53-qubit quantum computer completed a task that would take supercomputers thousands of years to process. IBM, Intel, and Alibaba are also racing on this quantum track. Conservative predictions suggest that by 2040, quantum computers with thousands of qubits will emerge.

By then, all systems relying on existing asymmetric encryption algorithms—including Bitcoin, Ethereum, and even the entire internet's HTTPS encryption protocol—will face the risk of large-scale failure.

This is no longer a "technical update" issue, but a challenge to an entire order.

By the end of 2024:

IBM announced that its latest quantum chip, Condor, has reached 1121 qubits, though not fully fault-tolerant, it is nearing the thousand-qubit threshold【Source: IBM Quantum Roadmap, https://www.ibm.com/quantum/roadmap】.

The U.S. National Institute of Standards and Technology (NIST) is urgently advancing the selection plan for "post-quantum cryptographic algorithms," clearly stating that ECDSA will face "predictable risks" in the next decade【Source: NIST PQC Project, https://csrc.nist.gov/Projects/post-quantum-cryptography】.

In this context, the risks faced by Bitcoin have officially transitioned from a distant "theoretical threat" to a "strategic defense phase."

And the most vulnerable and sensitive part of the system is that batch of early Bitcoins that have never moved—specifically, the addresses belonging to the well-known Patoshi blocks.

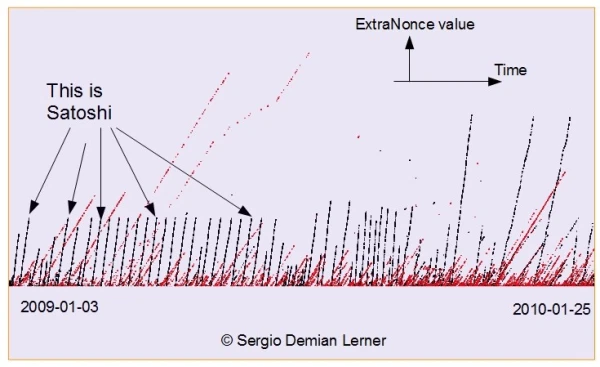

The so-called Patoshi blocks refer to a series of blocks suspected to have been personally mined by Satoshi Nakamoto in the early days of Bitcoin, identified by blockchain analysis experts based on mining behavior patterns.

The characteristics of these blocks include: fixed time intervals, highly consistent Nonce distribution, and a unique growth pattern of "ExtraNonce." Based on these on-chain traces, researchers speculate that the miner account controlling these blocks is very likely to belong to Satoshi Nakamoto himself.

The Patoshi blocks have mined approximately 1.096 million Bitcoins, which have never been moved since their inception and have no spending records, becoming the most mysterious and sensitive "silent assets" in the Bitcoin world. Their security status directly concerns the symbolic faith of Bitcoin and the system's potential vulnerabilities.

Compared to the quantum-resistant code upgrades achieved through soft and hard forks, these 1.096 million Satoshi Bitcoins are the true potential trigger for community division.

3. How to process Satoshi's Bitcoins will trigger a conflict of values?

So, why are these Satoshi Bitcoins so dangerous?

Because they use the very early Pay-to-PubKey (P2PK) script format, and their public keys have long been exposed in plain text on the chain. This means:

An attacker can derive the private key from the public key, allowing them to directly transfer assets.

This method of attack is precisely what quantum computing excels at.

According to on-chain tracking data, this batch of addresses holds approximately 1.096 million BTC. If these assets are breached and sold, the market will face a shock of over 120 billion dollars, with unimaginable consequences.

Therefore, the discussion on whether to "pre-process" this batch of Satoshi Bitcoins is gradually shifting from a marginal topic to a reality that must be faced. A heated debate around "Should Satoshi's coins be processed?" is ongoing in the community, and currently, there are three main voices:

3.1 The First Voice: "Do Not Move" — The Bitcoin Ledger Must Not Be Touched

This is the oldest and most deeply rooted voice in the Bitcoin community. They argue that even if these coins are truly stolen, truly crash the market, and truly shake confidence, we must not set a precedent for "human intervention in the ledger."

Why? Because once you intervene once, you will intervene a second and third time. This is no longer a singular event, but the beginning of a "permission"—who defines what constitutes "reasonable intervention"? Is it the Core developers? The miners? A certain country or court?

As Bitcoin Core developer Matt Corallo has publicly stated multiple times:

Once you touch the ledger, it is no longer Bitcoin.

They believe that the meaning of decentralization is that even if the system is about to explode, no one should be allowed to hit the pause button.

This is a persistence of "letting faith outweigh risk." But the problem lies here—if this is not a politically correct self-hypnosis, then one must be mentally prepared to "watch Bitcoin be looted by hackers."

3.2 The Second Voice: "We Must Act, but with Limitations and Extreme Caution"

This faction does not act lightly, but they do not believe that "inaction" is sacred. They emphasize realism:

"If we can prevent an impending nuclear-style sell-off through consensus, why not do it?"

The specific proposals they put forward often include the following elements:

Implementing a locking mechanism through soft forks, such as setting spendability restrictions on certain specific P2PK addresses;

Freezing is not permanent but rather a delayed activation: for example, setting a 10-year cooling-off period during which holders can "prove themselves" with post-quantum signatures to redeem their coins;

A community-wide consensus voting mechanism: decisions are not made by a single team, but collectively by miners, nodes, developers, and users.

This path sounds more rational and has precedents to follow.

For example, BIP-119 (OPCHECKTEMPLATEVERIFY) is a proposal tool that can be used to implement complex locking script structures. Although initially designed for batch payments and fee optimization, some developers have suggested it could be used to restrict the spending authority of specific UTXOs, thereby "freezing" certain addresses【Source: Bitcoin Optech Newsletter, https://bitcoinops.org/en/topics/opchecktemplateverify/】.

They emphasize that this is not "centralized intervention," but a technical, community-wide consensus-driven "system self-defense mechanism."

But the problem is: even with high consensus, once the ledger can be altered, trust is no longer "automatic," but "negotiated."

3.3 The Third Voice: "Do Not Freeze, Do Not Change, Do Not Negotiate — Let It Die Naturally"

Another faction advocates: "We should do nothing."

This is not giving up, but a calmness rooted in technocracy. They believe that rather than creating ethical troubles, it is better to guide users to migrate to quantum-safe addresses through protocol upgrades, allowing these high-risk old addresses to "naturally deactivate."

How to do it?

Encourage users to migrate assets from old addresses to P2TR (Taproot) or future XMSS/LMS addresses that support post-quantum signatures;

Use economic incentives (such as fee discounts) to induce "security upgrades" on-chain;

Do not freeze any addresses at the system level, but also do not recognize non-post-quantum signatures' control over certain key paths.

The advantage of this approach is that it does not harm consensus, does not alter the ledger, and does not provoke controversy, but the cost is extremely slow and has no effect on Satoshi's "naked coins"—because no one can "migrate" them.

In other words, this solution is responsible for the future but powerless against "that bomb."

3.4 Summary

Currently, no single solution can completely avoid controversy. Each path represents a value prioritization: do you care more about unchanging rules, or do you care more about real-world safety?

Some say Bitcoin is a temple and should not move the statue just because of danger; others say Bitcoin is a ship, and if you know there is dynamite in the hull, you should deal with it immediately.

But this time, it is no longer a problem that code can automatically solve. It is a trial of the collective will of the community, an ultimate vote on "power and principles."

And the real question is:

Are we truly ready to face a future where Bitcoin is not "untouchable," but "able to be touched but choosing not to"?

Clearly, this is yet another clash of values.

4. Values, Non-Negotiable?

Every time Bitcoin faces a crisis, on the surface, it appears to be a technical divergence over code, parameters, or addresses, but essentially, it almost always points to the same deep question:

Can we still unify our definition of "what is Bitcoin"?

This time is no exception.

You might think the community is debating whether to freeze Satoshi's Bitcoins or whether to intervene to prevent theft, but what everyone is really arguing about is something much harder to unify—the prioritization of values.

And this is not the first time Bitcoin has encountered such a "faith rift."

Back in 2017, Bitcoin was embroiled in a civil war over the "scalability" issue.

One faction insisted on maintaining the 1MB block limit, emphasizing decentralization and node operability;

The other faction advocated for increasing block size to improve TPS, making Bitcoin more like a "global payment network."

This debate ultimately ended in a hard fork, giving birth to Bitcoin Cash (BCH). The historical trajectory is also clear: BTC has adhered to the "simple ledger" bottom line and remains the highest market-cap cryptocurrency to this day; while BCH, though not sunk, has always been outside the mainstream narrative.

What does this indicate?

Bitcoin's technology can be upgraded, routes can be debated, but consensus cannot be easily torn apart. Once torn, the cost is not merely "switching to another chain," but a reconstruction of the entire faith system.

Compared to the "block wars" of 2017, the current divergence surrounding "whether to intervene in Satoshi's address" will only intensify.

The previous debate was about "transaction efficiency," while this discussion is about "whether the ledger can be rewritten";

The previous divergence was about "application positioning," while this rift concerns "the boundaries of decentralized governance";

The previous controversy focused on "how to make a better Bitcoin," while this one pertains to "what can still be called Bitcoin."

Some voices supporting proactive intervention believe it is time to allow Bitcoin to have a certain degree of "governance flexibility," and it can no longer be a "bystander system." But the counterarguments from opponents are equally sharp:

"If we also start modifying history, freezing addresses, and filtering transactions, what essential difference do we have from Ethereum?"

This is not an emotional accusation, but a wake-up call.

Once you open the door for "special circumstances," the dam of logic will begin to collapse:

You can freeze Satoshi's coins;

You may also freeze addresses sanctioned by the U.S. (such as Tornado Cash);

Then you might cooperate with regulators to set up some kind of "transaction whitelist" mechanism…

Continuing down this path is precisely the road Bitcoin has refused to take for fourteen years.

And if this divergence over "whether to intervene" cannot achieve an overwhelming consensus, the likely outcome is—yet another hard fork.

Do not misunderstand, while the Bitcoin protocol is resilient, it is not "indivisible."

Any individual, organization, or mining pool, as long as they are willing to fork the source code, modify the rules, and launch a new blockchain, can create "another Bitcoin."

In the past decade, such attempts have been numerous, from Bitcoin XT to Bitcoin Gold, and then to Bitcoin SV, the vast majority of which ultimately sank without a trace.

But if this time the core of the split is not technical parameters, but the understanding of "the boundaries of governance," then this forked chain may not just be a temporary "test chain," but the beginning of a new "consensus."

By then, BTC may still be BTC, but it will no longer be the "digital gold" that everyone could reach a minimum consensus on.

It may become two Bitcoins:

One guarding the "pure ledger," refusing to use permissions even if passively bombed;

One advocating for "rational intervention," willing to make limited historical modifications for system safety.

And you, as a member of this system, will ultimately have to choose:

Do you believe in "the supremacy of rules"? Or "flexible survival"?

Conclusion

The quantum threat has pushed Satoshi's 1.096 million Bitcoins into the spotlight, but this does not mean "doomsday countdown." Even if they are ultimately cracked, the most direct consequence will only be a sudden supply shock—prices may fluctuate violently, but it will not be enough to destroy the entire system.

Bitcoin has already weathered the collapse of Mt. Gox, the liquidation of 3AC, and the FTX disaster; each seemingly "waterfall" moment has ultimately been absorbed by the market, bottomed out, and reconstructed new highs. New chips will eventually fall into the hands of long-term believers, and on-chain fees and hash rates will be repriced amid violent fluctuations.

The quantum storm may stir up huge waves, but the true course of the journey is steered by the resilience and direction of consensus.

The quantum impact is not an end, but a magnifying glass.

It magnifies panic, but also magnifies confidence; it magnifies technical fragility, but also magnifies collective wisdom.

Ultimately, Bitcoin will demonstrate to the world through practice:

Faith is not weak; it only needs crises time and again to prove that it is worth protecting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。