What looked like a rebound at first glance reflected something deeper; a change in the nature of demand. As digital assets rallied, institutional flows became more targeted, and corporate balance sheets emerged as a key driver of market structure. Bitcoin rose 29.8%, reaching a new all-time high in June, according to CoinDesk Data, but it was the nature of the buyers, not just the size of the move, that marked a turning point. With public companies increasing their BTC holdings by nearly 20%, and expanding into assets like ETH, SOL and XRP, corporate treasury adoption has entered a new phase, with the potential to reshape the asset landscape.

Corporate treasuries take the lead

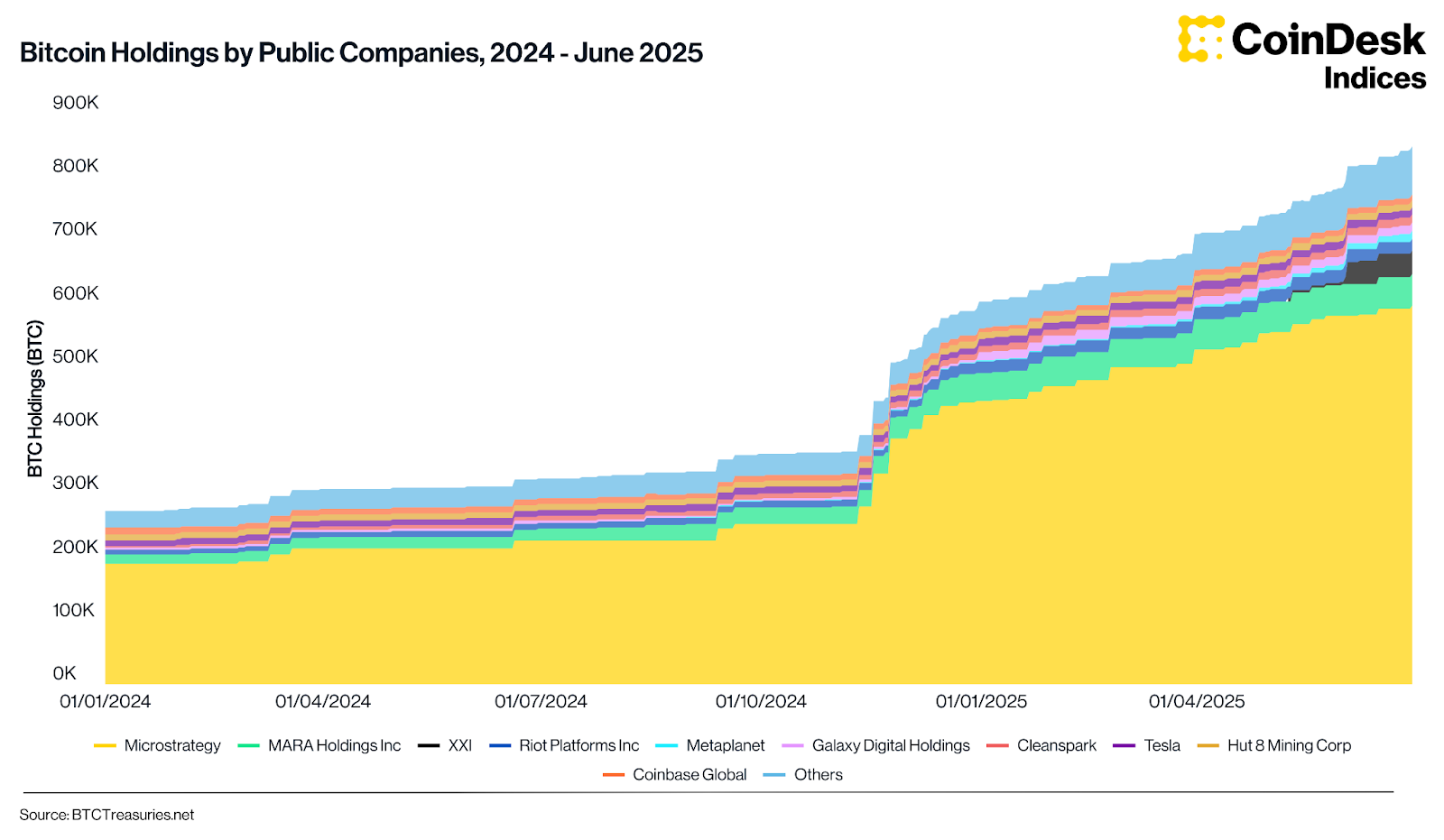

Bitcoin’s performance in Q2 was not led by retail flows or leveraged positions. Instead, capital came from corporate treasuries. Public companies added nearly 850,000 BTC to their balance sheets by quarter-end, marking a 19.6% increase. For the third consecutive quarter, corporates outpaced ETFs in net accumulation, reinforcing the shift in long-term holders. The message from listed firms was clear: bitcoin is moving from speculation to allocation.

Bitcoin is no longer the only asset benefiting from this trend. Public companies now hold over $1.4 billion in altcoins. ETH accounts for the majority, but firms are increasingly looking beyond the top two. Solana has seen corporate accumulation, while TRX, XRP and even BNB are beginning to feature in strategic announcements. Nano Labs, for example, unveiled a $1 billion initiative to accumulate BNB. Meanwhile, Tridentity and Webus.vip are planning substantial capital raises to support XRP buys. This level of activity, previously confined to BTC, is now spreading across the broader market.

ETH reclaims market share, Aave tops index rankings

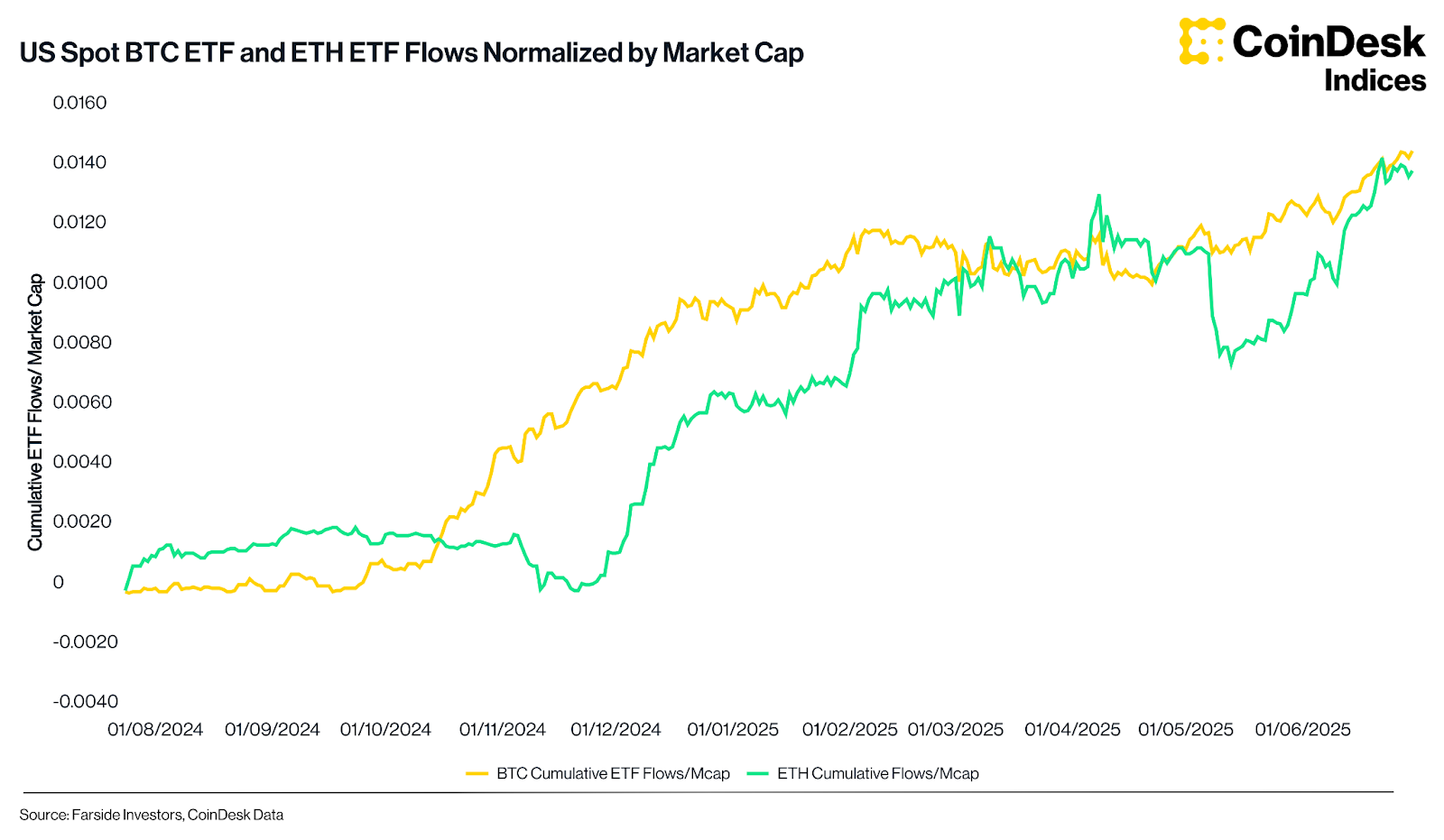

Ethereum, which had lagged in earlier quarters, reclaimed its footing with a 36.4% rise in Q2, CoinDesk Data shows. Flows into ETH ETFs turned positive, and have now remained so for eight consecutive weeks. Adjusted for market cap, these flows are nearly on par with BTC, marking a convergence in sentiment. The 30% uplift in ETH/BTC hinted at a strategic rebalancing, with allocators rotating back into ether.

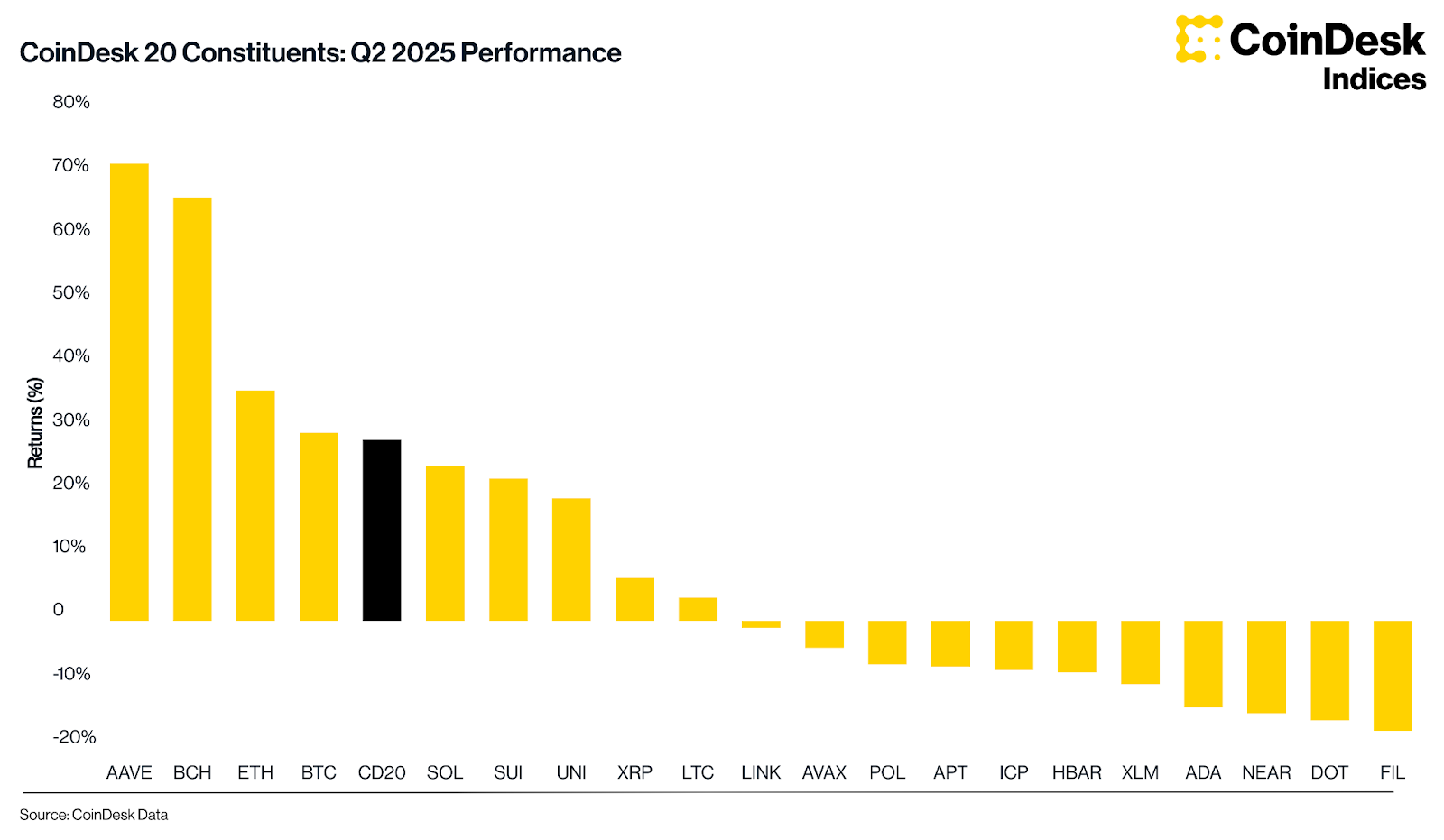

Beyond ETH, Aave delivered the strongest performance within the CoinDesk 20 Index, gaining 72% in the quarter based on CoinDesk Data, as lending activity hit all-time highs and vePENDLE collateral was added to the protocol. Institutional relevance is beginning to take shape here too. The upcoming Aave v4 upgrade, along with the Horizon initiative aimed at tokenised real-world assets, positions the protocol for greater adoption beyond crypto-native circles.

Solana keeps pace, but loses spotlight

Solana returned 24.3% in the quarter, according to CoinDesk Data, and retained its position as the leading chain by application-level revenue. However, it underperformed both bitcoin and ether. Despite solid fundamentals, investor flows were directed elsewhere. Capital concentrated in assets with more mature ETF infrastructure and longer-established treasury narratives. Even the launch of the REX-Osprey Solana staking ETF, which attracted $12 million on its debut trading day, was not enough to reignite momentum.

That said, investor interest is still building. The recent Pump.fun token generation event is drawing attention from both ends of the spectrum. On one side are speculative participants, while on the other are value-driven investors assessing the project’s revenue potential. Treasury activity also continues to rise, with over one million SOL now held by corporations such as SOL Strategies and DeFi Development Corp.

Narrower gains, clearer signals

The second quarter confirmed what the first quarter had suggested: leadership in digital assets is narrowing, and the market is rewarding clarity. The CoinDesk 20 Index rose by 22.1%, although only four constituents outperformed it: Aave, bitcoin cash, ether and bitcoin. The CoinDesk 80 declined by 0.78%, while the CDMEME Index ended the quarter up 27.8% despite a 109% spike in May (based on data from CoinDesk Indices). Outside the majors, most assets lacked consistent inflows or structural support, leaving them prone to retracements.

Bitcoin and ether both saw their index weights decline by over five percentage points. This made space for assets that posted stronger returns, but it did not meaningfully change the composition of leadership. Aave and BCH still represent a small fraction of the index, reflecting the reality that outperformance alone is not enough to shift structural weightings. Liquidity and credibility remain prerequisites.

Benchmarks as allocation tools

As adoption broadens and corporate behaviour becomes more material to price action, benchmarks are playing a more active role in capital decisions. With more than $15 billion in cumulative trading volume since launch, the CoinDesk 20 is now both a measure of market direction and a foundation for building structured exposure.

The rally in Q2 was real, but more importantly, it was orderly. Allocators are not trend-chasers. They are building frameworks. Benchmarks, indices and ETFs are at the centre of this evolution. As digital assets move from the edges of portfolios to their core, tools that bring discipline and structure become increasingly important.

For full performance details and constituent analysis, you can explore the Q2 Digital Assets Quarterly Report.

Disclaimer: All price, index and performance figures references are sourced from CoinDesk Data and CoinDesk Indices unless stated otherwise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。