U.S. President Donald Trump announced late Tuesday what he says is “perhaps the largest deal ever made,” a trade agreement with Japan that will see the East Asian country invest $550 billion in the U.S. The deal will also facilitate the trade of automobiles and agricultural products between the two countries. Stock markets climbed higher on the news, with the S&P 500, Nasdaq, and Dow all rising 0.26%, 0.09%, and 0.42% respectively. Conversely, bitcoin ( BTC) shed 0.55%.

“We just completed a massive Deal with Japan, perhaps the largest Deal ever made,” the president wrote on Truth Social. “Japan will invest, at my direction, $550 Billion Dollars into the United States, which will receive 90% of the Profits.” Trump went on to say the agreement will “create Hundreds of Thousands of Jobs,” and that “There has never been anything like it.”

(Japan’s Prime Minister Shigeru Ishiba (left) with U.S. President Donald Trump (right) at the White House / Shuttershock)

And while bitcoin edged lower, the broader crypto market fared worse, dropping 1.20% and sending the Coinmarketcap Altcoin Season Index all the way down to 46. The index peaked at 56 on Monday, causing some to prematurely declare the beginning of “altcoin season” where, according to Coinmarketcap, 75% of the top 100 tokens outperform bitcoin over a three-month stretch.

But now with the index at 46, it seems even a significant trade agreement between two of the largest economies in the world, while buoying stocks, wasn’t enough to make bitcoin budge.

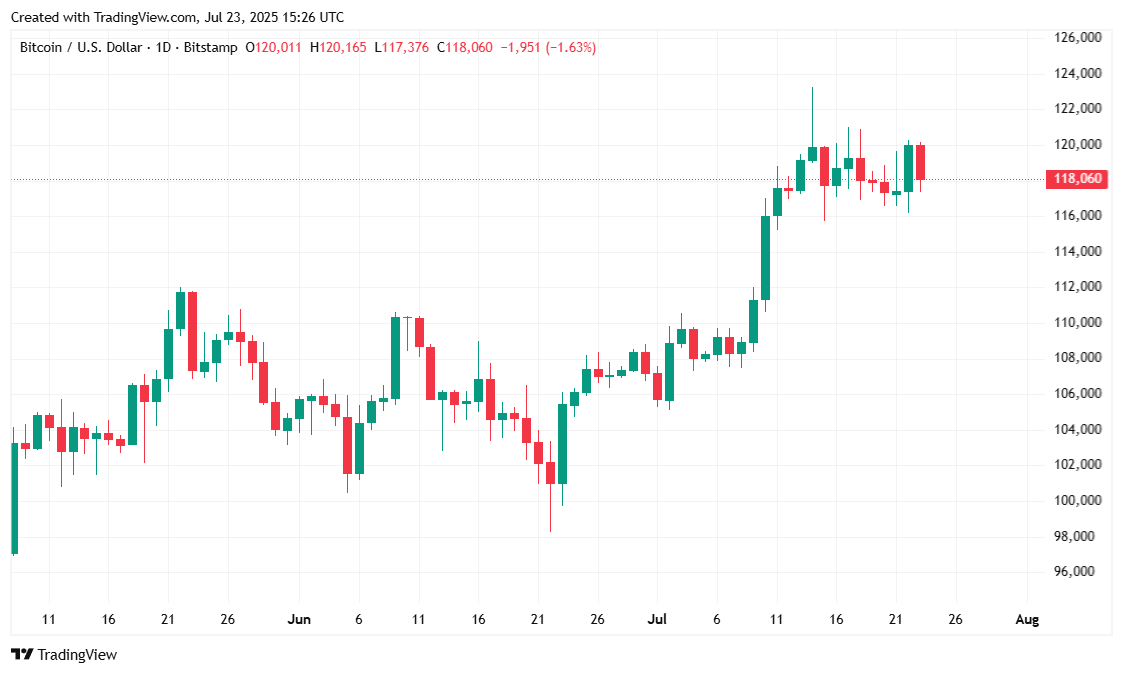

Bitcoin, at the time of writing, was priced at $118,203.22, down 0.77% over 24 hours and also down 0.88% since last week. The asset has traded between $117,391.39 and $120,269.97 since yesterday.

( BTC price / Trading View)

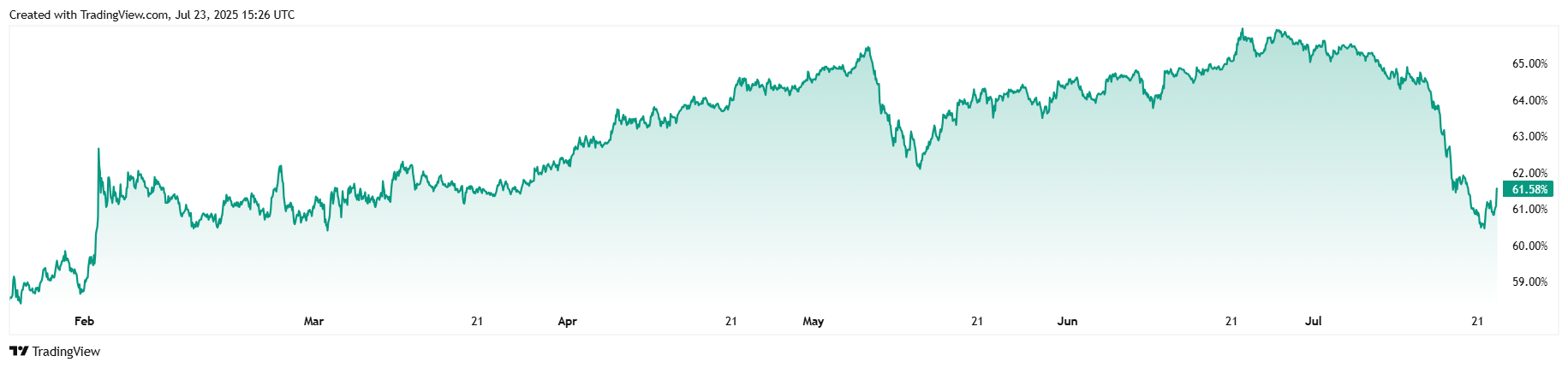

Twenty-four-hour trading volume fell 11.52% to $67.28 billion, and BTC’s market capitalization also dipped 0.78% to $2.35 trillion. Bitcoin dominance jumped 1.10% and stood at 61.57% at the time of reporting.

( BTC dominance / Trading View)

Total BTC futures open interest for the day fell slightly by 0.05% to $85.02 billion, as per Coinglass. Total bitcoin liquidations over 24 hours came in at $51.23 million. Of that figure, shorts had $16.57 million wiped out, and the rest were long liquidations at $34.66 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。