本文来自:Flashbots 数据分析师danning

编译|Odaily星球日报(@OdailyChina);译者|Azuma(@azuma_eth)

MEV套利机器人究竟可以从 CEX-DEX 套利中赚取多少利润?

此前无人能解答这个问题,但我们激动地宣布,现在终于有一篇采用形式化方法进行测量的新论文问世(论文链接:https://arxiv.org/abs/2507.13023),我将在下文中用一系列图片以及解释为你概述该论文的所有核心发现。

超级浓缩版

利润?很可观,但没你想的那么多;

Bot 策略各异,但顶级交易者的超额收益大多在 0.5~2 秒内衰减;

市场集中化愈演愈烈,区块构建者(builder)领域亦如此;

不过,随着区块链构建者竞争加剧,CEX-DEX 套利利润空间逐年压缩;

Bot 正以各种方式深度融入区块构建流程;

与区块构建者绑定越深,“表面”利润越薄(实则转移至关联方);

区块构建者市场份额越小,其关联套利者保留的实际利润率反而越高;

即便稳居行业前二,区块构建仍是一门苦生意(利润薄如纸)。

相对详细版

在我们采集的 1 年零 7 个月数据中,19 个头部的 CEX-DEX 套利机器人数据表现如下:

交易总量达2410亿美元;

提取2.338亿美元利润;

仅保留 9010万美元净收益(向区块构建者支付了1.437亿美元分成);

综合来看,CEX-DEX 套利平均利润率为38.5%。

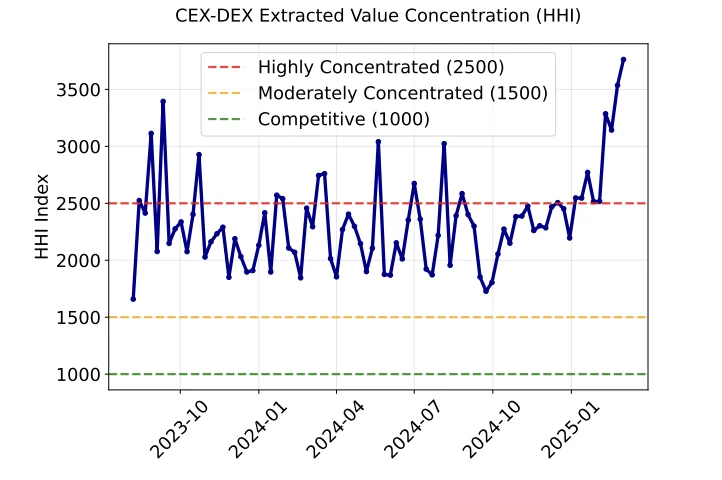

基于套利者的市场份额分析,我们确认 CEX-DEX 的MEV市场集中化趋势已达到“高度垄断”级别。

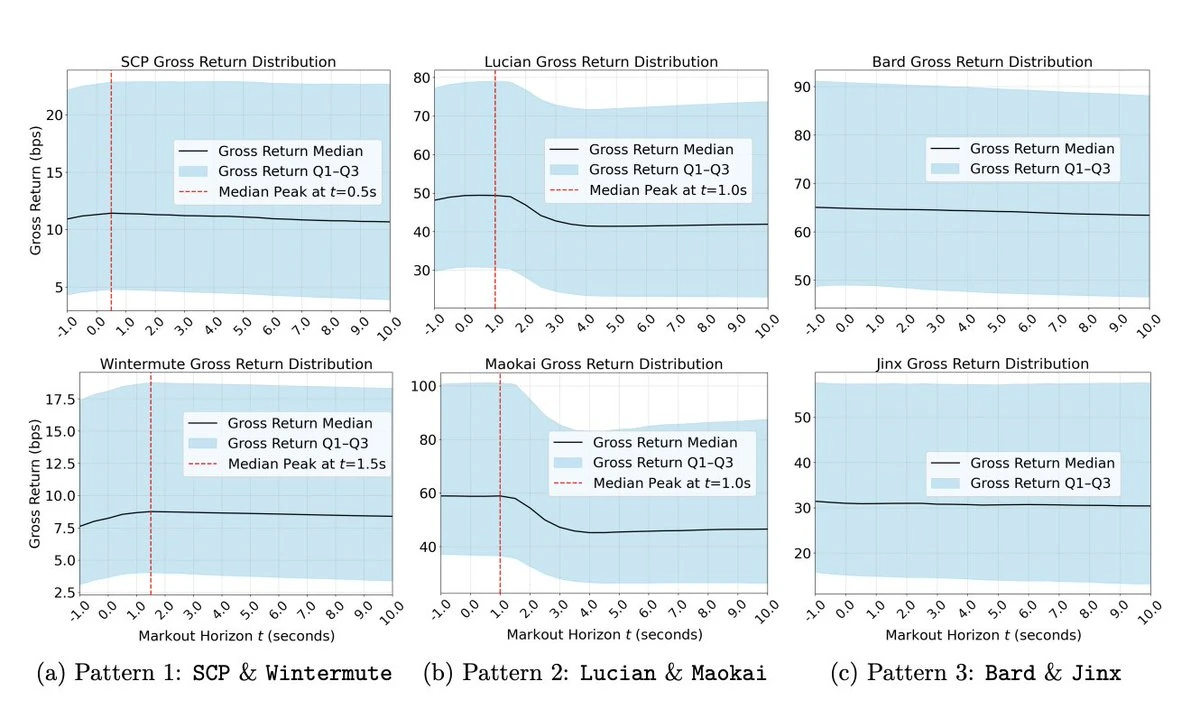

沿用 @0xRezin 提出的“英雄联盟”段位标签系统,我们计算了套利机器人的币安标记价差(markouts),采用加权平均值定义其对冲前的“总收入”。

数据显示,多数 CEX-DEX 套利信号在数秒内急速消失。通过中位数分布可观察到收入峰值 —— 即最佳对冲时机出现在0.5-1.5秒区间。

扣除支付给区块构建者的分成后,我们得到了 Bot 利润的上限估值。

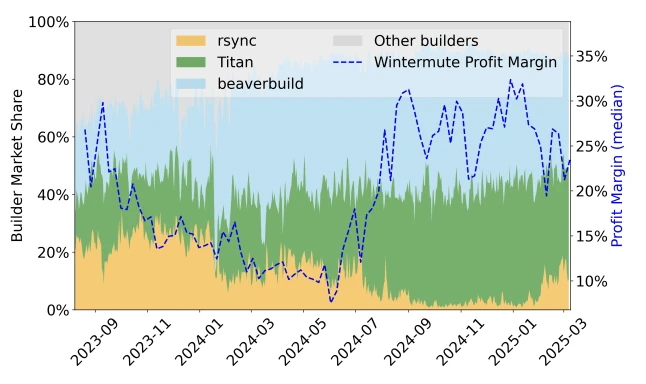

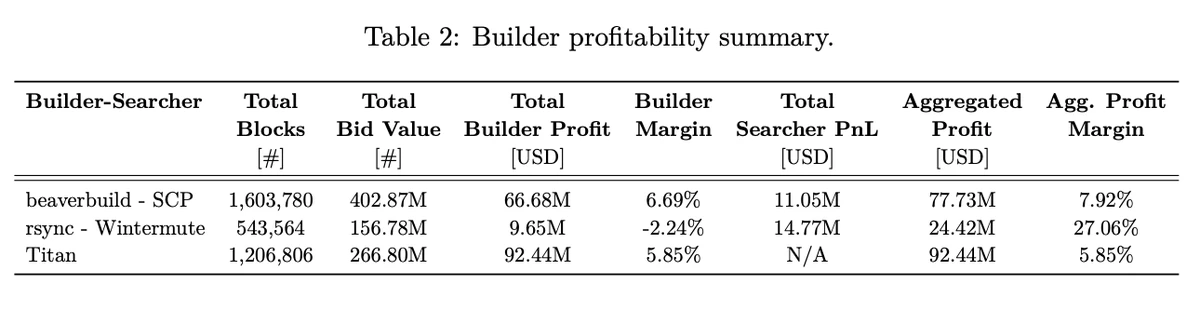

那么结合了套利者的利润修正后,当前排名前三的区块构建者的收益到底如何?

自 rsync(当前排名第三)去年中放弃“订单流战争”后,其市场份额明显跳水,但无人察觉的是,其利润率已从 5% 急速回升至 25%+,这使其综合利润率(套利+区块构建)达到了约 27%。

然而排名前两位的区块构建者实力盈利却很有限。

在18个月数据周期内,beaverbuild(当前排名第一)的综合利润率仅7.92%(含套利收益),而无自营套利的 Titan(当前排名第二)利润率仅5.85%。

显然,不透明的“订单流”交易使得这一情况更难以解释。

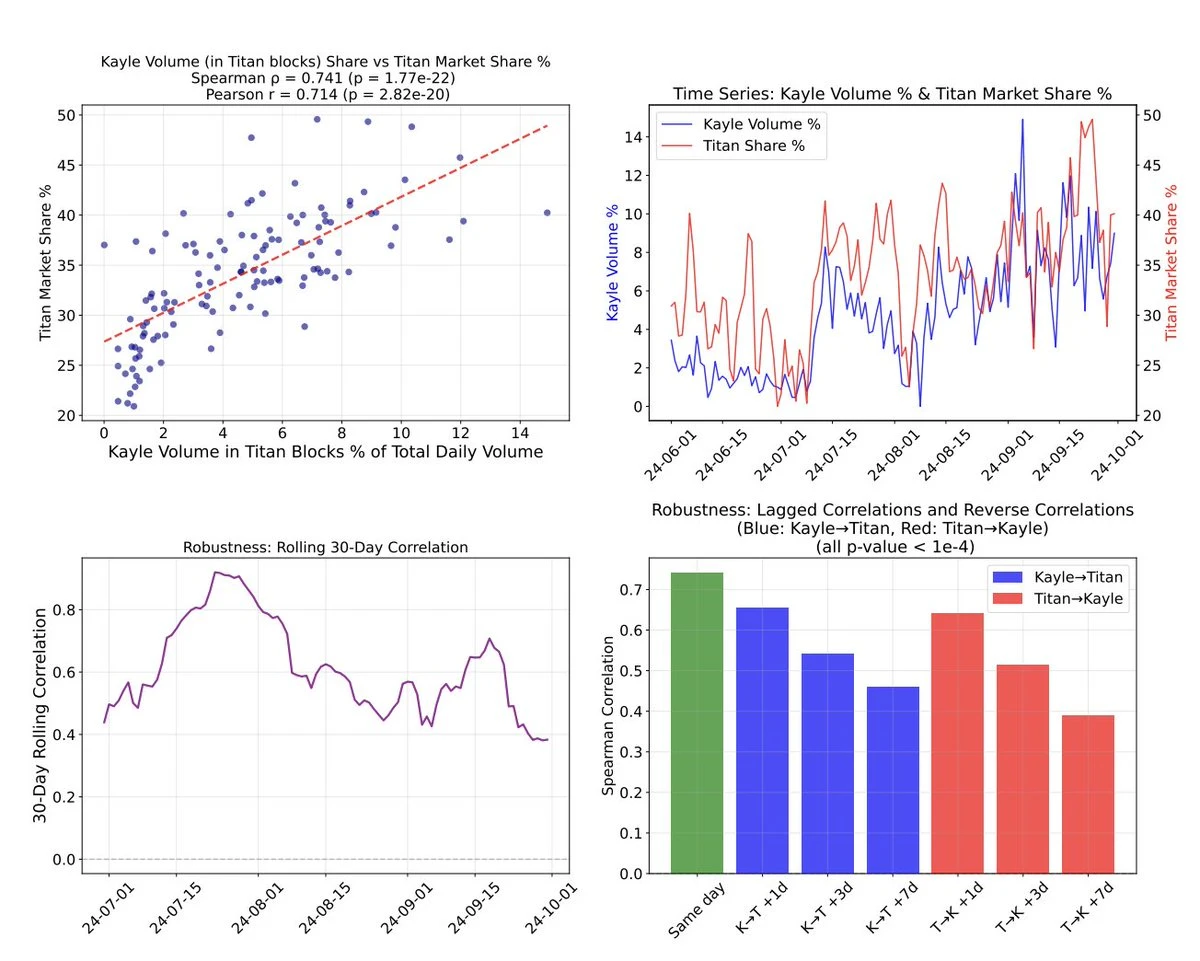

除已知的 beaverbuild + SCP、rsync + Wintermute 等“区块构建者 + 套利者”组合外,相关性分析揭示了另一组显著的排他性合作案例。观察下图中“Kayle 在 Titan 构建区块中的交易量占比”与“Titan市场份额”的 30 天滚动相关性,即见看出端倪。

我们的核心结论是,区块构建属低利润业务,若未持有超高 MEV 价值的订单流,当今市场已无入场机会。

此外,当前的区块拍卖机制存在严重的低效问题。一方面,补贴机制会压榨区块构建者的利润;另一方面,排他性合作会割裂订单流,延长交易上链等待时间。

但现状并非不可改变。Flashbots 新推出的 BuilderNet 或许能够能破解困局,提升区块构建者收益。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。