尽管转移背后的动机仍然是个谜,SpaceX在区块高度906627处转移了1,308 BTC,价值1.55亿美元。这笔交易引发了一波猜测,许多人试图猜测公司重新定位比特币的意图。

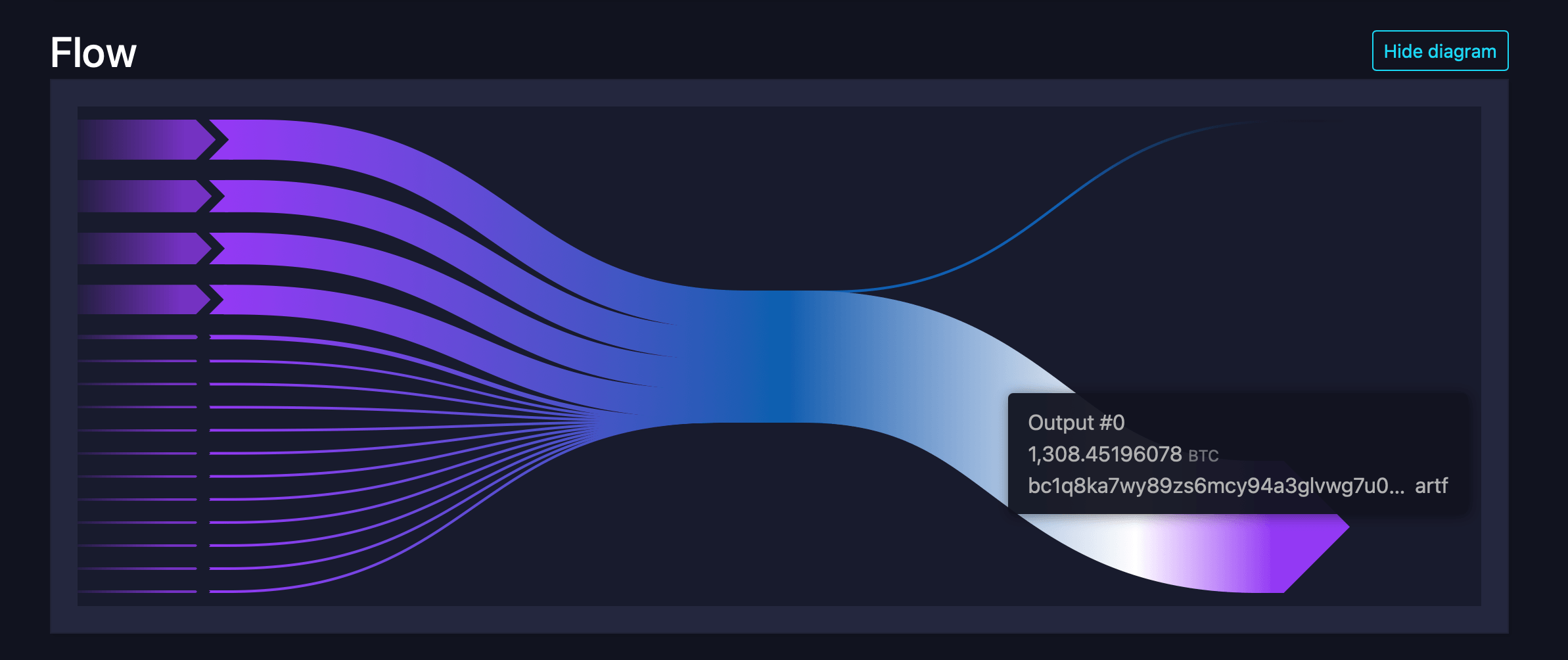

这些币从16个独立的支付到公钥哈希(P2PKH)地址中提取,并汇聚到一个单一的支付到见证公钥哈希(P2WPKH)地址中,目前它们仍然保留在该地址中。

Timechainindex.com的创始人Sani指出,这一举动似乎是未花费交易输出(UTXO)整合的案例,并且是“转向Segwit”。SpaceX突然的比特币操作暗示该公司在数字资产管理方面保持着敏锐的关注,即使在安静时刻。

尽管细节仍然保密,这一有条不紊的转变表明了战略优化而非冲动行为。无论这是否标志着财务管理的更广泛转变,还是仅仅是整理事务,这一举动为马斯克的区块链足迹增添了另一个神秘的条目。

在缺乏正式解释的情况下,观察者们只能解读散布在链上的线索。整合资金并转向Segwit可能反映了技术前瞻性、税务规划或为未来交易做准备。

无论如何,SpaceX的这一静默举动重新点燃了人们对主要参与者如何看待保管、结构和长期比特币战略的好奇心。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。